In 2020, global sales of the PSA Group (Peugeot, Citroen, DS, Opel / Vauxhall) were sharply lower although Peugeot gained market share in some markets.

In full-year 2020, global sales of the PSA Group (Peugeot, Citroen, DS, Opel / Vauxhall) were 28% lower worldwide with Peugeot brand performing the best with sales down by 23%. Citroen sales were 28% lower than in 2019 while Opel sales were 35% lower worldwide. Peugeot gained market share in some markets.

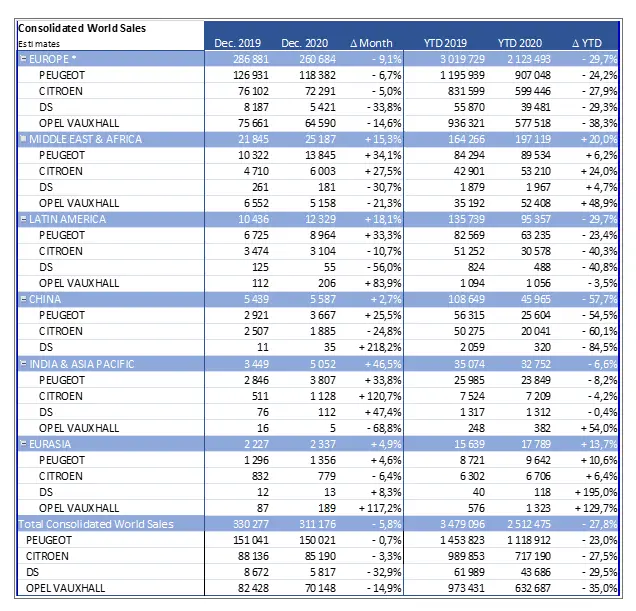

PSA (Peugeot) Group Global Sales by Brand and Market in 2020

The PSA Group (Peugeot, Citroen, DS, Opel / Vauxhall) reported global car sales as following by brand and major world market in 2020:

Opel (Vauxhall in some markets) performed the worst of the four brands with sales down 35%. However, Opel is reportedly profitable, as was the intention when PSA acquired the brand from GM, with the focus on earnings rather than volume.

Peugeot Brand Global Sales in 2020

The PSA Group’s largest brand, Peugeot, also performed the best of the four marques. Despite global sales contracting by nearly a quarter, Peugeot reported some gains for the year:

- Five regions out of six Peugeot increased market share in 2020: Europe: + 0.1 point, Middle East-Africa: + 0.6 points, Eurasia: + 0.1 point, India and Asia Pacific: + 0.1 point and Latin America.

- 25 countries beat market share record: France, Spain, Italy, Austria, Czech Republic, Japan, Portugal, Norway, Ukraine, Asean, Estonia, Slovenia, Greece, Ireland, Egypt, Iceland, Bolivia, Colombia, Ecuador, Peru, Dominican Republic, Mexico, South Africa, Arabia, and Latvia

PSA Sales in Europe in 2020

In 2020, the PSA Group’s sales volumes in Europe recovered strongly in the second half of the year (+40% vs H1) and the Group returned to growth in the last quarter with an increase of its market share (+0.5pt vs Q3) with an increase of Peugeot (+ 0.1 pt year-on-year) and DS Automobiles (+0.1 pt year-on-year on the premium market), and a rebound of Opel-Vauxhall in Q4 (+0.3 pt compared to Q4 2019). The Group also managed to keep a strong position in its main market with France increasing slightly its market share in 2020 (+0.14 pt).

The PSA Group remained focused on CO2 performance and met European targets in 2020. It complied with its CO2 objectives both on the optimization of ranges in terms of ICE emissions and on the growth of LEV sales volumes (clear take off with 120,000 registrations in 2020).

PSA Sales in Africa and the Middle East in 2020

In 2020, Groupe PSA’s market share in the Middle East and Africa gained 2.1 pts at 7.2%. In a market that has declined by -14%, the regional deliveries have increased by 21% vs 2019 and reached more than 201 000 units. Breakthroughs were made in several countries from which Egypt (+3.8 pts), Turkey (+1.4 pt) and Morocco (+0.7 pt). The regional business coverage has been extended to boost sales with new importers in GCC (Gulf Cooperation Council) and sub-Saharan Countries.

2020 witnessed a significant industrial evolution in Groupe PSA’s footprint in the region with the Kenitra plant production capacity doubled and the production launch of the Citroën Ami.

Peugeot and Citroen Sales in China in 2020

After a challenging first half, sales have been growing month-on-month from September onwards and reached in December 2020 the level of December 2019.

The new business model of DS in China is in place with a fully owned subsidiary focused on execution with cars either imported or locally manufactured. DS 9 is planned to be launched in the first half of 2021.

In contrast, most German car brands in China increased sales and gained market share in 2020.

PSA Sales in Latin America in 2020

Latin American markets were badly hit by the coronavirus crisis with sales decreases ranging from -27% to -31% versus 2019. Groupe PSA achieved a strong sales recovery process and was able to reach a higher market share in the fourth quarter 2020 than in the same period in 2019: 2.5% versus 2.3%.

In Argentina, its market share increased from 10.1% in 2019 to 10.5% in 2020, supported by launches such as the New Peugeot 208, locally produced (Palomar) on the state-of-the-art CMP platform, and the Citroën C5 Aircross. The New Peugeot Landtrek 1-tonne pickup truck was launched in the second half of 2020 in Mexico, where the Group’s market share is now above 1% for the first time.

PSA Sales in India and Asia Pacific in 2020

Groupe PSA market share improved for the region in 2020, in spite of a decrease of the consolidated sales by 6.6%, beating a market in decline of 18.3% compared to 2019.

The three brands of Groupe PSA are still successful in Japan notably with the recent launches of Citroen Berlingo, Peugeot 208, 2008 and e-2008, DS 3 CROSSBACK and DS 3 CROSSBACK E-TENSE.

In India, the introduction of the Citroën Brand is expected for the first semester of 2021 with Citroën C5 Aircross SUV, and will be followed by new and disruptive models designed locally.

PSA Sales in Eurasia in 2020

While performance in the region[6] was hit by the coronavirus crisis, Group sales were up and market share increased by 0.2 pt (0.7% to 0.9%), in particular in the two main countries – Russia and Ukraine by respectively +0.1 pt (to reach 0.5%) and +2.2 pt (to reach 8.5%).

All Peugeot, Citroën, DS Automobiles, and Opel brands contributed to this performance, especially in Ukraine. The recent relaunch of the Opel brand in Russia is underway positively for the first full year.

Global Worldwide Car Sales by Brand in 2020 (Full Year)

→→ Latest global sales by brands

Global worldwide car sales by brand in 2020 (Full Year):

- Audi

- Bentley

- BMW (including Mini & Rolls Royce)

- Daihatsu (see Toyota)

- Hyundai

- Ferrari

- Kia

- Lamborghini

- Lexus (see Toyota)

- Mazda

- Mercedes-Benz (including Smart)

- Mini

- Nissan

- PSA Group (Peugeot, Citroen, DS, Opel / Vauxhall)

- Porsche

- Renault Group (including Dacia)

- Rolls-Royce

- Skoda

- Tesla

- Toyota (including Lexus, Daihatsu, Hino)

- Volkswagen (VW Car Brand)

- Volkswagen Commercial Vehicles (VWCV)

- Volkswagen Group

- Volvo

“Sales” as reported by brands generally refer to deliveries and not necessarily sales to the customer and final registration. Terms and definitions may vary.

About Groupe PSA

Groupe PSA has five car brands, Peugeot, Citroën, DS, Opel, and Vauxhall.