In 2020, CO2 emissions of new cars fell by 12% in Europe with the Netherlands having the lowest average and Toyota the top brand.

CO2 emissions of new passenger vehicles registered in the European Union in 2020 fell by 12% to an average of 106.7 g/km. The Netherlands was the country with the lowest CO2 emissions for new cars while France was the leading big market. CO2 emissions for new cars were particularly high in East European countries while Germany and Italy were the dirtiest large markets. Toyota and the PSA Group were the lowest polluting carmakers while Subaru and Jaguar-Land Rover were the dirtiest brands. The popularity of SUVs contributed to the slow decline in CO2 emissions, although electric SUVs could help to counter the effect in 2021.

European Car Market Statistics 2020: January, February, March, April, May, June, July, August, September, October, November, December

CO2 Emissions of New Cars in Europe in 2020

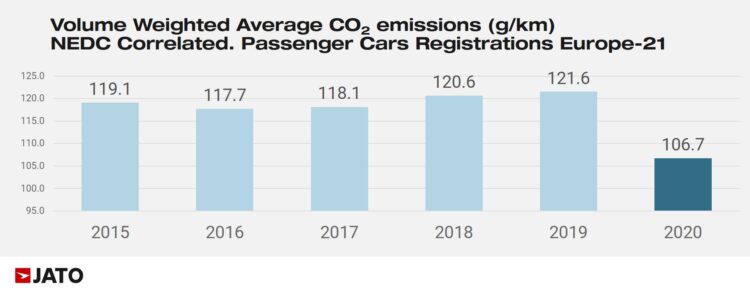

According to data collected by JATO Dynamics in 21 countries across Europe, the volume-weighted average CO2 emissions (NEDC) of new passenger vehicles registered in 2020 was 106.7 g/km – 12% lower than the average recorded in 2019.

This drop in CO2 emissions can be attributed to tougher government regulations such as the enforcement of WLTP fuel economy rules and a shift in consumer attitudes in favor of electric vehicles. Registrations of pure battery-electric and plug-in hybrid vehicles totaled 1.21 million units in 2020 – a 10.6% share of the total European new car market. This is an increase from 2019, when volume totaled 466,000 units, accounting for just 3.1% of total registrations.

Felipe Munoz, JATO’s global analyst, commented: “Although the industry still needs to do more to meet the European Commission’s CO2 targets, manufacturers have demonstrated significant progress with their range and sales in 2020.”

CO2 New Car Emissions by EU Country 2020

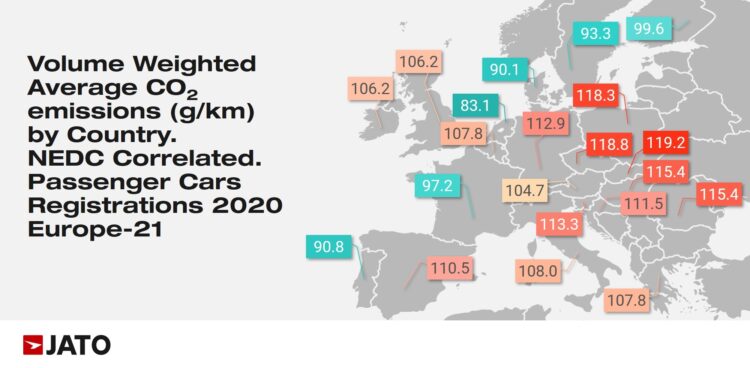

The Netherlands was the EU country with the lowest average CO2 emissions for new cars registered for the first time in 2020. Rich countries with high numbers of battery-electric vehicles such as the Netherlands and the Scandinavian countries had particularly low emissions. However, countries such as Portugal which favors smaller cars also performed well.

Of the largest five markets, only France had CO2 emissions below 100g/km while Germany and Italy had emissions around 113 g/100km. The high popularity, and government subsidies for plug-in hybrids, probably distort the on-the-road numbers for Germany even further in the wrong direction.

Six countries posted average emissions below 100g/km: the Netherlands, Denmark, Portugal, Sweden, France, and Finland. This also reflects the ranking for countries with the highest registration of EVs, with Sweden (32%) and the Netherlands (25%) topping the list. Finland, Denmark, and Portugal occupied the following positions. On the other side of the spectrum, the opposite trend can be seen in Slovakia, the Czech Republic, and Poland – all of which registered the highest CO2 averages and recorded low levels of EV penetration.

CO2 Emissions in Europe by Car Brand in 2020

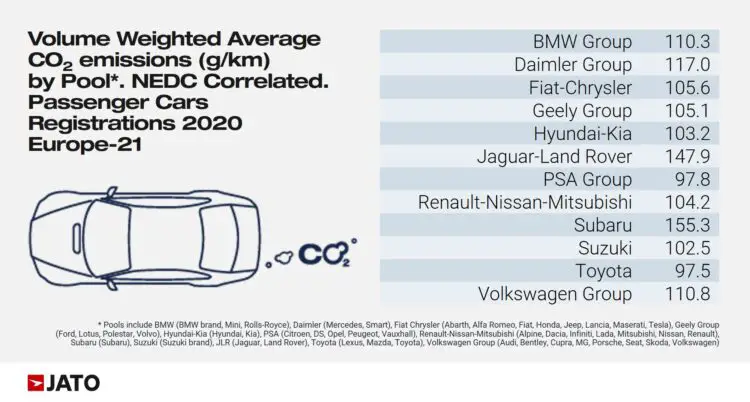

Subaru and Jaguar-Land Rover Group had by far the highest weighted average CO2 emissions by any manufacturing group in Europe in 2020. These manufacturers failed to provide sufficient electric and electrified cars to the market and also failed to pool with a cleaner brand to bring down averages.

Toyota, which is strong in hybrids but not electric cars, somewhat surprisingly had the lowest weighted average CO2 emissions in Europe for new cars in 2020. It was closely followed by the PSA Group that benefited from electric vehicles and smaller engines, as well as a move away from diesels.

The higher availability of electric and electrified cars from all brands in Europe should contribute to a further lowering of CO2 emissions of new cars in 2021. EU fines are seemingly giving car manufacturers the necessary incentive to lower emissions rather than pushing increasingly more powerful SUVs onto the market.

CO2 Emissions by Fuel Type in Europe in 2020

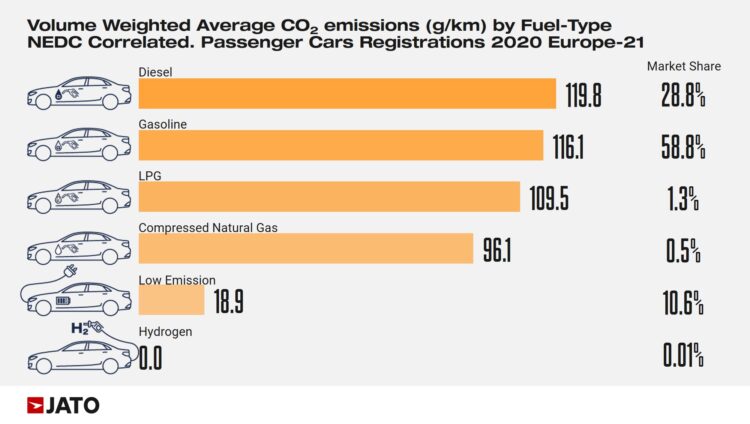

The Covid-19 pandemic has supported the growth of EVs across Europe. Focussing on how to bring the automotive market back to full strength, European countries opted to promote a green, sustainable recovery, with some governments creating new purchase incentives within their economic stimulus packages. the decline in the sale of large-engined diesel cars, especially in smaller vehicles, seemed to have contributed significantly to the decline in CO2 emissions.

This resulted in many consumers moving away from traditional internal combustion engines (ICE) vehicles during the pandemic, instead purchasing low-emissions alternatives. Volume for ICE vehicles fell from 14.7 million units in 2019 to 8.6 million last year – accounting for 3 in 4 cars registered in Europe. This had an immediate effect on emissions levels. Munoz noted: “In a year when millions of potential buyers were not allowed to leave their homes, it is notable that total average emissions decreased by 15g/km. It signifies a fundamental change to our notion of mobility and a greater appetite for sustainable options.”

With lockdown restrictions imposed across Europe and many governments delivering incentives packages for zero and low emissions cars, OEMs have made changes to their offering and marketing in order to entice consumers towards EV and PHEV vehicles.

CO2 Emissions by Car Segment in Europe in 2020

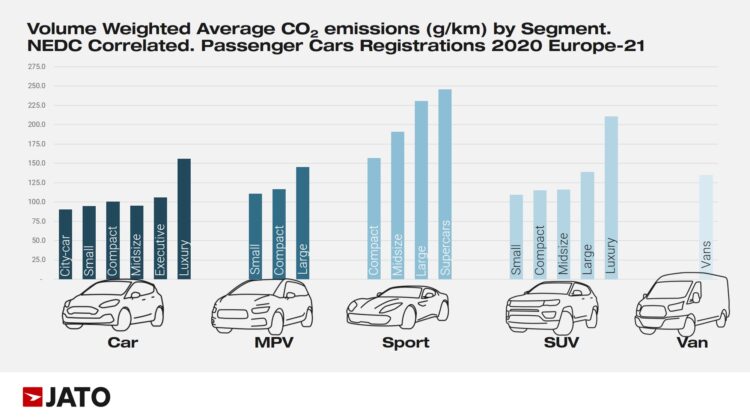

Despite the turbulent economic backdrop, SUVs were a key driver of growth last year, easing the fall in sales across traditional hatchbacks, sedans, MPVs, and wagons. In 2020, the volume of SUV registrations accounted for 40% of all passenger cars and also posted the best results for average reduction to emissions levels. High-polluting sports cars are sold in far lower numbers but are far more polluting by individual vehicle.

According to JATO, SUV emissions fell by 16.2g/km between 2019 and 2020 – the biggest decrease among the 5 mega segments analyzed (regular cars, MPVs, sports cars, SUVs, and vans). This is, in part, due to the improved range of PHEV and BEV midsize, and large SUVs now available to consumers. However, doubt remains about the on-the-road efficiency of plug-in hybrids, especially as many are bought as subsidized company cars with no requirement that the battery must actually ever be charged.

Despite these achievements, SUVs continued to produce greater emissions levels than city cars, subcompacts, compacts, midsize, executive, and luxury cars. On average, an SUV produces 18% more CO2 than traditional cars, and even the smallest SUVs produce larger average emissions than executive cars. Munoz stated: “More often than not, SUVs tend to be heavier than hatchbacks and sedans, meaning fuel consumption is higher. That said, they are now the next target on the list for electrification and we will undoubtedly see more progress in the coming months”.

So far, the race for electrification has largely been seen across more traditional models. For instance, the Tesla Model 3, Renault Zoe and Volkswagen ID.3 are Europe’s top selling BEVs. There is still great potential within the SUV market and demand is expected to accelerate at an even greater pace when more electrified models are introduced. Munoz added: “After a year of disruption, there are reasons to be positive and manufactures could rapidly offset the decline in sales by focusing on what consumers are looking for at the moment – zero and low emissions SUVs.”

Note on JATO CO2 Data

All emission data is taken directly from public sources or, when there was no public source, taken from comparable vehicles. The information includes the registrations weighted NEDC-Correlated emissions without supercredits and phase-in.

CO2 data corresponding to Austria, Belgium, Croatia, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, United Kingdom.