March 2020: New passenger vehicle registrations in the European Union, UK, and EFTA halved while car sales in the first quarter were down 26%.

During the first quarter of 2020, new car sales in the European Union (EU), EFTA, and the UK were down by more than a quarter. In March 2020, usually one of the most important months of the year for new car sales, the effect of the Coronavirus started to hit the European market with sales down by 52%. All the major markets were weaker with the important French, Spanish, and Italian new car markets collapsing. The effect of the Coronavirus on the European new car market overshadowed any other underlying economic and political developments, changes in taxes and regulations, and the launch of new models. Volkswagen remained the best-selling car brand in Europe.

European Car Market Statistics 2020: January, February, March, April, May, June, July, August, September, October, November, December

Car Sales by European Countries in 2020 (Q1)

New passenger vehicle registrations in the European Union (EU), UK, and EFTA countries during the first three months of 2020 were as follows according to data released by the ACEA:

| Q1/2020 | Q1/2019 | % Change | |

| TOTAL (EU + EFTA + UK) | 3,054,703 | 4,146,822 | -26.3 |

| AUSTRIA | 54,680 | 80,855 | -32.4 |

| BELGIUM | 127,416 | 155,865 | -18.3 |

| BULGARIA | 5,927 | 8,419 | -29.6 |

| CROATIA | 10,001 | 12,173 | -17.8 |

| CYPRUS | 2,941 | 2,800 | +5.0 |

| CZECH REPUBLIC | 50,194 | 59,616 | -15.8 |

| DENMARK | 48,859 | 66,266 | -26.3 |

| ESTONIA | 5,647 | 6,174 | -8.5 |

| FINLAND | 28,266 | 29,102 | -2.9 |

| FRANCE | 364,679 | 553,335 | -34.1 |

| GERMANY | 701,362 | 880,092 | -20.3 |

| GREECE | 21,390 | 26,289 | -18.6 |

| HUNGARY | 32,670 | 34,338 | -4.9 |

| IRELAND | 50,700 | 64,126 | -20.9 |

| ITALY | 347,193 | 538,067 | -35.5 |

| LATVIA | 3,870 | 4,461 | -13.2 |

| LITHUANIA | 10,728 | 10,200 | +5.2 |

| LUXEMBOURG | 11,912 | 14,867 | -19.9 |

| NETHERLANDS | 103,203 | 115,451 | -10.6 |

| POLAND | 107,636 | 139,809 | -23.0 |

| PORTUGAL | 45,282 | 59,445 | -23.8 |

| ROMANIA | 27,979 | 35,836 | -21.9 |

| SLOVAKIA | 18,966 | 23,897 | -20.6 |

| SLOVENIA | 14,508 | 20,262 | -28.4 |

| SPAIN | 218,705 | 316,890 | -31.0 |

| SWEDEN | 66,141 | 73,880 | -10.5 |

| EUROPEAN UNION (EU) | 2,480,855 | 3,332,515 | -25.6 |

| ICELAND | 2,481 | 2,721 | -8.8 |

| NORWAY | 32,358 | 38,485 | -15.9 |

| SWITZERLAND | 55,452 | 72,065 | -23.1 |

| EFTA | 90,291 | 113,271 | -20.3 |

| UNITED KINGDOM | 483,557 | 701,036 | -31.0 |

| TOTAL (EU + EFTA + UK) | 3,054,703 | 4,146,822 | -26.3 |

| Source: ACEA |

European New Car Market in 2020 (Q1)

Car sales in Europe had a slow start in 2020 — the market contracted by 8% in January, 7% in February but most of the damage was done during the important March when sales were down by 52%. The effects of the Coronavirus were so overwhelming, it would be futile to consider any other factors on market movements during the first three months of 2020.

Somewhat surprisingly, there was little movement in the rank order of the largest European new car markets during the first quarter of 2020 compared to the first three months of 2019.

Germany remained by far the largest new car market in Europe and as the German market started closing a few days later than many other large European countries, new car sales were down by only a fifth. In the other large markets — UK, France, Italy, and Spain — car sales were down by around a third.

Only two EU countries had stronger car sales during the first quarter of 2020 — the very small markets in Lithuania and Cyprus added a few units each.

Car Sales Per EU Country in March 2020

Car sales per EU, UK and EFTA countries — listed by market contraction –were as follows according to the ACEA in March 2020:

| March 2020 | March 2019 | % Change | |

| TOTAL (EU + EFTA + UK) | 853,077 | 1,771,030 | -51.8 |

| ITALY | 28,326 | 194,302 | -85.4 |

| FRANCE | 62,668 | 225,818 | -72.2 |

| SPAIN | 37,644 | 122,659 | -69.3 |

| AUSTRIA | 10,654 | 31,958 | -66.7 |

| IRELAND | 6,152 | 16,687 | -63.1 |

| SLOVENIA | 2,743 | 7,304 | -62.4 |

| GREECE | 3,743 | 9,518 | -60.7 |

| PORTUGAL | 10,596 | 24,900 | -57.4 |

| EUROPEAN UNION (EU) | 567,308 | 1,264,569 | -55.1 |

| TOTAL (EU + EFTA + UK) | 853,077 | 1,771,030 | -51.8 |

| BULGARIA | 1,609 | 3,266 | -50.7 |

| LUXEMBOURG | 2,798 | 5,621 | -50.2 |

| BELGIUM | 28,801 | 54,872 | -47.5 |

| CROATIA | 2,716 | 5,049 | -46.2 |

| SLOVAKIA | 5,013 | 9,222 | -45.6 |

| UNITED KINGDOM | 254,684 | 458,054 | -44.4 |

| LITHUANIA | 2,236 | 3,957 | -43.5 |

| DENMARK | 15,183 | 26,316 | -42.3 |

| POLAND | 29,657 | 50,118 | -40.8 |

| SWITZERLAND | 17,556 | 28,958 | -39.4 |

| GERMANY | 215,119 | 345,523 | -37.7 |

| CZECH REPUBLIC | 13,685 | 21,491 | -36.3 |

| EFTA | 31,085 | 48,407 | -35.8 |

| LATVIA | 1,067 | 1,618 | -34.1 |

| NORWAY | 12,451 | 18,375 | -32.2 |

| ROMANIA | 6,654 | 9,813 | -32.2 |

| ESTONIA | 1,685 | 2,233 | -24.5 |

| NETHERLANDS | 29,496 | 38,507 | -23.4 |

| CYPRUS | 742 | 888 | -16.4 |

| HUNGARY | 11,478 | 13,394 | -14.3 |

| SWEDEN | 27,649 | 30,256 | -8.6 |

| FINLAND | 9,194 | 9,279 | -0.9 |

| ICELAND | 1,078 | 1,074 | +0.4 |

| Source: ACEA |

European Car Market in March 2020

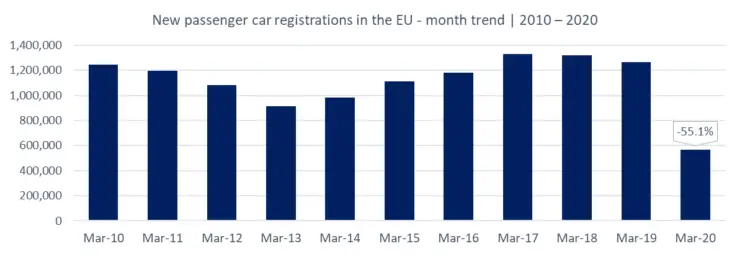

March is traditionally one of the most important car sales months of the year in Europe. New passenger vehicle registrations in the EU have been as follows in March during the last decade:

Four car markets in Europe contracted by over two thirds in March 2020. This hit the overall market very hard, as three of these were Italy, France, and Spain — all amongst the top five largest European new car markets. Austria dropped out of the top ten.

The early closure of the Italian car market meant that sales in Italy were lower than in Poland, Netherlands, and Belgium in March 2020.

Iceland was the only European new car market with stronger sales in March 2020 — an increase of 4 sales. All EU countries had weaker sales with Finland flat (-0.9%) while the second least affected market was Sweden (-8.6%) where Coronavirus restrictions were only introduced to a very limited extent.

Volkswagen remained the largest car brand in Europe during the first quarter of 2020.

European New Car Market in 2020

Sales and Market Analysis: