October 2020: car sales in Europe were down 7% but electric vehicle sales increased. The VW ID3 became Europe’s best-selling electric car.

New passenger vehicle registrations in Europe contracted by 7% in October 2020 largely due to new restrictions imposed on the movement of people due to Covid-19 towards the end of the month. Sales of electrified vehicles increased sharply to gain market share. FCA, Renault-Nissan, and Fiat gained market share but the Volkswagen Group remained Europe’s largest carmaker, with VW the leading brand, the VW Golf the best-selling car, and the VW ID3 the top-selling battery-electric car in Europe.

European Car Market Statistics 2020: January, February, March, April, May, June, July, August, September, October, November, December

European New Car Market in 2020 (October)

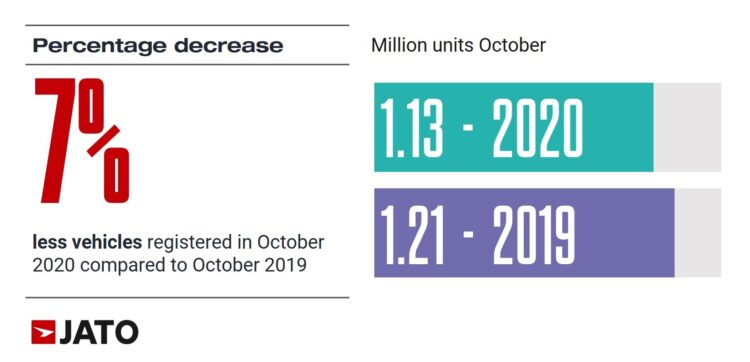

According to JATO, the global pandemic continues to have its grip on the European new car market. Year-to-date (YTD) 2020 registrations fell by 27% to 9.7 million units.

In October 2020, total registrations fell by 7.0% to 1,127,624 units, decreasing to the same level recorded in October 2018 and reflecting the significant impact caused by the second wave of the pandemic. However, the decrease in registrations recorded in October is the second smallest decline this year, demonstrating that there are still reasons to be positive.

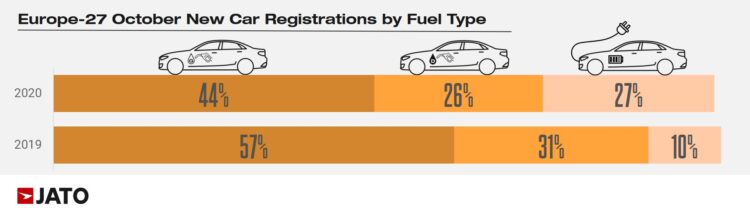

Car Sales by Fuel Type in Europe in 2020 (October)

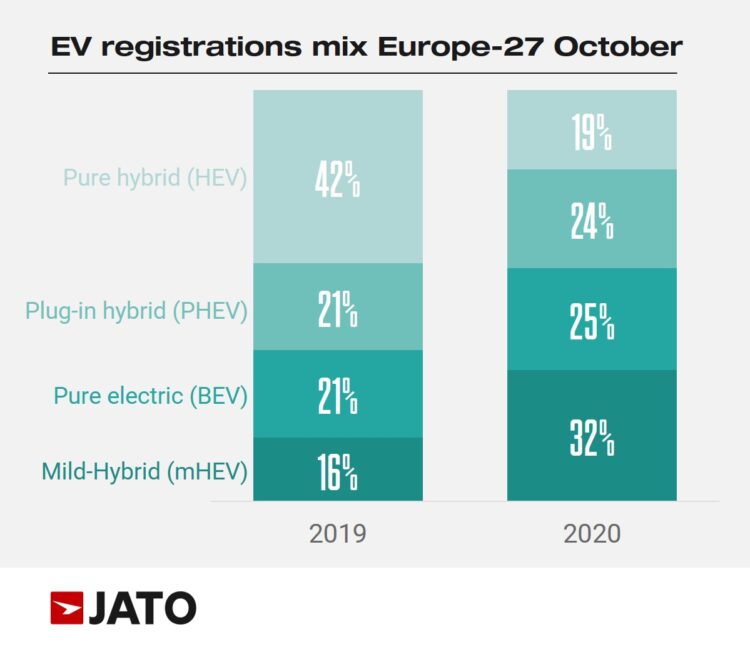

In the face of Covid-19 electrified vehicles (EVs) continue to buck the trend. In fact, EVs including pure battery electric vehicles (BEV), plug-in hybrids (PHEV), pure hybrids (HEV), and mild hybrids have seen extremely positive results. In October 2020, EVs registered 302,587 units, taking 26.8% of the total market share. For a second month running, EVs outsold diesel cars, with a falling market share of 26.3%.

When compared to October 2019, EVs have seen a huge growth of +153%, in part due to the success and popularity of mild-hybrid cars. They have become the preferred vehicle for carmakers and consumers looking for greener cars with a more accessible price tag than offered by pure electric and hybrid vehicles. In October 2020, mild-hybrids accounted for nearly a third (32%) of EV registrations, with their demand soaring by 427%. This impressive growth was aided in part by a strong commercial performance from the likes of the Fiat Panda, Ford Puma, and Fiat 500.

Lower emissions became very urgent for carmakers in Europe to avoid high European Union fines for excess pollution. European manufacturers are already restricting sales of high-emission cars during the final months of 2020 to try and meet targets.

Volkswagen Europe’s Largest Electric Carmaker

Pure electric cars (BEV) saw an increase of 197%, with 71,800 units sold in October 2020. Growth was driven by new launches, including the Volkswagen ID.3, which registered 10,590 units in Europe-27. In its first full month on the market, the ID.3 became Europe’s top-selling electric car model and 29th in the overall ranking. The Volkswagen ID.3 owed much of its success to businesses and fleets, with more than half of these registrations coming from buyers in these areas.

Felipe Munoz, global analyst at JATO Dynamics commented: “Similarly to the demand seen for the Tesla Model 3, the Volkswagen ID.3 is another example of how the appetite for competitive and stylish electric cars continues to grow day by day”.

As a result, Volkswagen Group became Europe’s biggest producer of EVs in October, comprising 25% of the market registrations. Interestingly, the German manufacturer posted a bigger market share in the BEV (29%). Munoz continued: “Volkswagen Group is catching up to its peers at great pace, in part due to its strong presence in Northern and Central Europe, where appetite for EVs continues to grow.”

Fiat Chrysler achieved the largest market share increase year-on-year for October. The double-digit growth posted by the Fiat Panda – which placed in the top 5 again for the first time since March 2020 – alongside the Jeep Renegade and Jeep Compass, helped FCA grow by 5% during the month. Renault-Nissan also increased its market share thanks to the Renault and Dacia brands, whose volume increased by 2% and 1% respectively. These two were closely followed by Suzuki, who increased their registrations by 18% and recorded double-digit growth across 4 of its most popular models.

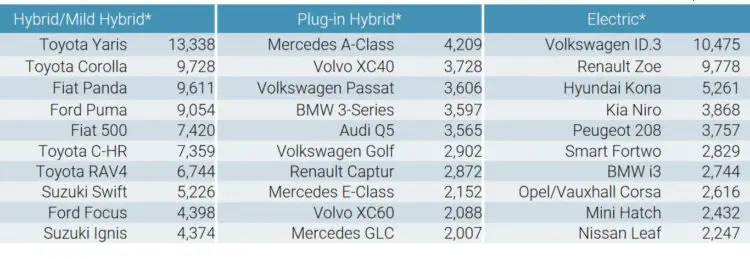

Top-Selling Electrified Car Models in Europe in 2020 (October)

The ten best-selling battery electric, plug-in hybrid, and mild hybrid car models in Europe in October 2020 were as follows according to JATO:

The VW ID.3 became Europe’s top-selling battery-electric vehicle in October 2020 ahead of the Renault Zoe. The electric Mini also made it into the top ten. Tesla was struggling with model availability and failed to make much of an impact on sales in Europe in October 2020.

The Mercedes-Benz A-Class was the best-selling plug-in hybrid in Europe followed by the Volvo XC40 and the Volkswagen Passat. Toyota continued to dominate the hybrid car market in Europe with four of the top-ten best-selling models including the top two: the Yaris and Corolla. The Fiat Panda was a surprising third while the Fiat 500 continue to be a top-seller. (An electric-only new Fiat 500 was recently introduced.)

Top Ten Best-Selling Car Models in Europe in October 2020

The Volkswagen Golf remained Europe’s favorite car model in October 2020 followed by the Renault Clio. The Opel/Vauxhall Corsa performed outstandingly well in October, becoming the third best-selling car in Europe for October and the year-to-date. It outsold both the Peugeot 208 and Citroen C3 that it shares a platform with.

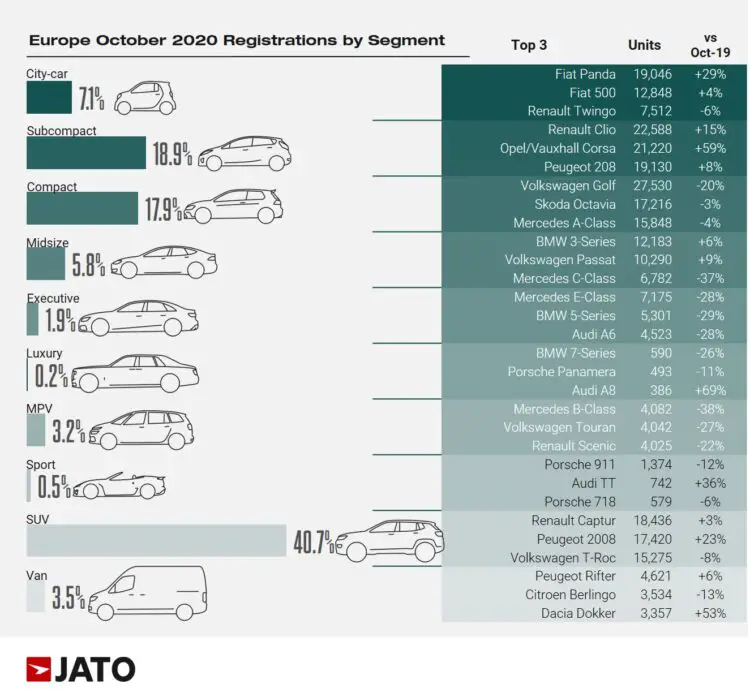

Registrations by Market Segment

SUVs remained by far the most-popular market segment in Europe with SUV registrations in October accounting for 41% of the market. The three top-selling SUVs were all smaller models, which until recently were often termed crossover models.

Strong growth was also posted by the Renault Clio, Fiat Panda, Peugeot 2008, Hyundai Kona, and Volvo XC40. The Ford Puma continued to climb up the rankings, becoming the 5th best-selling SUV with 14,430 units registered in October.

Other successes for the month include the Audi A3 (+50% to 10,821 units), Renault Zoe (+183% to 9,903 units), Kia Niro (+62% to 8,125 units), Mercedes GLA (+56% to 7,981 units), Audi Q5 (+59% to 7,395 units), Skoda Kamiq (+227% to 7,042 units), Suzuki Swift (+42% to 6,065), Nissan Juke (+500% to 5,724), Suzuki Ignis (+66% to 4,756), and Kia Xceed (+61% to 4,560 units).

European New Car Market in 2020

Sales and Market Analysis: