July (2025): New passenger vehicle registrations in Europe (EU, EFTA, UK) increased by 6% with electric car sales up by third.

In July 2025, new car sales in Europe increased by nearly 6% to to 1,085,356 vehicles. During the first seven months of 2025, new passenger vehicle registrations in Europe (EU, EFTA, UK) were almost unchanged from 2024. Germany had unexpectedly strong car sales in July 2025 while the British, Italian, and French markets were weaker. Volkswagen remained the largest carmaker and best-selling car brand in Europe. The VW T-Roc became the top-selling car model in Europe for the first time ever in July 2025.

Latest European Car Market Statistics: 2025 (Full Year): Market Overview, Sales by Country, Electric Sales per Country, Brands; 2025 by Month; 2025-2007.

European New Car Market in 2025 (July)

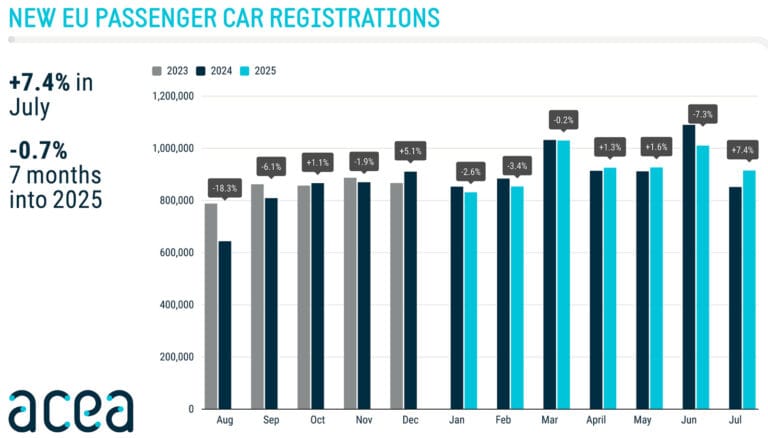

New passenger vehicle registrations in Europe (EU, EFTA, UK) increased by 5.9% to 1,085,356 cars compared to 1,024,806 car in July 2024. In the European Union (EU), car sales increased by a stronger 7.4% to 914,680 cars.

Year-to-date 2025, the European new car market was unchanged from the first seven months of 2024. New car sales in Europe during the period January to July amounted to 7,900,877 cars — only 3,535 fewer car than were sold in the corresponding months in 2024.

Car Sales in Europe by Power Source in 2025

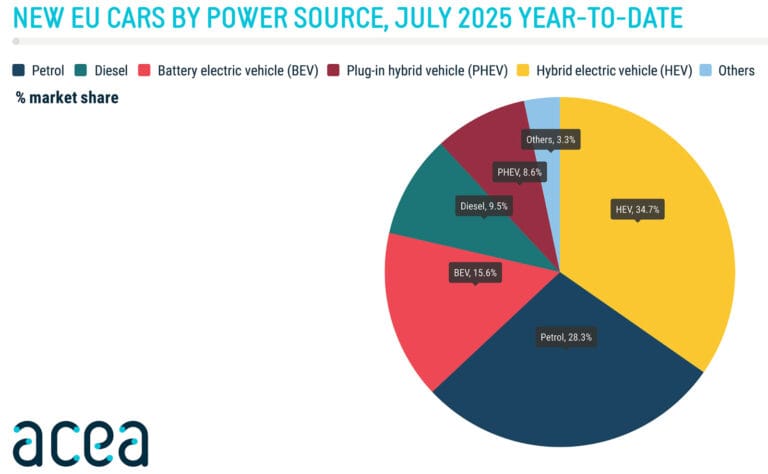

Car sales by power source in Europe during the first seven months of 2025, according to the ACEA, were as follows:

| Power Source | % Market Share |

| Hybrid electric vehicle (HEV) | 34.7 |

| Petrol | 28.3 |

| Battery electric vehicle (BEV) | 15.6 |

| Diesel | 9.5 |

| Plug-in hybrid vehicle (PHEV) | 8.6 |

| Others | 3.3 |

Battery-electric vehicle sales in Europe in July 2025 increased by 33.6% to 186,440 cars. In the EU only, electric car sales grew by 39.1%.

Year-to-date, electric car sales in Europe totalled 1,376,720 (+25.9%) while EU sales increased to 1,011,903 (+24.2%). BEV market share increased from 12.5% in January to July 2024 to 15.6% in the same period in 2025.

Car Sales per European Country in July 2025

New passenger vehicle registrations per European country in July 2025 and January to July 2025, according to the ACEA, were as follows:

| Countries | Sales July 2025 | % Change July 25/24 | Total Sales Jan-Jul 2025 |

| Austria | 24,867 | 31.6 | 167,918 |

| Belgium | 31,613 | -1.7 | 266,229 |

| Bulgaria | 4,706 | 20.5 | 28,779 |

| Croatia | 6,308 | 12.3 | 48,259 |

| Cyprus | 1,438 | 5.7 | 9,660 |

| Czechia | 20,817 | 19.3 | 143,456 |

| Denmark | 13,812 | 20 | 103,366 |

| Estonia | 1,106 | -40.3 | 7,262 |

| Finland | 5,425 | 4.4 | 42,681 |

| France | 116,377 | -7.7 | 958,581 |

| Germany | 264,802 | 11.1 | 1,667,591 |

| Greece | 13,606 | 11.5 | 91,768 |

| Hungary | 10,809 | 26.8 | 76,910 |

| Ireland | 26,750 | 4.2 | 108,494 |

| Italy | 118,583 | -5.1 | 973,755 |

| Latvia | 2,236 | 60.2 | 13,473 |

| Lithuania | 3,598 | 33.3 | 24,389 |

| Luxembourg | 4,514 | 5.2 | 29,770 |

| Malta | 584 | -1.8 | 3,723 |

| Netherlands | 28,986 | 9 | 211,423 |

| Poland | 50,265 | 16.5 | 335,576 |

| Portugal | 17,549 | 20.6 | 141,575 |

| Romania | 16,362 | 25.3 | 81,182 |

| Slovakia | 8,437 | 23.7 | 53,587 |

| Slovenia | 5,109 | 12.8 | 35,242 |

| Spain | 98,337 | 17.1 | 708,139 |

| Sweden | 17,684 | 8.2 | 158,660 |

| European Union | 914,680 | 7.4 | 6,491,448 |

| Iceland | 1,330 | 59.1 | 9,215 |

| Norway | 9,563 | 48.1 | 85,079 |

| Switzerland | 19,629 | 6.5 | 132,762 |

| EFTA | 30,522 | 18.7 | 227,056 |

| United Kingdom | 140,154 | -5 | 1,182,373 |

| EU + EFTA + UK | 1,085,356 | 5.9 | 7,900,877 |

While Gemany had unexpectedly strong car sales in July 2025, the other large European markets (UK, Italy, and France) all contracted.

Electric Car Sales per European Country in July 2025

New battery-electric passenger vehicle registrations per European Union country in July 2025, according to the ACEA, were as follows:

| Countries | Battery Electric Car Sales July 2025 | % Change July 25/24 |

| Austria | 4,920 | 67.7 |

| Belgium | 10,195 | 5 |

| Bulgaria | 272 | 77.8 |

| Croatia | 69 | -74.3 |

| Cyprus | 164 | 107.6 |

| Czechia | 1,070 | 30.5 |

| Denmark | 9,288 | 56.7 |

| Estonia | 100 | -18 |

| Finland | 1,971 | 47.1 |

| France | 19,547 | 14.8 |

| Germany | 48,614 | 58 |

| Greece | 611 | -30.7 |

| Hungary | 984 | 69.4 |

| Ireland | 4,903 | 56.7 |

| Italy | 5,864 | 37.6 |

| Latvia | 175 | 68.3 |

| Lithuania | 279 | 75.5 |

| Luxembourg | 877 | -30.1 |

| Malta | 113 | -46 |

| Netherlands | 8,949 | 10.2 |

| Poland | 3,814 | 231.4 |

| Portugal | 3,632 | 9.5 |

| Romania | 525 | -18 |

| Slovakia | 369 | 112.1 |

| Slovenia | 531 | 266.2 |

| Spain | 8,691 | 127.1 |

| Sweden | 6,172 | 11.9 |

| European Union | 142,699 | 39.1 |

| Iceland | 542 | 116.8 |

| Norway | 9,291 | 56.6 |

| Switzerland | 4,083 | 18.9 |

| EFTA | 13,916 | 44.7 |

| United Kingdom | 29,825 | 9.1 |

| EU + EFTA + UK | 186,440 | 33.6 |

Germany was the largest market for battery-electric cars in Europe in July 2025 but the strong growth was somewhat flattered by relatively low sales in July 2024. The UK was the second largest market for BEVs followed by France.x

Best-Selling Carmakers and Car Brands in Europe in 2025 (July)

The top-selling car manufacturing groups and brands in Europe in July 2025 and 1-7/2025, according to the ACEA, were as follows:

| Car manufacturing groups / brands | Sales July 2025 | Sales Jan-Jul 2025 | % Change 25/24 Jan-Jul |

| Volkswagen Group | 306,543 | 2,118,454 | 3.6 |

| – Volkswagen | 124,464 | 872,817 | 5.7 |

| – Skoda | 77,591 | 490,531 | 11.3 |

| – Audi | 52,971 | 381,895 | -5.5 |

| – Cupra | 24,199 | 177,241 | 36.8 |

| – Seat | 18,564 | 132,209 | -23.9 |

| – Porsche | 7,801 | 57,777 | -10.9 |

| – Others (Bentley, Bugatti, Lamborghini, MAN) | 952 | 5,984 | 9.8 |

| Stellantis | 151,391 | 1,192,746 | -8.1 |

| – Peugeot | 48,027 | 411,792 | 4.3 |

| – Opel/Vauxhall | 36,279 | 241,385 | -9.8 |

| – Citroen | 26,333 | 216,659 | -13.3 |

| – Fiat | 22,314 | 172,926 | -21.8 |

| – Jeep | 10,422 | 82,692 | 1.7 |

| – Alfa Romeo | 4,317 | 37,442 | 34.0 |

| – DS | 2,245 | 19,356 | -20.3 |

| – Lancia/Chrysler | 905 | 7,401 | -73.3 |

| – Others (Dodge, Maserati, RAM) | 549 | 3,093 | -20.2 |

| Renault Group | 104,194 | 812,116 | 5.8 |

| – Renault | 49,559 | 443,682 | 7.8 |

| – Dacia | 53,945 | 362,839 | 2.7 |

| – Alpine | 690 | 5,595 | 102.9 |

| Hyundai Group | 91,819 | 631,027 | -4.1 |

| – Hyundai | 49,148 | 316,492 | -3.9 |

| – Kia | 42,671 | 314,535 | -4.4 |

| Toyota Group | 77,435 | 556,411 | -7.2 |

| – Toyota | 71,376 | 510,094 | -8.4 |

| – Lexus | 6,059 | 46,317 | 9.0 |

| BMW Group | 83,279 | 569,338 | 5.0 |

| – BMW | 67,875 | 474,149 | 2.6 |

| – Mini | 15,404 | 95,189 | 19.0 |

| Mercedes-Benz | 53,458 | 388,876 | 0.3 |

| Ford | 35,858 | 260,342 | 0.7 |

| Volvo Cars | 25,030 | 195,266 | -13.2 |

| Nissan | 20,882 | 187,969 | -5.3 |

| SAIC Motor | 23,316 | 176,415 | 17.8 |

| Suzuki | 13,376 | 106,860 | -18.3 |

| Tesla | 8,837 | 119,013 | -33.6 |

| Mazda | 10,036 | 91,975 | -12.5 |

| BYD | 13,503 | 84,416 | 290.6 |

| Jaguar Land Rover Group | 9,828 | 82,332 | -13.9 |

| – Land Rover | 9,821 | 79,512 | -0.4 |

| – Jaguar | 7 | 2,820 | -82.2 |

| Honda | 6,024 | 43,314 | -8.6 |

| Mitsubishi | 3,327 | 31,221 | -23.6 |

In July 2025, and year-to-date 2025, the Volkswagen Group easily remained the largest carmaker in Europe and Volkswagen to top-selling marque. VW brand on its own outsold all other car manufacturing groups, except for second placed Stellantis. Stellantis is struggling with low sales for almost all its brands.

Hyundai-Kia was also struggling while Toyota sales were also sharply down.

Tesla sales were down by a third while BYD sales increased by 290%.

Top-Selling Electric Car Models in Europe in July 2025

The ten best-selling car models in Europe in July 2025 according to JATO were:

| – | Make | Model | July 2025 |

| 1 | Volkswagen | T-Roc | 20,577 |

| 2 | Dacia | Sandero | 19,990 |

| 3 | Toyota | Yaris Cross | 17,107 |

| 4 | Volkswagen | Tiguan | 16,006 |

| 5 | Volkswagen | Golf | 15,614 |

| 6 | Skoda | Octavia | 15,206 |

| 7 | Kia | Sportage | 14,839 |

| 8 | Dacia | Duster | 14,826 |

| 9 | Opel/Vauxhall | Corsa | 14,446 |

| 10 | Renault | Clio | 14,259 |

The VW T-Roc was the best-selling car in Europe in July 2025 — the first time ever for the small Volkswagen SUV to top the listings. The VW T-Roc is in the process of changing the model completely.

The Dacia Sandero was the second most popular car model in Europe in July 2025 but remained the top-selling car year-to-date 2025. The Toyota Yaris Cross was the third best-selling car model followed by the VW Tiguan and VW Golf.

Europe Car Sales Statistics

→ Latest European Car Sales Statistics

- 2025 (Full Year): Market Analysis, Sales by Country, Electric Sales per Country, Best-Selling Brands

- 2025 Market Analysis: January, February, March, April, May, June, July, August, September, October, November.

- 2025 (HY): Car & BEV Sales by Country, Electric Car Brands & Models, Brands, Top 10 Models.

- 2025 (Q1): Car Sales by Country, Best-Selling Brands, Electric Cars.

- 2025 (Outlook) Europe: Car and Electric Car Sales Forecasts.

- 2024 (Full Year): Market Analysis, Car Sales by Country, Electric Sales by Country, Best-Selling Brands, Top 50 Models, Top 20 Electric Models.

- 2024: January, February, March, April, May, June, July, August, September, October, November.

- Full-Year 2023: Car Sales by Country, Brands, Top 50 Models, Top 20 Electric Car Models.