In 2020, new passenger vehicle registrations in Britain contracted by 29% — market analysis showed a decrease in UK car sales in all segments.

New passenger vehicle registrations in Britain contracted by 29.4% to only 1,631,064 cars — the smallest new car market in the UK since 1992. Electric cars gained market share but sales were down in all other segments of the market. Ford remained the largest carmaker in Britain while the Fiesta only narrowly maintained its position as Britain’s favorite car model.

Latest British Car Sales Data: 2024: Market Overview, Brands, Models, Electric; 2023-2008.

New Car Market in Britain in 2020 (Overview)

In full calendar year 2020, new passenger vehicle registrations in the UK decreased by 29.4% to 1,631,064 cars compared to car sales of 2,311,140 vehicles in 2019. In 2020, over 680,000 fewer cars were sold in Britain than in 2019 for the lowest annual total since 1992, when sales were 1,594,000.

The British market was particularly hard hit by the first lockdown starting in March — traditionally the strongest month for car sales in the UK due to a change in number plates. Normal March sales would have had a huge impact on the overall total.

According to the Society of Motor Manufacturers and Traders (SMMT), against a backdrop of Covid restrictions, an acceleration of the end of sale date for petrol and diesel cars to 2030, and Brexit uncertainty, the industry suffered a total turnover loss of some £20.4 billion.

In 2020, private vehicle demand in Britain fell by -26.6% overall, amounting to a £1.9 billion loss of VAT to the Exchequer. The year saw also saw -31.1% fewer vehicles joining large company car fleets.

In an atypical year, demand fell across all segments bar specialist sports, which grew by 7.0%, although Britain’s most popular class of car remained the supermini, retaining a 31.2% market share despite a -25.9% decline in registrations.

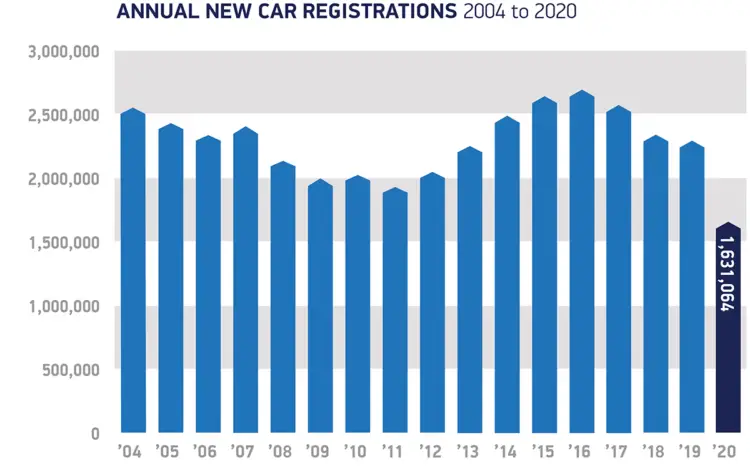

British Car Sales by Year (2007 – 2020)

The British new car market contracted in 2020 for the fourth consecutive year with total sales the lowest since 1992. 2020 was also the first year since 2011 that UK car sales were below two million vehicles. Car sales in the UK reached a record high 2,692,786 vehicles in 2016.

Annual new car sales in Britain were as follows since 2207:

| Year | UK Car Sales | % Change |

| 2020 | 1,631,064 | -29.4 |

| 2019 | 2,311,140 | -2.4 |

| 2018 | 2,367,147 | -6.8 |

| 2017 | 2,540,617 | -5.65 |

| 2016 | 2,692,786 | 2.25 |

| 2015 | 2,633,503 | 6.3 |

| 2014 | 2,476,435 | 9.4 |

| 2013 | 2,264,737 | 11 |

| 2012 | 2,044,609 | 5.3 |

| 2011 | 1,941,253 | -4.4 |

| 2010 | 2,030,846 | 1.8 |

| 2009 | 1,994,999 | -6.4 |

| 2008 | 2,131,795 | -11 |

| 2007 | 2,404,007 | – |

| 1992 | 1,594,000 | – |

| Source: SMMT |

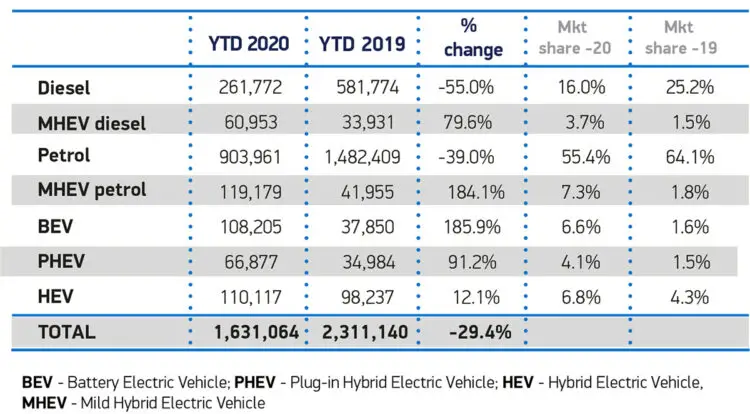

Car Sales in Britain in 2020 by Fuel Type

2020 was a bumper year for battery and plug-in hybrid electric cars, which together accounted for more than one in 10 new car registrations in Britain – up from around one in 30 in 2019.

Demand for battery electric vehicles (BEVs) grew by 185.9% to 108,205 units, while registrations of plug-in hybrids (PHEVs) rose 91.2% to 66,877. Most of these registrations (68%) were for company cars, indicating to the SMMT that private buyers need stronger incentives to make the switch, as well as more investment in charging infrastructure, especially public on-street charging. PHEVs receive favorable tax treatment despite the suspicion that many of these company cars are never plugged in.

Although falling by a combined -32.9%, petrol and mild-hybrid (MHEV) petrol cars made up 62.7% of registrations, while diesel and MHEV diesels, down -47.6%, comprised almost a fifth (19.8%) of the market.

More than 100 plug-in car models are now available to UK buyers, and manufacturers are scheduled to bring more than 35 to market in 2021 – more than the number of either petrol or diesel new models planned for the year.

British Car Market – Outlook for 2021

The outlook for the new car market in Britain in 2021 is largely dependent on developments regarding the Coronavirus. Not only will a lockdown hinder the sale and registration of cars directly, it will also have a continued serious effect on the economic outlook and personal finances of consumers.

Looking ahead, another lockdown across England and ongoing tough restrictions across the rest of the UK will further impact the industry and, while click and collect can continue to provide a lifeline, it cannot offset the impact of showroom closures. With a vaccine programme now underway, however, in 2021 there is the potential to drive a recovery that would also support the UK’s environmental goals.

Additionally, with the UK-EU Trade and Cooperation Agreement now in force, the industry has avoided a catastrophic ‘no deal’ scenario and can plan for a future with more certainty over trading conditions. Given seven out of 10 new cars registered in the UK in 2020 were imported from Europe, the continuation of tariff- and quota-free trade is critical to a strong new car market in the UK.

Latest British Car Sales Data: 2024: Market Overview, Brands, Models, Electric; 2023-2008.