First Semester 2020: Ford was the best-selling car brand in Britain and the Fiesta the favorite model. The new car market halved.

During the first half of 2020, the British new car market contracted by 49% to only 653,503 new passenger vehicle registrations — the lowest first-semester car sales in the UK since 1971. Ford and Volkswagen remained the top two best-selling car brands in Britain but BMW moved into third place ahead of Mercedes-Benz and Audi. The Ford Fiesta remained the most-popular car model in Britain during the first six months of 2020.

British New Car Market in 2020 (Half Year)

During the first half of 2020, new passenger vehicle registrations in Britain contracted by -48.5% to 653,502 new cars — the lowest level since 1971, when only 623,483 cars were registered during the first semester of the year.

The lackluster performance means that the British new car market was almost 616,000 cars smaller than during the first six months of 2019. Private sales were around 240,000 cars lower.

Most of the damage to the new car market was done in April (-97%) and May (-89%) but the first quarter (-31%) was not brilliant either.

British New Car Market in June

In June 2020, UK new car registrations fell -34.9%, according to figures published by the Society of Motor Manufacturers and Traders (SMMT), as the market began a tentative restart after more than two months of lockdown. The drop was an improvement on May’s -89.0% wipe-out but, with 145,377 new car registrations, this still represented a significant decline of 78,044 compared with June 2019, as dealerships in Wales and Scotland remained closed for much of the month.

Private demand proved more resilient than business, down -19.2% in June with orders made pre-lockdown resulting in 72,827 registrations and accounting for more than half of the market. Fleet sales fell by a very substantial -45.2% to 69,498 units as businesses paused purchasing amid expenditure reviews.

With one in five showrooms in England remaining shut throughout June, and those in Wales and Scotland unable to open until the end of the month, there remains some uncertainty regarding the true level of demand. The hoped for release of pent-up sales has not yet occurred, with consumer confidence for big ticket purchases looking weak meaning that automotive is likely to lag behind other retail sectors.

In addition to general economic uncertainty, car buyers might also be holding out on purchases in the hope of discounts and other buying incentives, as followed after previous crises. However, given that manufacturing was closed for much of the same period, surplus stocks may be less of a problem than after the beginning of the financial crisis in 2008/9.

Mike Hawes, SMMT Chief Executive, said, “While it’s welcome to see demand rise above the rock-bottom levels we saw during lockdown, this is not a recovery and barely a restart. Many of June’s registrations could be attributed to customers finally being able to collect their pre-pandemic orders, and appetite for significant spending remains questionable.

The SMMt made no new prediction for the market in 2020 — the forecast was lower to 1.73 million vehicles after the first quarter but that number is unlikely to be achieved.

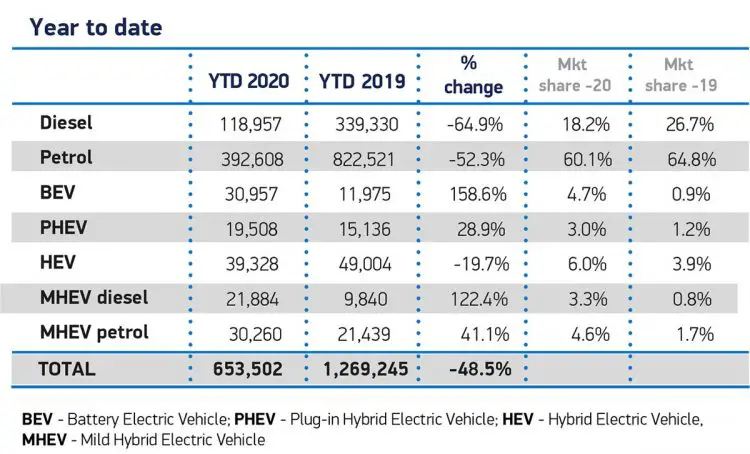

Fuel Types of New Cars in the UK in 2020 (First Half)

Petrol cars remain by far the most popular in Britain with a market share of 60% during the first half of 2020. Diesel’s share dropped from 27% during the first half of 2019 to 18% this year.

Hybrid electric vehicles in various permutations increased market share but the strongest growth was for battery-electric vehicles (BEV) that increased market share from 0.9% to 4.7%.

Best-Selling Car Brands in Britain in 2020 (First Half)

According to new passenger vehicle registration data released by the SMMT, the following were the 40 top-selling car marques in Britain during the first six months of 2020:

| MARQUE | 2020 HY | HY 2019 | % 19/20 | |

| Total | 653,502 | 1,269,245 | -48.51 | |

| 1 | Ford | 59,874 | 127,789 | -53.15 |

| 2 | Volkswagen | 58,933 | 110,891 | -46.86 |

| 3 | BMW | 46,580 | 90,021 | -48.26 |

| 4 | Mercedes-Benz | 45,683 | 92,990 | -50.87 |

| 5 | Audi | 40,405 | 81,129 | -50.20 |

| 6 | Toyota | 39,360 | 56,684 | -30.56 |

| 7 | Vauxhall | 37,576 | 94,564 | -60.26 |

| 8 | Nissan | 30,109 | 52,743 | -42.91 |

| 9 | Kia | 28,970 | 53,232 | -45.58 |

| 10 | Land Rover | 25,624 | 42,092 | -39.12 |

| 11 | Skoda | 23,112 | 41,264 | -43.99 |

| 12 | Peugeot | 21,450 | 44,344 | -51.63 |

| 13 | SEAT | 20,267 | 37,778 | -46.35 |

| 14 | MINI | 18,276 | 33,250 | -45.03 |

| 15 | Hyundai | 17,701 | 45,916 | -61.45 |

| 16 | Volvo | 17,698 | 29,989 | -40.99 |

| 17 | Renault | 15,269 | 32,113 | -52.45 |

| 18 | Citroen | 11,617 | 29,422 | -60.52 |

| 19 | Honda | 11,439 | 25,079 | -54.39 |

| 20 | Jaguar | 10,551 | 19,748 | -46.57 |

| 21 | Mazda | 8,746 | 21,443 | -59.21 |

| 22 | Fiat | 8,328 | 17,749 | -53.08 |

| 23 | Suzuki | 7,813 | 20,337 | -61.58 |

| 24 | MG | 7,712 | 6,286 | 22.69 |

| 25 | Dacia | 7,433 | 18,568 | -59.97 |

| 26 | Lexus | 5,971 | 7,432 | -19.66 |

| 27 | Mitsubishi | 4,708 | 9,784 | -51.88 |

| 28 | Porsche | 4,073 | 6,785 | -39.97 |

| 29 | Jeep | 1,532 | 3,237 | -52.67 |

| 30 | Alfa Romeo | 940 | 1,862 | -49.52 |

| 31 | DS | 918 | 1,831 | -49.86 |

| 32 | Abarth | 914 | 1,887 | -51.56 |

| 33 | Ssangyong | 669 | 1,089 | -38.57 |

| 34 | Bentley | 531 | 812 | -34.61 |

| 35 | smart | 426 | 3,142 | -86.44 |

| 36 | Subaru | 306 | 1,363 | -77.55 |

| 37 | Maserati | 239 | 534 | -55.24 |

| 38 | Alpine | 57 | 85 | -32.94 |

| 39 | Chevrolet | 0 | 21 | 0.00 |

| 40 | Infiniti | 0 | 203 | 0.00 |

| 41 | Other Imports | 10,832 | 2,172 | 398.71 |

| 42 | Other British | 860 | 1,172 | -45.74 |

| Source: SMMT |

Top-Selling Car Brands in the UK in 2020 (First Half)

Ford remained the largest car marque in Britain during the first six months of 2020 but underperformed the broader market. Ford’s share of the British new car market shrank by nearly a percentage point to only 9.16%. Ford’s advantage over Volkswagen shrunk from 17,000 cars last year to only 941 cars.

Volkswagen maintained second place in Britain and with 9.02% took its biggest share of the British new car market ever. BMW also outperformed the broader market to take third place — up from fifth — for the first time ever.

Vauxhall, third last year, was the worst-performing top-ten brand with sales down 60% Vauxhall slipped to 7th allowing Mercedes-Benz to maintain fourth while Audi and Toyota moved up one place each. Toyota was the best performer of the top 20 brands with sales down by less than a third.

Nissan and Kia swapped positions while Land Rover moved into the top ten from 12th. Hyundai dropped from tenth to 15th.

The only brand with an increase in sales was MG. Tesla, which is listed amongst the “Other Imports” saw very strong growth too with the Tesla Model 3 the top-selling car in April and May.

Top-Ten Best-Selling Car Models in Britain in 2020 (Half Year)

According to the SMMT, the following were the top-selling car models in Britain during the first half of 2020:

| Model | 2020 (HY) | 2019 (HY) | 2018 (HY) | 2017 (HY) | 2016 (HY) | |

| 1 | Ford Fiesta | 21,098 | 43,297 | 56,415 | 59,380 | 68,833 |

| 2 | Ford Focus | 18,145 | 32,239 | 30,757 | 40,045 | 38,715 |

| 3 | Volkswagen Golf | 17,889 | 31,493 | 39,930 | 36,703 | 37,577 |

| 4 | Vauxhall Corsa | 17,646 | 29,982 | 28,003 | 33,560 | 42,356 |

| 5 | Nissan Qashqai | 14,806 | 29,180 | 30,066 | 33,574 | 33,656 |

| 6 | Mercedes-Benz A-Class | 13,726 | 27,904 | 20,002 | 22,944 | NA |

| 7 | Mini | 12,240 | 21,037 | 23,641 | 25,582 | 24,293 |

| 8 | Toyota Yaris | 10,134 | 19,147 | NA | NA | NA |

| 9 | Kia Sportage | 10,122 | NA | NA | NA | NA |

| 10 | Volkswagen Polo | 10,114 | 23,605 | 22,027 | 27,205 | 28,000 |

| Source: SMMT |

Despite the upheaval in the British new car market during the first six months of 2020, the Ford Fiesta remained the top-selling car model in the UK. In fact, the top six car models were in the same rank order as during the first six months last year.

However, the popularity of the Fiesta in Britain continued to decline — sales during the first six months of 2020 were less than a third of sales in 2016 and 2015. The Ford Focus only narrowly outsold the VW Golf, which was also only few hundred cars ahead of the Vauxhall Corsa.

The Nissan Qashqai remained the most-popular SUV in Britain and the Mercedes-Benz A-Class the top-selling premium brand model. The Mini improved one place from a year ago.

The Toyota Yaris moved up from tenth, the Kia Sportage was a new entrant and the VW Polo slipped from 7th. Only 20 cars separated 8th and tenth. The Ford Kuga slipped out of the top ten.