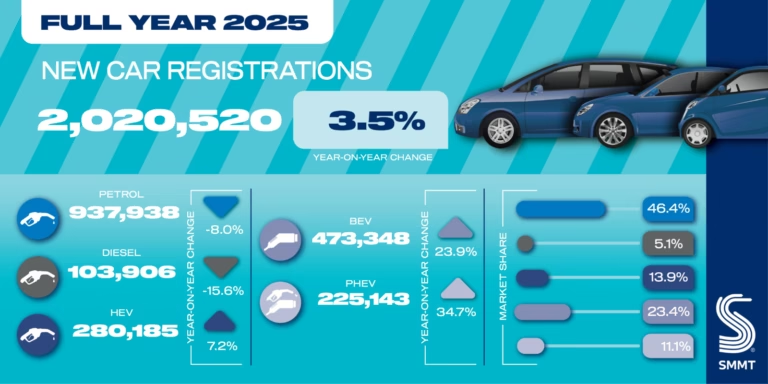

In full-year 2025, the new car market in Britain expanded with sales up by 3.5% to just over 2 million new passenger vehicle registrations in the UK.

2025 (January to December): new passenger vehicle registrations in Britain increased by 3.5% to 2,020,520 cars. This was the third consecutive year of growth and the first time that the British new car market exceeded two million vehicles since 2019, but sales remained well below pre-pandemic levels. Petrol remained the preferred fuel for new cars, while battery-electric car sales increased to a record 23% of the total British new car market in 2025.

In 2025, the new car market in Britain increased 3.5% to 2,020,520 newly registered passenger vehicles. Volkswagen was the top-selling brand in the UK for the fifth consecutive year. The Ford Puma was again the favorite car model of the British in 2025, and the Tesla Model Y remained the best-selling battery-electric car in the UK.

Latest British Car Sales Data: 2025: Market Overview, Brands, Models, Electric; 2024-2008.

New Car Market in Britain in 2025

New passenger vehicle registrations in Britain increased by 3.5% to 2,020,520 cars in the full calendar year 2025. This was the third consecutive year of growth and the first time the UK’s new car market exceeded 2 million vehicles since the global pandemic.

According to the Society of Motor Manufacturers and Traders (SMMT), car sales in Britain in 2025 grew across all buyer types. Demand from private buyers recovered slightly from 2024, when uptake fell below levels last seen during 2020, with a 4.5% increase to 779,587 units, but still only comprising 38.6% of registrations. Fleet and business registrations also rose, up 2.6% to 1,194,545 and 8.8% to 46,388, respectively.

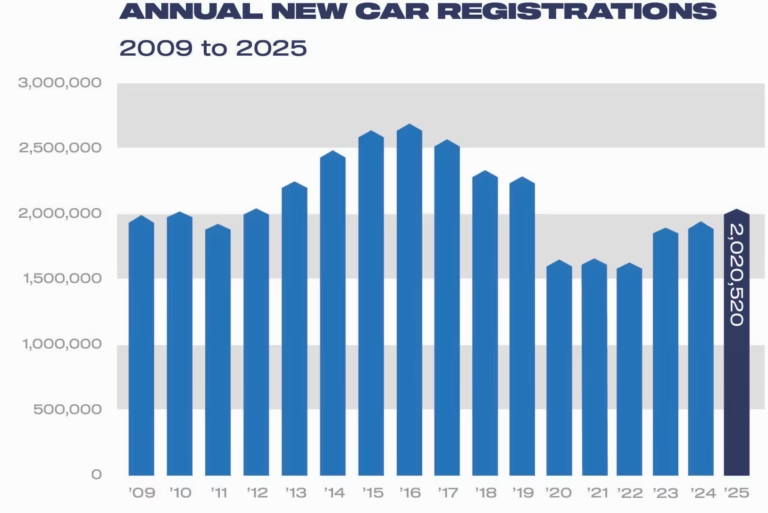

British Car Sales by Year (2007 – 2025)

New car sales in Britain in 2025 were at the highest level in six years and exceeded the two-million vehicle mark for the first time since 2019.

Annual new car sales in Britain were as follows since 2007:

| Year | UK Car Sales | % Change |

| 2025 | 2,020,520 | 3.5 |

| 2024 | 1,952,778 | 2.61 |

| 2023 | 1,903,054 | 17.9 |

| 2022 | 1,614,063 | -2 |

| 2021 | 1,647,181 | 1 |

| 2020 | 1,631,064 | -29.4 |

| 2019 | 2,311,140 | -2.4 |

| 2018 | 2,367,147 | -6.8 |

| 2017 | 2,540,617 | -5.65 |

| 2016 | 2,692,786 | 2.25 |

| 2015 | 2,633,503 | 6.3 |

| 2014 | 2,476,435 | 9.4 |

| 2013 | 2,264,737 | 11 |

| 2012 | 2,044,609 | 5.3 |

| 2011 | 1,941,253 | -4.4 |

| 2010 | 2,030,846 | 1.8 |

| 2009 | 1,994,999 | -6.4 |

| 2008 | 2,131,795 | -11 |

| 2007 | 2,404,007 | – |

| 1992 | 1,594,000 | – |

| Source: SMMT |

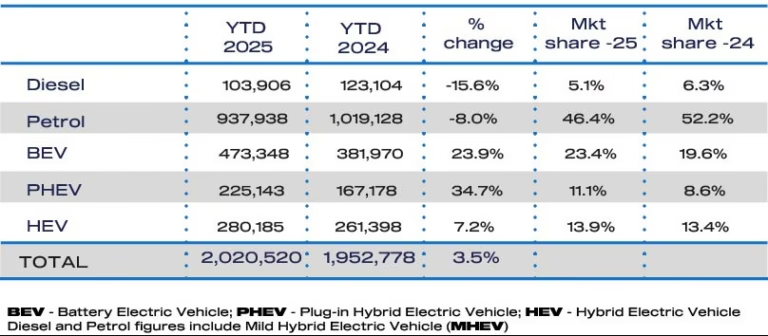

Car Sales in the UK in 2025 by Fuel Type

Petrol remained the most popular fuel source for new cars sold in Britain in 2025, but purely petrol cars fell to below 50% of the British new car market. Most hybrid vehicles, of course, also run predominantly on petrol.

The share of diesel new passenger cars in the UK slipped to only 5.1% in 2025.

Battery-electric car sales increased by 19.6% in Britain in 2025 for a record market share of 23.4%. However, BEV sales remained well below the mandate target of 28%.

Average new car CO2 fell 10.1% to 91.8 g/km (102.1g/km in 2024) for all new passenger vehicles registered in the UK in 2025.

In 2025, the new car market in Britain increased 3.5% to 2,020,520 newly registered passenger vehicles. Volkswagen was the top-selling brand in the UK for the fifth consecutive year. The Ford Puma was again the favorite car model of the British in 2025, and the Tesla Model Y remained the best-selling battery-electric car in the UK.

Latest British Car Sales Data: 2025: Market Overview, Brands, Models, Electric; 2024-2008.