2025 (October): New passenger vehicle registrations in Europe (EU, EFTA, UK) increased by 5% with battery car sales up by a third.

The European new car market expanded in October for the fourth consecutive month in 2025. Sales of of battery-electric vehicles were up by a third. Car sales increased in the three largest car markets in Europe: Germany, Britain, and France. Volkswagen remained the leading carmaker and brand in Europe. The Dacia Sandero was the best-selling car model in Europe in October 2025 (and year-to-date), followed by the Renault Clio and VW T-Roc.

Latest European Car Market Statistics: 2025 (Full Year): Market Overview, Sales by Country, Electric Sales per Country, Brands; 2025 by Month; 2025-2007.

European New Car Market in October 2025

New passenger vehicle registrations in the European Union (EU) increased by 5.8% in October 2025 to 916,609 cars, according to the ACEA. This was the fourth consecutive month of higher sales. During the first ten months of 2025, car sales in the EU increased by a moderate 1.4% to 8974,026 vehicles, including 1,473,447 electric cars (+25.7%).

In the larger European region, including the EU, EFTA, and the UK, new car sales in October 2025 increased by 4.9% to 1,091,904 passenger vehicles compared to 1,041,389 in October 2024. Year-to-date 2025, the European new car market expanded by 1.9% to 11,020,514 cars — only around 200,000 more than in 2024.

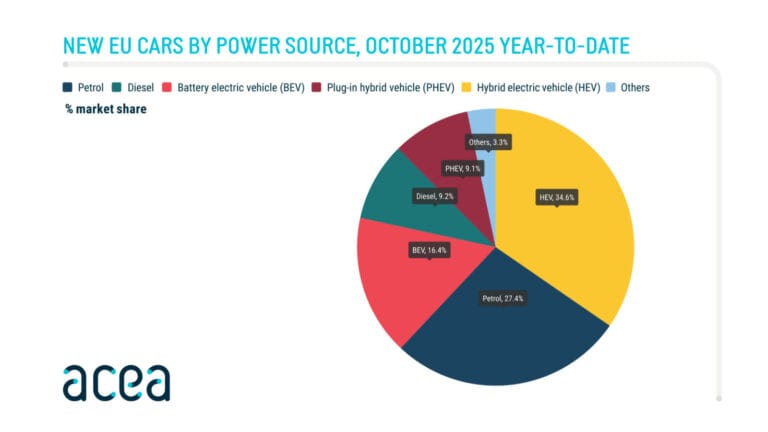

Car Sales in Europe by Fuel Type in 2025 (October)

Battery-electric vehicle (BEV) sales in the European Union increased by a strong 38.6% to 173,173 all-electric cars in October. The market share of all-electric cars in the EU increased from 14.4% in October 2024 to 18.9% in October 2025. In the period January to October 2025, electric car sales in the EU increased by 25.7% for a 16.4% market share (up from 13.2%).

The most popular power sources for new cars in the EU were hybrid-electric vehicles, i.e. mostly petrol, and purely petrol engines. The share of diesels fell to below 10%.

Electric car sales in Europe (EU, EFTA, UK) increased by 32.9% to 225,399 all-electric cars in October 2025 and a 20.6% market share (up from 16.3% in October 2024).

Car Sales per European Country in 2025 (January to October)

New passenger vehicle registrations per European (EU, EFTA, UK) country in October and the first 10 months of 2025, according to the ACEA, were as follows:

| Country | Oct 2025 | Oct 2024 | % | Jan-Oct 2025 | Jan-Oct 2024 | % |

| Austria | 24,479 | 21,981 | 11.4 | 239,594 | 213,004 | 12.5 |

| Belgium | 33,955 | 36,447 | -6.8 | 357,823 | 393,015 | -9 |

| Bulgaria | 4,932 | 3,872 | 27.4 | 41,148 | 36,255 | 13.5 |

| Croatia | 5,200 | 4,433 | 17.3 | 61,891 | 57,181 | 8.2 |

| Cyprus | 1,147 | 1,003 | 14.4 | 12,952 | 13,307 | -2.7 |

| Czechia | 23,298 | 21,070 | 10.6 | 205,735 | 193,069 | 6.6 |

| Denmark | 16,156 | 14,400 | 12.2 | 150,258 | 140,618 | 6.9 |

| Estonia | 1,266 | 2,673 | -52.6 | 10,688 | 18,500 | -42.2 |

| Finland | 6,219 | 5,937 | 4.7 | 60,161 | 61,440 | -2.1 |

| France | 139,514 | 135,529 | 2.9 | 1,326,298 | 1,401,435 | -5.4 |

| Germany | 250,133 | 231,992 | 7.8 | 2,360,481 | 2,348,066 | 0.5 |

| Greece | 10,763 | 9,670 | 11.3 | 122,995 | 117,705 | 4.5 |

| Hungary | 10,803 | 10,034 | 7.7 | 106,755 | 99,085 | 7.7 |

| Ireland | 2,181 | 2,417 | -9.8 | 123,843 | 119,772 | 3.4 |

| Italy | 125,961 | 126,599 | -0.5 | 1,293,967 | 1,329,082 | -2.6 |

| Latvia | 1,831 | 1,547 | 18.4 | 19,347 | 14,455 | 33.8 |

| Lithuania | 4,048 | 2,864 | 41.3 | 35,421 | 25,034 | 41.5 |

| Luxembourg | 3,800 | 4,174 | -9 | 40,291 | 40,087 | 0.5 |

| Malta | 533 | 486 | 9.6 | 5,167 | 6,325 | -18.3 |

| Netherlands | 34,724 | 32,074 | 8.3 | 304,674 | 310,228 | -1.8 |

| Poland | 52,728 | 48,097 | 9.6 | 480,636 | 446,727 | 7.6 |

| Portugal | 16,137 | 15,289 | 5.5 | 187,701 | 173,130 | 8.4 |

| Romania | 12,839 | 11,552 | 11.1 | 121,609 | 127,061 | -4.3 |

| Slovakia | 8,215 | 8,963 | -8.3 | 75,669 | 76,552 | -1.2 |

| Slovenia | 4,884 | 4,509 | 8.3 | 49,301 | 45,514 | 8.3 |

| Spain | 96,785 | 83,479 | 15.9 | 951,516 | 828,237 | 14.9 |

| Sweden | 24,078 | 25,026 | -3.8 | 228,105 | 218,417 | 4.4 |

| European Union | 916,609 | 866,117 | 5.8 | 8,974,026 | 8,853,301 | 1.4 |

| Iceland | 757 | 679 | 11.5 | 11,442 | 8,877 | 28.9 |

| Norway | 11,138 | 11,552 | -3.6 | 124,546 | 103,496 | 20.3 |

| Switzerland | 18,452 | 18,753 | -1.6 | 187,380 | 194,483 | -3.7 |

| EFTA | 30,347 | 30,984 | -2.1 | 323,368 | 306,856 | 5.4 |

| United Kingdom | 144,948 | 144,288 | 0.5 | 1,723,120 | 1,658,382 | 3.9 |

| EU + EFTA + UK | 1,091,904 | 1,041,389 | 4.9 | 11,020,514 | 10,818,539 | 1.9 |

Strong car sales in Germany, by far the largest new car market in Europe, lifted the market in October 2025. However, weakness in the German market earlier in 2025 remains a brake on European car sales, with a modest 0.5% increase year to date.

In the UK, car sales were flat in October 2025 but stronger earlier in the year. In France, car sales increased in October 2025 but France remained the worst-performing top market in Europe thus far in 2025. Of the ten largest car markets in Europe, only Belgium performed worse thus far in 2025.

Car sales in Italy remained weak, but the Spanish market continued to grow with sales up around 15% in October and thus far in 2025.

Electric Car Sales per European Country in 2025 (January to October)

New battery-electric passenger vehicle registrations in the ten largest European markets in the first ten months of 2025 and in October, according to the ACEA, were as follows:

| – | Country | Oct 2025 | Oct 2024 | % | Jan-Oct 2025 | Jan-Oct 2024 | % |

| EU + EFTA + UK | 225,399 | 169,550 | 32.9 | 2,022,173 | 1,602,342 | 26.2 | |

| European Union | 173,173 | 124,932 | 38.6 | 1,473,447 | 1,172,363 | 25.7 | |

| EFTA | 15,396 | 14,816 | 3.9 | 162,482 | 130,246 | 24.8 | |

| 1 | Germany | 52,425 | 35,491 | 47.7 | 434,627 | 311,881 | 39.4 |

| 2 | United Kingdom | 36,830 | 29,802 | 23.6 | 386,244 | 299,733 | 28.9 |

| 3 | France | 34,108 | 20,899 | 63.2 | 250,418 | 237,740 | 5.3 |

| 4 | Belgium | 12,360 | 12,738 | -3 | 120,581 | 109,017 | 10.6 |

| 5 | Norway | 10,852 | 10,862 | -0.1 | 118,458 | 91,792 | 29.1 |

| 6 | Netherlands | 13,968 | 10,961 | 27.4 | 107,817 | 101,181 | 6.6 |

| 7 | Denmark | 11,405 | 8,823 | 29.3 | 99,857 | 69,598 | 43.5 |

| 8 | Spain | 9,065 | 4,769 | 90.1 | 81,129 | 42,767 | 89.7 |

| 9 | Sweden | 8,707 | 8,780 | -0.8 | 80,937 | 74,625 | 8.5 |

| 10 | Italy | 6,280 | 5,030 | 24.9 | 67,335 | 53,248 | 26.5 |

Germany remains by far the largest market in Europe for new battery-electric vehicles, with sales up almost 50% in October and 40% year-to-date 2025. Electric car sales in the UK increased by around a quarter, while sales in France in October 2025 increased by almost two-thirds following weak electric car sales earlier in the year.

Although all-electric car sales in Italy increased by a quarter, BEV sales remain a dismally small percentage of the total Italian new car market.

Best-Selling Car Manufacturers and Brands in Europe in 2025 (Oct)

The top carmakers and brands in Europe (EU, EFTA, UK) in the first ten months of 2025 and in October, according to the ACEA, were as follows:

| Manufacturer | Oct 2025 | Oct 2024 | % | Jan-Oct 2025 | Jan-Oct 2024 | % |

| Volkswagen Group | 308,508 | 289,787 | 6.5 | 2,963,187 | 2,832,668 | 4.6 |

| – Volkswagen | 122,239 | 116,321 | 5.1 | 1,208,829 | 1,140,322 | 6 |

| – Skoda | 78,436 | 71,607 | 9.5 | 698,586 | 632,540 | 10.4 |

| – Audi | 57,767 | 54,552 | 5.9 | 541,881 | 560,038 | -3.2 |

| – Cupra | 24,576 | 19,465 | 26.3 | 246,702 | 178,529 | 38.2 |

| – Seat | 17,207 | 16,947 | 1.5 | 181,231 | 226,518 | -20 |

| – Porsche | 7,653 | 10,382 | -26.3 | 77,938 | 87,835 | -11.3 |

| Stellantis | 157,350 | 150,436 | 4.6 | 1,621,790 | 1,701,081 | -4.7 |

| – Peugeot | 51,712 | 58,032 | -10.9 | 552,051 | 543,095 | 1.6 |

| – Opel/Vauxhall | 35,400 | 31,490 | 12.4 | 340,349 | 358,886 | -5.2 |

| – Citroen | 30,569 | 22,926 | 33.3 | 296,655 | 310,337 | -4.4 |

| – Fiat | 21,771 | 18,735 | 16.2 | 232,405 | 273,331 | -15 |

| – Jeep | 9,366 | 11,555 | -18.9 | 110,217 | 110,872 | -0.6 |

| – Alfa Romeo | 4,939 | 3,485 | 41.7 | 51,019 | 36,542 | 39.6 |

| – DS | 2,150 | 2,890 | -25.6 | 25,195 | 31,956 | -21.2 |

| – Lancia/Chrysler | 1,106 | 880 | 25.7 | 9,844 | 31,027 | -68.3 |

| Renault Group | 113,448 | 102,609 | 10.6 | 1,116,387 | 1,040,747 | 7.3 |

| – Renault | 62,778 | 56,687 | 10.7 | 609,004 | 564,675 | 7.9 |

| – Dacia | 49,747 | 45,633 | 9 | 499,324 | 472,668 | 5.6 |

| – Alpine | 923 | 289 | 219.4 | 8,059 | 3,404 | 136.8 |

| Hyundai Group | 81,540 | 82,734 | -1.4 | 879,479 | 904,712 | -2.8 |

| – Hyundai | 41,137 | 41,488 | -0.8 | 443,364 | 450,139 | -1.5 |

| – Kia | 40,403 | 41,246 | -2 | 436,115 | 454,573 | -4.1 |

| Toyota Group | 74,741 | 84,871 | -11.9 | 776,321 | 829,413 | -6.4 |

| – Toyota | 68,728 | 77,914 | -11.8 | 712,076 | 766,750 | -7.1 |

| – Lexus | 6,013 | 6,957 | -13.6 | 64,245 | 62,663 | 2.5 |

| BMW Group | 81,984 | 77,066 | 6.4 | 799,922 | 756,420 | 5.8 |

| – BMW | 66,335 | 64,538 | 2.8 | 661,310 | 639,590 | 3.4 |

| – Mini | 15,649 | 12,528 | 24.9 | 138,612 | 116,830 | 18.6 |

| Mercedes-Benz | 56,221 | 57,921 | -2.9 | 557,264 | 556,919 | 0.1 |

| Ford | 33,411 | 35,670 | -6.3 | 360,396 | 362,708 | -0.6 |

| Volvo Cars | 28,878 | 30,497 | -5.3 | 272,402 | 305,910 | -11 |

| SAIC Motor | 23,860 | 17,552 | 35.9 | 250,250 | 197,686 | 26.6 |

| Nissan | 20,316 | 20,817 | -2.4 | 249,668 | 260,124 | -4 |

| Tesla | 6,964 | 13,519 | -48.5 | 180,688 | 256,495 | -29.6 |

| Suzuki | 13,812 | 14,473 | -4.6 | 147,062 | 174,996 | -16 |

| BYD | 17,470 | 5,695 | 206.8 | 138,390 | 35,949 | 285 |

| Mazda | 11,573 | 12,454 | -7.1 | 127,362 | 144,388 | -11.8 |

| Jaguar Land Rover Group | 7,877 | 9,574 | -17.7 | 107,274 | 128,659 | -16.6 |

| Honda | 5,101 | 5,223 | -2.3 | 61,944 | 65,712 | -5.7 |

| Mitsubishi | 2,189 | 4,063 | -46.1 | 38,158 | 51,507 | -25.9 |

The Volkswagen Group remained by far the largest carmaker in Europe in October 2025, with sales slightly better than the general market. Cupra sales were up by a quarter while high-earning Porsche sales were weaker.

Stellantis slightly underperformed with weak sales by Peugeot, balanced out by stronger sales by Opel, Fiat, and especially Citroen. The Renault Group performed well.

Toyota remained the second largest brand in Europe despite sales slipping by 12%.

The most improved brand in Europe in October 2025 was BYD, with sales up by over 200%. BYD outsold established brands, including Mini and Seat.

The worst performing brand was Tesla, with sales down 48.5% in October 2025 and 30% thus far this year.

Top-Selling Car Models in Europe in October 2025

The Dacia Sandero was Europe’s best-selling car model in October 2025 for the fifth month in 2025. It was followed by the Renault Clio and VW T-Roc. The Tesla Model Y, the top-selling car in September 2025, slipped out of the top 50 in October.

Europe Car Sales Statistics

→ Latest European Car Sales Statistics

- 2026 Market Analysis: January

- 2025 (Full Year): Market Analysis, Sales by Country, Electric Sales per Country, Best-Selling Brands

- 2025 Market Analysis: January, February, March, April, May, June, July, August, September, October, November.

- 2025 (HY): Car & BEV Sales by Country, Electric Car Brands & Models, Brands, Top 10 Models.

- 2025 (Q1): Car Sales by Country, Best-Selling Brands, Electric Cars.

- 2025 (Outlook) Europe: Car and Electric Car Sales Forecasts.

- 2024 (Full Year): Market Analysis, Car Sales by Country, Electric Sales by Country, Best-Selling Brands, Top 50 Models, Top 20 Electric Models.

- 2024: January, February, March, April, May, June, July, August, September, October, November.

- Full-Year 2023: Car Sales by Country, Brands, Top 50 Models, Top 20 Electric Car Models.