In April 2020, British car production fell by 99.7% to a record low – only 197 passenger vehicles were produced in Britain. The lowest number of cars made in the UK since the Second World War.

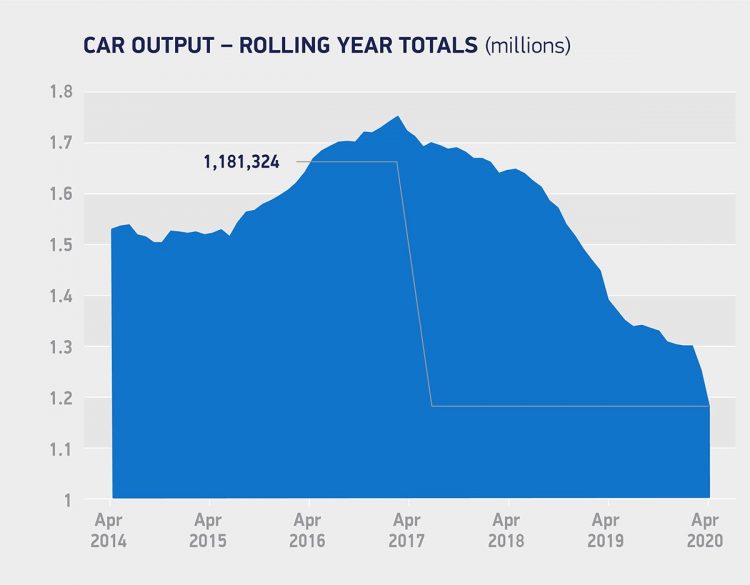

The British automotive industry came to a standstill in April 2020 with only 197 cars made, as the coronavirus pandemic forced the closure of factories. As a result, car production was 99.7% lower than in April 2019. Only 15 commercial vehicles (CV) were produced in Britain in April 2020 (-99.3) while engine production was down a similar 99.5% to only 830 units. Year-to-date 2020, car production in the UK was -27.6%, with 121,811 fewer cars built. The outlook for car production in Britain was lowered to below a million units for 2020 with lost production costing the sector up to £12.5bn.

Car Production in Britain in April 2020

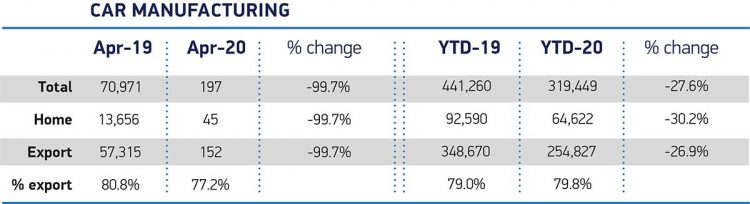

UK car production fell to its lowest level since the Second World War in April, down -99.7%, according to figures released by the Society of Motor Manufacturers and Traders (SMMT). As the coronavirus crisis forced plants to close, just 197 premium, luxury, and sports cars left factory gates in Britain in April 2020 — all models that had been assembled prior to shutdowns with only finishing touches needed. Car sales in Britain in April 2020 were down an equally significant 97.3%.

Output for both the domestic and overseas markets was severely curtailed in the month, with 152 cars built for export and 45 for customers in the UK. The exceptional month follows a particularly weak April 2019, when volumes fell -44.5% year on year due to temporary shutdowns as manufacturers sought to mitigate the impact of an expected end-March Brexit.

During the first four months of 2020, car production in Britain contracted by 27.6% to 319,449 passenger vehicles. Nearly 80% of cars produced in Britain are destined for the export market.

In April 2020, instead of making cars for the UK and global export markets, many manufacturers refocused efforts on producing personal protective equipment (PPE) but these are hardly going to replace lost earnings.

Car Production in Britain During the Second World War

The previous lowest UK car production month according to SMMT records — that go only as far back as 1946 — was January 1946 when 6,319 units were produced.

Annual UK car production totals during the Second World War period according the SMMT were as follows:

| Year | Passenger Car Made in Britain |

| 1940 | 1,949 |

| 1941 | 5,117 |

| 1942 | 5,468 |

| 1943 | 1,649 |

| 1944 | 2,108 |

| 1945 | 16,938 |

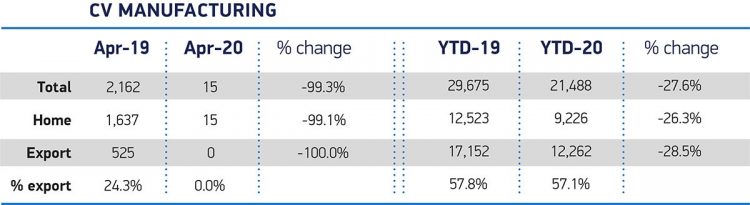

Commercial Vehicles Produced in Britain in April 2020

British commercial vehicle output drops -99.3% in April, with just 15 units rolling off production lines as nationwide factory closures hit.

Year-to-date 2020 commercial vehicle production in Britain fell -27.6% on what was already an exceptionally weak April in 2019 when volumes fell a staggering -70.9% due to planned factory shutdowns timed to mitigate any disruption arising from the anticipated March Brexit. Commercial vehicle production in Britain in April 2019 was 2,162 while CV production in April 2018 was a considerably higher 7,423 vehicles.

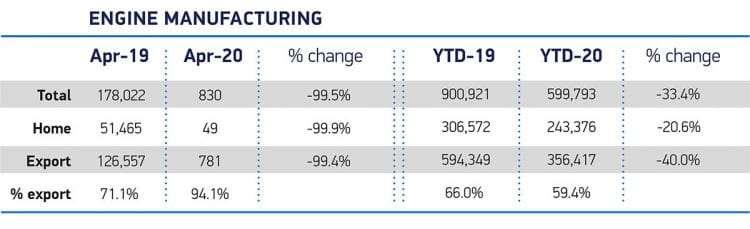

Engine Production in the UK in April 2020

Just 830 engines produced in April 2020 in Britain — down from 178,022, as UK output declines -99.5%. Of these, only 49 engines were for domestic use.

Year-to-date 2020, engine production in the UK was down by a third with units destined for the domestic market down a fifth while engine exports were 40% lower than during the first four months of 2019. Thus far in 2020, 94% of all engines produced in Britain were exported compared to 71% during the first four months of 2019.

British Car Production Outlook in 2020

The latest independent analysis suggests annual UK car production could fall below one million units in 2020, which would represent lower volumes than in 2009 when 999,460 units were produced and possibly a third lower than expected in January pre-crisis when production outlook was still a healthier 1.27 million cars.

Although the UK’s 168,000 automotive manufacturing employees are now starting to return to work, with around half of the country’s car and engine plants set to be operating by the end of May 2020, factories are scaling up production on different timescales and, with strict social distancing measures in place, output initially will be restricted with a predicted loss of up to some 400,000 units by year-end, compared with the January outlook, and a cost to industry of up to £12.5 billion at factory gate prices.

Mike Hawes, SMMT Chief Executive, said, “With the UK’s car plants mothballed in April, these figures aren’t surprising but they do highlight the tremendous challenge the industry faces, with revenues effectively slashed to zero last month. Manufacturers are starting to emerge from prolonged shutdown into a very uncertain world and ramping up production will be a gradual process.”

According to the SMMT, the British automotive industry is a vital part of the UK economy accounting for £82 billion turnover and £18.6 billion value added. With some 168,000 people employed directly in manufacturing and 823,000 across the wider automotive industry, it accounts for 14.4% of total UK export of goods and invests £3.75 billion each year in automotive R&D. More than 30 manufacturers build some 70 models of vehicle in the UK supported by 2,500 component providers and some of the world’s most skilled engineers.