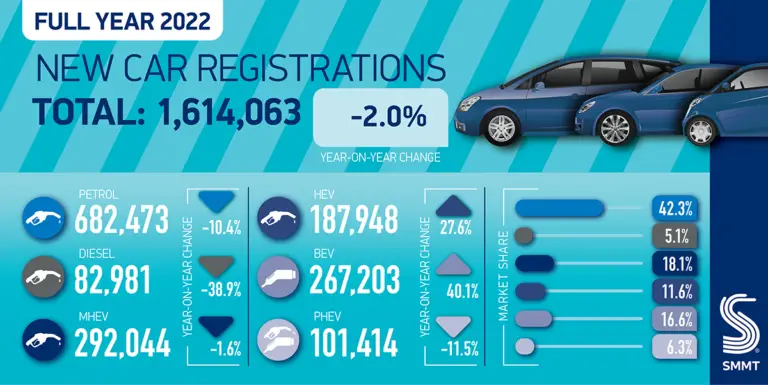

In full-year 2022, the new car market in Britain contracted by 2% to only 1.6 million vehicles — the lowest sales in 30 years.

2022 (January to December): New passenger vehicle registrations in the United Kingdom were 2% lower than in 2021 for the smallest British new car market since 1992. The sale of battery-electric vehicles increased by 40% to a new record market share of 16.6% while fewer than one in ten new cars were fueled by diesel. The outlook for the British new car market in 2023 is considerably more positive although the two-million mark is unlikely to be reached.

Latest British Car Sales Data: 2024: Market Overview, Brands, Models, Electric; 2023-2008.

New Car Market in Britain in 2022 (Overview)

New passenger vehicle registration in Britain contracted by 2% in 2022 to 1,614,063 cars. This marked the third consecutive year that the British new car market was smaller than two million vehicles and the lowest car sales since 1992. In 2022, the British new car market was around 700,00 vehicles smaller than in 2019.

According to the Society of Motor Manufacturers and Traders (SMMT), the market was mostly hundred by supply-side problems rather than lack of demand, although economic uncertainty in Britain is likely to be an increasingly visible factor once supply is normalized.

Looking ahead, the SMMT expects that the supply chains are beginning to stabilize and although the shortage of semiconductors is expected to ease, erratic supply will likely impact manufacturing throughout 2023. The most recent market outlook, published in October 2022, anticipates around 1.8 million new car registrations in 2023.

British Car Sales by Year (2006 – 2022)

Although the British new car market in 2022 was again the second-largest in Europe this was largely due to equal weakness in the French new car market. 2022 was the third consecutive year that new car sales in Britain fell below 2 million cars. It was also the weakest year since 1992. Car sales in the UK reached a record high 2,692,786 vehicles in 2016.

Annual new car sales in Britain were as follows since 2007:

| Year | UK Car Sales | % Change |

| 2022 | 1,614,063 | -2 |

| 2021 | 1,647,181 | 1 |

| 2020 | 1,631,064 | -29.4 |

| 2019 | 2,311,140 | -2.4 |

| 2018 | 2,367,147 | -6.8 |

| 2017 | 2,540,617 | -5.65 |

| 2016 | 2,692,786 | 2.25 |

| 2015 | 2,633,503 | 6.3 |

| 2014 | 2,476,435 | 9.4 |

| 2013 | 2,264,737 | 11 |

| 2012 | 2,044,609 | 5.3 |

| 2011 | 1,941,253 | -4.4 |

| 2010 | 2,030,846 | 1.8 |

| 2009 | 1,994,999 | -6.4 |

| 2008 | 2,131,795 | -11 |

| 2007 | 2,404,007 | – |

| 1992 | 1,594,000 | – |

| Source: SMMT |

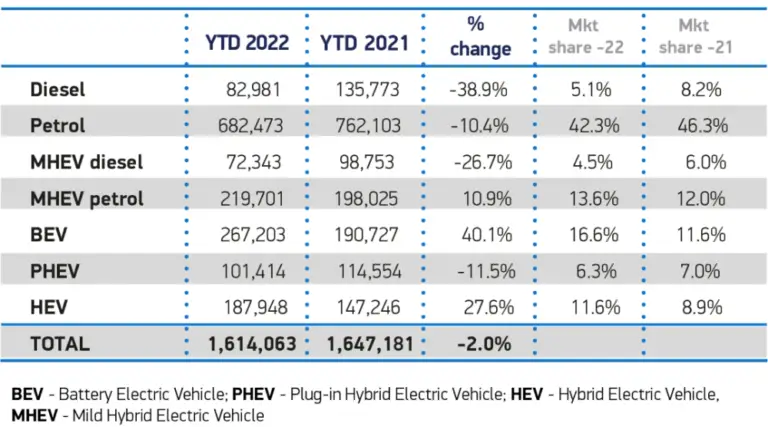

Car Sales in Britain in 2022 by Fuel Type

The share of diesel cars in new passenger vehicle registrations in Britain in 2022 fell to a record low 9.6% if pure diesels and MHEV diesels are combined. Petrol remains by far the most popular fuel type for new cars, especially when the various hybrids that mostly run on petrol are added.

The sales of battery-electric vehicles (BEV) in the UK increased by 40% in 2022 for a new record 16.6% market share. While private buyers accounted for more than half of all registrations, fleets and business buyers were responsible for two-thirds (66.7%) of all BEV registrations and 74.7% of the volume gain in 2022.

Latest British Car Sales Data: 2024: Market Overview, Brands, Models, Electric; 2023-2008.