In January 2024, new car sales in Europe increased by 11% with Volkswagen the top-selling brand in Europe and the Dacia Sandero Europe’s favorite car model.

The European new car market (EU, EFTA, and UK) expanded by 11% in January 2024 to just over a million new passenger vehicle registrations. Volkswagen remained the largest carmaker in Europe with VW the top-selling brand. The Dacia Sandero was the top-selling car model in Europe in January 2024 while the Tesla Model Y was the best-selling battery-electric vehicle.

Latest European Car Market Statistics 2024 (Full Year): Market Analysis, Sales by Country, Electric, Brands, Top 50 Models, Top 20 Electric Models; 2023-2007.

European New Car Market in 2024 (January)

Despite predictions of gloom by various carmakers, new passenger vehicle registrations in Europe increased by 11% to 1,011,281 cars in January 2024. Electric cars and plug-in hybrids accounted for a large percentage of this increase but SUVs also increased in popularity.

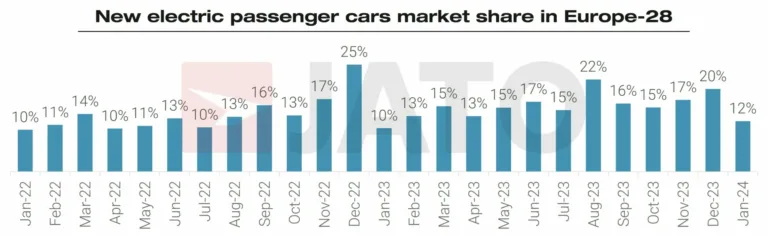

While volume for new battery-electric vehicles increased by 29% from January 2023 figures, these vehicles took just 12% of the total market share in January 2024, with 120,536 registered. This marks the lowest levels recorded for new registrations since their 10% share in January 2023.

Felipe Munoz said: “While interest in electric vehicles remains strong among consumers and fleets, these vehicles are no longer enjoying the same growth rate seen over the last year and a half. It is clear that a lack of affordable models alongside regulatory uncertainty continues to have an impact on mass adoption across Europe.”

Strong SUV Sales in Europe in January 2024

According to Jato Dynamics, SUVs, sports cars, and compact cars saw increased popularity in January 2024. In particular, 543,000 SUVs were registered – accounting for over half (52.8%) of total European registrations and marking a rise of 1.2 points from the same period last year. Felipe Munoz, Global Analyst at JATO Dynamics, commented: “It’s clear that SUVs are not losing their shine to European consumers, despite these vehicles being subject to new campaigns and regulations in certain countries.”

97% of Jaguar Land Rover’s volume in January came from SUVs. Similarly, these vehicles accounted for 92% of Nissan’s volume, 86% of Geely’s (including Volvo and Polestar), and 79% of Chinese brands (excluding Geely and SAIC groups).

In contrast, SUVs were less popular for Mitsubishi and Renault Group, with the vehicles accounting for just 31% and 34% of volume registered, respectively. Felipe Munoz added: “From the 19 car groups we analyzed, SUVs were the best-selling vehicles among 14 of them – a significant achievement for the segment.”

While Volkswagen Group led the SUV segment with 23% overall share, its volume declined by 4% compared to January 2023. In contrast, over the same period, Stellantis saw a 25% increase in volume, as the second-largest SUV seller. This performance comes as a result of strong registrations recorded for the Peugeot 2008, Opel/Vauxhall Mokka, and Jeep Avenger.

The top 10 most registered SUVs for the month were: the Toyota Yaris Cross; Peugeot 2008; Volkswagen T-Roc; Kia Sportage; Ford Puma; Dacia Duster; Hyundai Tucson; Nissan Qashqai; Tesla Model Y; and Volkswagen Tiguan. However, several of these cars could just as well be classified as compact vehicles.

Best-Selling Car Brands in Europe in January 2024

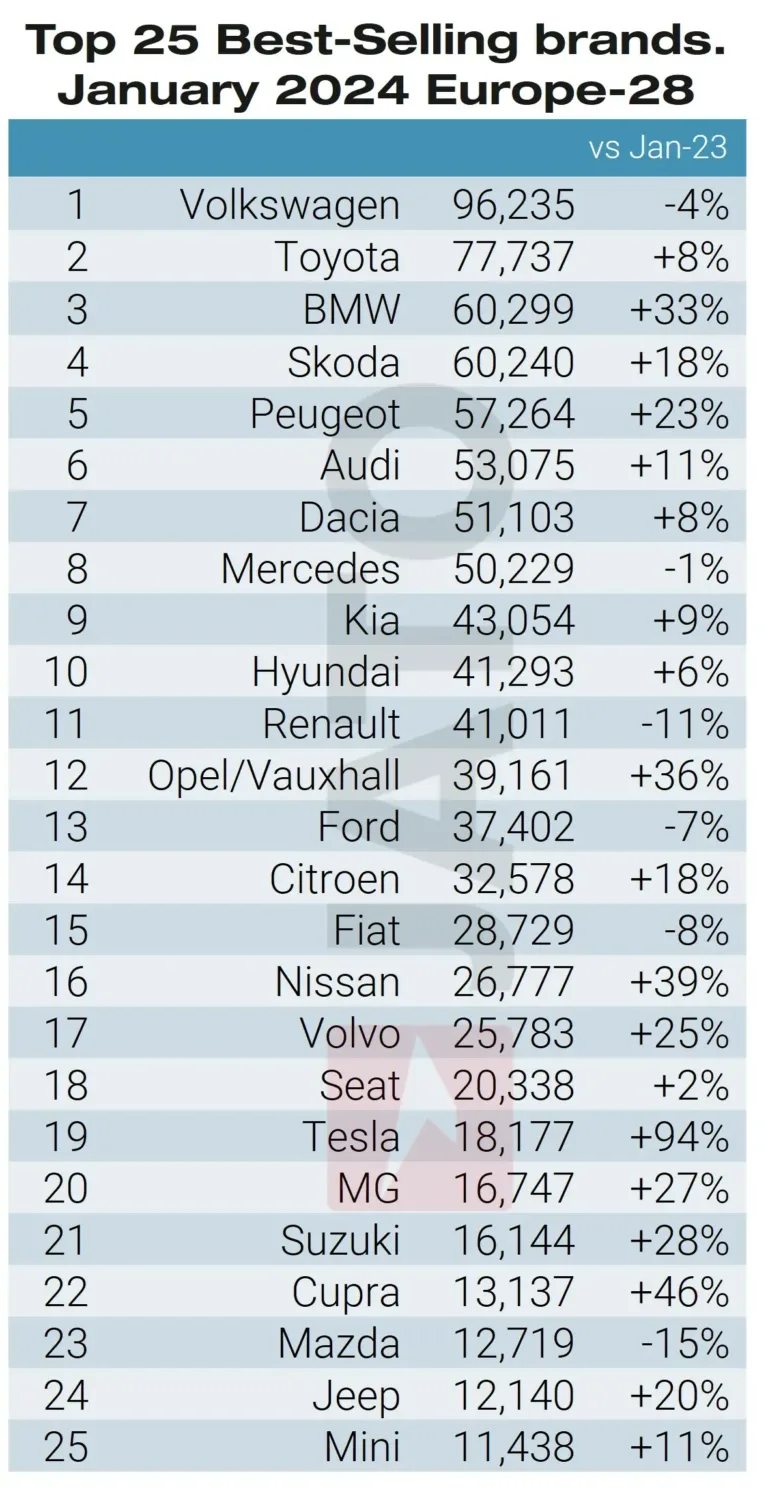

The top-selling car brands in Europe (EU, EFTA, UK) in January 2024 according to JATO were:

Volkswagen and Mercedes-Benz were the only two top-ten brands with weaker sales in January 2024 compared to a year ago. BMW increased sales by a third while Skoda sales were up by nearly a fifth. Tesla almost doubled sales.

Best-Selling Electric Car Brands and Models in Europe in 2024 (January)

Tesla led the BEV brand ranking, accounting for 15% of the share of electric car sales in Europe – up from 10% in January 2023. The Model Y was the most registered electric vehicle in Europe in January 2024, and the 2023 best-selling car model in Europe. The Model Y outperformed the combined volume registrations for all BMW electric models, which was the second brand in the ranking. The Model 3 also saw a significant uplift in market share, with an increase of 344% from January 2023.

Although the Tesla Model Y was the top-selling electric car model, it was only the 20th most popular car model overall in Europe in January 2024.

Volvo was third in the BEV ranking due to the strong performance of the EX30, making up over a quarter (28%) of its BEV registrations. Audi and Mercedes followed this, outselling Volkswagen brand, whose volume dropped by 28%.

The Volkswagen Group registered the highest volume of electric vehicles, retaining its crown. In January 2024 it held an 18% market share (down from 25% in January 2023). The German maker was closely followed by Tesla, and Stellantis with 15% and 12.6% market share respectively.

Best-Selling Car Models in Europe in January 2024

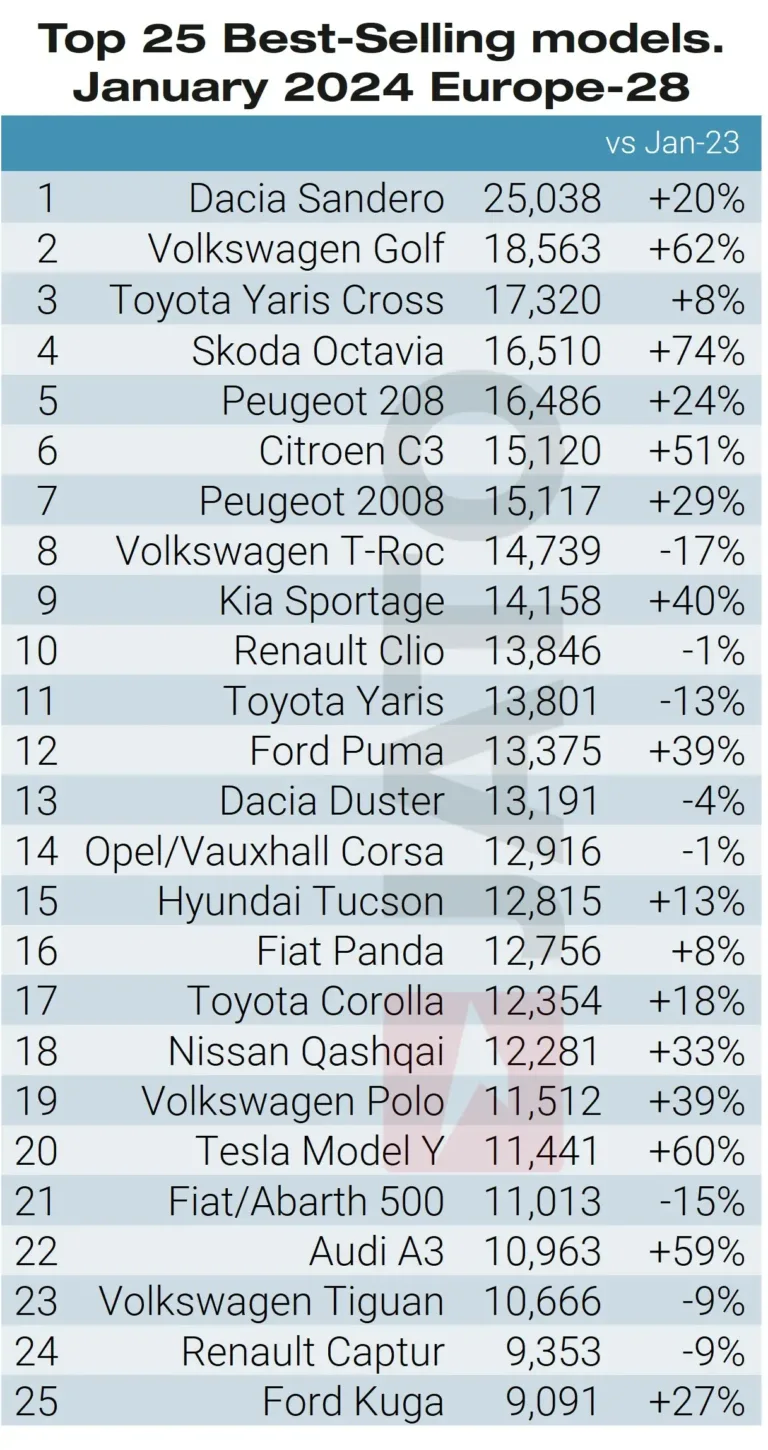

The best-selling car models in Europe in January 2024 were:

The Dacia Sandero once again secured the top spot among the overall model rankings in Europe in January 2024. The Romanian, Renault-owned brand registered more than 25,000 units of its B-hatchback, up by 20%, due to strong results recorded in Italy and Germany – its second and third largest markets, respectively.

The Sandero was followed by the Volkswagen Golf, with its volume increasing by 62%. The compact benefited from strong registration increases across its three largest markets – Germany, the UK, and France. Sales of the Skoda Octavia were up a strong 74% to take fourth place behind the Toyota Yaris Cross.

Among the latest entries, the Jeep Avenger did well, recording more than 7,200 units (its electric model accounted for 22% of this total). The Volvo EX30 registered more than 2,300 units, becoming the fourth most popular Volvo. BYD registered 1,257 units of the Atto 3, while Kia registered 1,242 units of the EV9. The Smart #1 recorded almost 1,100 units, outselling the Fortwo. Mitsubishi registered 1,074 units of the Colt, and BMW registered 1,073 units of the i5.

Europe Car Sales Statistics

→ Latest European Car Sales Statistics

- 2025 (Outlook) Europe: Car and Electric Car Sales Forecasts

- 2024 (Full Year): Market Analysis, Car Sales by Country, Electric Sales by Country, Best-Selling Brands, Top 50 Models, Top 20 Electric Models

- 2024: January, February, March, April, May, June, July, August, September, October, November

- 2024 (Half Year): Car Sales by European Country, Top Brands, Top 25 Models

- Full-Year 2023: Car Sales by Country, Brands, Top 50 Models, Top 20 Electric Car Models