In 2019, manufacturing of cars in Britain contracted by 14% to the lowest number in a decade. Commercial vehicle and engine production was also down.

In full-year 2019, car manufacturing in the UK was lower for the third consecutive year to the lowest production numbers since 2010 with further reductions forecasted for 2020. More than 80% of cars produced in Britain in 2019 were exported with just over half going to European Union countries. British commercial vehicle production in 2019 was nearly 8% lower. Nearly 60% of commercial vehicles produced in the UK in 2019 were exported with almost all going to the EU. UK engine production declined in 2019 for the third consecutive year with almost two-third of output exported. The SMMT called on the British government to conclude ambitious future trade deals due to the important role of the automotive sector on the British economy and exports.

British Car Production in 2019 (Full Year)

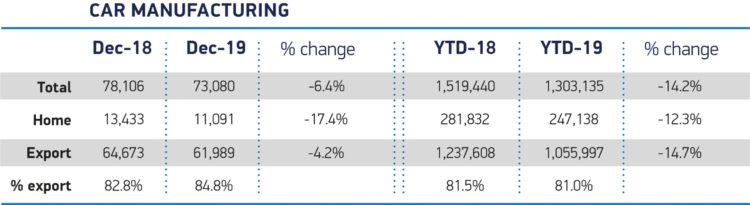

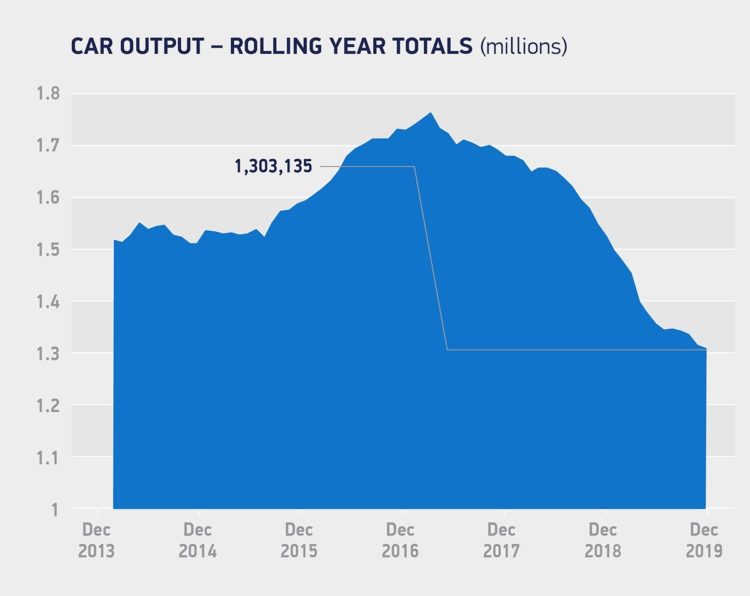

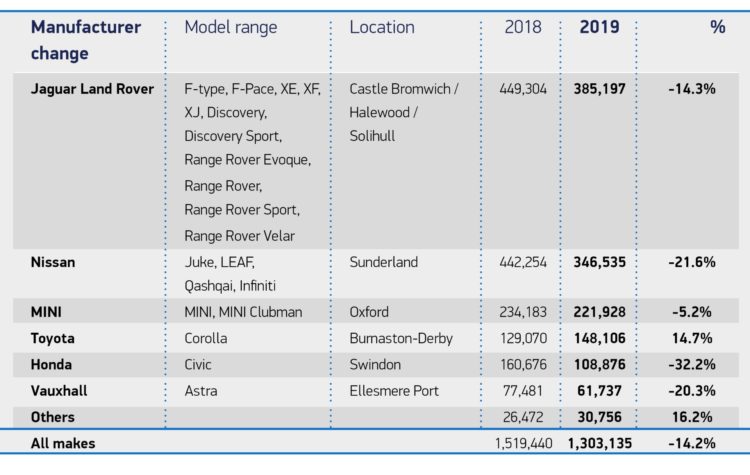

UK car production fell -14.2% in 2019, to 1,303,135 units, according to figures released today by the Society of Motor Manufacturers and Traders (SMMT), with a -6.4% drop in December rounding off a third year of decline. In 2019, car production in Britain was at its lowest level since 2010 when 1.27 million cars were built in the UK.

In 2019, British car production output was affected by multiple factors, including weakened consumer and business confidence at home, slower demand in key overseas markets, a number of significant model production changes and a shift from diesel across Europe. Factory shutdowns in the spring and autumn, timed to mitigate expected disruption arising from the anticipated departure of the UK from the EU on 29 March and 31 October, also had a marked effect.

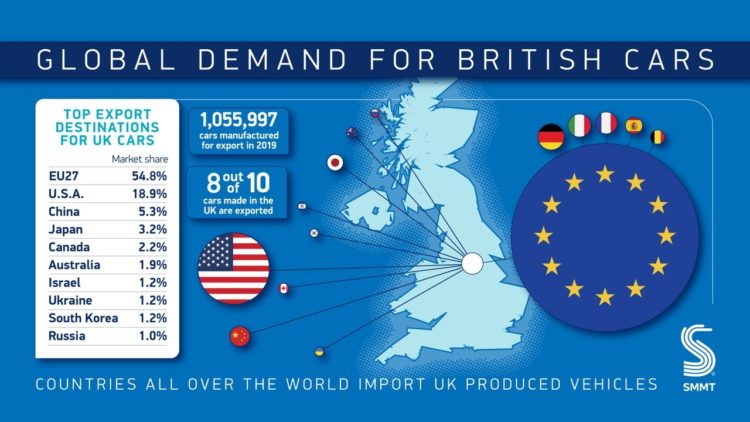

Manufacturing for domestic car buyers fell -12.3%, to 247,138 units, while exports also took a hit, down -14.7%, although overseas orders continued to drive volumes, accounting for more than eight in 10 cars built and totaling over one million units. Although shipments to the EU27 fell, by -11.1%, the bloc remains the sector’s most important market with its share of exports rising by two percentage points to 54.8%. Meanwhile, trade with the UK’s next largest markets, the US (representing 18.9% of export volumes), China (5.3%) and Japan (3.2%) also fell, with exports down -9.8%, -26.4% and -17.7% respectively.

The UK’s renowned small volume car manufacturing sector, however, bucked the trend with growing demand for some of the world’s most iconic and desirable brands boosting output by 16.2% in the year – for example, Rolls-Royce had a record year. Meanwhile, production of alternatively fuelled cars rose, by 34.7% to 192,304 units, as global appetite for the UK’s electric, plug-in hybrid and hybrid offering continues to rise. Thanks to its engineering excellence, expertise in advanced powertrain technologies, light-weighting, and aerodynamics, the UK is well-placed to lead the charge in ultra-low and zero-emission vehicle development and manufacturing – if the right business conditions are in place.

DriveElectric recently predicted that electric car sales in Britain in 2020 will increase by 260%.

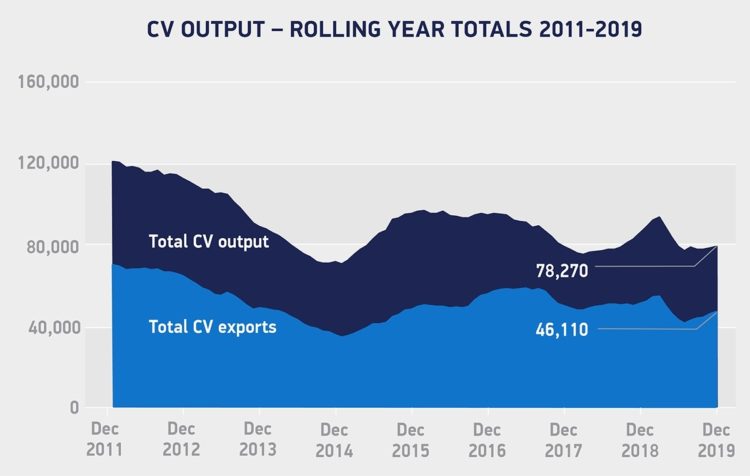

Commercial Vehicle Production in the UK in 2019

UK commercial vehicle manufacturing declined -7.8% in 2019, with 78,270 units leaving production lines, according to the latest figures released by the SMMT. The fall in output follows a turbulent year for CV production, as model changeovers, variable fleet buying patterns, and regulatory issues combined to affect production numbers.

These issues ensured output for the domestic market declined by -7.0% in the year, with 2,408 fewer UK-built CVs joining British roads. Exports were down -8.4% to 46,110 units.

Almost six out of every 10 vans, trucks, taxis and buses built in the UK in 2019 were exported, with 94.6% of those going to the EU, highlighting the vital need for a free trading relationship with the bloc. While Europe was by far the sector’s biggest overseas customer, British-built CVs were shipped to at least 57 different countries globally, including 619 units to Israel, 299 to Australia and 168 to Hong Kong.

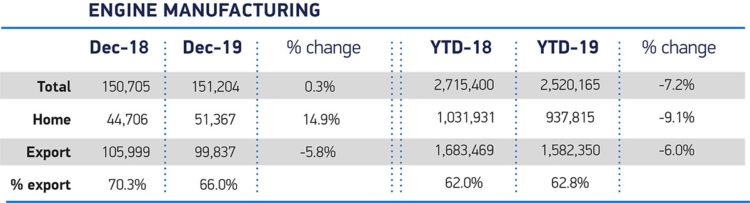

UK Engine Manufacturing in 2019 (Full Year)

In 2019, engine manufacturing in Britain was down -7.2% to 2.5 million units. The contraction reflects reduced demand from car manufacturing plants and additional shutdowns in April and November that affect annual production totals.

As with car and commercial vehicle production, the SMMT pointed out the need for ambitious future trade deals, as more than six in 10 UK-built engines were exported in 2019.

Investment in the British Automotive Industry in 2019

In 2019, only £1.10 billion of fresh automotive investment publicly announced for the UK. The bulk of that investment, however, was from one company looking to expand electric vehicle production in the West Midlands. With 2019’s investment tally some 60% lower than the £2.75 billion averaged over the previous seven years, it’s clear that more must be done to encourage overseas investors to follow suit.

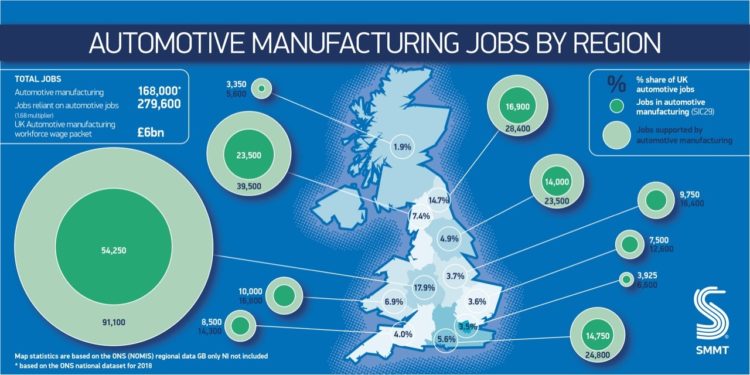

The news comes as SMMT reveals new figures highlighting the critical contribution of UK Automotive to regions right across Britain. One in 14 people (168,000) employed in manufacturing nationwide works in Automotive, with an additional 279,000 jobs supported, while in regions such as the North East and West Midlands, automotive accounts for more than one in six manufacturing jobs. With annual salaries typically 21% higher than the average across all UK employment, Automotive’s combined national salary contribution amounts to some £6 billion.

Meanwhile, the latest independent production outlook downgrades expectations for 2020 to 1.27 million units, down from the 1.32 million forecast made in November. To arrest this decline and ensure the future competiveness and success of UK automotive manufacturing, negotiations on the future UK-EU relationship – and trade deals with the rest of the world – must move quickly and deliver for this critical sector.

About SMMT and the UK Automotive Industry

The Society of Motor Manufacturers and Traders (SMMT) is one of the largest and most influential trade associations in the UK. It supports the interests of the UK automotive industry at home and abroad, promoting a united position to government, stakeholders and the media.

The automotive industry is a vital part of the UK economy accounting for £82 billion turnover and £18.6 billion value added. With some 168,000 people employed directly in manufacturing and 823,000 across the wider automotive industry, it accounts for 14.4% of total UK export of goods and invests £3.75 billion each year in automotive R&D. More than 30 manufacturers build some 70 models of vehicle in the UK supported by 2,500 component providers and some of the world’s most skilled engineers.

All graphics and graphs are by the SMMT. More detail on UK automotive available in SMMT’s Motor Industry Facts 2019.

The total British new car market contracted by 2.4% to 2,3 million cars with Ford still the best-selling manufacturer and the Ford Fiesta the top-selling model.