In 2021, new passenger vehicle registrations in Britain increased by 1% — market analysis showed record battery electric car sales in the UK.

New passenger vehicle registrations in Britain increased by a moderate 1% to 1.65 million cars – the second smallest new car market in the UK since 1992. However, slow growth was largely due to supply chain problems for carmakers that restricted production and deliveries — demand and economic strength seemed to have been less of a factor. Electric cars gained market share while diesel cars made out less than a tenth of all new passenger cars in the UK in 2021. Volkswagen became the largest carmaker in Britain while the Vauxhall Corsa was Britain’s favorite car model and the Tesla Model 3 the top-selling electric car.

Latest British Car Sales Data: 2024: Market Overview, Brands, Models, Electric; 2023-2008.

New Car Market in Britain in 2021 (Overview)

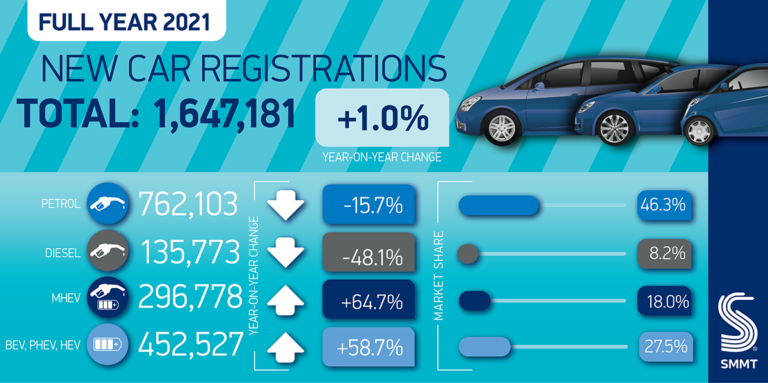

In full calendar year 2021, new passenger vehicle registrations in the UK increased by 1% to 1,647,181 cars compared to 1,631,064 cars in 2020 and 2,311,140 vehicles in 2019. Total annual car sales in Britain were at the lowest levels in 2021 and 2020 since 1992, when sales were 1,594,000.

According to the Society of Motor Manufacturers and Traders (SMMT), these figures underline the ongoing impact of Covid and the semiconductor shortage on the industry. Supply-chain issues seemed to have played a larger role worldwide in reducing car production than restrictions imposed by Covid regulations.

Registrations by private buyers increased by a moderate 7.4%, while those by businesses and large fleets fell by -4.4% and -4.7% respectively, in part due to supply shortages. Superminis remained Britain’s most popular cars, with 514,024 registrations, followed by the lower medium (449,631) and dual purpose (443,632) segments.

The UK finished 2021 as the third-largest European market for new car registrations but the second largest by volume for plug-in vehicles and the second largest for BEVs. Germany remained Europe’s largest car market despite sales contracting by 10% in 2021 while France was second with growth of only half a percentage point and in total only 28,000 cars more sold than in the UK

British Car Sales by Year (2007 – 2021)

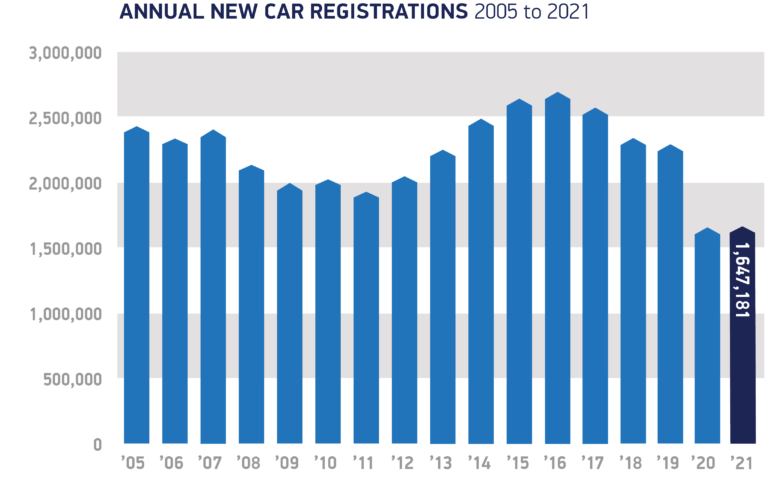

The British new car market expanded by a modest 1% in 2021 — the first time in five years that car sales increased. However, total sales were the second-lowest since 1992. 2021 and 2020 were the only years since 2011 that UK car sales were below two million vehicles. Car sales in the UK reached a record high 2,692,786 vehicles in 2016.

Annual new car sales in Britain were as follows since 2007:

| Year | UK Car Sales | % Change |

| 2021 | 1,647,181 | 1% |

| 2020 | 1,631,064 | -29.4 |

| 2019 | 2,311,140 | -2.4 |

| 2018 | 2,367,147 | -6.8 |

| 2017 | 2,540,617 | -5.65 |

| 2016 | 2,692,786 | 2.25 |

| 2015 | 2,633,503 | 6.3 |

| 2014 | 2,476,435 | 9.4 |

| 2013 | 2,264,737 | 11 |

| 2012 | 2,044,609 | 5.3 |

| 2011 | 1,941,253 | -4.4 |

| 2010 | 2,030,846 | 1.8 |

| 2009 | 1,994,999 | -6.4 |

| 2008 | 2,131,795 | -11 |

| 2007 | 2,404,007 | – |

| 1992 | 1,594,000 | – |

| Source: SMMT |

Car Sales in Britain in 2021 by Fuel Type

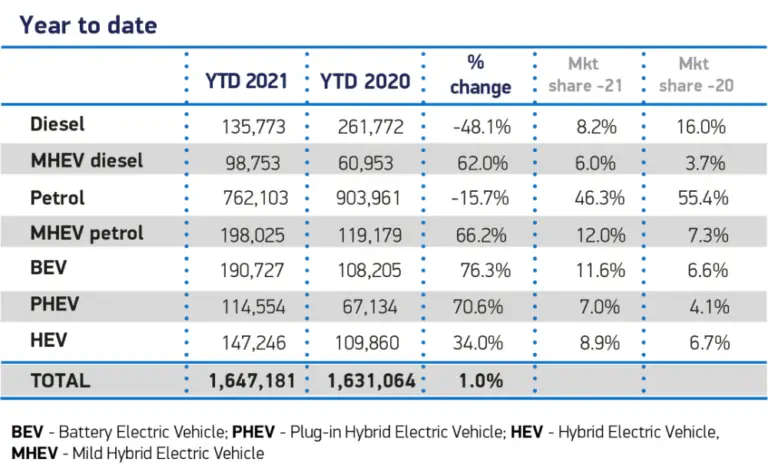

2021 was the most successful year in history for electric vehicle uptake in the UK as more new battery electric vehicles (BEVs) were registered than over the previous five years combined. 190,727 new BEVs joined Britain’s roads, along with 114,554 plug-in hybrids (PHEVs), meaning 18.5% of all new cars registered in 2021 can be plugged in. This is in addition to the 147,246 hybrid electric vehicles (HEVs) registered which took a further 8.9% market share in a bumper year for electrified car registrations, with 27.5% of the total market now electrified in some form.

Petrol-powered vehicles, including mild hybrids (MHEVs), remain Britain’s most popular powertrain, accounting for 58.3% of all new cars registered in 2021, with diesel-powered cars including MHEVs making up 14.2% of the market, followed by BEVs at 11.6%, HEVs at 8.9% and PHEVs at 7.0%.

British Car Market – Outlook for 2022

The outlook for the new car market in Britain in 2022 is largely dependent on developments regarding the Coronavirus, as well as the availability of cars while supply-chain issues affect all global carmakers.

According to the SMMT, the biggest obstacle to Britain’s net-zero ambitions is not product availability, however, but cost and charging infrastructure. Recent cuts to incentives and home charging grants should be reversed and we need to boost the roll-out of public on-street charging with mandated targets, providing every driver, wherever they live, with the assurance they can charge where they want and when they want.

Looking ahead, the latest forecast for 2022 – published in October, before the rise of the Omicron variant – is for 1.96 million new car registrations.

Latest British Car Sales Data: 2024: Market Overview, Brands, Models, Electric; 2023-2008.