January 2020: New passenger vehicle registrations in Europe contracted by 8% while electrified car sales surged in many markets.

The European new car market was smaller in January 2020 with sales significantly down on both January 2019 and December 2019. The contraction was largely predicted due to a change in emission regulations that brought many car purchases forward to the end of 2019. Electrified vehicle sales increased strongly. Volkswagen was again the largest car brand in Europe and the VW Golf Europe’s favorite car.

European Car Market Statistics 2020: January, February, March, April, May, June, July, August, September, October, November, December

Lower Car Sales in Europe in January 2019

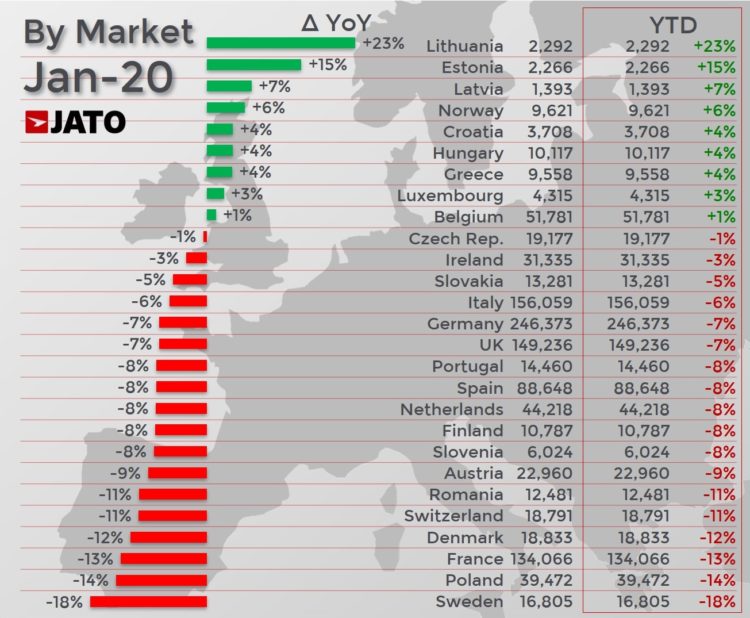

After a large increase in European registrations experienced in December 2019, volumes for January have decreased, marking another month of transition for the complex new car market. A total of 1,138,057 new passenger cars were registered in January 2020, representing a decline of 7.6% from January 2019. According to Jato, this steep reduction was in large part caused by the last-minute purchases made in December, due to the impending introduction of the new CO2 emissions regulation.

Despite the decrease from December, registration levels were actually the 4th highest in January, for any year in the last decade. Felipe Munoz, global analyst at JATO Dynamics explained: “The European market is still showing signs of strength despite a tough environment. We believe that the market is capable of adapting to meet new regulations and impending challenges. This is exemplified by the increase of EV registrations, which was a lifeline for many OEMs in January. Only two years ago not many in the industry would have predicted such high levels of demand for EVs.”

Increase in Electrified Car Sold in Europe in 2020 (January)

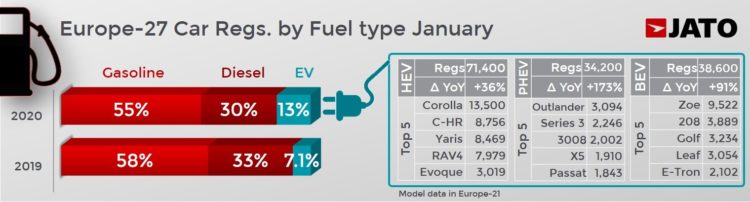

Electrified vehicles provided the only driver of growth for the European new car market in January 2020. They posted a record in volume and market share due to increasing incentives for consumers, greater awareness about the benefits of electrified vehicles, and the growing concern about diesel and petrol cars.

During January 2020, total EV registrations increased by a huge 72%, jumping from 87,100 units posted in January 2019 to 150,100 units in the same month of 2020. This is a market share of 13.3% compared to just 7.1% in the year prior.

All EV types contributed to growth as Hybrids (HEV) increased their volume by 36%, pure electric (BEV) by 91% and plug-in hybrids (PHEV) by 173%. For the first time, the hybrids counted for less than half of total EV registrations. Munoz commented: “Europe demonstrated that the widespread adoption of EVs is increasingly feasible, and will become a likely reality once the cars become more affordable”.

However, it should also be born in mind that electrified cars in for example Germany receive very generous tax benefits, irrespective if the car is ever charged or driven in battery mode. Many of the electrified cars sold in Germany are used by business travelers driving long distances where fuel consumption may actually be higher in an electrified car than in a normal combustion engine vehicle.

Electrified Vehicle Sales Per EU Country and Car Brand

The penetration of EVs in each market highlights the outstanding performance of these vehicles. They made up 77% of total car registrations in Norway, 38% in Sweden and 28% in Finland. Among the big markets, EVs counted for almost 19% in France, 14% in the UK, 12% in Spain, 10% in Germany and 8% in Italy.

By brand, these cars represented an important part of the volume registered by Smart (96%), Lexus and Toyota (95% and 66% respectively), DS (42%), Suzuki (41%) and Land Rover (37%). In contrast to this, they made up a significantly smaller proportion of the volume by registered by Citroen (1.4%), Seat (1.4%), Ford (3.3%), Opel (3.9%), Skoda (4%) and Volkswagen (5%).

The Renault Zoe was the top-selling battery-electric car in Europe in January 2020 followed by the Peugeot 208, VW Golf, and Nissan Leaf.

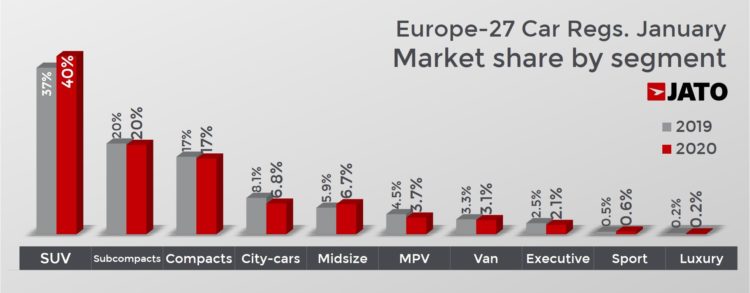

Car Sales in Europe by Sector

Meanwhile, despite a slight decrease in total registrations SUVs did manage to increase market share due to the drop in overall vehicle sales in January. Across Europe, consumers bought 452,900 SUVs, down by only 1%, which allowed them to gain 2.6 points of share at 39.8% of total registrations. Only 14% of all SUV registrations in January were powered by electrified engines, whereas 28% of luxury sedans were HEV, PHEV or BEV. Munoz noted: “SUVs continue to gain traction. However, manufacturers need to produce more EV models if they want to keep up the momentum of growth moving forward”.

Top-Selling Car Brands and Models in Europe in January 2020

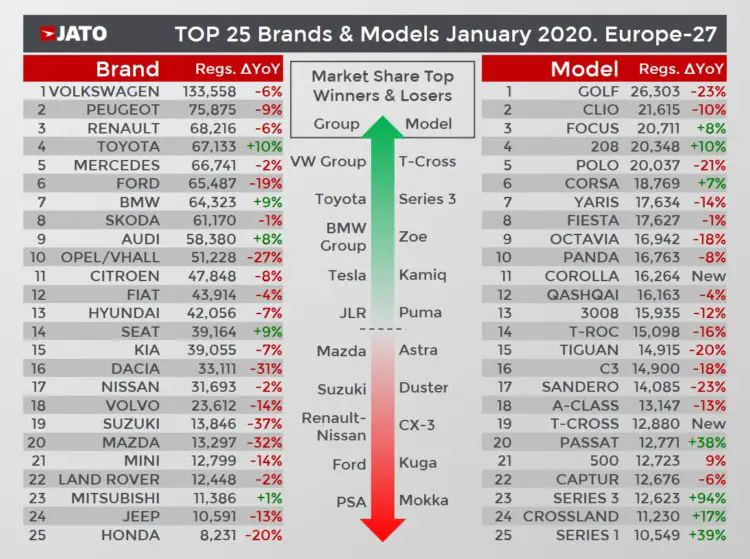

Volkswagen, Peugeot, and Renault were the largest car brands in Europe in January 2020 but all three sold in lower volumes. In contrast, Toyota, BMW, and Audi all increase volume sales and gained market share.

The VW Golf remained the best-selling car model despite sales contracting by a quarter – this is partly due to the Golf changing to a new model with limited availability. Sales of the Renault Clio were also lower while the Ford Focus and Peugeot 208 both sold in higher numbers. Polo sales were down by a fifth while the new Opel Corsa had stronger sales.

Among the latest launches, the Volkswagen T-Cross registered 12,880 units; the Skoda Kamiq 6,079 units; Ford Puma 6,036 units; Skoda Scala 5,646; Mazda CX-30 5,561; Kia Xceed 3,231; Audi Q3 Sportback 3,080; DS 3 Crossback 2,382; Lexus UX 1,894; Tesla Model 3 1,457; Toyota Camry 1,182.

European New Car Market in 2020

Sales and Market Analysis: