December 2015: the annual car sales trend intensified – the market strengthened in China, Europe, the USA and India but weakened in Russia, Brazil and Japan. In 2015, Europe registered the strongest increase in new passenger vehicle registrations but China remained the largest single-country market by far and increased its lead over the USA. Car sales in India were up but in Japan sales were down all year. In Russia, car sales were down by more than a third in 2015 while the Brazilian new car market contracted by a quarter.

December 2015: the annual car sales trend intensified – the market strengthened in China, Europe, the USA and India but weakened in Russia, Brazil and Japan. In 2015, Europe registered the strongest increase in new passenger vehicle registrations but China remained the largest single-country market by far and increased its lead over the USA. Car sales in India were up but in Japan sales were down all year. In Russia, car sales were down by more than a third in 2015 while the Brazilian new car market contracted by a quarter.

Worldwide Car Sales in December 2015

New vehicle registrations figures in major regions of the world monitored by the VDA were as follows in December 2015:

| Region | December 2015 | % Change |

| Europe (EU+EFTA) | 1,156,300 | 15.9 |

| Russia* | 147,000 | -45.7 |

| USA* | 1,632,700 | 9.0 |

| Japan | 307,900 | -14.6 |

| Brazil* | 220,800 | -37.6 |

| India | 231,000 | 10.5 |

| China | 2,347,600 | 19.0 |

| Source: VDA | ||

Note: *USA, Brazil and Russia include light vehicles (trucks). % Change refers to same period the previous year.

Worldwide Car Sales in 2015 (Full Year)

New vehicle registrations figures in major regions of the world monitored by the VDA were as follows in full year 2015:

| Region | Jan – Dec 2015 | Jan – Dec 2014 | % Change |

| Europe (EU+EFTA) | 14,201,900 | 13,006,500 | 9.2 |

| Russia* | 1,601,200 | 2,491,400 | -35.7 |

| USA* | 17,386,300 | 16,435,300 | 5.8 |

| Japan | 4,215,900 | 4,699,600 | -10.3 |

| Brazil* | 2,480,500 | 3,333,400 | -25.6 |

| India | 2,772,700 | 2,570,500 | 7.9 |

| China | 20,047,200 | 18,368,900 | 9.1 |

| Source: VDA | |||

Note: *USA, Brazil and Russia include light vehicles (trucks). % Change refers to same period the previous year.

Europe – Fastest Growing Car Market in 2015

The European Union and EFTA countries were the fastest growing car market in 2015 with new passenger vehicle registrations up by 9.2% to 14,201,900 cars. Almost 1.2 million more cars were sold in Europe in 2015 compared to a year ago. European car sales in 2015 were the highest since 2010 but still weaker than before the global financial crisis.

December 2015 was the 28th consecutive month of growth in the European car market. With a 16% increase, December was also the strongest growth month in 2015.

In 2015, all European Union countries with the exception of the small Estonian and Luxembourg markets increased car sales. Sales in Spain were up by a fifth while a 16% increase in Italy added over 200,000 cars to the market. The three largest markets – Germany, Britain and France – also expanded by around 6%.

China – The World’s Largest Car Market in 2015

Car sales in China were on a roller coaster for much of the year but the final months of the year showed a strong upward trend helped by the lowering of taxes on cars with engines smaller than 1.6 liter.

Car sales in China increased by a strong 19% in December. In 2015, only November with sales up by a quarter was a better performance. With 2,347,600 cars sold in China in December 2015, the market was twice the size of Europe and a good 700,000 more than the USA.

In 2015, cars sales in China increased by 9.1% – a growth rate just eclipsed by Europe. However, the Chinese car market exceeded 20 million cars for the first time ever in a calendar year. This is an increase of nearly 1.7 million cars over 2014, nearly 3 million more than in the US and 6 million more than in Europe in 2015.

German luxury carmakers were somewhat hit by the change in tax regime and a crackdown on ostentatious spending but for especially Mercedes-Benz and Porsche the Chinese car market still offered strong growth in 2015.

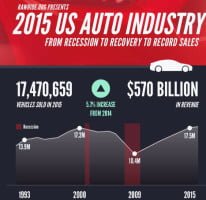

Light Vehicle Sales in the USA in 2015

The American new light vehicle market grew by 5.8% in 2015 to 14,386,300 new registrations – almost a million cars more than in 2014. Trucks and SUVs contributed 9.9 million vehicles – an increase of 13%. Passenger car sales contracted by 2% to 7.5 million cars.

The American new light vehicle market grew by 5.8% in 2015 to 14,386,300 new registrations – almost a million cars more than in 2014. Trucks and SUVs contributed 9.9 million vehicles – an increase of 13%. Passenger car sales contracted by 2% to 7.5 million cars.

In December 2015, new light vehicle sales in the USA increased by 9% to 1,632,700 vehicles.

Weaker Car Sales in Japan in 2015

The Japanese car market struggled throughout 2015. New passenger vehicle registrations were down every month of the year and the trend accelerated in December when the market contracted by 15%.

The Japanese market was somewhat skewed by the increase in taxes in April 2014 but the statistical effect has weakened towards the end of the year but car sales remained weak. In 2015, car sales in Japan were down 10% or nearly half a million vehicles less than in 2014 and a quarter of a million less than in 2013.

Continued Growth in the Indian Car Market in 2015

New car sales in India grew throughout most of 2015. In 2015, the Indian car market expanded by 8% to nearly 2.8 million cars – an increase of 200,000 vehicles.

In December 2015, the Indian new car market grew by 10.5% to 231,000 cars.

Lower Car Sales in Russia in 2015

In 2015, the Russian light vehicle market contracted by more than a third to 1.6 million vehicles – almost 900,000 fewer vehicles than were sold in 2014.

Vehicle sales in Russia in December 2015 were nearly half that of a year ago. December 2014 car sales were relatively high as buyers rushed to market to buy cars before the weakening exchange rate would increase prices.

Continued Weakness in the Brazilian Car Market in 2015

Light vehicles sales in Brazil continued to weaken throughout 2015. For the full year, vehicle sales in Brazil were down by over a quarter to less than 2.5 million cars or 850,000 cars fewer than in 2014. Much of Volkswagen’s international decline in sales was due to a loss of nearly a quarter million sales in Brazil alone.

In December 2015, the contraction in the Brazilian car market accelerated with sales down by 37.6% to only 220,800 vehicles – only Russia had a worse month. The outlook for 2016 in the Brazilian car market remains largely negative.