In November 2025, new passenger vehicle registrations in Europe (EU, EFTA, UK) increased by by 2.4% while electric car sales were up by more than a third.

The European new car market continued to expand moderately in November 2025, with new passenger vehicle registrations increasing by 2.4% to just over 12 million cars. All-electric car sales in the European Union increased by a much stronger 44% and 21.3% market share in the EU in November 2025. Germany remained by far the largest new car market in Europe and was also the largest market for battery-electric vehicles. The Volkswagen Group increased its lead as Europe’s largest car manufacturer, while VW was the largest brand. The Renault Clio was the top-selling car model in Europe in November 2025.

Latest European Car Market Statistics: 2025 (Full Year): Market Overview, Sales by Country, Electric Sales per Country, Brands; 2025 by Month; 2025-2007.

European New Car Market in November 2025

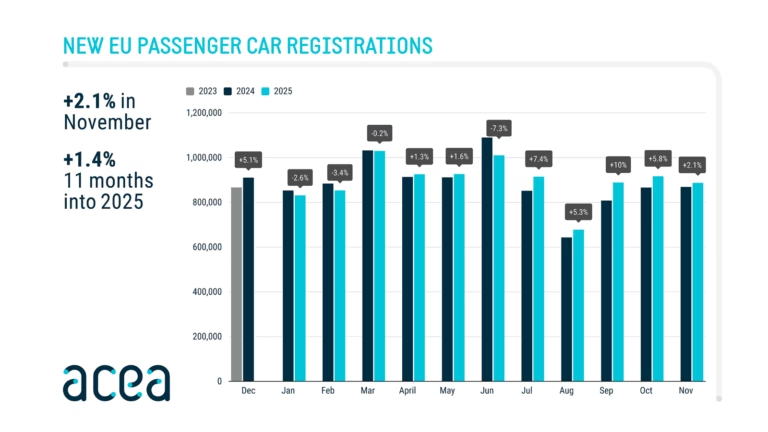

New passenger vehicle registrations in Europe (EU, EFTA, UK) increased by 2.4% in November 2025 to 1,079,553 cars, 25,000 more than were sold in November 2024. In the European Union (EU), new car sales increased by 2.1% to 887,491 vehicles — the fifth consecutive month of growth.

Year-to-date 2025, new car sales in Europe increased by a moderate 1.9% to just over 12 million vehicles, while the EU market expanded by 1.4% to 9,860,092 new vehicle registrations.

Car Sales in Europe by Fuel Type in 2025 (November)

In November 2025, hybrid electric vehicles (HEV) and petrol remained the most common energy source for new cars in Europe. Battery-electric vehicles (BEV) increased sales by 37.3% to 253,768 all-electric cars and a 23.5% share of the European (21.3% of the EU) new car market.

In the EU, all-electric car sales increased by 27.6% during the first eleven months of 2025 for a 16.9% share of the total new car market.

Car Sales per European Country in 2025 (January to November)

New passenger vehicle registrations per European (EU, EFTA, UK) country in November and the first 11 months of 2025, according to the ACEA, were as follows:

| Country | 11/2025 | 11/2024 | % | Jan-Nov 2025 | Jan-Nov 2024 | % YTD |

| Austria | 23,008 | 19,096 | 20.5 | 262,602 | 232,100 | 13.1 |

| Belgium | 28,071 | 31,825 | -11.8 | 385,893 | 424,840 | -9.2 |

| Bulgaria | 4,064 | 3,955 | 2.8 | 45,212 | 40,210 | 12.4 |

| Croatia | 4,070 | 4,094 | -0.6 | 65,961 | 61,275 | 7.6 |

| Cyprus | 980 | 1,072 | -8.6 | 13,932 | 14,379 | -3.1 |

| Czechia | 21,317 | 20,641 | 3.3 | 227,052 | 213,710 | 6.2 |

| Denmark | 15,908 | 14,929 | 6.6 | 166,166 | 155,547 | 6.8 |

| Estonia | 1,184 | 3,313 | -64.3 | 11,872 | 21,813 | -45.6 |

| Finland | 6,175 | 6,341 | -2.6 | 66,336 | 67,781 | -2.1 |

| France | 132,927 | 133,319 | -0.3 | 1,459,225 | 1,534,754 | -4.9 |

| Germany | 250,671 | 244,544 | 2.5 | 2,611,152 | 2,592,610 | 0.7 |

| Greece | 10,458 | 10,666 | -2 | 133,453 | 128,371 | 4 |

| Hungary | 10,754 | 10,647 | 1 | 117,510 | 109,732 | 7.1 |

| Ireland | 838 | 1,121 | -25.2 | 124,680 | 120,893 | 3.1 |

| Italy | 124,228 | 124,256 | 0 | 1,417,045 | 1,452,387 | -2.4 |

| Latvia | 1,721 | 1,416 | 21.5 | 21,068 | 15,871 | 32.7 |

| Lithuania | 3,580 | 2,607 | 37.3 | 39,008 | 27,641 | 41.1 |

| Luxembourg | 3,482 | 3,455 | 0.8 | 43,773 | 43,542 | 0.5 |

| Malta | 483 | 683 | -29.2 | 5,800 | 7,008 | -17.2 |

| Netherlands | 35,601 | 34,469 | 3.3 | 339,846 | 344,631 | -1.4 |

| Poland | 49,021 | 49,149 | -0.3 | 529,657 | 495,876 | 6.8 |

| Portugal | 16,459 | 16,400 | 0.4 | 204,160 | 189,530 | 7.7 |

| Romania | 13,882 | 10,237 | 35.6 | 135,491 | 137,298 | -1.3 |

| Slovakia | 8,608 | 8,185 | 5.2 | 84,277 | 84,737 | -0.5 |

| Slovenia | 4,861 | 4,284 | 13.5 | 54,162 | 49,798 | 8.8 |

| Spain | 94,124 | 83,362 | 12.9 | 1,045,638 | 911,599 | 14.7 |

| Sweden | 21,016 | 24,844 | -15.4 | 249,121 | 243,261 | 2.4 |

| European Union | 887,491 | 868,910 | 2.1 | 9,860,092 | 9,721,194 | 1.4 |

| Iceland | 1,405 | 506 | 177.7 | 12,847 | 9,383 | 36.9 |

| Norway | 19,898 | 11,689 | 70.2 | 144,444 | 115,185 | 25.4 |

| Switzerland | 19,615 | 19,698 | -0.4 | 206,993 | 214,181 | -3.4 |

| EFTA | 40,918 | 31,893 | 28.3 | 364,284 | 338,749 | 7.5 |

| United Kingdom | 151,154 | 153,610 | -1.6 | 1,874,274 | 1,811,992 | 3.4 |

| EU + EFTA + UK | 1,079,563 | 1,054,413 | 2.4 | 12,098,650 | 11,871,935 | 1.9 |

| Source: ACEA |

Germany remained by far the largest single-country market in Europe in November 2025, with sales just above the market average. In the UK, sales in November was 1.6% lowe,r but year-to-date 2025, the British new car market grew by over 3.4%. Of the top five European new car markets, only Spain performed stronger.

In November 2025, the French and Italian markets were only marginally weaker than a year ago, while the year-to-date sales in both France and Italy remained weak.

Electric Car Sales per European Country in 2025 (January to November)

New battery-electric passenger vehicle registrations per European (EU, EFTA, UK) country in November and the first 11 months of 2025, according to the ACEA, were as follows:

| Country | 11/2025 | 11/2024 | % | Jan-Nov 2025 | Jan-Nov 2024 | % YTD |

| Austria | 4,714 | 3,737 | 26.1 | 56,030 | 40,359 | 38.8 |

| Belgium | 11,935 | 11,247 | 6.1 | 132,516 | 120,264 | 10.2 |

| Bulgaria | 228 | 156 | 46.2 | 2,184 | 1,394 | 56.7 |

| Croatia | 157 | 60 | 161.7 | 1,082 | 1,668 | -35.1 |

| Cyprus | 63 | 168 | -62.5 | 1,349 | 1,150 | 17.3 |

| Czechia | 1,143 | 1,249 | -8.5 | 12,587 | 9,934 | 26.7 |

| Denmark | 11,730 | 8,760 | 33.9 | 111,587 | 78,358 | 42.4 |

| Estonia | 65 | 131 | -50.4 | 800 | 1,232 | -35.1 |

| Finland | 2,336 | 1,995 | 17.1 | 23,790 | 19,539 | 21.8 |

| France | 34,293 | 23,255 | 47.5 | 284,711 | 260,995 | 9.1 |

| Germany | 55,741 | 35,167 | 58.5 | 490,368 | 347,048 | 41.3 |

| Greece | 790 | 1,106 | -28.6 | 7,743 | 7,626 | 1.5 |

| Hungary | 852 | 648 | 31.5 | 9,820 | 7,812 | 25.7 |

| Ireland | 348 | 511 | -31.9 | 23,431 | 17,164 | 36.5 |

| Italy | 15,266 | 6,565 | 132.5 | 82,555 | 59,804 | 38 |

| Latvia | 102 | 119 | -14.3 | 1,476 | 1,161 | 27.1 |

| Lithuania | 248 | 145 | 71 | 2,726 | 1,668 | 63.4 |

| Luxembourg | 1,130 | 911 | 24 | 11,448 | 11,898 | -3.8 |

| Malta | 105 | 408 | -74.3 | 2,023 | 2,441 | -17.1 |

| Netherlands | 17,192 | 13,593 | 26.5 | 124,923 | 114,774 | 8.8 |

| Poland | 4,986 | 1,181 | 322.2 | 35,627 | 14,824 | 140.3 |

| Portugal | 5,341 | 4,063 | 31.5 | 46,666 | 36,615 | 27.5 |

| Romania | 1,052 | 492 | 113.8 | 7,495 | 8,435 | -11.1 |

| Slovakia | 472 | 188 | 151.1 | 3,844 | 2,088 | 84.1 |

| Slovenia | 629 | 296 | 112.5 | 5,740 | 2,860 | 100.7 |

| Spain | 9,316 | 5,791 | 60.9 | 90,445 | 48,558 | 86.3 |

| Sweden | 8,496 | 9,011 | -5.7 | 89,433 | 83,636 | 6.9 |

| European Union | 188,730 | 130,953 | 44.1 | 1,662,399 | 1,303,305 | 27.6 |

| Iceland | 880 | 267 | 229.6 | 5,002 | 2,355 | 112.4 |

| Norway | 19,427 | 10,940 | 77.6 | 137,885 | 102,732 | 34.2 |

| Switzerland | 4,766 | 4,151 | 14.8 | 44,666 | 40,517 | 10.2 |

| EFTA | 25,073 | 15,358 | 63.3 | 187,553 | 145,604 | 28.8 |

| United Kingdom | 39,965 | 38,581 | 3.6 | 426,209 | 338,314 | 26 |

| EU + EFTA + UK | 253,768 | 184,892 | 37.3 | 2,276,161 | 1,787,223 | 27.4 |

| Source: ACEA |

Battery-electric car sales in November 2025 increased in most European countries. In Germany and France, all-electric car sales were up by around a half — both countries offer some incentives, with the German market expected to expand significantly in 2026. In France, the electric-only Renault 5 has been very well received.

Electric car sales in the UK were uncharacteristically weak in November 2025, while year to date increases were a stronger 25%. Sweden was the only major market with weaker electric car sales in November, but the total Swedish car market contracted far more strongly.

Best-Selling Car Manufacturers and Brands in Europe in 2025 (November)

The top carmakers and brands in Europe (EU, EFTA, UK) in the first 11 months of 2025 and in November, according to the ACEA, were as follows:

| Manufacturer | 11/2025 | 11/2024 | % | Jan–Nov 2025 | Jan–Nov 2024 | % YTD |

| Volkswagen Group | 299,402 | 287,697 | 4.1 | 3,263,542 | 3,120,365 | 4.6 |

| — Volkswagen | 119,626 | 118,728 | 0.8 | 1,328,916 | 1,259,050 | 5.5 |

| — Skoda | 71,623 | 68,688 | 4.3 | 770,506 | 701,228 | 9.9 |

| — Audi | 58,153 | 52,904 | 9.9 | 600,089 | 612,942 | -2.1 |

| — Cupra | 25,500 | 19,802 | 28.8 | 272,694 | 198,331 | 37.5 |

| — Seat | 17,212 | 17,494 | -1.6 | 198,155 | 244,012 | -18.8 |

| — Porsche | 6,723 | 9,462 | -28.9 | 84,611 | 97,297 | -13 |

| — Others (VW) | 566 | 619 | -8.6 | 8,572 | 7,505 | 14.2 |

| Stellantis | 138,747 | 142,622 | -2.7 | 1,760,601 | 1,843,702 | -4.5 |

| — Peugeot | 44,636 | 52,846 | -15.5 | 596,706 | 595,941 | 0.1 |

| — Opel/Vauxhall | 30,056 | 28,496 | 5.5 | 370,409 | 387,382 | -4.4 |

| — Citroen | 28,580 | 25,126 | 13.7 | 325,243 | 335,463 | -3 |

| — Fiat | 19,948 | 17,189 | 16.1 | 252,354 | 290,520 | -13.1 |

| — Jeep | 8,318 | 10,634 | -21.8 | 118,554 | 121,506 | -2.4 |

| — Alfa Romeo | 4,062 | 4,289 | -5.3 | 55,088 | 40,830 | 34.9 |

| — DS | 1,785 | 2,787 | -36 | 26,982 | 34,743 | -22.3 |

| — Lancia/Chrysler | 1,085 | 899 | 20.7 | 10,933 | 31,926 | -65.8 |

| — Others (Stellantis) | 277 | 356 | -22.2 | 4,332 | 5,391 | -19.6 |

| Renault Group | 115,041 | 111,692 | 3 | 1,231,225 | 1,152,439 | 6.8 |

| — Renault | 65,595 | 62,050 | 5.7 | 674,562 | 626,725 | 7.6 |

| — Dacia | 48,517 | 49,354 | -1.7 | 547,673 | 522,022 | 4.9 |

| — Alpine | 929 | 288 | 222.6 | 8,990 | 3,692 | 143.5 |

| Hyundai Group | 79,901 | 79,729 | 0.2 | 959,317 | 984,470 | -2.6 |

| — Hyundai | 41,026 | 39,577 | 3.7 | 484,327 | 489,745 | -1.1 |

| — Kia | 38,875 | 40,152 | -3.2 | 474,990 | 494,725 | -4 |

| BMW Group | 81,901 | 80,524 | 1.7 | 882,020 | 836,944 | 5.4 |

| — BMW | 67,043 | 67,681 | -0.9 | 728,598 | 707,271 | 3 |

| — Mini | 14,858 | 12,843 | 15.7 | 153,422 | 129,673 | 18.3 |

| Toyota Group | 74,090 | 82,211 | -9.9 | 850,309 | 911,624 | -6.7 |

| — Toyota | 68,483 | 75,771 | -9.6 | 780,495 | 842,521 | -7.4 |

| — Lexus | 5,607 | 6,440 | -12.9 | 69,814 | 69,103 | 1 |

| Mercedes-Benz | 57,480 | 62,329 | -7.8 | 614,744 | 619,248 | -0.7 |

| Ford | 33,045 | 32,782 | 0.8 | 393,441 | 395,490 | -0.5 |

| Volvo Cars | 26,469 | 31,074 | -14.8 | 298,939 | 336,984 | -11.3 |

| SAIC Motor | 23,666 | 19,575 | 20.9 | 273,991 | 217,261 | 26.1 |

| Nissan | 20,100 | 22,327 | -10 | 269,341 | 282,451 | -4.6 |

| Tesla | 22,801 | 25,840 | -11.8 | 203,382 | 282,335 | -28 |

| BYD | 21,133 | 6,568 | 221.8 | 159,869 | 42,517 | 276 |

| Suzuki | 12,274 | 14,192 | -13.5 | 159,368 | 189,188 | -15.8 |

| Mazda | 13,457 | 12,410 | 8.4 | 140,859 | 156,798 | -10.2 |

| Jaguar Land Rover Group | 8,723 | 12,055 | -27.6 | 116,044 | 140,714 | -17.5 |

| — Land Rover | 8,723 | 10,827 | -19.4 | 113,199 | 118,882 | -4.8 |

| — Jaguar | 0 | 1,228 | -100 | 2,845 | 21,832 | -87 |

| Honda | 5,216 | 4,403 | 18.5 | 67,160 | 70,115 | -4.2 |

| Mitsubishi | 2,676 | 3,591 | -25.5 | 40,834 | 55,098 | -25.9 |

| Source: ACEA |

Thus far in 2025, the Volkswagen, Renault, and BMW Groups were the best-performing larger carmakers in Europe, while Stellantis and Toyota lost market share. Of the larger brands, Skoda improved the most, followed by Renault and VW.

The most-improved larger car brands in Europe thus far in 2025 were BYD (+276%), Cupra (+143%), and SAIC / MG (+26%%). BYD outsold established brands including Mazda, Mini, and Suzuki, while SAIC (MG) passed Tesla, Fiat, and Nissan.

Of the larger brands, Tesla lost the most sales thus far in 2025 (-28%), although its performance in November 2025 was only 12% weaker. Seat sales were down by 19% but somewhat balanced out by strong growth at Cupra (+37%).

Best-Selling Car Models in Europe in November 2025

The Renault Clio was the top-selling car model in Europe in November 2025. It was followed by the Dacia Sandero, which remained Europe’s favorite car model thus far in 2025. The VW T-Roc was the third-most popular car in Europe in November 2025.

Europe Car Sales Statistics

→ Latest European Car Sales Statistics

- 2025 (Full Year): Market Analysis, Sales by Country, Electric Sales per Country, Best-Selling Brands

- 2025 Market Analysis: January, February, March, April, May, June, July, August, September, October, November.

- 2025 (HY): Car & BEV Sales by Country, Electric Car Brands & Models, Brands, Top 10 Models.

- 2025 (Q1): Car Sales by Country, Best-Selling Brands, Electric Cars.

- 2025 (Outlook) Europe: Car and Electric Car Sales Forecasts.

- 2024 (Full Year): Market Analysis, Car Sales by Country, Electric Sales by Country, Best-Selling Brands, Top 50 Models, Top 20 Electric Models.

- 2024: January, February, March, April, May, June, July, August, September, October, November.

- Full-Year 2023: Car Sales by Country, Brands, Top 50 Models, Top 20 Electric Car Models.