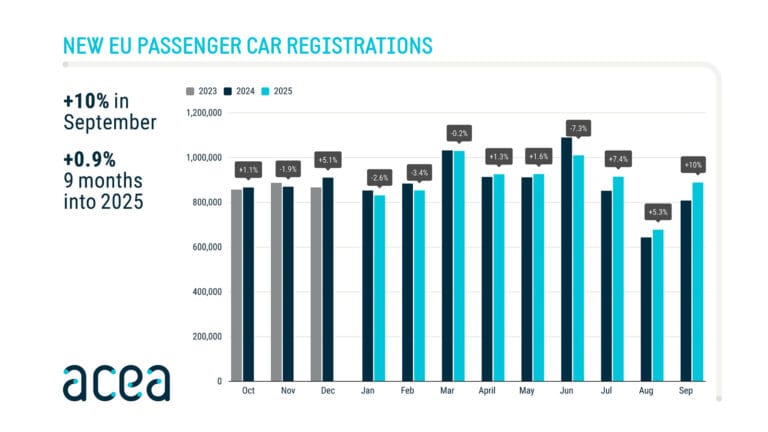

2025 (September): New passenger vehicle registrations in Europe (EU, EFTA, and the UK) increased by over 10% with car sales up in all major European markets.

New passenger vehicle registrations in the major European markets (EU, EFTA, UK) increased by 10.7% to 1,236,876 cars in September 2025 — the third successive month of car sales increases in Europe. All electric car sales increased by a fifth. Almost all major car manufacturing groups increased sales in Europe in September 2025, with Volkswagen Group sales up 10%, Stellantis +11.5%, and Renault +15%. BYD became a top 20 brand in Europe with sales up 400%. Tesla sales were down 10.5% (-28.5% year-to-date 2025). The Tesla Model Y was the best-selling car model in Europe in September 2025, followed by the Renault Clio and Dacia Sandero.

Latest European Car Market Statistics: 2025 (Full Year): Market Overview, Sales by Country, Electric Sales per Country, Brands; 2025 by Month; 2025-2007.

New Passenger Vehicle Registrations in Europe in 2025 (September)

New passenger vehicle registrations in the European Union (EU) increased by 10% to 888,672 cars in September 2025, according to the ACEA. In the larger European market (EU, EFTA, UK), sales increased by an even stronger 10.7% to 1,236,876 cars. September 2025 was the third consecutive month of higher car sales in Europe but sales were comparatively weak in the corresponding months in 2024.

The UK was the largest European new car market in September 2025 with 312,891 sales. A change in British number plate numbers traditionally contributed to market strength in the UK in September (and March). Germany was the second-largest country market in September with 235,528 (+12.8%) car sales, followed by France (+40,354 / +1%) and Italy (126,863 / +4.2%).

Car Sales in the Largest European Markets in 2025 (Q1 – Q3)

During the first three quarters of 2025, car sales in Europe and the ten largest European country markets were as follows, according to the ACEA:

| – | Country | SALES (Q1-3/2025) | SALES (Q1-Q3/2024) | % 25/24 |

| EU + EFTA + UK | 9,928,527 | 9,777,143 | 1.5 | |

| EU Total | 8,057,335 | 7,987,177 | 0.9 | |

| 1 | Germany | 2,110,348 | 2,116,074 | -0.3 |

| 2 | United Kingdom | 1,578,172 | 1,514,094 | 4.2 |

| 3 | France | 1,186,784 | 1,265,906 | -6.3 |

| 4 | Italy | 1,167,995 | 1,202,483 | -2.9 |

| 5 | Spain | 854,658 | 744,751 | 14.8 |

| 6 | Poland | 427,908 | 398,630 | 7.3 |

| 7 | Belgium | 323,868 | 356,568 | -9.2 |

| 8 | Netherlands | 269,953 | 278,154 | -2.9 |

| 9 | Austria | 215,115 | 191,023 | 12.6 |

| 10 | Sweden | 204,027 | 193,391 | 5.5 |

New passenger vehicle registrations in Europe increased by a moderate 1.5% during the first nine months of 2025, despite contractions in the large German, French, and Italian new car markets. The British new car market continued to expand with sales of battery-electric vehicles increasing by an even stronger 29%.

Electric Car Sales in Europe in 2025 (September)

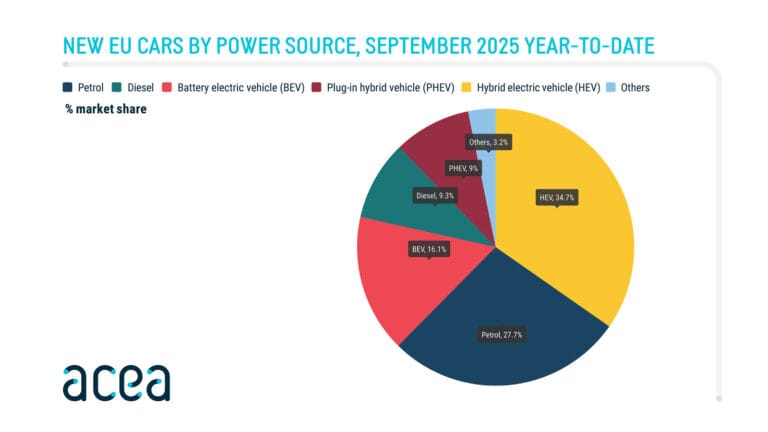

In the European Union, new battery-electric vehicle sales increased by 20% from 139,678 electric cars in September 2024 to 167,586 electric cars, according to the ACEA. In the larger European regions (EU, EFTA, UK), the growth was an even stronger 21.9% from 213,419 cars to 260,256 electric cars sold in September 2025.

The strong growth was largely due to electric car sales in Britain increasing by 29.1% in September 2025. The UK was, with 72,779 (+29.1%), by far the largest electric car market in Europe. It was followed by Germany (45,495 / +31.9%) and France (31,439 / +11.2%) as the three largest BEV markets in Europe in September 2025. Norway remains the market share leader for electric cars with only 14,084 sales (+12.7%), but with 97.7% of all new passenger vehicle registrations as battery-electric cars.

Battery Electric Car Sales in Europe in 2025 (Q1 – Q3)

Battery electric car sales in Europe during the first nine months of 2025, according to the ACEA, were as follows in the ten largest country markets:

| – | Country | BEV (1-9/2025) | BEV (1-9/2024) | % 25/24 |

| EU + EFTA + UK | 1,796,688 | 1,432,787 | 25.4 | |

| EU Total | 1,300,188 | 1,047,426 | 24.1 | |

| 1 | Germany | 382,202 | 276,390 | 38.3 |

| 2 | United Kingdom | 349,414 | 269,931 | 29.4 |

| 3 | France | 216,310 | 216,841 | -0.2 |

| 4 | Belgium | 108,221 | 96,279 | 12.4 |

| 5 | Norway | 107,606 | 80,930 | 33 |

| 6 | Netherlands | 93,768 | 90,220 | 3.9 |

| 7 | Denmark | 88,452 | 60,775 | 45.5 |

| 8 | Sweden | 72,230 | 65,845 | 9.7 |

| 9 | Spain | 72,062 | 37,998 | 89.6 |

| 10 | Italy | 61,055 | 48,218 | 26.6 |

During the first three quarters of 2025, battery electric car sales in Europe increased by over a quarter. Germany was the largest market for electric cars in Europe thus far in 2025, and further growth is expected, as the German government finally announced some clarification on subsidies and the tax regime for all-electric cars. BEV had a market share of 18.1% in Germany thus far in 2025 compared to 22.1% in the UK, 18.2% in France, and only 5.2% in Italy.

Top Car Manufacturers and Brands in Europe in September & Q1-Q3 2025

The largest carmakers and best-selling car brands in Europe (EU, EFTA, UK) in September 2025 and the first nine months of 2025, according to the ACEA, were:

| Manufacturer | Sep 2025 | Sep 2024 | % | 1-9/2025 | 1-9/2024 | % |

| TOTAL | 1,236,876 | 1,116,975 | 10.7 | 9,928,527 | 9,777,143 | 1.5 |

| VW Group | 317,432 | 289,404 | 9.7 | 2,654,576 | 2,542,882 | 4.4 |

| — Volkswagen | 126,507 | 115,412 | 9.6 | 1,086,591 | 1,024,001 | 6.1 |

| — Skoda | 77,611 | 70,000 | 10.9 | 620,098 | 560,933 | 10.5 |

| — Audi | 60,829 | 58,893 | 3.3 | 484,060 | 505,486 | -4.2 |

| — Cupra | 25,479 | 17,174 | 48.4 | 222,106 | 159,064 | 39.6 |

| — Seat | 18,563 | 19,602 | -5.3 | 164,142 | 209,571 | -21.7 |

| — Porsche | 7,646 | 7,818 | -2.2 | 70,192 | 77,453 | -9.4 |

| Stellantis | 165,457 | 148,381 | 11.5 | 1,464,419 | 1,550,647 | -5.6 |

| — Peugeot | 54,894 | 54,069 | 1.5 | 500,331 | 485,063 | 3.1 |

| — Opel/Vauxhall | 38,914 | 33,959 | 14.6 | 304,952 | 327,396 | -6.9 |

| — Citroen | 28,531 | 22,053 | 29.4 | 266,082 | 287,411 | -7.4 |

| — Fiat | 22,967 | 19,874 | 15.6 | 210,627 | 254,597 | -17.3 |

| — Jeep | 11,107 | 10,795 | 2.9 | 100,851 | 99,317 | 1.5 |

| — Alfa Romeo | 5,628 | 3,275 | 71.8 | 46,079 | 33,058 | 39.4 |

| — DS | 2,260 | 2,839 | -20.4 | 23,044 | 29,066 | -20.7 |

| Renault Group | 115,830 | 100,570 | 15.2 | 1,003,085 | 938,138 | 6.9 |

| — Renault | 64,884 | 60,545 | 7.2 | 546,314 | 507,988 | 7.5 |

| — Dacia | 49,961 | 39,809 | 25.5 | 449,634 | 427,035 | 5.3 |

| — Alpine | 985 | 216 | 356 | 7,137 | 3,115 | 129.1 |

| Hyundai Group | 97,846 | 97,114 | 0.8 | 797,888 | 821,984 | -2.9 |

| — Hyundai | 48,181 | 46,621 | 3.3 | 402,176 | 408,657 | -1.6 |

| — Kia | 49,665 | 50,493 | -1.6 | 395,712 | 413,327 | -4.3 |

| Toyota Group | 86,797 | 84,424 | 2.8 | 701,797 | 744,542 | -5.7 |

| — Toyota | 79,014 | 75,972 | 4 | 643,543 | 688,836 | -6.6 |

| — Lexus | 7,783 | 8,452 | -7.9 | 58,254 | 55,706 | 4.6 |

| BMW Group | 85,538 | 82,075 | 4.2 | 717,653 | 679,354 | 5.6 |

| — BMW | 68,483 | 65,266 | 4.9 | 594,696 | 575,052 | 3.4 |

| — Mini | 17,055 | 16,809 | 1.5 | 122,957 | 104,302 | 17.9 |

| Mercedes-Benz | 67,942 | 67,583 | 0.5 | 501,043 | 498,998 | 0.4 |

| Ford | 40,713 | 42,127 | -3.4 | 326,985 | 327,038 | 0 |

| Volvo Cars | 32,072 | 29,965 | 7 | 243,520 | 275,413 | -11.6 |

| Nissan | 29,882 | 28,674 | 4.2 | 229,471 | 239,307 | -4.1 |

| SAIC Motor | 33,924 | 19,334 | 75.5 | 226,379 | 180,134 | 25.7 |

| Tesla | 39,837 | 44,502 | -10.5 | 173,694 | 242,976 | -28.5 |

| Suzuki | 16,535 | 17,773 | -7 | 133,619 | 160,523 | -16.8 |

| BYD | 24,963 | 5,013 | 398 | 120,859 | 30,254 | 299.5 |

| Mazda | 16,087 | 16,927 | -5 | 115,743 | 131,934 | -12.3 |

| JLR Group | 10,237 | 16,200 | -36.8 | 99,397 | 119,085 | -16.5 |

| — Land Rover | 10,237 | 14,024 | -27 | 96,552 | 100,174 | -3.6 |

| — Jaguar | 0 | 2,176 | -100 | 2,845 | 18,911 | -85 |

| Honda | 9,293 | 8,508 | 9.2 | 56,843 | 60,489 | -6 |

| Mitsubishi | 2,591 | 3,414 | -24.1 | 35,969 | 47,444 | -24.2 |

Note: Exclude smaller brands

Largest Car Brands in Europe in September 2025

Most of the larger carmakers and brands performed well in Europe in September 2025. Especially Volkswagen and Stellantis brands sold far better than during the first nine months of the year.

The best-performing brands in Europe in September 2025 were BYD (+400%) and Alpine (+360%) but even larger, more established brands such as SAIC Motor (MG) increased sales strongly. Tesla was the worst-performing larger brand (-10.5%) but sales were much stronger in September than earlier in the year.

Best-Selling Car Models in Europe in September 2025

The Tesla Model Y was Europe’s best-selling car model in September 2025 for the first time in nine months. Sales at 25,938 were down 8.6% from a year earlier to 25,938. Tesla sales are traditionally high in the final month of the quarter. It remains unclear if the updated Model Y found new favor with car buyers in Europe or whether it is a one-off statistical effect.

The Tesla Model Y was followed by the Renault Clio and Dacia Sandero.

Europe Car Sales Statistics

→ Latest European Car Sales Statistics

- 2025 (Full Year): Market Analysis, Sales by Country, Electric Sales per Country, Best-Selling Brands

- 2025 Market Analysis: January, February, March, April, May, June, July, August, September, October, November.

- 2025 (HY): Car & BEV Sales by Country, Electric Car Brands & Models, Brands, Top 10 Models.

- 2025 (Q1): Car Sales by Country, Best-Selling Brands, Electric Cars.

- 2025 (Outlook) Europe: Car and Electric Car Sales Forecasts.

- 2024 (Full Year): Market Analysis, Car Sales by Country, Electric Sales by Country, Best-Selling Brands, Top 50 Models, Top 20 Electric Models.

- 2024: January, February, March, April, May, June, July, August, September, October, November.

- Full-Year 2023: Car Sales by Country, Brands, Top 50 Models, Top 20 Electric Car Models.