In December 2020, the European new car market contracted by 3.8% but battery-electric car sales increased with the VW ID3 the second most popular car model in Europe behind only the Golf.

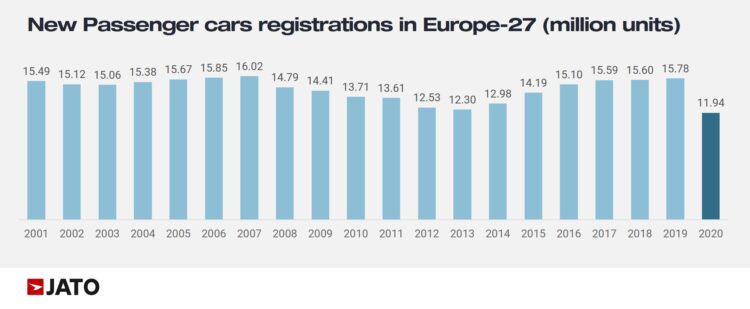

New passenger vehicle registrations in Europe were down 3.8% in December 2020 to only 1.2 million cars. However, the contraction was less severe than in previous months with the full-year market down a more substantial 24% to 11.94 million cars. Electric cars sold well and took nearly a quarter of the European new car market in December 2020. Although the Volkswagen Golf remained the top-selling car model in Europe, the battery-electric VW ID3 was the second most popular car overall for the month.

European Car Market Statistics 2020: January, February, March, April, May, June, July, August, September, October, November, December

Europe New Car Market in December 2020

The European new car market closed 2020 with further decline. According to data for 27 markets analyzed by Jato Dynamics, the volume fell by 3.8% in December 2020 to 1,212,858 units. While this demonstrates a smaller decrease than seen in previous months, this did not offset the overall trend as cumulative registrations for the full-year 2020 totaled 11,941,633 units, down by 24%.

The last time the industry registered less than 12 million units was in 1993 when volume totaled 11.82 million. Felipe Munoz, global analyst at JATO Dynamics, commented: “While the industry was already showing signs of decline in the last months of 2019, the COVID-19 pandemic has accelerated these existing trends – moving the market into an unprecedented environment, with consumers in lockdown unable to purchase vehicles.”

Lower SUV Sales

According to Jato, December’s decline in registrations was driven by double-digit decreases for SUVs in Italy, France, and the UK. Despite strong increases posted by pure electric and plug-in hybrid cars, the total market continued to demonstrate a decline due to this fall in demand alongside poor results across diesel and petrol car registrations.

In December 2020, the European market share of SUVs decreased when compared with results from December 2019 – the percentage dropping from 41.7% to 40.2%. Registrations totaled 487,560 units, marking a decrease of 7.2%, following an 11% drop across compact SUVs (the largest subsegment).

Munoz continued: “Two key factors have contributed to the recent stagnation in SUV growth. Firstly, after several months of continuous growth, it was always likely that new SUV registrations would start to level out. Secondly, the new electrification push from governments across Europe has drawn market interest away from SUVs – particularly as there are still very few pure electric SUVs available to buy”.

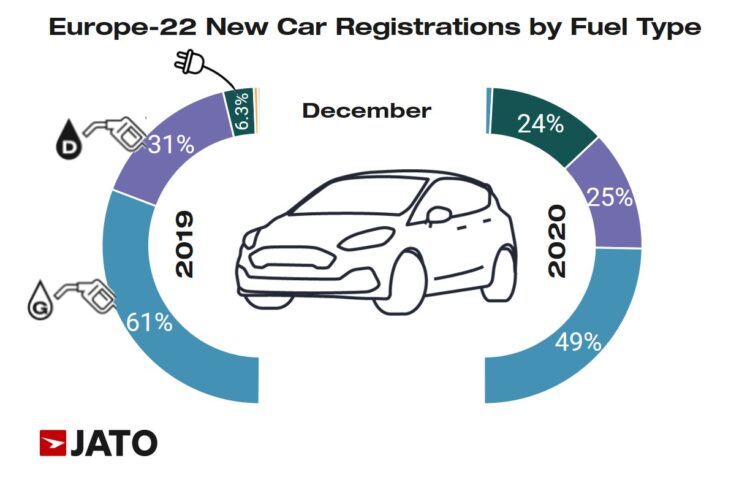

Car Sales by Fuel Type in Europe in December 2020

Demand for gasoline and diesel cars (including hybrids and mild-hybrids) fell by 23% each, in contrast with a 271% increase in pure electric cars and plug-in hybrids (EVs). These results close the gap between EVs and diesel cars, with EVs registering a 24.1% market share, compared to the 24.7% share seen for diesel cars. This is particularly significant when compared to December 2019 – when EVs made up only 6.3% of total registrations.

In a desperate attempt to avoid EU fines for excessive CO2 emissions, some manufacturers were delaying sales of heavily polluting cars while rushing electric cars to customers. Volkswagen brand for example managed to reduce fleet CO2 emissions below target but the larger Volkswagen Group is facing a €100 million fine.

Best-Selling Car Models in Europe in December 2020

Although the Volkswagen Golf was Europe’s best-selling car model for 2020, it fell behind the Renault Clio a few months earlier in the year and in December received strong competition from in house when the ID3 was the second-most-popular car model.

The strong demand for EVs resulted in two electric models securing places in the top 3 European best-selling cars. Behind the popular Volkswagen Golf, the Volkswagen ID.3 registered almost 28,000 units and became the second most registered car in Europe, during December. This significant achievement was possible due to positive results posted in the Netherlands, Sweden and Austria – where it led the overall rankings. The ID.3 was Germany’s third best-selling car, the 4th best-selling in the UK, and the 2nd best-seller in Denmark, Norway and Luxembourg.

This electric hatchback was followed by the electric Tesla Model 3 in the overall rankings for December. Munoz stated: “Europe is getting ready for an EV revolution and last month’s results are a clear indicator that when these cars have the right price attached to them, they can lure consumer demand away from popular gasoline and diesel models.”

The Renault Zoe, Tesla Model 3, and ID3 were the top-selling battery-electric cars for the full year.

Car Market Leaders in Europe in December 2020

Other models that have benefitted from recent EV growth include the Fiat 500 (boosted by the pure electric version) the Peugeot 2008, the Hyundai Kona, the Opel/Vauxhall Corsa, and the Renault Zoe. Further down the rankings, other models that performed well include: Seat Leon (+66%), Volvo XC40 (+67%), Skoda Kamiq (+58%), Volkswagen Up (+58%), Kia Niro (+99%), Nissan Juke (+90%), Nissan Leaf (+94%).

Among the latest launches the Ford Puma registered 12,874 units, Volkswagen registered 4,714 units of the ID.4, Mercedes registered 4,013 units of the GLB; Mazda registered 3,327 units of the MX-30, Polestar registered 3,117 units for its model 2; Citroen registered 2,314 units of the C4, Audi registered 1,962 units of the E-Tron Sportback, and Porsche registered 1,912 units of the Taycan.

European Car Sales Statistics for 2020 (Full Year)

- 2020 — Car Sales per EU, UK and EFTA Country (including market overview)

- 2020 — Europe: Best-Selling Car Manufacturers and Brands

- 2020 — Europe: Car Market by Fuel Type

- 2020 — Europe: Car Sales per Country for Electric and Plug-In Hybrid Cars

- 2019 Full Year: by Country, by Brands, by Model

European New Car Market in 2020

Sales and Market Analysis: