January to August 2020: Volvo reached its CO2 target as the greenest carmaker in Europe. Other car brands also reduced CO2 emissions on sales in Europe in 2020.

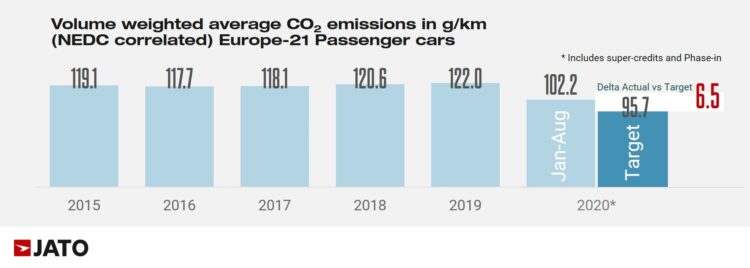

January to August 2020: The combined car sales in the European new car market were only 6.5 g/km above the combined CO2 target set by the European Union (EU) for cars sold in Europe in 2020. Volvo claimed to be the greenest carmaker in Europe by already reaching its target four months early. BMW is also expected to reach its target soon as it was only 0.54 g/km above its limit.

Lower CO2 Emissions in Europe in 2020 (Jan to August)

Many car manufacturers have started to see a significant reduction in their average emissions levels and are largely on track to hit targets set by the European Commission, despite new car registrations being severely affected by the Covid-19 pandemic. Lower general car sales probably also helped to increase the market share of generally more expensive cleaner cars.

According to data collected and updated on a monthly basis by JATO Dynamics, for 21 countries in Europe, the average CO2 emissions totaled 102.2 g/km* – under the New European Driving Cycle (NEDC) between January – August 2020. (*Includes super-credits system and pools. Excludes Norway and Switzerland.) By these calculations, the European automotive market is currently 6.5 g/km over their combined target for 2021– this is a dramatic shift when compared to figures recorded in 2019.

Despite overall registrations falling by 29% between January and September 2020 (Q3/2020) — when contrasted with the same period in 2019, registrations for electrified cars in Europe increased by 67% through September to 1.54 million units. This increase goes some way to explain the double-digit drops seen in demand for gasoline and diesel cars, and the increase in market share for EVs from 7.8% in January – September 2019, to 18.1% in January – September 2020.

Volvo First Brands to Reach CO2 Target in Europe in 2020

Geely Group has secured pole position in the race for CO2 rankings and smashed its target. Outperforming Toyota – which has traditionally led by brand in the CO2 race – the owner of Volvo (which accounts for 99% of Geely Group’s volume in Europe), Polestar, LEVC, and Lotus, met the target by August 2020, 4 months ahead of the deadline.

Geely’s CO2 target for 2020 was an average of 110.3 g/k, but by August 31st its average was 103.1 g/km – making Geely the only manufacturer to outperform the target. A consistent focus on EVs is behind this achievement, with electrified vehicles accounting for almost half of its registrations in August, and 38% in January – August 2020.

Although Volvo is thus the greenest car brand in Europe by these calculations, it also builds the heaviest cars in Europe and thus receive special flexibilities, which results in its relatively high 110.3 g/km target.

BMW Near CO2 Target for 2020

According to JATO, BMW is next in line to meet the EU’s CO2 emissions target. With an average of 103.5 g/km in August 2020, BMW was only 0.54 g/km above their target of 102.9 g/km. If this average remained the same, the German car maker would only have to pay a minimal penalty at the end of the year.

JATO believes meeting the target is more than achievable due to the mix of two strategies: increasing the share of electrified vehicles on sale, and the relatively low emissions generated by their diesel cars. (Partly for similar reasons, Mercedes-Benz stopped production of several low-volume, but high-polluting coupes and cabriolets earlier in 2020.)

Toyota Brands CO2 Strategy in Europe in 2020

According to JATO, Toyota’s apparently good position only 2.2 grams away from target is deceptive. It seems that Toyota’s hybridization objectives (which started some years ago) are now stalling. For the past 3 years, hybrids have accounted for around two-thirds of Toyota’s registrations in Europe, yet they are still not meeting the targets.

Damagingly, its pure electrics vehicles (real zero-emissions cars) have also taken a long time to arrive in Europe – with the new Lexus UX 300e, the first fully electric vehicle of the group, finally hitting the market this year.

Toyota’s rival, Hyundai-Kia has started to question Toyota’s methods. The strategy of Korea’s largest maker has been to boost its small SUVs and green compact cars. It seems to be paying off. While hybrids accounted for 65% of Toyota Group volume in August 2020, they only made up 13% for Hyundai. However, pure electric cars represented 8% of registrations for the Korean manufacturer, while Toyota has been unable to put any on sale this year.

According to JATO, this perfectly demonstrates how BEVs are much more strongly placed to meet emissions targets, perhaps more so, than hybrid vehicles. It also partly explains the huge importance of battery elective vehicles for Volkswagen that maintained production of the old electric Golf while waiting for the ID3 to reach the market. BMW similarly extended the production life of the i3.

See also 2020 & 2021 Europe: CO2 Targets and Electric Car Sales Forecasts for the state of the market at mid-2020 and predictions by the Transport & Environment NGO.

European New Car Market in 2020

Sales and Market Analysis: