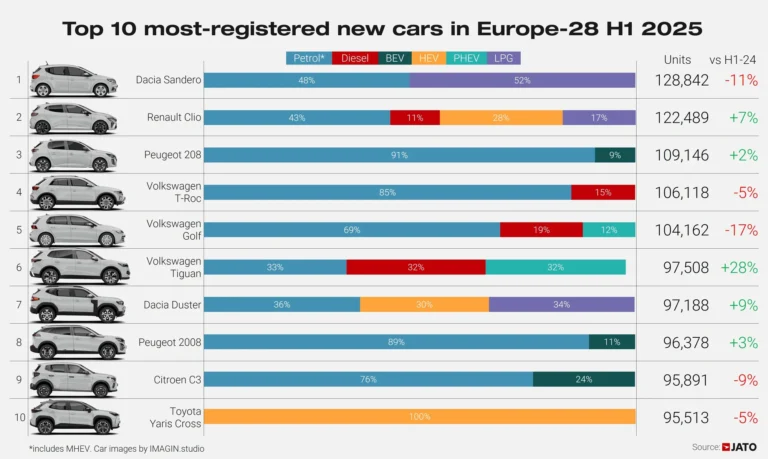

2025 (Half Year): The top-selling car models in Europe were the Dacia Sandero, Renault Clio, and Peugeot 208.

During the first semester of 2025, the Renault Group dominated the top models with the Dacia Sandero and Renault Clio the best-selling car models in Europe. The Peugeot 208 was third. It was followed by the Volkswagen T-Roc, VW Golf, and VW Tiguan. The Dacia Duster narrowly outsold the Peugeot 2008 while the Citroen C3 was ahead of the Toyota Yaris Cross, the most popular Japanese car model in Europe.

Latest European Car Market Statistics: 2025: January, February, March, (Q1), April, May, June (HY), July, August, September, October, November; 2024 (Full Year): Market, By Country, Electric, Brands, Top 50 Models, Top 20 Electric Models; 2025-2007.

Top Ten Best-Selling Car Models in Europe in 2025 (Half Year)

The ten most popular car models in Europe during the first semester of 2025 according to JATO were:

Top Three Car Models in Europe in 2025 (First Half)

In the first half of 2025, the European car market (EU-28) saw shifting trends in consumer preferences, with the Dacia Sandero maintaining its top position despite an 11% decline in registrations, totaling 128,842 units. The Sandero’s appeal lies in its affordability and dual-fuel flexibility—48% petrol and 52% LPG, making it unique among top sellers.

The Renault Clio followed closely in second place with 122,489 units, up 7% compared to H1 2024. Its diverse powertrain mix—43% petrol, 28% hybrid, 17% LPG, and 11% diesel—shows strong consumer demand for flexibility in fuel options.

The Peugeot 208, ranking third, recorded a modest 2% gain with 109,146 units and stood out with 91% petrol models, along with a 9% share of battery-electric vehicles (BEVs), showing Peugeot’s gradual move toward electrification.

Top Three Volkswagens

Volkswagen models took the next three spots:

- The VW T-Roc came fourth with 106,118 units, although down 5%, still dominated by 85% petrol and 15% diesel.

- The VW Golf, once Europe’s best-seller, dropped 17% to 104,162 units, with a powertrain mix of 69% petrol, 19% diesel, and 12% plug-in hybrid (PHEV).

- Interestingly, the VW Tiguan surged by 28% to 97,508 units, offering the most balanced drivetrain spread—33% petrol, 32% diesel, and 32% PHEV—underscoring its appeal to buyers looking for hybrid flexibility.

Small SUVs Remain Popular in Europe

The Dacia Duster climbed to seventh place with 97,188 units, a 9% increase, powered by 36% petrol, 30% hybrid, and 34% LPG, affirming Dacia’s value-for-money strategy. The Peugeot 2008 held eighth place with 96,378 units and a 3% increase, led by 89% petrol and 11% BEV, continuing the brand’s success in the B-SUV segment.

In ninth place, the Citroën C3 registered 95,891 units, down 9%, with a strong 76% petrol and 24% BEV mix, reflecting the brand’s investment in affordable electrification. Finally, the Toyota Yaris Cross, entirely hybrid (100% HEV), rounded out the top ten with 95,513 units, down 5%, but standing as a symbol of Toyota’s dominance in the hybrid space.

Europe Car Sales Statistics

→ Latest European Car Sales Statistics

- 2025 Market Analysis: January, February, March, April, May, June, July, August, September, October, November.

- 2025 (HY): Car & BEV Sales by Country, Electric Car Brands & Models, Brands, Top 10 Models.

- 2025 (Q1): Car Sales by Country, Best-Selling Brands, Electric Cars.

- 2025 (Outlook) Europe: Car and Electric Car Sales Forecasts.

- 2024 (Full Year): Market Analysis, Car Sales by Country, Electric Sales by Country, Best-Selling Brands, Top 50 Models, Top 20 Electric Models.

- 2024: January, February, March, April, May, June, July, August, September, October, November.

- Full-Year 2023: Car Sales by Country, Brands, Top 50 Models, Top 20 Electric Car Models.