2025 (Half Year): New passenger vehicle registrations in Europe contracted but battery electric car sales increased with Germany and the UK the top country markets.

The European new car market contracted by almost 1% during the first half of 2025 but battery-electric vehicle (BEV) sales increased by a quarter. Germany and the United Kingdom (UK) were the largest country markets for passenger new car and all-electric car sales during the first semester of 2025. Volkswagen remained the largest carmaker and brand, the Dacia Sandero the top-selling car model, and the Tesla Model Y the leading electric car model.

Latest European Car Market Statistics: 2025 (Full Year): Market Overview, Sales by Country, Electric Sales per Country, Brands; 2025 by Month; 2025-2007.

European New Car Market in 2025 (Half Year)

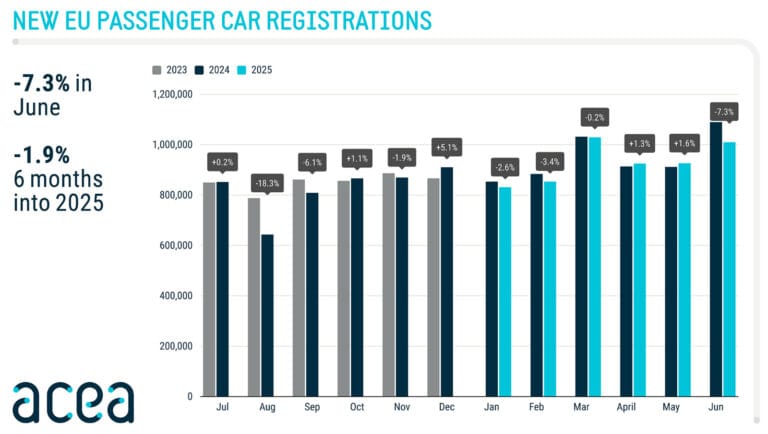

New passenger vehicle registrations in Europe (EU, EFTA and UK) contracted by 0.9% to 6,815,320 cars — over 60,000 fewer cars than were sold in the first half of 2024. In the European Union (EU), the market was even weaker with sales down 1.9% to 5,576,568.

Car Sales by Power Source in Europe 2025 (First Half)

During the first semester of 2025, battery-electric vehicle sales in Europe (EU, EFTA, UK) increased by 24.9% to 1,190,346 BEV registrations compared to 953,309 all-electric car sales in half-year 2024. The market share of all-electric cars in Europe increased from 14% to 17% during the first half of 2025.

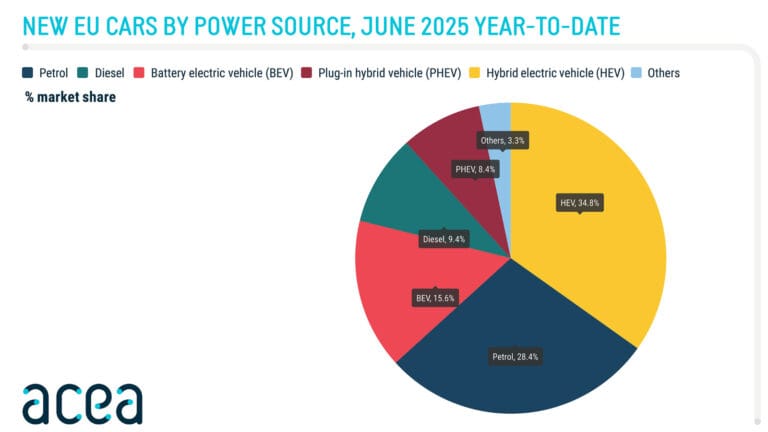

In the European Union, battery-electric car sales increased by 22% for a market share of 15.6%. Hybrids and petrol remained by far the most popular power source for new cars in the EU. The share of diesel cars fell below 10%.

Car Sales by Country in Europe in 2025 (First Half Year)

New passenger vehicle registrations in European countries during the first six months of 2025 were as follows, according to the ACEA:

| Country | Jan-Jun 2025 | Jan-Jun 2024 | % change |

| Austria | 143,051 | 135,113 | 5.9 |

| Belgium | 234,616 | 263,408 | -10.9 |

| Bulgaria | 24,083 | 23,033 | 4.6 |

| Croatia | 41,951 | 39,591 | 6.0 |

| Cyprus | 8,222 | 8,791 | -6.5 |

| Czechia | 122,639 | 119,221 | 2.9 |

| Denmark | 89,554 | 86,309 | 3.8 |

| Estonia | 6,156 | 10,167 | -39.5 |

| Finland | 37,256 | 39,154 | -4.8 |

| France | 842,204 | 914,889 | -7.9 |

| Germany | 1,402,789 | 1,471,641 | -4.7 |

| Greece | 78,162 | 78,020 | 0.2 |

| Hungary | 66,098 | 63,344 | 4.3 |

| Ireland | 81,744 | 78,979 | 3.5 |

| Italy | 855,028 | 886,631 | -3.6 |

| Latvia | 11,237 | 8,702 | 29.1 |

| Lithuania | 20,790 | 14,790 | 40.6 |

| Luxembourg | 25,258 | 25,095 | 0.6 |

| Malta | 3,139 | 4,143 | -24.2 |

| Netherlands | 182,680 | 193,312 | -5.5 |

| Poland | 285,311 | 276,956 | 3.0 |

| Portugal | 124,026 | 116,417 | 6.5 |

| Romania | 64,820 | 83,505 | -22.4 |

| Slovakia | 45,150 | 47,142 | -4.2 |

| Slovenia | 29,827 | 28,337 | 5.3 |

| Spain | 609,801 | 535,296 | 13.9 |

| Sweden | 140,976 | 132,293 | 6.6 |

| EUROPEAN UNION | 5,576,568 | 5,684,279 | -1.9 |

| Iceland | 7,885 | 6,339 | 24.4 |

| Norway | 75,515 | 60,559 | 24.7 |

| Switzerland | 113,133 | 121,218 | -6.7 |

| EFTA | 196,533 | 188,116 | 4.5 |

| United Kingdom | 1,042,219 | 1,006,763 | 3.5 |

| EU + EFTA + UK | 6,815,320 | 6,879,158 | -0.9 |

| Source: ACEA |

Germany remained by far the largest new car market in Europe during the first half of 2025, but sales were down nearly 5% while the British market expanded by 3.5%. Italy took third place from France, with both countries having lower car sales. In contrast, the Spanish and Polish new car markets expanded.

Electric Car Sales by Country in Europe in 2025 (First Half Year)

Battery-electric vehicle (BEV) sales per European country in the first half of 2025, according to the ACEA, were as follows:

| Country | Jan-Jun 2025 (BEV) | Jan-Jun 2024 (BEV) | % change |

| Austria | 31,534 | 22,178 | 42.2 |

| Belgium | 76,980 | 64,404 | 19.5 |

| Bulgaria | 1,135 | 863 | 31.5 |

| Croatia | 396 | 792 | -50.0 |

| Cyprus | 735 | 496 | 48.2 |

| Czechia | 6,910 | 4,146 | 66.7 |

| Denmark | 57,178 | 38,917 | 46.9 |

| Estonia | 444 | 649 | -31.6 |

| Finland | 12,726 | 10,569 | 20.4 |

| France | 148,332 | 158,402 | -6.4 |

| Germany | 248,726 | 184,125 | 35.1 |

| Greece | 4,265 | 3,341 | 27.7 |

| Hungary | 5,219 | 4,653 | 12.2 |

| Ireland | 13,629 | 10,737 | 26.9 |

| Italy | 44,726 | 34,939 | 28.0 |

| Latvia | 743 | 586 | 26.8 |

| Lithuania | 1,205 | 851 | 41.6 |

| Luxembourg | 6,559 | 6,435 | 1.9 |

| Malta | 805 | 1,239 | -35.0 |

| Netherlands | 63,940 | 60,280 | 6.1 |

| Poland | 14,256 | 8,861 | 60.9 |

| Portugal | 25,017 | 19,214 | 30.2 |

| Romania | 3,201 | 5,743 | -44.3 |

| Slovakia | 2,008 | 1,233 | 62.9 |

| Slovenia | 2,700 | 1,649 | 63.7 |

| Spain | 46,235 | 25,146 | 83.9 |

| Sweden | 49,667 | 42,003 | 18.2 |

| EUROPEAN UNION | 869,271 | 712,451 | 22.0 |

| Iceland | 2,283 | 957 | 138.6 |

| Norway | 70,748 | 51,418 | 37.6 |

| Switzerland | 23,203 | 21,387 | 8.5 |

| EFTA | 96,234 | 73,762 | 30.5 |

| United Kingdom | 224,841 | 167,096 | 34.6 |

| EU + EFTA + UK | 1,190,346 | 953,309 | 24.9 |

| Source: ACEA |

Germany and Britain remained the largest markets in Europe for electric cars during the first semester of 2025. Both markets expanded by more than a third. France was the only large European country with lower electric car sales volumes than in 2024.

All-electric car sales in Spain increased by 84% but Spain was only the 9th largest BEV market in Europe while Italy was only 10th and not even a fifth the size of German electric car sales.

Europe Car Sales Statistics

→ Latest European Car Sales Statistics

- 2026 Market Analysis: January

- 2025 (Full Year): Market Analysis, Sales by Country, Electric Sales per Country, Best-Selling Brands

- 2025 Market Analysis: January, February, March, April, May, June, July, August, September, October, November.

- 2025 (HY): Car & BEV Sales by Country, Electric Car Brands & Models, Brands, Top 10 Models.

- 2025 (Q1): Car Sales by Country, Best-Selling Brands, Electric Cars.

- 2025 (Outlook) Europe: Car and Electric Car Sales Forecasts.

- 2024 (Full Year): Market Analysis, Car Sales by Country, Electric Sales by Country, Best-Selling Brands, Top 50 Models, Top 20 Electric Models.

- 2024: January, February, March, April, May, June, July, August, September, October, November.

- Full-Year 2023: Car Sales by Country, Brands, Top 50 Models, Top 20 Electric Car Models.