In April 2021, new car sales in Europe increased by 261% from April 2020 but the market was still a quarter smaller than in April 2019. Volkswagen remained the largest producer and brand.

Although new passenger vehicle registrations in Europe increased by 261% in April 2021, the market was still far from pre-pandemic levels with sales down by 23% compared to April 2019. Low emissions vehicles took a 15% market share while diesels were down to less than a quarter. Volkswagen remained the leading car manufacturer and best-selling brand with the VW ID4 becoming the first SUV to lead battery-electric vehicle sales in Europe. The Peugeot 208 was again Europe’s favorite car model.

Latest European Car Market Statistics 2021: January, February, March, Q1, April, May, June, HY, July, August, September, Q3, October, November, December, Full Year — 2020: Q1, HY, Q3, Full Year

New Car Market in Europe in April 2021

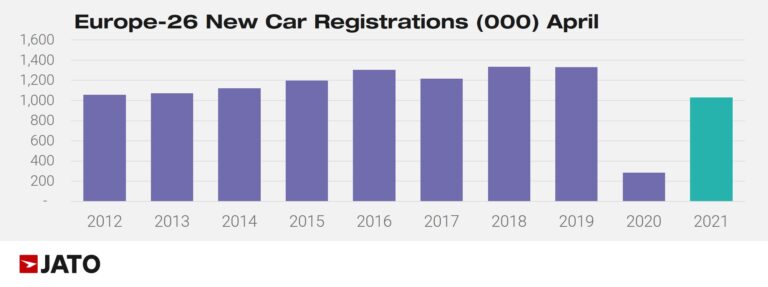

In April 2021, the European new car market saw an increase of 261% when compared to April 2020 – registering 1,029,008 units. This time last year, new registrations almost ceased completely due to the introduction of lockdown restrictions in Europe and, despite significant growth since then, the market is still far from returning to pre-pandemic levels, with the total volume of new car registrations 23% lower than seen in April 2019.

According to data for 26 markets in Europe analyzed by JATO, April 2021 recorded the lowest total volume in 20 years – excluding April 2020 when the pandemic was at its peak. Felipe Munoz, global analyst at JATO Dynamics commented: “These results indicate that recovery is going to be slower than many may have expected, and in the short term, this will not offer much encouragement to OEMs already busy dealing with the challenges of adapting to emissions compliance.

Although April’s year-to-date total was up by 23% from 2020, the total volume for January – April 2021 was 25% lower than seen in 2019, and the second-lowest since 2001. Munoz continued: “While lockdown restrictions and the impact of the pandemic may seem like the root of the problem, the shift towards EVs is also having a knock-on effect. As these vehicles are more expensive, we are seeing fewer units traded in comparison with traditional ICE models.”

European Car Market by Fuel Type April 2021

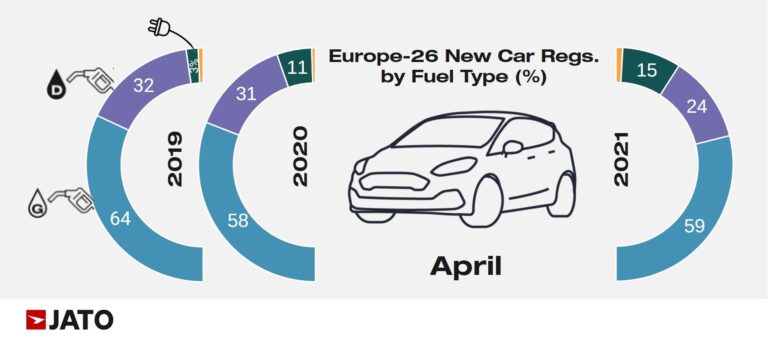

Despite the overall negative trend, low emissions vehicles posted record results in April 2021, with registrations accounting for 15% of the market, compared to just 11% posted a year ago. Demand for pure electric models increased by 338% to 71,500 units, and plug-in hybrids registrations recorded a volume growth of 507% to 81,000 units.

In contrast, diesel cars took just less than a quarter of the total market compared to nearly a third in recent years. Petrol remained by far the most popular fuel type for new cars sold in Europe.

Best-Selling Car Manufacturers in Europe in April 2021

The Volkswagen Group remained Europe’s largest car manufacturer and gained market share in April 2021 compared to pre-pandemic levels. VW took more than a third of the total battery-electric new car market in Europe in April 2021. In contrast, Stellantis and Renault both lost some market share while the BMW Group and Hyundai-Kia both increased market penetration.

All manufacturers had to deal with pandemic-related production and sales issues while delivery problems of electronic components are likely to hit the market particularly hard by mid-year.

Best-Selling Battery-Electric and Plug-in Hybrid Cars in Europe in April 2021

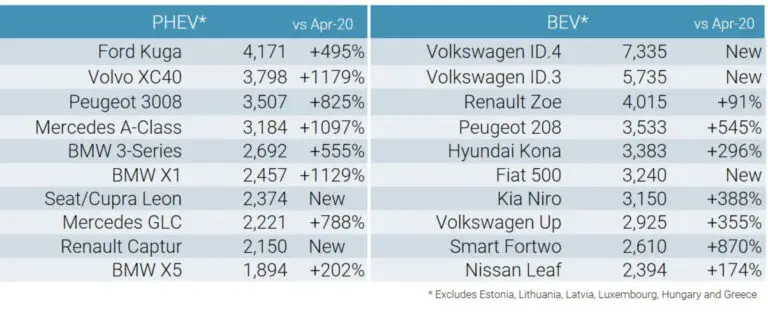

The recently launched Volkswagen ID.4 topped the BEV ranking, ahead of the ID.3 in second place. This is the first time since the introduction of pure electric vehicles that an SUV has led the BEV rankings. The much cheaper VW UP also performed well, especially in Germany where it at times outsold the special battery-only ID models.

Munoz added: “As anticipated, the next phase of growth for EVs is going to come from SUVs. The Volkswagen ID.4 taking the lead is just the beginning of the electric-SUV trend, and we expect new models to enter the market as consumer demand increases.” This is generally good. news for the bottom line of carmakers although disappointing for those that hoped that electric cars would ultimately be smaller and use less road space than current SUVs.

The contribution of the ID.4, in addition to strong results from other BEVs, helped Volkswagen Group gain 34% of the European BEV market in April. As a result, the German OEM performed better in the BEV market than it did in the overall market – where its market share was almost 27%.

The Ford Kuga was the best-selling plug-in hybrid car in Europe in April 2021 followed by the Volvo XC40. BMW managed to get three plug-ins on the top-ten list.

Top-Ten List of Best-Selling Car Models in Europe in April 2021

Peugeot was able to position both the 208 and 2008 as the first and second best-selling cars in Europe in April 2021. Replicating the results of February 2021, these models occupy the first and fourth positions in the YTD ranking respectively. Both have proven to be highly competitive products within their segments, consistently outperforming the offering of more conservative competitors.

BEVs are offsetting the losses posted by Volkswagen’s traditional ICE models. For example, the Volkswagen Golf was the third best-selling model in the overall rankings as its volume decreased by 49% between April 2019 and April 2021. In April 2018, the Golf accounted for 2.93% of all new car registrations compared with just 1.73% last month. The Renault Clio similarly saw a huge drop in sale volumes.

Volkswagen decided not to produce an electric version of the current Golf and although the Golf nameplate lost sales, the ID3 compensated. In contrast, Peugeot sold 3,533 electric versions of the 208 in April alone with the model also providing the platform for further top-ten models such as the Opel Corsa and Citroen C3 — a strategy also successfully applied by the Volkswagen Group across brands.

Car Sales Statistics for Europe in 2021

→ Latest European Car Sales Statistics

- Car Sales and Market Analysis: January, February, March, April, May, June, July, August, September, October, November, December, Full Year 2021

- Top-Selling Car Models: Top 25 Models 2021, Top 15 Electric Models

- Sales per European Country: Q1, Half Year, Q3, Full Year

- Sales by Brand: Q1, Half Year, Q3, Full Year

- Electric and PHEV Sales by Country: Q1, Half Year, Q3, Full Year, Top Electric Brands and Models