April 2020: The European new car market contracted by 78% to 292,600 cars — the lowest monthly volume since the 1970s.

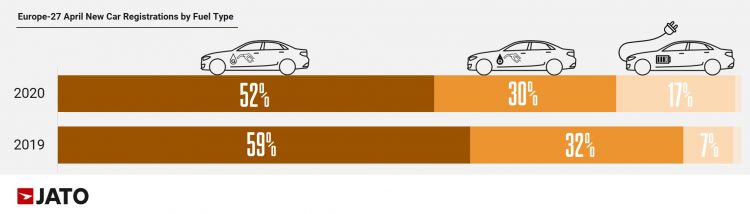

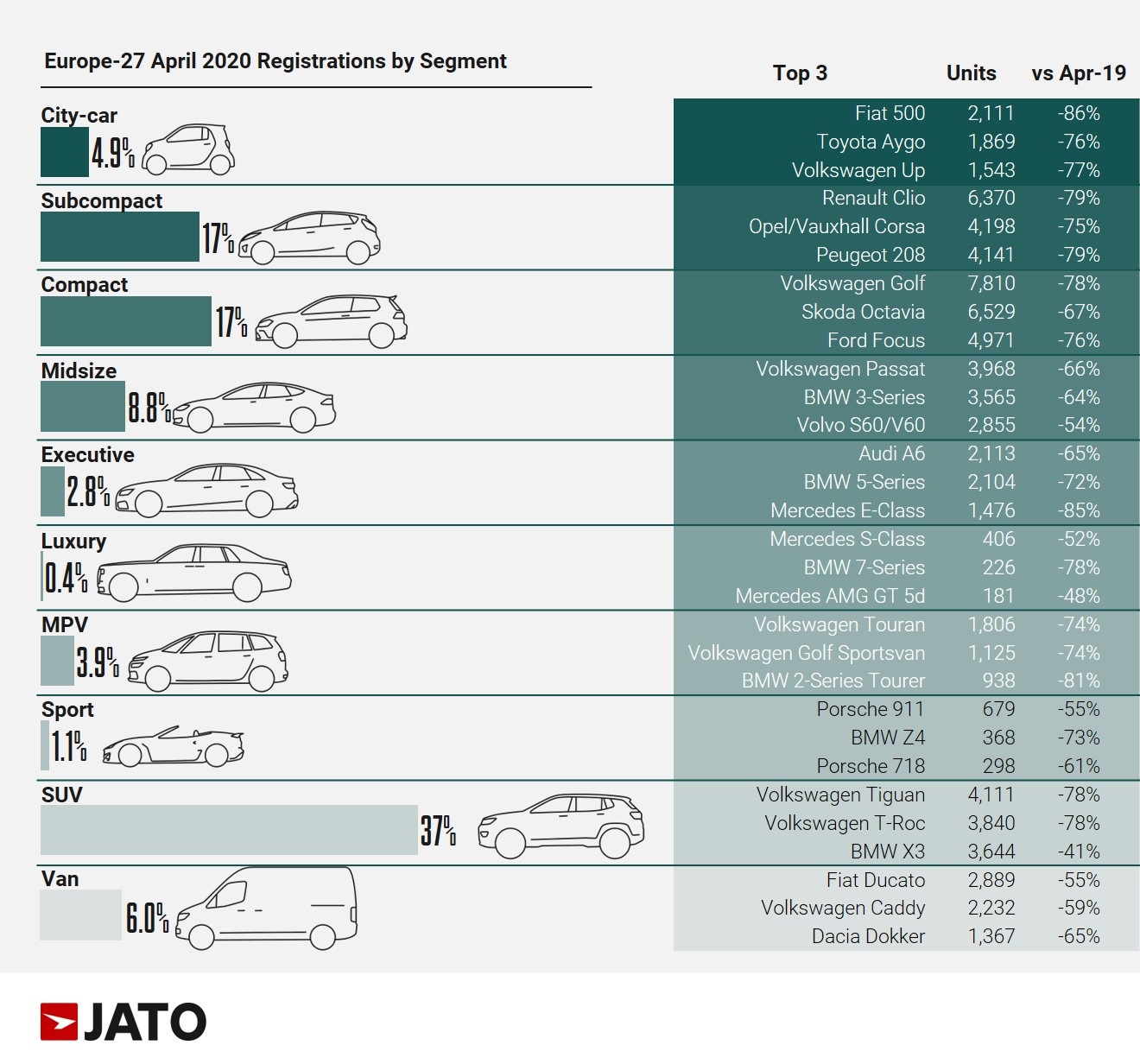

New passenger vehicle registrations in Europe contracted by 78% in April 2020 to only 292,000 cars — more than a million vehicles less than were sold in April 2019. SUVs remained the largest market segment with 37% followed by compact (e.g. VW Golf) and subcompact (e.g. VW Polo) with 17% each. Electrified vehicles took a record 17% share of the total European new car market in April 2020 with battery-electric cars and plug-in hybrids increasing volume sales too. The VW Golf was again Europe’s top-selling car model in April 2020 while the Tesla Model 3 was the best-selling electric car.

European Car Market Statistics 2020: January, February, March, April, May, June, July, August, September, October, November, December

Weak Car Sales Worldwide in April 2020

As expected, new car registrations in Europe faced a steady decline in April 2020 when sales volumes fell from 1.34 million units in April 2019 to 292,600 vehicles in April 2020. This represents the lowest monthly level since the 1970’s, and the worst result among the big three markets – China, USA-Canada, and Europe. Europe’s sharp decrease was only outperformed by India (-100%). Year-to-date volume for India was also the lowest result recorded since JATO started to track registration data in 1980.

Felipe Munoz, global analyst at JATO Dynamics commented: “Lockdown across the globe contributed significantly to the huge drop in registrations. Not a single OEM was prepared for this scenario or expecting a crisis on such a large scale. The only silver lining from this turbulence is that it has created an opportunity for automotive players to reassess their operations and become more agile.”

As quarantine was not enforced across all countries, registrations fell at different times and different levels. For instance, in Scandinavia, citizens were granted more freedom of movement, thus registrations fell by 37%, the lowest decrease. In contrast, four of the top five markets saw significant declines following strict lockdown restrictions. Combined registrations in Italy, the UK, Spain, and France tumbled from 646,000 units in April 2019 to 34,000 one year later.

See 2020 (April) Europe: Car Sales Per EU, UK, and EFTA Country for more details.

Electrified Cars Gained Market Share in April 2020 in Europe

However, not every aspect of the automotive industry saw a downturn in April. Despite the all-encompassing lockdown that took hold in Q1 and the negative economic indicators, electrified vehicles continued to gain traction. Their registrations totaled 50,400 units, making up 17% of the total new car market in Europe.

Demand for electrified cars fell by 46% compared to April 2019 but it was mostly due to the hybrid cars, which saw a decline of 66% to 18,900 units. Pure electric cars registered a decrease of 29% to 16,700 vehicles, while Plug-in hybrids saw almost 14,000 new clients, up by 7%.

Munoz explained: “EVs were already driving part of the small growth that remained in 2019. This year, as governments have acted quickly to protect their people and economies, EVs have gained even more traction and visibility due to incentives.” Munoz continued: “These cars are likely to become the top choice for consumers seeking private transportation. OEMs who have invested heavily in EVs, are best placed to navigate the tough months ahead.”

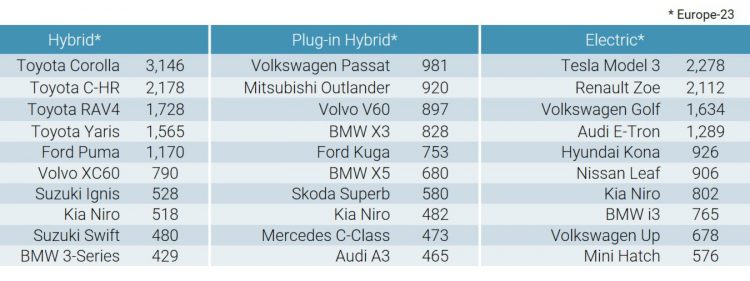

Best-Selling Electrified Car Models in Europe in April 2020

According to JATO, the best-selling electrified car models in Europe in April 2020 were as follows:

Toyota remained by far the best-selling hybrid car brand in Europe in April 2020. The VW Passat was Europe’s top-selling plug-in hybrid while the Tesla Model 3 outsold the Renault Zoe as Europe’s favorite electric car model.

Registrations of Volkswagen’s, Volvo’s, Audi’s, and Ford’s EVs posted double-digit growth. They were able to gain traction arising from the Volkswagen Passat PHEV (981 units), Up BEV (678 units), Volvo V60 PHEV (897), XC40 PHEV (339 units); Audi E-Tron (1,289 units), A3 PHEV (465); and Ford Puma HEV (1,170 units), Kuga PHEV (753). Other key models such as the Tesla Model 3, Renault Zoe, and Nissan Lead registered declines of 37%, 47%, and 56% respectively.

SUVs Remained the Top-Selling Market Segment in Europe in April 2020

Registrations of SUV in April 2020 in Europe totaled 109,500 units, 78% less than April 2019. Their market share remained stable at approximately 37%. Volume fell mostly due to the B-SUV and C-SUV subsegments – as they are very popular in France, Italy, and Spain, the models were badly hit given these were three of the most affected markets. In contrast, the bigger and more expensive SUVs posted more moderate declines.

SUVs lost market share in the UK from 43% in April 2019, down to 37% in April 2020. Spain also saw a decrease, down from 45% in April 2019 to 41% in April 2020. Contrary to this, SUVs gained notable traction in Greece, with their market share rising to 47% in April 2020, compared to just 28% in April 2019. Similarly, in Ireland, their market share increased to 62% in April 2020 from 47% in April 2019.

Top-Selling Car Models in Europe in April 2020

The global pandemic impacted the sales performance of 419 (out of 433) models that were available in both April 2019 and April 2020. Only 13 models saw an increase in registrations, among which were the Mercedes EQC (42 units to 409), Porsche Cayenne Coupe (68 to 210), Skoda Scala (713 to 1,673), BMW X7 (202 to 341), Audi E-Tron (963 to 1,307), Mercedes GLE (1,047 to 1,272), BMW X6 (405 to 471), and Mercedes GLS (174 to 195).

Among the top-selling models, were the Volkswagen Passat, BMW X3 (the top-selling premium car), and Volvo S60/V60 in 24th position. Top market share was awarded to the Skoda Kamiq, BMW X3, Skoda Octavia, Ford Puma, and Mercedes GLC. In contrast, the Fiat Panda, Nissan Qashqai, Volkswagen Polo, Opel Mokka and Peugeot 3008 recorded the largest declines in market share.

Top Ten Best-Selling Car Models in Europe in April 2020

The ten best-selling car models in Europe in April 2020 according to JATO were:

The VW Golf remained Europe’s favorite car model in April 2020 followed by its sister model the Skoda Octavia. The Toyota Corolla made a rare entry onto the European top-ten list at position eight — more than three quarters of all Corollas sold in Europe were hybrid cars.

European New Car Market in 2020

Sales and Market Analysis: