In July 2020, new car sales in Europe contracted by 4%, electrified vehicles took an 18% share of new car registrations, and the VW Golf was the top-selling car model.

In July 2020, new passenger vehicle registrations in the European Union were down 4% but markedly stronger than in recent months. However, year-to-date 2020, new car sales in the EU are down by 35%. The popularity of electrified vehicles increased to take an 18% share of new passenger vehicle registrations in Europe in July 2020. Sales of pure battery-electric vehicles more than doubled for a 4% share. The VW Golf was again the top-selling car model in Europe.

European Car Market Statistics 2020: January, February, March, April, May, June, July, August, September, October, November, December

New Car Sales in the European Union in 2020 (July)

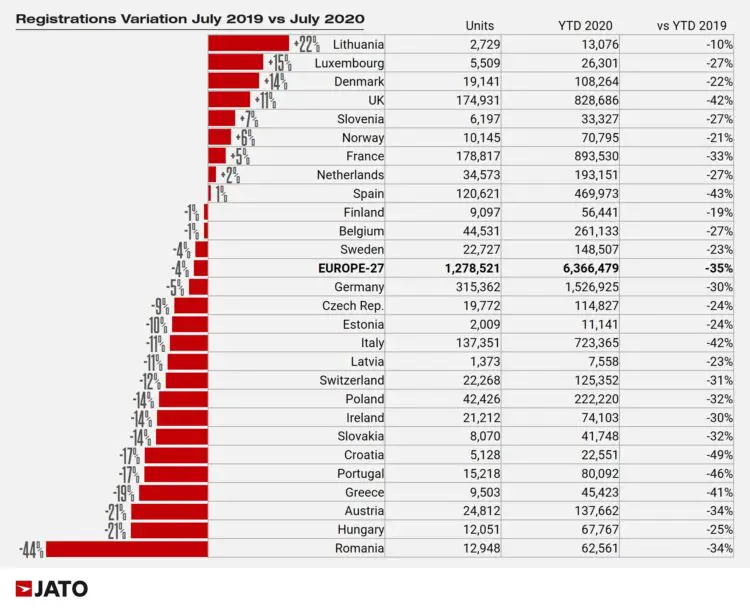

In July 2020, new passenger vehicle registrations in the European Union and Britain contracted by 4% to 1,278,521 cars. Although this hinted at some recovery, the numbers in no way compensate for sales lost during the preceding months.

According to JATO, the latest numbers demonstrated that the motor industry in Europe is slowly reverting back to normal. JATO’s data for 27 markets shows good news after several months of decline in registrations. July saw the highest monthly volume figures so far in 2020 – this also being the highest since September 2019 – with the industry registering 1,278,521 new passenger cars, down by only 4% month on month from 2019.

New Car Sales Per European Union Country in 2020 (July)

During the first seven months of 2020, new car sales contracted by 35% in Europe. Germany and France were the largest new car markets in Europe but during the first seven months of 2020 sales were down by nearly a third. In Britain, Italy, and Spain, new car sales were even weaker with the market shrinking by over 40%

Demand recorded healthy figures in countries such as the United Kingdom, Denmark, and France, alongside other small and midsize markets. Much of this boost can be explained by an increased appetite for green cars, and more value offers. Munoz continued: “The increasing demand predominantly favours SUVs, with a wider offering, including more electrified versions.”

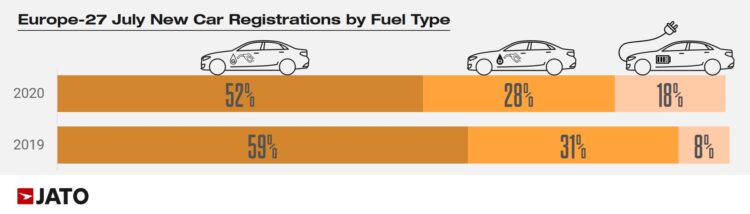

Car Sales in Europe by Fuel Type in July 2020

The global pandemic’s strong impact on the economy has not dampened consumer’s interest in electrified vehicles (EV). July 2020 was a record-breaking month for EV registrations with volume up 131% year on year to 230,700 – the first time that these vehicles were bought by more than 200,00 consumers in a single month. As a consequence, EVs accounted for 18% of total registrations in July, far greater than their market share of 7.5% in July 2019, and 5.7% in July 2018. “The rise in demand for EVs is strongly related to a wider offer that is finally including more affordable choices. The higher competition amongst brands is also pushing down prices.” Munoz commented.

It is important to note that these numbers are for new registrations — many manufacturers were unable to supply the electric cars consumers ordered with delivery times for some models as long as 12 months. According to the German car magazine Auto Motor und Sport, the only electric car that can be ordered and delivered in Germany in less than three months is the rather pricy Porsche Taycan. Cars with a three-month delivery date include the Renault Zoe, Nissan Leaf, and VW Id3 but most other electric car models were either sold out or won’t be delivered during 2020.

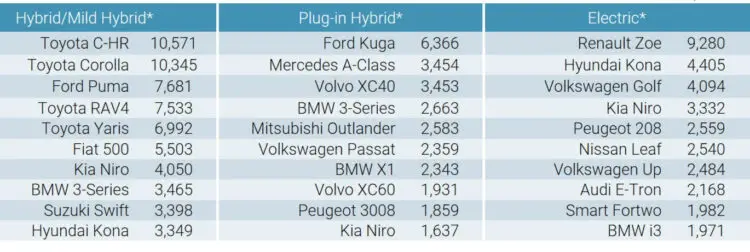

Best-Selling Electric and Hybrid Cars in Europe in July 2020

According to JATO, the following were the top-selling battery-electric, plug-in hybrid and mild-hybrid cars in Europe in July 2020:

Half of the electrified cars sold in Europe in July 2020 were powered by a hybrid engine (HEV), with demand soaring by 89%. The mild-hybrid versions of the Ford Puma and Fiat 500 contributed to this result. Plug-in hybrids (PHEV) followed with 55,800 units, up by 365% from July 2019, and boosted by new models like the Ford-Kuga, Mercedes A-class, BMW XC40, and BMW 3-Series.

Finally, the pure electric cars (BEV) also showed encouraging results. Registrations jumped from 23,400 units in July 2019 to 53,200 just one year later, and the offer increased from 28 different models available to 38. New models like the Peugeot 209, Mini Electric, MG ZS, Porsche Taycan and Skoda Citigo buoyed the figures.

Tesla posted a 76% decline to 1050 units following shipping delays to Europe, as a consequence of production challenges in its Fremont, California plant. Munoz said: “In contrast to the general trend of increasing demand for electric cars, Tesla is losing ground this year in Europe. Some of this can be explained by issues relating to the production continuity in California, but also by high competition from brands that play as locals in Europe.”

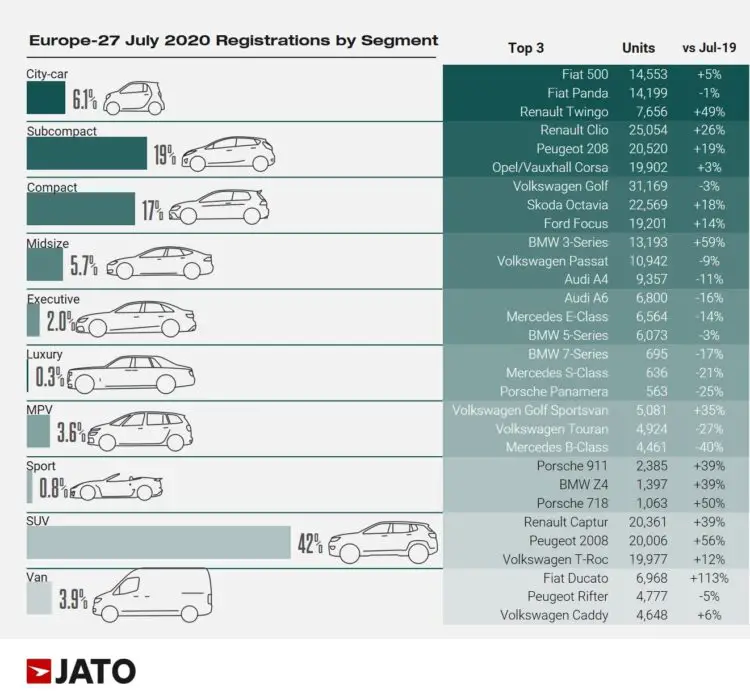

Car Sales in Europe by Vehicle Segment in July 2020

In July 2020, SUVs also showed record results despite the higher fuel consumption. SUVs accounted for almost 42% of total registrations to 530,800 units, posting the highest monthly volume since July 2019. “SUVs are usually more expensive than their car equivalents, so it is remarkable to see that despite the crisis, this is the only segment that has seen growth. They prove that with a competitive offer, consumers respond positively, despite the difficulties.”

Midsize SUVs were the only segment to record a decrease, of -6%, a contrast to the positive results seen from small (+9%), compact (+4%) and large/luxury SUVs (+14%). At the same time, their demand has grown fast due to the electrification of many of the models available. In July, 48% of the electrified vehicles registered were SUVs.

Top-Selling Car Models in Europe in July 2020

According to JATO, the ten best-selling car models in Europe in July 2020 were:

After trailing behind the Renault Clio for two months, the Volkswagen Golf regained the top position as the best-selling car model in Europe in July 2020 and for the first seven months of 2020. The greater availability of the 8th generation Volkswagen Golf helped this model to regain first place in the rankings. However, it was not enough to offset the large drop posted by the 7th generation, as the average variation was negative. In contrast, the Renault Clio was able to record a 26% increase, as 89% of its volume corresponded to the latest generation.

The Skoda Octavia, Peugeot 208, Renault Captur and Peugeot 2008 also posted double-digit growth thanks to their recently launched new generations. Other big improvers include the Hyundai Kona (+56%), BMW 3-Series (+59%), Mini Hatch (+26%), Volvo XC40 (+66%), BMW X1 (+49%) and BMW 1-Series (+52%). The Renault Zoe and Kia Niro increased their registrations by 146% and 111% respectively.

Among the latest launches: Ford Puma (13,157 units at 24th position); Skoda Kamiq (8,736 units); Mazda CX-30 (5,494); Kia Xceed (5,201); Audi Q3 Sportback (4,183); Mercedes GLB (2,469); and Porsche Taycan (1,498).

European New Car Market in 2020

Sales and Market Analysis: