In 2020, motor car, engine, and commercial vehicle production in Britain and exports fell sharply. Nissan was the largest carmaker in the UK.

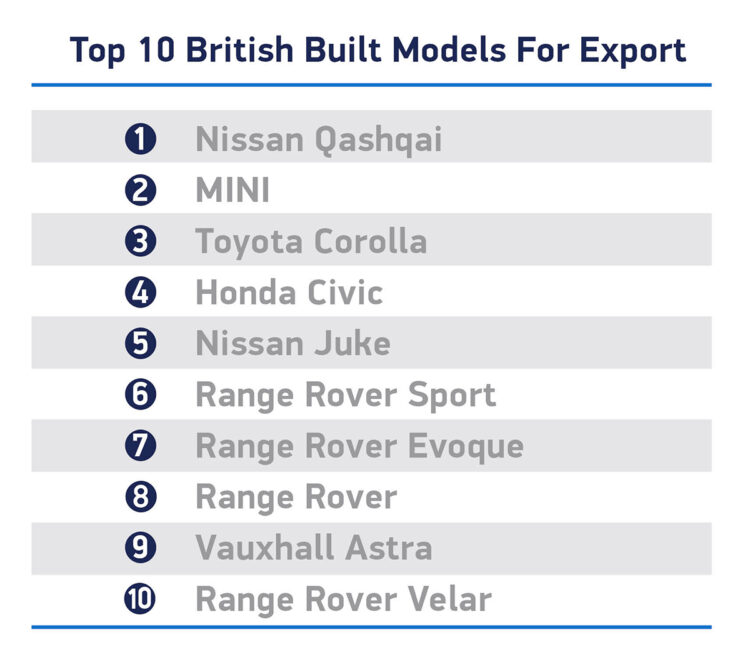

In full-year 2020, car production in Britain contracted by 29% to 920,928 cars — the lowest level since 1984. More than 80% of passenger cars made in the UK were exported. In 2020, commercial vehicle production in Britain contracted by 16% to the lowest level since 1933. Engine manufacturing in the UK contracted by 27% in 2020. The largest carmaker in Britain in 2020 was Nissan followed by Jaguar Land Rover. The top car models exported from Britain in 2020 were the Nissan Qashqai, Mini, and Toyota Corolla.

Latest British Car Sales Data: 2023: Market Overview, Brands, Models, Electric; 2022-2008.

Car Production in Britain in 2020 (Full Year)

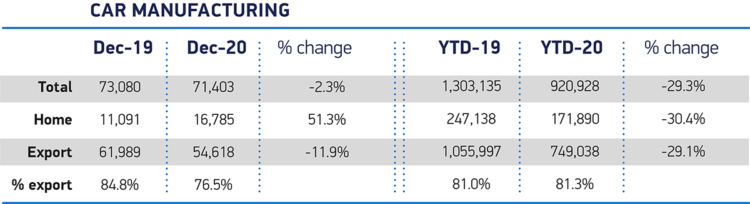

UK car production declined -29.3% in 2020, to 920,928 units, according to the latest figures released by the Society of Motor Manufacturers and Traders (SMMT). December, output was down -2.3% to 71,403, with some firms affected by border closures and thus component supply issues.

In full calendar year 2020, total new passenger vehicle registrations in the UK decreased by 29.4% — a percentage remarkably close to the production decline — to 1,631,064 cars for the lowest annual total since 1992, when sales were 1,594,000.

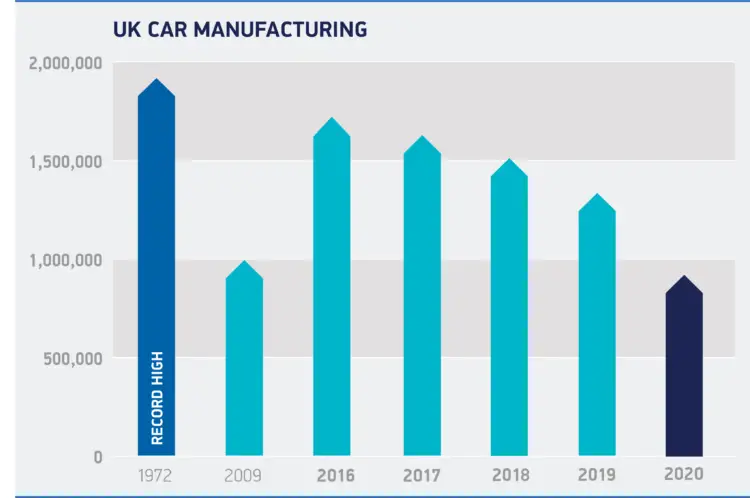

In 2020, car production in Britain was at its lowest level since 1984 when only 908,906 cars were produced in the UK. The record high for car production in Britain was as far ago as 1972. Manufacturing operations were severely disrupted throughout 2020, with lockdowns and social distancing measures restricting factory output, Brexit uncertainty continuing until Christmas Eve, and depressed market demand in key export destinations.

Meanwhile, the latest independent production outlook forecasts UK car production partly to recover in 2021 to one million units. Much, however, will depend on the extent of Covid measures here and abroad and the speed with which showrooms can reopen. In addition, manufacturers are coming to terms with new trading arrangements between GB and the EU, arrangements that are much more complicated than previously, despite the avoidance of ‘no deal’.

Mike Hawes, SMMT Chief Executive, said, “These figures, the worst in a generation, reflect the devastating impact of the pandemic on UK automotive production, with Covid lockdowns depressing demand, shuttering plants and threatening lives and livelihoods. The industry faces 2021 with more optimism, however, with a vaccine being rolled out and clarity on how we trade with Europe, which remains by far our biggest market.

British Car Exports in 2020

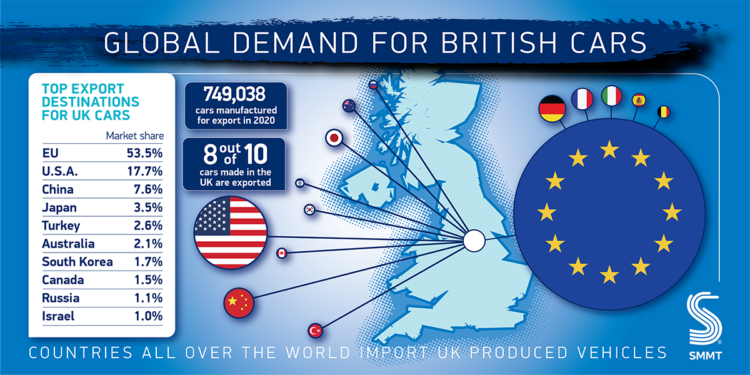

British car production in 2020 for overseas buyers fell -29.1% to 749,038 units, while output for the UK also fell in double-digits, down -30.4% to 171,890. Even amid the global pandemic, exports continued to drive UK car manufacturing, however, with more than eight in 10 of all cars made shipped overseas. The EU remained the UK’s biggest export destination, taking a 53.5% share, despite volumes falling -30.8% to 400,460 units.

The car trade with most of the UK’s other key export partners declined in 2020 in line with the tough market conditions resulting from the pandemic. Shipments to the US, Japan, and Australia were all lower, down -33.7%, -21.6%, and -21.8% respectively.

UK car exports to China, however, in 2020 increased 2.3%, and those to South Korea and Taiwan also rose 3.6% and 16.7% respectively as these nations traveled on different trajectories in dealing with Covid.

The top ten British car models produced for export in 2020 according to the SMMT were:

Top Car Producers in Britain in 2020

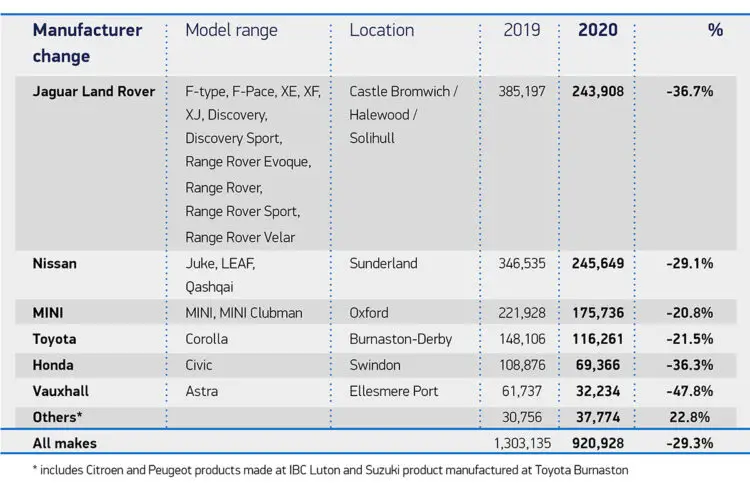

The largest car producers in Britain 2020 according to the SMMT were:

Nissan replaced Jaguar Land Rover in 2020 as the largest car producer in the UK in 2020. Of the larger carmakers in the UK, Mini and Toyota did best in 2020 with production down by only around a fifth while the total sector declined by 29%. All the large car producers in Britain are foreign-owned. The closure of the Honda plant in the UK has already been announced while the future of the Vauxhall plant is uncertain given the re-order of factories and brands in the new Stellantis group following the merger of PSA and FCA.

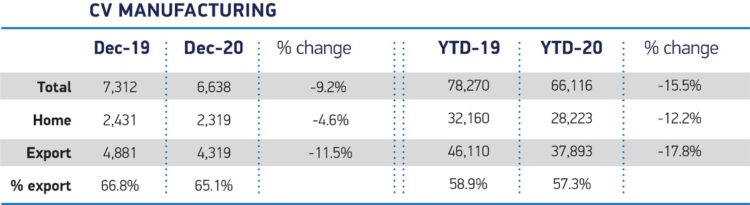

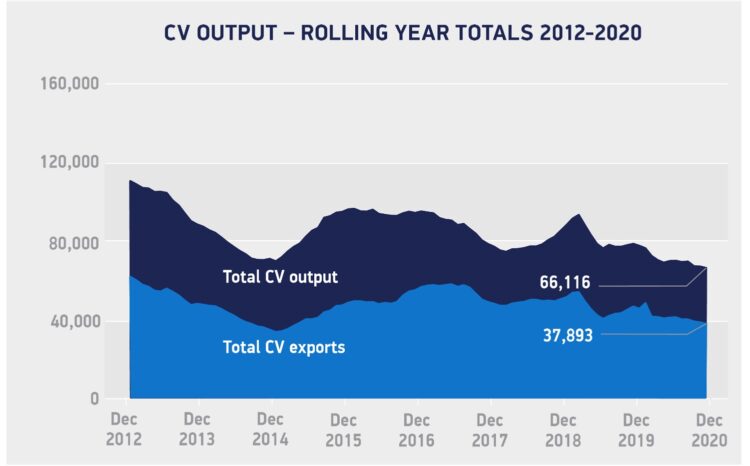

Commercial Vehicle Production in the UK in 2020

UK commercial vehicle (CV) manufacturing declined -15.5% in 2020, with just 66,116 vans, trucks, taxis, buses, and coaches leaving production lines. This was the lowest number since 1933 when only 65,508 commercial vehicles were produced in Britain. The coronavirus pandemic, with social distancing measures and multiple lockdowns throughout the year, badly affected manufacturing capabilities and demand, while uncertainty right up until the end of the Brexit transition period dented business confidence.

These issues meant production for both the overseas and domestic markets declined, down -17.8% (at 37,893) and -12.2% (at 28,223) respectively. Nevertheless, almost six out of every 10 commercial vehicles built in the UK in 2020 were exported, with the key market, the EU, placing the majority of orders for British-built CVs (94.9% export share). While the EU was by far the sector’s biggest overseas customer, 670 units were exported to Israel, 288 to Taiwan, and 248 to Russia, as well as exports going to more than 50 other countries.

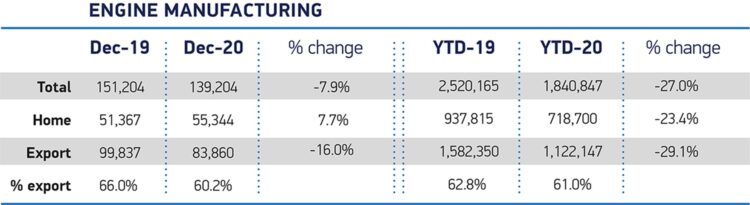

Car Engine Production in Britain in 2020

In 2020, UK car engine production fell by 27% to just over 1.8 million units according to the SMMT. 61% of all engines produced in Britain were destined for the export market.

Mike Hawes, SMMT Chief Executive, said, “2020 was a tough year for UK engine manufacturers with the coronavirus pandemic chiefly responsible for the fall in output. That said, factories still turned out more than 1.8 million internal combustion engines, with the majority of these exported globally. This reinforces how important it is that, in the increasingly rapid transition to electrification, the UK’s skilled engine manufacturing workforce is not left behind, as they should be a critical component in positioning the country as a competitive place to produce ultra-low and zero-emission vehicles.”

Latest British Car Sales Data: 2023: Market Overview, Brands, Models, Electric; 2022-2008.