In August 2022, car sales increased in Europe for the first time this year with battery-electric vehicles gaining market share.

The European new car market expanded in August 2022 by 3.5% but year-to-date 2022 car sales in Europe are still 12% lower than in 2021 and significantly below pre-pandemic levels. SUV remained the largest market sector with the three top-selling battery-electric vehicles in Europe in August 2022 all SUVs too. The most popular car model in Europe for the second consecutive month was the Volkswagen T-Roc while the Peugeot 208 remained the top-selling car model in Europe thus far in 2022.

Latest European Car Market Statistics 2022: By Country, Brands, Models, Electric, January, February, March, April, May, June, July, August, September, October, November, Full Year, 2021 & 2020

European New Car Market in 2022 (August)

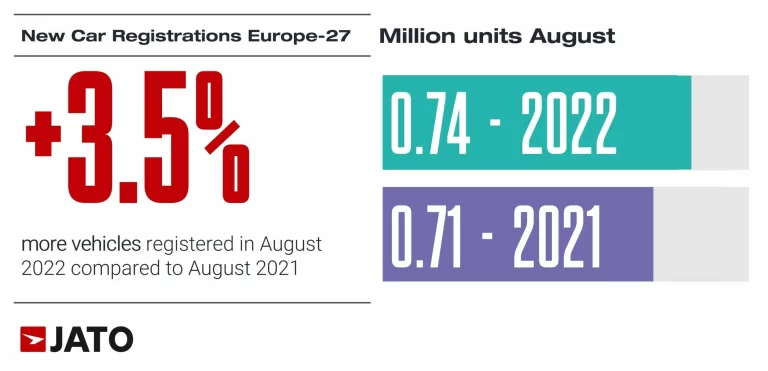

In August 2022, new passenger vehicle registrations in the European Union, EFTA, and UK increased by 3.5% — the first increase in car sales in Europe in 13 months. According to JATO Dynamics data for 27 European markets, volume increased by 3.5% when compared with August 2021 to 739,037 units. However, in August 2021, sales of 710,000 were down almost a fifth compared to August 2020 when 870,000 cars were sold. In August 2019, just over a million cars were sold in Europe.

Despite the European new car market finally expanding again in August, the total volume year-to-date continued to decrease, falling by 12% to 7,143,46 units.

Of the 27 European markets, only 6 posted a decline during August, with Europe’s big 5 (Germany, France, Spain, Italy, UK) among those that saw growth during the month. Felipe Munoz, Global Analyst at JATO Dynamics, commented: “The situation is still quite complex. Although the industry is slowly learning how to deal with the shortage of components and parts, consumers still face long waiting lists for new vehicles with many being forced to shift to the second-hand market”.

Economic uncertainty in most countries may also lead to a decrease in actual orders, as many consumers are unable, or unwilling, to commit to large purchases or long-term contracts. A change in market sentiment will be harder for manufacturers to deal with than component scarcity.

Car Sales in Europe by Fuel Type in 2022 (August)

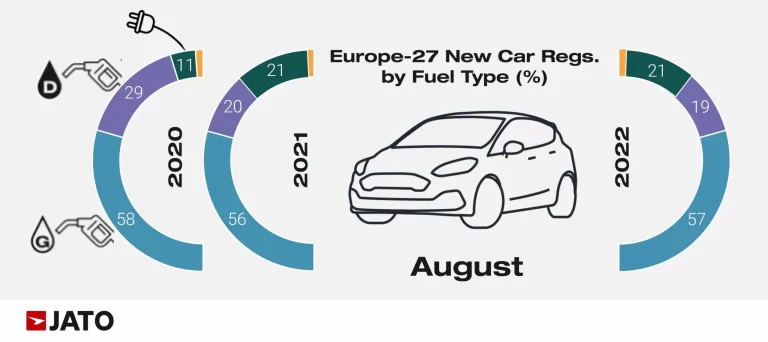

Despite the overall growth of the market in August, electric vehicles (BEV and PHEV) lost momentum due to the decline in demand for expensive plug-in hybrids that are losing subsidies in many countries. While registrations of gasoline vehicles increased by 6% to 422,659 units, the volume of electrified vehicle registrations increased by only 3.2% to 157,075 units. The volume of pure battery-electric vehicles (BEV) increased by 11% accounting for 61% of the total EV demand.

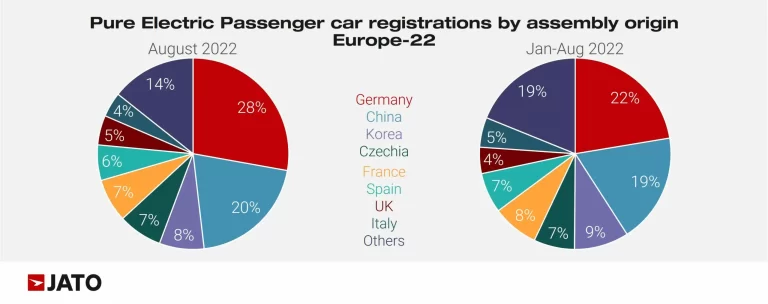

In August 2022, 20% of all BEVs registered in Europe were made in China – the second most popular country of origin, after Germany with 28%. Registrations of Chinese-made BEVs soared by 78% when compared to August 2021, while those produced in Europe increased by just 17%. Munoz added: “The rapid growth of Chinese manufactured EVs in Europe is an early indicator of how, sooner or later, they will play a key role in the global market”. Notably, most of the cars made in China were not produced by Chinese OEMs. Almost half of those made in China were manufactured by Tesla, while the Dacia Spring and several MG models also contributed to the total. In August, only 18% of EVs made in China and registered in Europe were sold under a Chinese brand but several brands are poised to enter the European car market in coming months.

Top-Selling Brands and Leading Market Sectors

In August 2022, SUVs accounted for almost 48% of total new vehicle registrations in Europe. Leading the way, the C-SUV and B-SUV segments secured 18.9% and 18.3% market share respectively – ahead of the B-Segment (hatchback and sedan) with 17.9%. Volkswagen Group led the SUV segment, accounting for 28% in this category and exceeding its share in the overall market at 26.5%. The German manufacturer saw an increase in volume of 16%, thanks largely to the Volkswagen T-Roc – Europe’s top-selling vehicle in August 2022 – supported by strong performances by the Tiguan, ID.4, and Taigo.

Stellantis followed Volkswagen Group in the SUV segment but lost traction with a 9% drop in volume. Registrations fell for the Peugeot 3008 (-39%), Opel/Vauxhall Grandland (-29%), Citroen C5 Aircross (-16%), and the Jeep Renegade and Compass (-42% and -53% respectively). Despite this, the positive performances of the Peugeot 2008 (+27%), Opel/Vauxhall Mokka (+25%) and Opel/Vauxhall Crossland (+21%) secured Stellantis’ second place position in the SUV market.

In contrast, it was Stellantis that led the market in the B-Segment with a 32% share due to the continued success of the Peugeot 208 – Europe’s second best-selling vehicle in August 2022, and the most popular year-to-date 2022.

Top-Selling Car and Electric Car Models in Europe in 2022 (August)

In August 2022, the Volkswagen T-Roc was the best-selling car model overall in Europe for the second consecutive month, registering almost 16,000 sales – an increase of 43%. The T-Roc surpassed the VW Golf in the year-to-date ranking and secured its position as Europe’s most popular SUV.

Other strong performers in August 2022 included the Peugeot 208, Citroen C3, and Opel/Vauxhall Corsa. Registrations of the Kia Sportage and Ford Kuga increased by 63% and 59%, respectively. Peugeot sold 6,275 units of the 308, a significant increase from 1,980 units registered in August 2021.

Registrations of the Tesla Model Y almost doubled, making it the best-selling electric car in Europe in August 2022, but only the 22nd most popular car model overall. It was followed by the Volkswagen ID.4 and the Skoda Enyaq — the three most popular electric car models in Europe were all SUVs. The VW ID3 and Tesla Model 3 both lost sales compared to August 2021.

Among the latest launches, Volkswagen registered more than 5,400 units of the Taigo, while the Dacia Jogger registered just over 5,000 units. Registrations of the Cupra Born totaled 2,838 units, while registrations of the Kia EV6 totaled 2,227 units.