October 2019: New passenger vehicle registrations in Europe increased by 8%. Diesels sales were down by SUVs took a record 40% market share.

New passenger vehicle registrations in the European Union increased by 8.7% to 1,177,746 cars in October 2019. The growth was helped by exceptionally low sales in October 2018 but still represents the highest October sales in ten years. While the German car market continues to expand slightly this year, the French and Italian markets are slightly weaker while the British and Spanish markets contracted markedly. The VW Golf remains the top-selling car model in Europe despite the new model already being announced with deliveries due to start by the end of the year but mostly only reaching customers in 2020.

European New Car Market in October 2019

According to JATO, the European car market continued to grow in October 2019 as 1,208,700 vehicles were registered – the highest October volume of the last 10 years. The strong growth, which can partly be explained by the market dropping in October 2018 following the introduction of WLTP, has improved the year-to-date figures overall.

However, the European new car market is still down 0.8% on the same period last year, with 13,284,600 vehicles registered so far in 2019. “The European market is facing a myriad of challenges at the moment, but the biggest threats to growth are not having a significant impact on sales – at least for the time being,” explains Felipe Munoz, JATO’s global analyst.

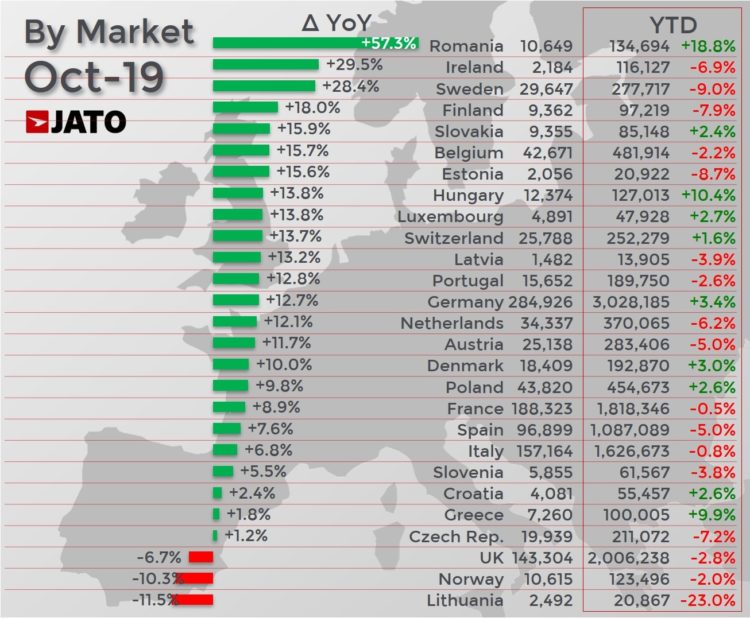

New Passenger Vehicle Registrations per EU Country in October 2019

17 of the 27 markets included in JATO’s analysis posted double-digit growth in October 2019. It was a particularly good month for Germany, where demand increased by 13%. “If the German market can continue to avoid a recession, then the state of the global industry might not be as bad as first expected,” continues Munoz.

New passenger vehicle registrations in European Union and EFTA countries in October 2019 and thus far this year were as follows according to the ACEA:

| October | October | %Change | Jan-Oct | Jan-Oct | %Change | |

| Year: | 2019 | 2018 | 19/18 | 2019 | 2018 | 19/18 |

| AUSTRIA | 25,138 | 22,513 | +11.7 | 283,410 | 298,271 | -5.0 |

| BELGIUM | 42,713 | 36,894 | +15.8 | 481,962 | 492,616 | -2.2 |

| BULGARIA | 2,798 | 2,562 | +9.2 | 29,692 | 29,005 | +2.4 |

| CROATIA | 4,081 | 3,984 | +2.4 | 55,457 | 54,060 | +2.6 |

| CYPRUS | 959 | 997 | -3.8 | 10,461 | 11,393 | -8.2 |

| CZECH REPUBLIC | 19,935 | 19,704 | +1.2 | 211,045 | 227,488 | -7.2 |

| DENMARK | 18,369 | 16,669 | +10.2 | 191,992 | 186,648 | +2.9 |

| ESTONIA | 2,057 | 1,724 | +19.3 | 22,675 | 22,243 | +1.9 |

| FINLAND | 9,366 | 7,940 | +18.0 | 97,299 | 105,674 | -7.9 |

| FRANCE | 188,987 | 173,798 | +8.7 | 1,830,354 | 1,836,480 | -0.3 |

| GERMANY | 284,593 | 252,628 | +12.7 | 3,024,751 | 2,926,046 | +3.4 |

| GREECE | 7,276 | 7,125 | +2.1 | 100,048 | 91,201 | +9.7 |

| HUNGARY | 12,451 | 10,922 | +14.0 | 127,549 | 115,537 | +10.4 |

| IRELAND | 2,180 | 1,689 | +29.1 | 116,124 | 124,884 | -7.0 |

| ITALY | 156,851 | 147,039 | +6.7 | 1,624,922 | 1,638,784 | -0.8 |

| LATVIA | 1,570 | 1,309 | +19.9 | 15,679 | 14,467 | +8.4 |

| LITHUANIA | 4,103 | 2,823 | +45.3 | 38,854 | 27,151 | +43.1 |

| LUXEMBOURG | 4,891 | 4,298 | +13.8 | 47,929 | 46,667 | +2.7 |

| NETHERLANDS | 34,101 | 29,763 | +14.6 | 364,999 | 389,080 | -6.2 |

| POLAND | 46,895 | 39,908 | +17.5 | 457,724 | 443,251 | +3.3 |

| PORTUGAL | 15,649 | 13,951 | +12.2 | 189,673 | 196,646 | -3.5 |

| ROMANIA | 10,649 | 6,736 | +58.1 | 134,698 | 113,331 | +18.9 |

| SLOVAKIA | 9,436 | 8,071 | +16.9 | 85,854 | 83,792 | +2.5 |

| SLOVENIA | 5,855 | 5,548 | +5.5 | 61,568 | 64,000 | -3.8 |

| SPAIN | 93,961 | 88,411 | +6.3 | 1,059,275 | 1,131,084 | -6.3 |

| SWEDEN | 29,631 | 23,088 | +28.3 | 277,405 | 304,916 | -9.0 |

| UNITED KINGDOM | 143,251 | 153,599 | -6.7 | 2,005,522 | 2,064,419 | -2.9 |

| EUROPEAN UNION | 1,177,746 | 1,083,693 | +8.7 | 12,946,921 | 13,039,134 | -0.7 |

| October | October | %Change | Jan-Oct | Jan-Oct | %Change | |

| Year: | 2019 | 2018 | 19/18 | 2019 | 2018 | 19/18 |

| ICELAND | 661 | 803 | -17.7 | 10,488 | 16,767 | -37.4 |

| NORWAY | 10,479 | 11,655 | -10.1 | 121,096 | 123,155 | -1.7 |

| SWITZERLAND | 26,103 | 22,788 | +14.5 | 252,413 | 248,074 | +1.7 |

| EFTA | 37,243 | 35,246 | +5.7 | 383,997 | 387,996 | -1.0 |

| EU + EFTA | 1,214,989 | 1,118,939 | +8.6 | 13,330,918 | 13,427,130 | -0.7 |

Note: Excludes Malta. JATO and ACEA numbers are slightly different. JATO numbers are used in the analysis.

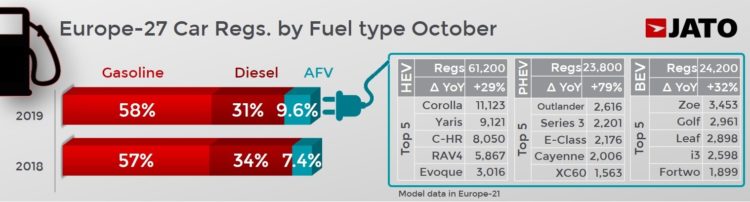

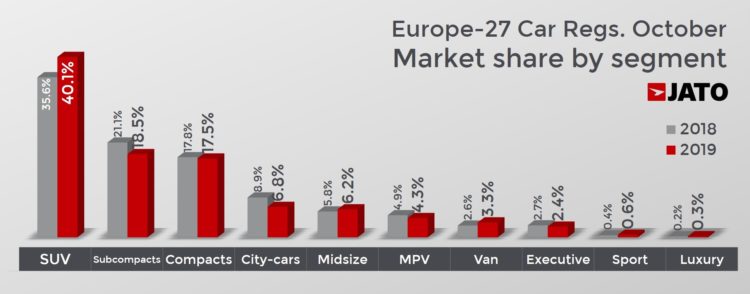

Increase Demand for SUVs and Electric Cars in Europe

The high car sales in Europe in October 2019 can also be explained by increased consumer demand for SUVs and electrified vehicles. SUVs, in particular, were an important source of growth during the month. In October 484,400 SUVs were registered in Europe, as demand increased by 22% on the same period last year and the segment posted a record market share of 40%. “Europe is slowly equalling the USA and China in terms of SUV penetration. This is mostly because of small and compact SUVs, which are hugely popular across the continent and make up 79% of all SUV registrations,” explains Munoz.

Electrified vehicles also boosted the overall market as they continued to gain traction in October. Demand increased by 79% for plug-in hybrid cars, 32% for pure electric cars and 29% for hybrid cars. European consumers bought 115,700 electrified vehicles during the month – which is 41% more than in October 2018 – as the fuel type counted for almost 10% of all passenger car registrations. “The results show that despite the high price of electrified vehicles, consumer interest is definitely there, and the latest market launches are being well-received,” explains Munoz.

Best-Selling Car Brands in Europe in 2019 (October)

New passenger vehicle registrations according to car manufacturers and brands in the European Union and EFTA in October 2019 and year to date were as follows according to the ACEA:

| 10/2019 | 10/2018 | 19/18 | 1-10/2019 | 1-10/2018 | 19/18 | |

| VW Group | 304,635 | 232,297 | +31.1 | 3,262,002 | 3,228,687 | +1.0 |

| VOLKSWAGEN | 146,982 | 113,900 | +29.0 | 1,485,726 | 1,508,305 | -1.5 |

| SKODA | 60,370 | 56,551 | +6.8 | 641,137 | 618,954 | +3.6 |

| AUDI | 51,038 | 30,892 | +65.2 | 631,519 | 641,196 | -1.5 |

| SEAT | 37,005 | 28,934 | +27.9 | 434,346 | 391,949 | +10.8 |

| PORSCHE | 8,858 | 1,792 | +394.3 | 64,284 | 64,013 | +0.4 |

| OTHERS2 | 382 | 228 | +67.5 | 4,990 | 4,270 | +16.9 |

| PSA Group | 181,386 | 190,741 | -4.9 | 2,138,037 | 2,151,332 | -0.6 |

| PEUGEOT | 79,823 | 79,154 | +0.8 | 818,497 | 832,326 | -1.7 |

| OPEL/VAUXHALL | 46,209 | 63,374 | -27.1 | 728,422 | 763,759 | -4.6 |

| CITROEN | 50,663 | 45,396 | +11.6 | 550,688 | 516,156 | +6.7 |

| DS | 4,691 | 2,817 | +66.5 | 40,430 | 39,091 | +3.4 |

| RENAULT Group | 121,015 | 107,208 | +12.9 | 1,385,941 | 1,403,530 | -1.3 |

| RENAULT | 79,863 | 68,964 | +15.8 | 887,575 | 954,504 | -7.0 |

| DACIA | 40,687 | 37,752 | +7.8 | 490,436 | 443,020 | +10.7 |

| LADA | 298 | 376 | -20.7 | 4,151 | 4,518 | -8.1 |

| ALPINE | 167 | 116 | +44.0 | 3,779 | 1,488 | +154.0 |

| 10/2019 | 10/2018 | 19/18 | 1-10/2019 | 1-10/2018 | 19/18 | |

| HYUNDAI Group | 87,419 | 81,418 | +7.4 | 905,290 | 892,794 | +1.4 |

| HYUNDAI | 46,145 | 40,678 | +13.4 | 474,865 | 466,236 | +1.9 |

| KIA | 41,274 | 40,740 | +1.3 | 430,425 | 426,558 | +0.9 |

| BMW Group | 88,047 | 85,595 | +2.9 | 864,765 | 863,470 | +0.1 |

| BMW | 70,507 | 66,738 | +5.6 | 683,655 | 683,807 | -0.02 |

| MINI | 17,540 | 18,857 | -7.0 | 181,110 | 179,663 | +0.8 |

| DAIMLER | 85,523 | 85,666 | -0.2 | 838,080 | 811,381 | +3.3 |

| MERCEDES | 77,980 | 76,480 | +2.0 | 751,524 | 727,366 | +3.3 |

| SMART | 7,543 | 9,186 | -17.9 | 86,556 | 84,015 | +3.0 |

| FORD | 75,988 | 76,130 | -0.2 | 815,479 | 844,714 | -3.5 |

| FCA Group | 67,896 | 66,270 | +2.5 | 809,138 | 891,336 | -9.2 |

| FIAT | 46,848 | 46,228 | +1.3 | 562,933 | 625,973 | -10.1 |

| JEEP | 11,499 | 10,941 | +5.1 | 143,894 | 142,223 | +1.2 |

| LANCIA/CHRYSLER | 4,847 | 4,534 | +6.9 | 50,660 | 39,998 | +26.7 |

| ALFA ROMEO | 4,267 | 3,830 | +11.4 | 45,649 | 74,870 | -39.0 |

| OTHERS3 | 435 | 737 | -41.0 | 6,002 | 8,272 | -27.4 |

| 10/2019 | 10/2018 | 19/18 | 1-10/2019 | 1-10/2018 | 19/18 | |

| TOYOTA Group | 66,984 | 60,414 | +10.9 | 680,007 | 657,927 | +3.4 |

| TOYOTA | 62,593 | 57,227 | +9.4 | 633,067 | 618,292 | +2.4 |

| LEXUS | 4,391 | 3,187 | +37.8 | 46,940 | 39,635 | +18.4 |

| NISSAN | 28,028 | 27,871 | +0.6 | 334,505 | 439,562 | -23.9 |

| VOLVO CAR CORP. | 28,283 | 27,343 | +3.4 | 276,619 | 265,230 | +4.3 |

| MAZDA | 21,838 | 17,196 | +27.0 | 206,135 | 200,836 | +2.6 |

| JAGUAR LAND ROVER Group | 16,111 | 18,802 | -14.3 | 194,074 | 198,275 | -2.1 |

| LAND ROVER | 11,146 | 11,879 | -6.2 | 127,887 | 129,055 | -0.9 |

| JAGUAR | 4,965 | 6,923 | -28.3 | 66,187 | 69,220 | -4.4 |

| MITSUBISHI | 11,163 | 12,890 | -13.4 | 127,427 | 121,933 | +4.5 |

| HONDA | 7,848 | 9,011 | -12.9 | 103,254 | 118,497 | -12.9 |

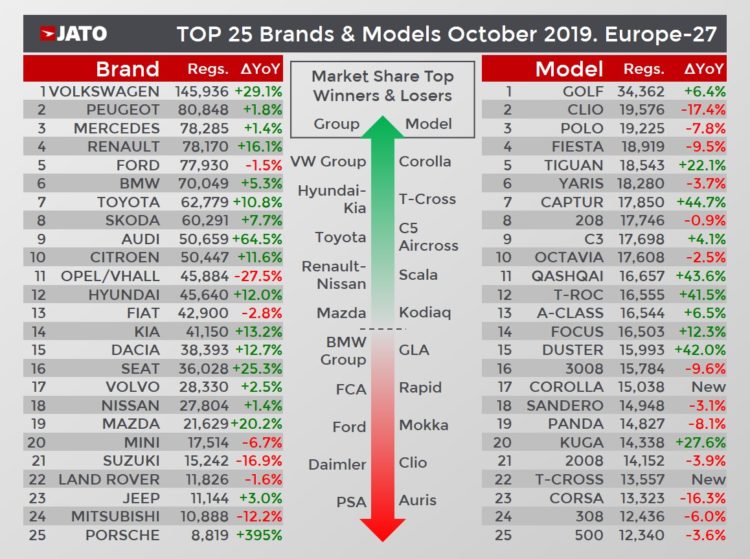

The European new car market’s growth didn’t benefit all of the industry’s key players, with Volkswagen Group the main winner of the month. The Germans posted a 4.4-point market share increase – the highest amongst all automakers – jumping from 20.7% in October 2018 to 25.1% last month. Hyundai-Kia, Toyota, Renault- Nissan, Mazda and Tesla also recorded market share gains, but their combined increase did not exceed 1 point overall. “Volkswagen Group is more solid than ever thanks to the SUV offensive. In fact, one in 10 vehicles registered in Europe is now an SUV made by the German group,” Munoz concludes.

Meanwhile, notable results from the brand rankings include Opel/Vauxhall and Fiat falling out of the top 10; Volvo outselling Nissan; Porsche outselling Honda; and Tesla recording a 129% volume increase to 2,093 registrations.

Best-Selling Car Models in Europe (October 2019)

The model rankings saw the Volkswagen Golf occupy the overall top spot, while the Tiguan was the best- selling SUV. Other strong performers included the new Toyota Corolla, Renault Megane (+43%), Hyundai Kona (+37%), Seat Arona (+30%), Renault Kadjar (+58%), Skoda Kodiaq (+181%), Toyota RAV4 (+39%), Audi A4 (+225%), Audi A6 (+50%) and Audi Q2 (+63%).

Among the market’s latest launches, the following totals were registered: Volkswagen T-Cross with 13,557 units; Citroen C5 Aircross 8,461 units; Skoda Scala with 5,986 units; Mazda CX-30 with 3,180 units; Seat Tarraco with 2,986 units; Kia Xceed with 2,797 units; DS 3 Crossback with 2,370 units; and Skoda Kamiq with 2,104 units.