2025 (Half Year): the European new car market contracts by 1% but battery-electric car sales in Europe increased by a quarter.

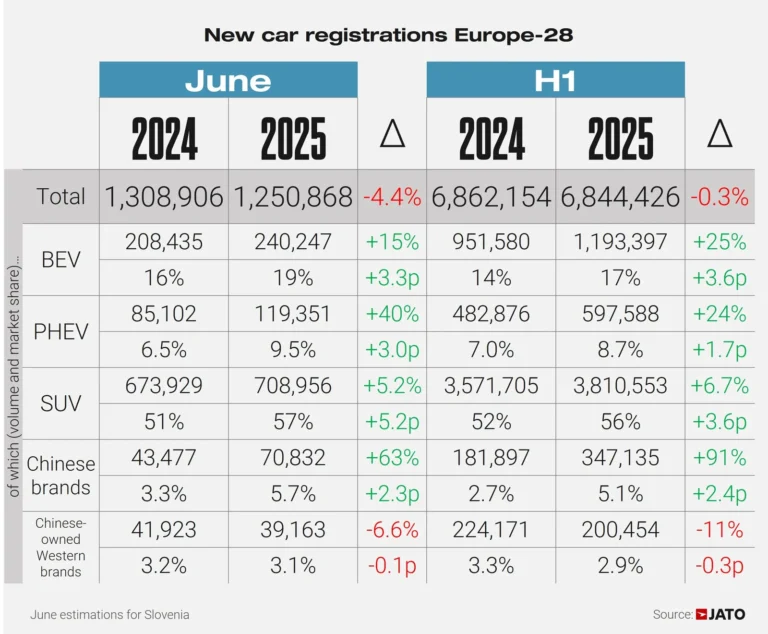

New passenger vehicle registrations in Europe contracted by 4.4% during June 2025 to drag the market down 0.3% for the first semester. Battery-electric vehicle (BEV) and plug-in hybrid car (PHEV) sales continue to grow strongly. Chinese brands also continued to make inroads into the European new car market. The Dacia Sandero was the most popular car model in Europe during the first half year but the Renault Clio was the top-seller in June 2025. The Tesla Model Y was the best-selling electric car model.

Latest European Car Market Statistics: 2025 (Full Year): Market Overview, Sales by Country, Electric Sales per Country, Brands; 2025 by Month; 2025-2007.

European New Car Market in 2025 (June and Half Year)

In June 2025, new passenger vehicle registrations in Europe contracted 4.4% year-on-year to 1,250,868 cars according to Jato Dynamics. All-electric car sales increased by 15% while plug-in hybrid sales were up 40%.

Among the hardest-hit markets were Italy (-17%), Belgium (-16%), and Germany (-14%). France and Switzerland also posted notable declines. Romania saw the biggest drop, down 50%.

From January to June 2025, registrations across the EU-28 totaled 6,844,426 units. That’s 0.3% lower than in the first half of 2024. High prices, global tensions, and post-pandemic realities continue to weigh on demand. Compared to the first half of 2019, the European new car market has lost 1.56 million units.

→ See also: 2025 (Half Year) Europe: Car and BEV Sales by European Country for a more detailed breakdown by EU, EFTA, and UK country.

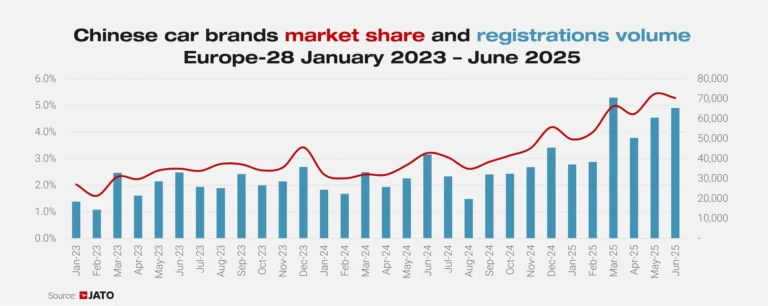

Chinese Car Brands Gained Market Share in Europe in 2025

While the overall market shrank, Chinese brands thrived. Their market share hit 5.1% in the first half of 2025, almost double that of last year. They now trail Mercedes by just 0.1 points and have overtaken Ford. In June 2025 alone, they outsold Mercedes.

Five brands led this charge: BYD, Jaecoo, Omoda, Leapmotor, and Xpeng. BYD was the standout, registering 70,500 cars in H1—a 311% increase. In June, it sold 15,565 cars, placing it among Europe’s top 25 brands. It outsold Suzuki, Mini, and Jeep. The BYD Seal U was the top-selling PHEV in June alongside the VW Tiguan.

Jaecoo and Omoda, both part of Chery, also advanced. Their success wasn’t due to EVs. Just 29% of sales were PHEVs. Most—63%—were still ICE vehicles. The Jaecoo 7 ranked as Europe’s 9th best-selling PHEV in June.

Leapmotor sold over 8,300 units in June, led by the T03 and C10 models. Xpeng became the top-selling high-end Chinese brand in Europe. It registered 8,338 units in H1, including 5,615 G6 SUVs.

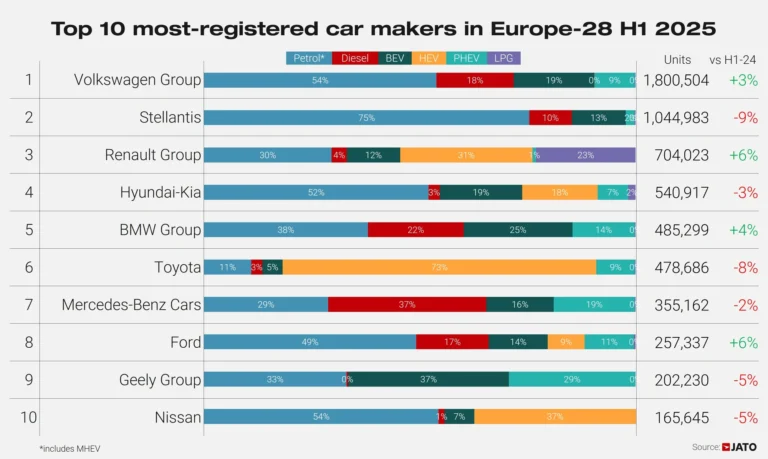

Top Car Manufacturing Groups in Europe in 2025 (Half Year)

Of the larger car manufacturing groups, Stellantis saw the sharpest decline in sales during the first half of 2025. Its share fell from 16.7% to 15.3%. This was its worst first semester sales since the company formed in 2021. Only Alfa Romeo (+33%), Peugeot (+6%), and Jeep (+2%) posted growth. Brands like Fiat, Citroen, Opel, and Lancia all recorded steep losses.

Citroen and Opel/Vauxhall also posted double-digit drops in registrations. “Stellantis’ woes are a result of two factors: the failure by many of its brands to introduce new models, and its growing focus on BEVs – typically more expensive than ICE models in the new car market,” Munoz highlighted.

Tesla also struggled. Its market share fell from 2.4% to 1.6%. Sales dropped 33% to 109,264 units. MG (SAIC Motor) overtook Tesla for the first time, selling 162,153 cars—a 22% rise.

→ See also: 2025 (Half Year) Europe: Best-Selling Car Brands.

Top-Selling Battery-Electric Car Brands in Europe in 2025 (June & Half Year)

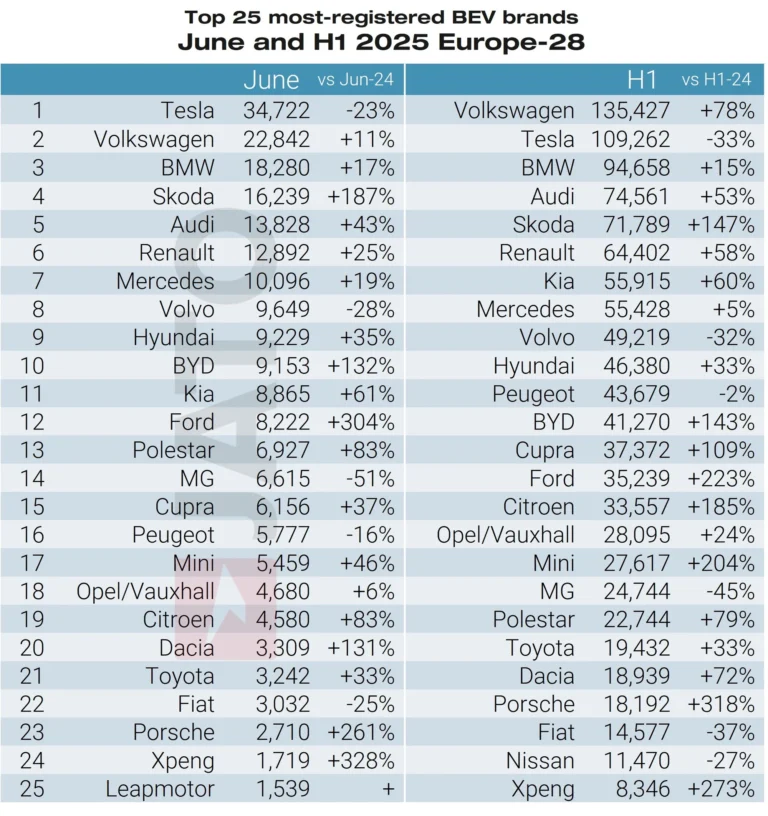

Battery electric vehicle sales in Europe continued to increase. For the first time, over one million BEVs were registered in the first semester for a total of 1,193,397 all-electric car sales, up 25%. In June 2025, BEV sales grew 15% to 240,247 units.

BEVs made up 17.4% of the market in the first half of 2025, up from 13.8% a year ago. Denmark saw the biggest jump in BEV share (+19 points), followed by Norway, Belgium, Finland, and Austria. BEV share was highest in Nordic and Benelux countries, and lowest in parts of Eastern and Southern Europe.

BYD was the most BEV-dependent large car brand after Tesla, with 64% of its sales being electric. Still, BYD’s BEV share dropped slightly as it focused more on hybrids and ICE to avoid tariffs. MG followed a similar path. Meanwhile, Ford tripled its BEV share, rising from 4.5% to 13.7%. VW, Hyundai-Kia, BMW, and Renault also recorded growth.

→ See also 2025 (Half Year) Europe: Top Electric Car Brands and BEV Models and 2025 (Half Year) Europe: Car and BEV Sales by European Country.

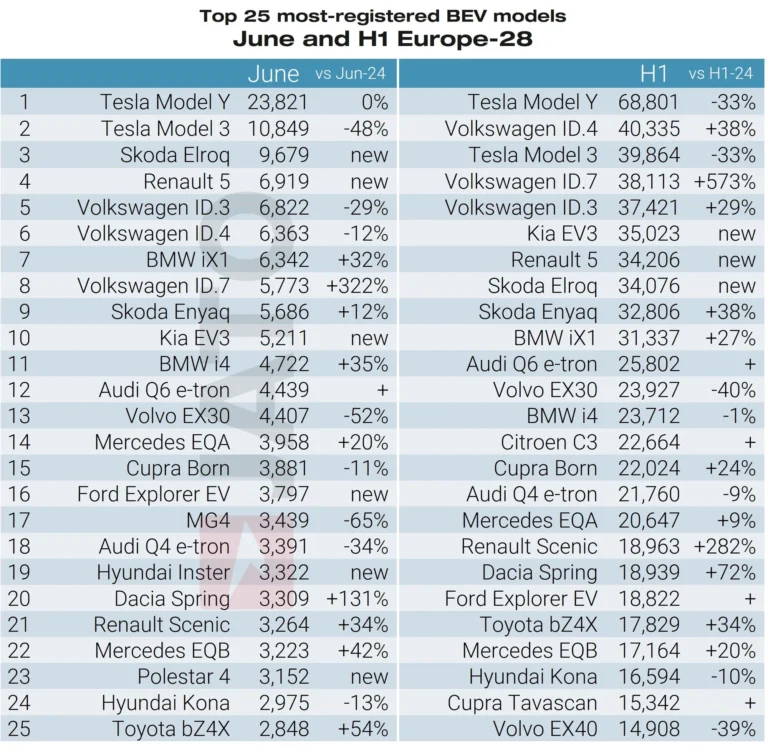

Best-Selling Electric Car Models in Europe in 2025 (June & Half Year)

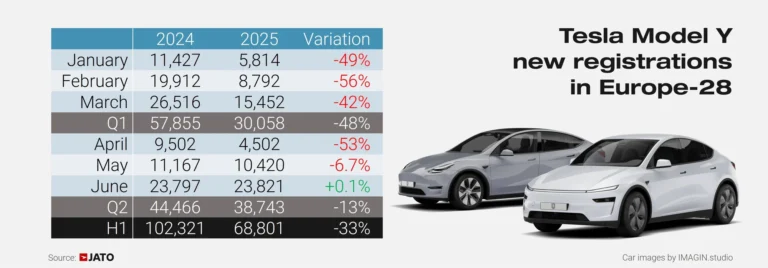

The Tesla Model Y remained the top BEV in Europe in both June and H1 2025. In June, its registrations edged up 0.1% year-on-year. This followed a sharp decline earlier in the year, with a 50% average monthly drop from January to April. Since May, volumes have stabilized.

Tesla’s updated Model Y failed to drive a recovery. Tesla sales contracted 33% while BEV sales increased by a quarter thus far this year. Rising competition from BYD and VW further pressured the brand.

VW increased sales of the ID4 and ID3, which are not the newest models either while the expensive ID7 performed well too. New car models including the Kia EV3, Renault 5, and Skoda Elroq entered the top ten for the first semester 2025.

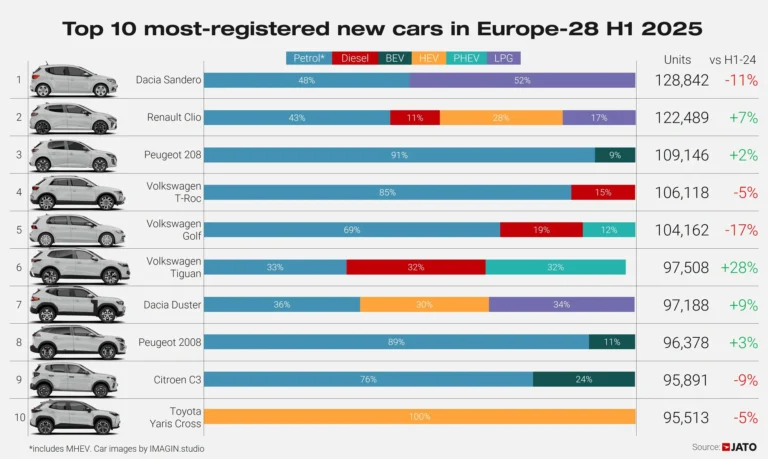

Top Ten Best-Selling Car Models in Europe in 2025 (Half Year)

The Dacia Sandero was the best-selling car model in Europe for the first half of 2025 followed by the Renault Clio, which was the top-seller in June.

H1 standouts included the VW Tiguan (+28%), MG ZS (+26%), Peugeot 3008 (+40%), Skoda Kodiaq (+30%), and VW ID.4 (+38%). The Fiat/Abarth 600 posted the strongest growth at +400%.

Among new models, Renault Symbioz led with 41,730 units. Jaecoo 7 followed with 37,700. Kia’s EV3 passed 35,000 units. Others included the Renault 5 (34,202), Skoda Elroq (34,105), and Audi Q6 (25,758).

→ See also: 2025 (Half Year) Europe: Top Ten Best-Selling Car Models.

Top Ten Best-Selling Car Models in Europe in June 2025

In June 2025, the ten best-selling car models in Europe according to JATO were:

| R | Brand | Model | Sales (June 2025) | % Change from June 2024 |

| 1 | Renault | Clio | 27,216 | 19% |

| 2 | Dacia | Sandero | 23,027 | -17% |

| 3 | Tesla | Model Y | 23,821 | 0% |

| 4 | Volkswagen | T-Roc | 20,369 | -8% |

| 5 | Peugeot | 2008 | 17,810 | 6% |

| 6 | Opel/Vauxhall | Corsa | 17,793 | 12% |

| 7 | Volkswagen | Golf | 17,175 | -15% |

| 8 | Peugeot | 208 | 17,213 | 16% |

| 9 | Nissan | Qashqai | 13,412 | 0% |

| 10 | Ford | Puma | 13,342 | 15% |

Renault Group topped the model rankings. The Renault Clio led in June with 27,200 units — sales increased by a fifth compared to June 2024 while the Dacia Sandero experienced a similar decline in sales. Tesla Model Y sales were flat despite strong growth in electric car sales.

The Clio (+19%), Peugeot 208 (+16%), and Opel/Vauxhall Corsa (+12%) were June’s big gainers. Other strong performers included the Ford Puma (+15%), BMW X1 (+27%), Mini Cooper (+25%), and Mercedes GLC (+31%).

Europe Car Sales Statistics

→ Latest European Car Sales Statistics

- 2026 Market Analysis: January

- 2025 (Full Year): Market Analysis, Sales by Country, Electric Sales per Country, Best-Selling Brands

- 2025 Market Analysis: January, February, March, April, May, June, July, August, September, October, November.

- 2025 (HY): Car & BEV Sales by Country, Electric Car Brands & Models, Brands, Top 10 Models.

- 2025 (Q1): Car Sales by Country, Best-Selling Brands, Electric Cars.

- 2025 (Outlook) Europe: Car and Electric Car Sales Forecasts.

- 2024 (Full Year): Market Analysis, Car Sales by Country, Electric Sales by Country, Best-Selling Brands, Top 50 Models, Top 20 Electric Models.

- 2024: January, February, March, April, May, June, July, August, September, October, November.

- Full-Year 2023: Car Sales by Country, Brands, Top 50 Models, Top 20 Electric Car Models.