In 2020, new passenger vehicle registrations in Germany decreased by nearly a fifth — market analysis shows the German car market at its smallest since 2010.

In full-year 2020, the German new car market contracted by 19.1% to 2,917,678 passenger cars (PKW) — the lowest total of new passenger vehicle registrations in Germany in a calendar year since 2010. Sales of commercial trucks and heavy vehicles were also lower while motorcycle sales were up by almost a third. Sales of electric cars more than doubled to take a 6.7% share of the German new market. Volkswagen was again the top-selling brand in Germany in 2020, the VW Golf the favorite car model, and the Renault Zoe the best-selling electric car model.

German Car Sales Statistics — 2022: Market Overview, Brands, Models, Electric; 2021: Market, Brands, Models, Electric; 2020: Market, Brands, Models, Electric; 2019: Market, Brands, Models, Electric

German New Motorized Vehicle Market in 2020 (Full Year)

In 2020, total new motorized vehicle registrations in Germany decreased by 16.3% to 3,542,443 vehicles (Kraftfahrzeuge) — almost 700,00 fewer vehicles than in 2019. Passenger cars (PKW) are by far the largest component of this total.

The only growth sector was motorcycles that increased sales by nearly a third, as many commuters turned away from public transportation. In Germany, car driving licenses are valid for smaller capacity motorbikes making the switch relatively easy even during the periods that the German licensing authorities were closed or worked restricted hours.

According to the KBA, the composition of the new motorized vehicle market in Germany in 2020 was as follows:

| Vehicle Category | Fahrzeugklasse | FY2020 | FY2019 | % 19/20 |

| Motor Cycles | Krafträder | 221,994 | 168,307 | +31.9 |

| Cars (PKW) | Personenkraftwagen | 2,917,678 | 3,607,258 | -19.1 |

| Buses | Kraftomnibusse | 6,460 | 6,437 | +0.4 |

| Trucks (Lorries / LKW) | Lastkraftwagen | 295,166 | 343,708 | -14.1 |

| Tractor Units | Zugmaschinen insgesamt | 79,646 | 86,039 | -7.4 |

| – of which Semi-Trailers | – dar. Sattelzugmaschinen | 25,946 | 38,620 | -32.8 |

| Other motorized vehicles | Sonstige Kraftfahrzeuge | 21,499 | 21,036 | +2.2 |

| All Motorized Vehicles | Kraftfahrzeuge zusammen | 3,542,443 | 4,232,785 | -16.3 |

| Trailers | Kraftfahrzeuganhänger | 335,296 | 317,945 | +5.5 |

| Source: KBA |

Car production in Germany in 2020 was down by a quarter to 3,508,500 vehicles — more than a million fewer than the 4,661,800 cars produced in Germany in 2019 according to the VDA. Car exports from Germany were down 24% to 2,633,100 cars in 2020.

New Passenger Car Sales in Germany by Month in 2020

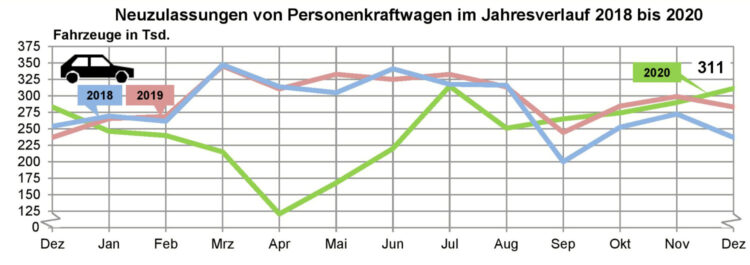

The German new passenger car market was mostly negative throughout 2020 with the first months of the year weaker following stronger sales during the final quarter of 2019. However, from March onwards, car sales in Germany were mostly determined by the lockdown measures relating to corona. At times dealers and factories were closed while licensing authorities had shorter hours and in some cases, new cars could not be registered for weeks.

New passenger vehicle registrations in Germany per month were as follows during the past three years:

New Car Sales in Germany by Year (2007-2020)

New passenger vehicle registrations in Germany in the full calendar year 2020 contracted by 19.1% to 2,917,678 cars — almost 690,000 fewer cars than in 2019. This was the lowest total for the German new car market since 2010 and only the second time this decade that the German new car market was smaller than three million vehicles.

New passenger vehicle registrations in Germany by year since 2007 were as follows:

| Year | German Car Sales | % Change |

| 2020 | 2,917,678 | -19.1 |

| 2019 | 3,607,258 | 5 |

| 2018 | 3,435,778 | -0.2 |

| 2017 | 3,441,262 | 2.7 |

| 2016 | 3,351,607 | 4.5 |

| 2015 | 3,206,042 | 5.6 |

| 2014 | 3,036,773 | 2.9 |

| 2013 | 2,952,431 | -4.2 |

| 2012 | 3,082,504 | -2.2 |

| 2011 | 3,173,634 | 9 |

| 2010 | 2,916,260 | -23.4 |

| 2009 | 3,807,175 | 23.2 |

| 2008 | 3,090,040 | -1.8 |

| 2007 | 3,148,163 | -9.2 |

| Source: KBA |

German Passenger Car Market in 2020 (Full Year)

During 2020, the popularity of both petrol and diesel-engined cars declined sharply in Germany. Petrol remained by far the largest component of new cars but the market share slipped to 46.7% in 2020 compared to 59.2% in 2019 and 62.4% in 2018. The market share for diesel was down to 28.1% (32% and 32.3%).

Hybrid cars took a market share of 18.1% (6.6% in 2019) with 527,864 (+120%) hybrid car registrations in Germany for the first time in 2020. This number included 200,469 (+342%) plug-in hybrids for a market share of 6.9%

Registrations of battery-electric cars increased by 207% to 194,163 battery-electric cars (63.281 in 2019) for a market share of 6.7% (1.8% in 2019).

Average CO2-Emissions of new cars sold in Germany in 2020 were down 11% to 139.8 g/km (157.0 g/km in 2019). (Methodology was different, so the figures are not directly comparable.)

58.8% of cars sold in Germany in 2020 were by German brands, 8.4% from Japan, 8% from France, and 6.2% from the Czech Republic.

The most popular car colors in Germany in 2020 remained grey (including silver) at 30.5%, black (24.1%), and white (21.3%).

The most important market sectors for German new car sales in 2020 were:

- 21.3% SUV, e.g. VW T-Roc

- 20.5% compact, e.g. VW Golf

- 15.1% small, e.g. VW Polo

It should be noted that SUV sales in Germany do not include Geländewagen (cross-country vehicles e.g. VW Tiguan), which should add another 10.5% to SUV sales using more common usage.

Volkswagen was again the top-selling brand in Germany in 2020, VW Golf the favorite car model, and the Renault Zoe the best-selling electric car model.