First quarter 2014 new passenger vehicle registrations in the European Union and EFTA increased by 8% with all major markets growing.

The European Union and EFTA car market expanded by 8.1% during the first three months of 2014. All major European markets showed an increase in new passenger vehicle registrations during the first quarter of 2014. Germany remains the largest single-country car market in Europe with Britain second and the fastest growing of the major markets. Volkswagen remained the best-selling carmaker in Europe with the VW Golf the most popular car model.

The European Union & EFTA Car Market in 2014 (Q1)

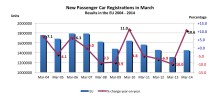

New passenger vehicle registrations in the European Union and EFTA grew by 8.1% during the first quarter of 2014 to 3,353,180 cars. March 2014 was the seventh consecutive month of growth of car sales in Europe but in absolute terms the sales figures remain the second lowest first quarter since the current statistical series was introduced just over a decade ago.

New passenger vehicle registrations in the European Union and EFTA grew by 8.1% during the first quarter of 2014 to 3,353,180 cars. March 2014 was the seventh consecutive month of growth of car sales in Europe but in absolute terms the sales figures remain the second lowest first quarter since the current statistical series was introduced just over a decade ago.

Car sales in the EU in March 2014 increased by more than 10%. The only time in the previous decade that growth in March was in double digits was in 2010.

Car Sales per European Union and EFTA Countries in 2014 (Q1)

New passenger vehicle registrations during the first three months of 2014 in the EU and EFTA countries according to car sales statistics released by the ACEA were as follows:

| Q1/2014 | Q1/2013 | % Change | |

| AUSTRIA | 81’281 | 80’024 | +1.6 |

| BELGIUM | 148’532 | 149’160 | -0.4 |

| BULGARIA | 4’619 | 3’541 | +30.4 |

| CROATIA | 7’244 | 6’037 | +20.0 |

| CYPRUS | 2’099 | 1’869 | +12.3 |

| CZECH REPUBLIC | 42’993 | 36’453 | +17.9 |

| DENMARK | 47’842 | 41’952 | +14.0 |

| ESTONIA | 4’736 | 4’678 | +1.2 |

| FINLAND | 30’503 | 27’648 | +10.3 |

| FRANCE | 446’609 | 433’882 | +2.9 |

| GERMANY | 711’753 | 673’957 | +5.6 |

| GREECE | 16’607 | 14’142 | +17.4 |

| HUNGARY | 15’496 | 12’556 | +23.4 |

| IRELAND | 49’966 | 39’493 | +26.5 |

| ITALY | 376’519 | 355’818 | +5.8 |

| LATVIA | 2’852 | 2’354 | +21.2 |

| LITHUANIA | 3’406 | 2’734 | +24.6 |

| LUXEMBURG | 12’311 | 12’315 | -0.0 |

| NETHERLANDS | 107’723 | 115’421 | -6.7 |

| POLAND | 97’622 | 75’721 | +28.9 |

| PORTUGAL | 33’954 | 24’162 | +40.5 |

| ROMANIA | 13’345 | 11’233 | +18.8 |

| SLOVAKIA | 16’855 | 14’501 | +16.2 |

| SLOVENIA | 13’799 | 12’768 | +8.1 |

| SPAIN | 202’128 | 180’725 | +11.8 |

| SWEDEN | 67’803 | 56’074 | +20.9 |

| UNITED KINGDOM | 688’122 | 605’198 | +13.7 |

| EUROPEAN UNION | 3’246’719 | 2’994’416 | +8.4 |

| NORWAY | 36’492 | 33’696 | +8.3 |

| ICELAND | 1’574 | 1’333 | +18.1 |

| SWITZERLAND | 68’395 | 71’751 | -4.7 |

| EFTA | 106’461 | 106’780 | -0.3 |

| EU & EFTA | 3’353’180 | 3’101’196 | +8.1 |

Excluding data for Malta.

European Car Sales per Country in 2014 (Q1)

Car sales in Europe improved in all major markets during the first three months of 2014. Although the expansion was relatively weak in Germany, France and Italy, positive growth is no longer just depended on the fast growing British market.

The British car market traditionally has a very strong first quarter due to the importance of March sales, which see the introduction of new number plates. For Germany, and many other markets, the second quarter of the year is usually more important for absolute sales.

However, even when taking this anomaly into account, the British market is fast catching up with Germany, still the largest single-country market in Europe. The first quarter of 2014 difference between German and British new passenger vehicle registrations was less than 24,000 cars – during 2012 (Q1) the gap was 210,000 cars.

Other salient features from the first quarter of 2014 European car sales statistics:

- Only four countries saw a decline in the number of cars sold compared to the first three months in 2013: The Netherland, Belgium, Luxemburg and Switzerland.

- The Dutch figures – the weakest performance in the EU – were heavily influenced by a change in fiscal policy, which saw many buyers advancing sales at the end of last year. Switzerland had its second best year on record in 2013 and lower sales were widely expected for this year.

- Portugal and Bulgaria were the strongest performers during this quarter but more significant was the around 20,000 cars added to the Polish market.