Most car brands are on target to meet CO2 targets in 2020 in Europe while forecasts show electric vehicles taking a 15% share of car sales in 2021.

Electric car sales are due to treble market share in Europe in 2020, as carmakers rush to comply with European Union CO2 targets. By mid-2020, the PSA, Volvo, FCA-Tesla, and BMW groups were already on target to meet CO2 reductions to avoid heavy fines while Jaguar-Land Rover and Daimler were lagging. The forecast is for electric cars to take a 15% share of new car sales in Europe in 202.

Electric Car Sales and CO2 Targets in Europe in 2020 and 2021

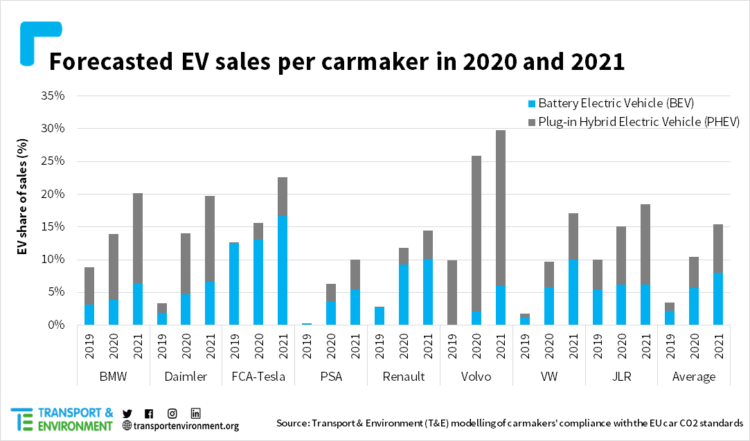

Electric cars will treble their market share in Europe in 2020, as a result of EU car CO2 targets. Despite the pandemic, EV sales have surged since 1 January 2020, just as the emissions standards kicked in, and will reach 10% in 2020 and 15% in 2021. The NGO Transport & Environment (T&E), which analyzed sales in the first half of 2020, as well as carmakers’ compliance strategies, said it shows ambitious CO2 standards work but there’s a risk EV momentum runs out of steam after 2021 due to lax EU targets for 2025 and 2030.

Electric vehicles (EV) refer to both battery-electric vehicles (BEV) and plug-in hybrid vehicles (PHEV). Various studies have indicated that PHEV actually increased overall emissions, as many owners fail to ever plug the cars in.

Manufacturers may follow various strategies to reduce emissions with a complex set of rules. The main strategies are:

- Battery-electric cars give manufacturers a bonus, e.g. counting double.

- Plug-in hybrids give a bonus irrespective of any electric distance ever be driven.

- Improving the fuel consumption of internal combustion engines (ICE) through mild hybrids, better efficiency, or smaller engines.

- Lower targets for heavier cars (thank the German car industry lobby for this one, although the average Volvo car is the heaviest).

- Special rules for smaller manufacturers — some producing the heaviest polluting supercars and large SUVs on the European market.

- Flexibilities — special rules for eg pooling brands, phasing-in credits, and eco-innovations.

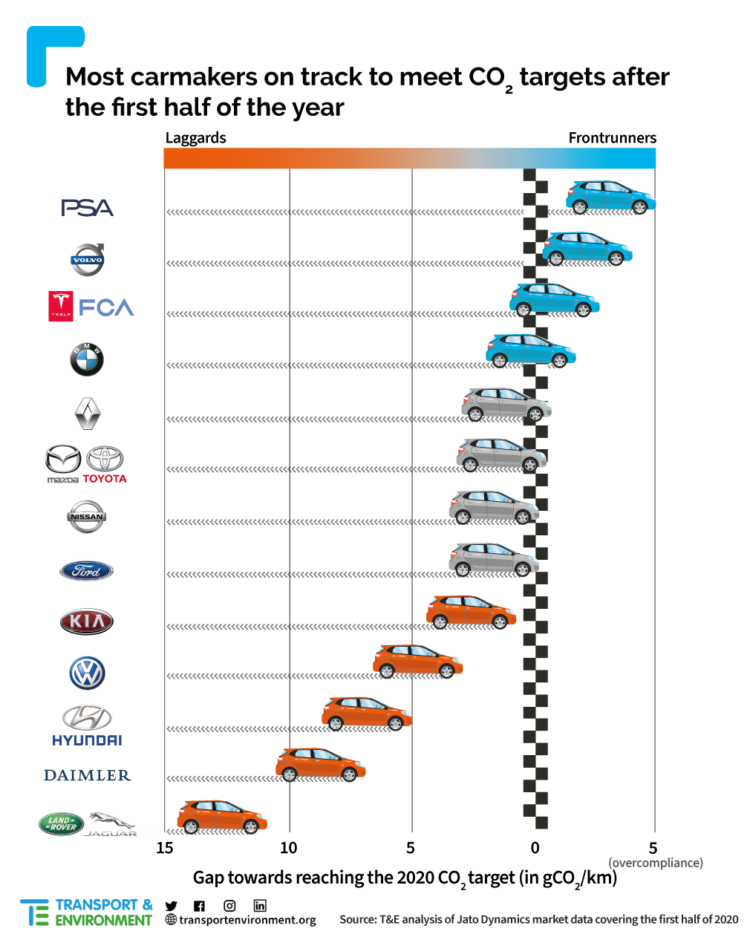

Car Manufacturers European Union CO2 Targets in 2020 (Half Year)

By mid-2020, most carmakers in Europe were on target to reduce CO2 emissions to near the 95g/km target set by the European Union. According to Transport & Environment, European carmakers were performing as follows by mid-2020:

Car Makers on CO2 Emission Targets Mid-2020

The PSA Group (Peugeot, Citroen, DS, Opel) was the only carmaker to significantly over comply with 3 g/km below target. The PSA Group relied heavily on improvements in ICE but battery-electric cars are likely to become more important towards the end of the year and in 2021.

Volvo was also complying with plug-in hybrids nearly a quarter of all sales. However, Volvo has the heaviest vehicles making its target only 111 g/km. According to T&E, Volvo was the only manufacturer to actually reduce the efficiency of its ICE (by 1%) between 2019 and 2020.

The FCA group (Fiat, Jeep, Alfa Romeo) woefully lack behind in clean technology but grouped with battery-only Tesla to reduce emission to below target. Without Tesla, FCA would miss the target by a massive 17 g/km. The planned merger with PSA may reduce FCA’s need for Tesla credit, which the American company could probably sell equally profitable elsewhere.

The BMW Group (BMW, Mini) is the only German car company to have reached its target by mid-year. BMWs strategy relies heavily on plug-in hybrids, although electric cars also contribute and should become more important in 2021.

Car Brands Missing CO2 Targets by Mid-2020

By mid-2020, the Volkswagen Group (VW, Audi, Porsche, Seat, Skoda) was missing its target by 5 g/km which could mean significant fines due to the group building around a quarter of all cars sold in Europe. However, a late rush to supply the ID3 cars during the second half of 2020 may see VW meeting the target by increasing electric car sales share from 7% mid-year to 10% for the full 2020 (6% BEV and 4% PHEV). VW will also pool with SAIC — its high BEV sales through MG in the UK will be particularly important after the finalization of Brexit, as VW seems particularly successful with heavy polluting cars in Britain.

Daimler (Mercedes-Benz, Smart) was struggling mid-2020 with sales 9 g/km over target. However, Daimler has apparently performed well with electrified vehicles during the third quarter and might be near target by year-end. Daimler could also pool with a compliant manufacturer to avoid fines. According to T&E, if Daimler cut the 1% of vehicles that emit the most (close to 300 g/km), overall emissions will drop 1.6 g/km. Unfortunately, for the environment, those 1% probably earn Mercedes-Benz a lot more than cleaner cars.

Jaguar-Land Rover has the highest target of all brands — 132 g/km — but by mid-2020 was still 13 g/km over target. JLR is expected to make use of special rules (“flexibilities”) and an increase in PHEV sales. JLR may also have to reduce sales of some models or pool with another manufacturer. In October 2020, JLR announced that they expect having to pay around $118 million in penalties for cars sold in 2020.

Electric Car Sales Forecasts in Europe in 2020 & 2021

T&E forecasts that electric car share for sales by brand in Europe will be as follows in 2020 and 2021:

But while electric cars’ market share will go from 3% to 10% in 2020, and to 15% in 2021, T&E expects to see it at only 20% four years later if the current CO2 regulation is not revised. Norway shows how fast the EV market can grow: from 6% of sales in 2013 to almost 50% five years later, in 2018.

Worryingly, sales of lucrative but highly-polluting SUVs in Europe crept up to 39% in the first half of 2020. This is encouraged by a loophole in the EU regulation whereby selling heavy vehicles actually gives carmakers laxer CO2 targets. Also, studies showed half of all the electric cars sold today are “fake electric” plug-in hybrids that are rarely charged and emit 2-4 times more CO2 in the real world than the lab tests show.

Julia Poliscanova, senior director for clean vehicles at T&E, concluded: “The electric car is finally entering the mainstream in Europe but SUV sales are still growing like weeds. The only way to kill off highly-polluting vehicles is to give carmakers a clear end date now. Cars that run on biofuels, fake electric engines or fossil gas emit CO2 and shouldn’t be allowed on the market after 2035.”

The “Mission (almost) accomplished! Carmakers’ race to meet the 2020/21 CO2 targets and the EU electric cars market” report by the European Federation for Transport and Environment is available as a free pdf download.

See also: 2020 (August) Europe: Top Car Brands for CO2 Targets

European New Car Market in 2020

Sales and Market Analysis: