First Semester 2021: Volkswagen replaced Ford as the best-selling car brand in Britain and the Vauxhall Corsa outsold the Fiesta as the UK’s favorite model.

During the first half of 2021, the British new car market expanded by 40% to only 910,000 new passenger vehicle registrations — still well below ten-year averages for first-semester car sales in the UK. Volkswagen replaced Ford as the best-selling car brand in Britain while Audi claimed third place ahead of BMW and Mercedes-Benz. The Vauxhall Corsa replaced the Ford Fiesta as the most popular car model in Britain during the first six months of 2021.

Latest British Car Sales Data: 2023: Market Overview, Brands, Models, Electric; 2022-2008.

British New Car Market in 2021 (Half Year)

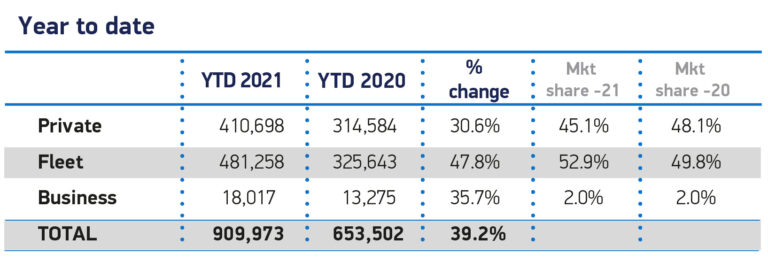

During the first half of 2021, new passenger vehicle registrations in Britain increased by 39.25% to 909,973 cars. Although this was a strong improvement over the first six months of 2020 when the UK market contracted by -48.5% to 653,502 new cars — the lowest level since 1971 — the market remained weak. Average new car sales in the UK during the first semesters were 1,242,944 cars in the period 2010-2019.

Demand for new cars in the UK was strongest among fleet buyers during the first half of 2021. Private demand increased by less than a third for only a 45% share of the British new car market thus far in 2021.

British New Car Market in June 2021

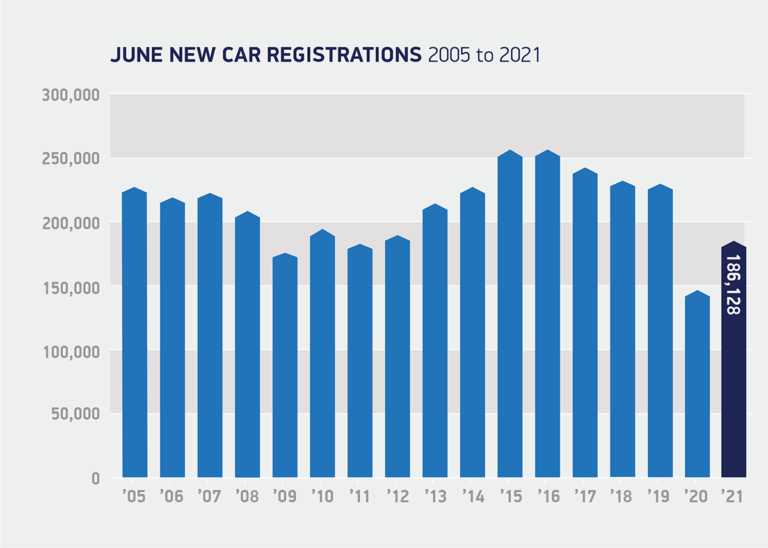

New car registrations in the UK in June 2021 grew 28.0% year-on-year to 186,128, according to the Society of Motor Manufacturers and Traders (SMMT)’s latest figures. The monthly performance was again artificially lifted through comparison with June 2020, when the UK began to emerge from the first pandemic lockdown and showrooms in England opened up at the beginning of the month.

Compared with the previous decade average of 222,652 June sales, June 2021 registrations were down -16.4%, while total registrations for Q2 2021 fell short of industry expectations by around 9,000 units partly as the ongoing global semiconductor shortage acted as a limiting factor on supply.

While economic confidence continues to strengthen, with some independent forecasts for GDP growth reaching 8% in 2021, new registrations still remain adrift of pre-pandemic levels. Returning to the previous decade average of 2.3 million new car registrations per annum, and for that total to be electrically driven, consumers need certainty about the future with long-term government commitments to incentives, and confidence in the rollout of charging infrastructure nationwide.

Fuel Types of New Cars in the UK in 2021 (First Half)

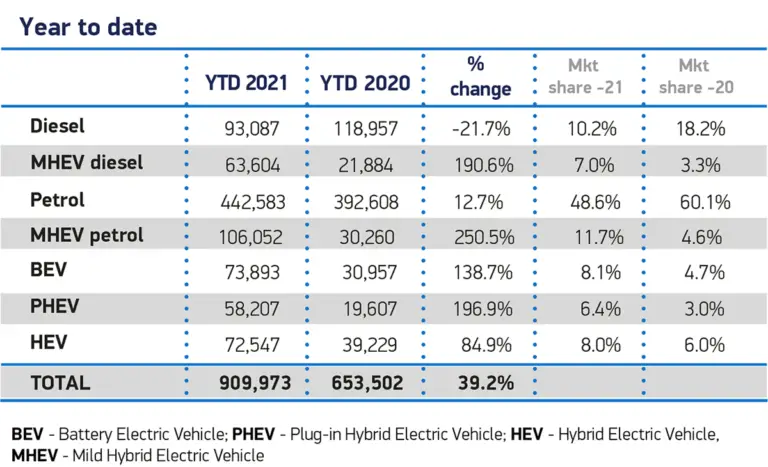

Petrol cars remain by far the most popular in Britain with a market share of nearly 60% (including MHEV) during the first half of 2021. Diesel’s share dropped from 27% during the first half of 2019 to 17% this year (including MHEV).

Hybrid electric vehicles in various permutations increased market share but the strongest growth was for mild hybrids and plug-in hybrids. The sales of battery-electric vehicles (BEV) increased by nearly 140% while the market share increased from 4.7% to 8.1%.

Best-Selling Car Brands in Britain in 2021 (First Half)

According to new passenger vehicle registration data released by the SMMT, the following were the 40 top-selling car marques in Britain during the first six months of 2021:

| MARQUE | 2021 HY | 2020 HY | % Change 20/21 | |

| Total UK Sales | 909,973 | 653,502 | 39.25 | |

| 1 | Volkswagen | 85,409 | 58,933 | 44.93 |

| 2 | Ford | 74,698 | 59,874 | 24.76 |

| 3 | Audi | 67,842 | 40,405 | 67.90 |

| 4 | BMW | 65,324 | 46,580 | 40.24 |

| 5 | Mercedes-Benz | 58,867 | 45,683 | 28.86 |

| 6 | Vauxhall | 53,443 | 37,576 | 42.23 |

| 7 | Toyota | 52,156 | 39,360 | 32.51 |

| 8 | Kia | 45,277 | 28,970 | 56.29 |

| 9 | Nissan | 36,688 | 30,109 | 21.85 |

| 10 | Land Rover | 36,216 | 25,624 | 41.34 |

| 11 | Peugeot | 34,748 | 21,450 | 62.00 |

| 12 | Skoda | 32,906 | 23,112 | 42.38 |

| 13 | Hyundai | 31,342 | 17,701 | 77.06 |

| 14 | Volvo | 27,143 | 17,698 | 53.37 |

| 15 | SEAT | 26,080 | 20,267 | 28.68 |

| 16 | MINI | 22,624 | 18,276 | 23.79 |

| 17 | Citroen | 16,894 | 11,617 | 45.42 |

| 18 | Renault | 15,712 | 15,269 | 2.90 |

| 19 | Mazda | 13,603 | 8,746 | 55.53 |

| 20 | MG | 13,594 | 7,712 | 76.27 |

| 21 | Honda | 12,618 | 11,439 | 10.31 |

| 22 | Jaguar | 11,854 | 10,551 | 12.35 |

| 23 | Suzuki | 10,770 | 7,813 | 37.85 |

| 24 | Fiat | 9,680 | 8,328 | 16.23 |

| 25 | Lexus | 7,161 | 5,971 | 19.93 |

| 26 | Dacia | 6,900 | 7,433 | -7.17 |

| 27 | Porsche | 5,836 | 4,073 | 43.29 |

| 28 | Mitsubishi | 4,562 | 4,708 | -3.10 |

| 29 | Cupra | 3,158 | 0.00 | |

| 30 | Jeep | 2,111 | 1,532 | 37.79 |

| 31 | Polestar | 1,642 | 0.00 | |

| 32 | Abarth | 1,310 | 914 | 43.33 |

| 33 | DS | 858 | 918 | -6.54 |

| 34 | smart | 820 | 426 | 92.49 |

| 35 | Subaru | 811 | 306 | 165.03 |

| 36 | Alfa Romeo | 734 | 940 | -21.91 |

| 37 | Ssangyong | 615 | 669 | -8.07 |

| 38 | Bentley | 607 | 531 | 14.31 |

| 39 | Maserati | 337 | 239 | 41.00 |

| 40 | Alpine | 102 | 57 | 78.95 |

| 41 | Genesis | 27 | 0.00 | |

| 42 | Other Imports | 15,625 | 10,832 | 44.25 |

| 43 | Other British | 1,269 | 860 | 47.56 |

| Source: SMMT |

Top-Selling Car Brands in the UK in 2021 (First Half)

After three years as the second-largest car brand in Britain, Volkswagen finally dethroned Ford as the top-selling car marque in the UK during the first half of 2021. VW sales increased by 45% while Ford underperformed the market and increased sales by only a quarter during the first semester of 2021.

Volkswagen-owned Audi was the most improved of the top ten brands in Britain thus far in 2021. It improved two rank positions to claim third place for the first time ever in the UK. As a result, BMW and Mercedes-Benz both slipped one rank position. BMW narrowly outperformed while Mercedes-Benz lost market share.

Vauxhall and Toyota swapped rank positions. Vauxhall sales were up 42% but sixth was still far from the traditional second position it claimed in Britain for years but lost to VW in 2018.

Kia and Nissan swapped positions with Nissan the worst performing of the top ten brands in Britain in the first half of 2021. Land Rover was the only top-ten brand with the same rank position as a year ago.

The most-improved brands in Britain during the first semester of 2021 were the small-volume marques Subaru and Smart. Only five brands sold fewer cars in the UK during the first half of 2021: Dacia, Mitsubishi, DS, Alfa Romeo, and Ssangyong.

MG entered the top 20 list — in 2017 it was only the 35th largest car brand in Britain.

Three new marques were added to the statistics: Cupra, Polestar, and Genesis.

Tesla continued to be listed amongst the “other imports” despite outselling many of the top-30 brands. For example, the Tesla Model 3 was the top-selling car model in Britain in June 2021 with 5,468 sales.

Top-Ten Best-Selling Car Models in Britain in 2021 (Half Year)

According to the SMMT, the following were the top-selling car models in Britain during the first half of 2021:

| Model | 2021 (HY) | 2020 (HY) | 2019 (HY) | 2018 (HY) | 2017 (HY) | 2016 (HY) | 2015 (HY) | |

| 1 | Vauxhall Corsa | 24,399 | 17,646 | 29,982 | 28,003 | 33,560 | 42,356 | 50,125 |

| 2 | Ford Fiesta | 21,511 | 21,098 | 43,297 | 56,415 | 59,380 | 68,833 | 71,990 |

| 3 | Volkswagen Golf | 19,608 | 17,889 | 31,493 | 39,930 | 36,703 | 37,577 | 38,261 |

| 4 | Mercedes-Benz A-Class | 19,498 | 13,726 | 27,904 | 20,002 | 22,944 | NA | NA |

| 5 | Ford Puma | 18,232 | NA | NA | NA | NA | NA | NA |

| 6 | Nissan Qashqai | 16,482 | 14,806 | 29,180 | 30,066 | 33,574 | 33,656 | 34,501 |

| 7 | Kia Sportage | 16,310 | 10,122 | NA | NA | NA | NA | NA |

| 8 | Volkswagen Polo | 15,554 | 10,114 | 23,605 | 22,027 | 27,205 | 28,000 | 28,980 |

| 9 | BMW 3 Series | 15,402 | NA | NA | NA | NA | NA | NA |

| 10 | Toyota Yaris | 15,124 | 10,134 | 19,147 | NA | NA | NA | NA |

| Source: SMMT |

The Vauxhall Corsa finally outsold the Ford Fiesta in Britain during the first half of 2021. The Fiesta, the UK’s favorite car for years, was the only top-ten model with weaker unit sales than during the first semester of 2020.

Britain’s car market remained highly competitive and models increasingly diverse. Sales of the top ten models are increasingly a smaller share of the total market. For example, Corsa sales in 2021 were only half of sales volume in 2015 while the Fiesta sold only a third of the number of cars that left the forecourts in 2016 and 2017.

The Volkswagen Golf was at third the only top-ten car in the same rank position as a year ago. It outsold the Mercedes-Benz A-Class (up two positions) by only 110 cars.

The Ford Puma was a new entrant at fifth. It took the title of Britain’s favorite SUV / crossover from the Nissan Qashqai that slipped one rank position. Qashqai sales were only around half of those in 2015 to 2018 when fewer competing models were on the market.

The Kia Sportage and VW Polo both improved two rank positions. The BMW 3 Series was a new entrant at ninth — the BMW used to be a regular but dropped out of the list after BMW split off the 4 Series several years ago. The Toyota Yaris slipped two positions to round out the top-ten list.

The two cars slipping out of the top ten were the Ford Focus (down from second!) and the Mini (from 7th).

Latest British Car Sales Data: 2023: Market Overview, Brands, Models, Electric; 2022-2008.