July 2022: new car sales in Europe contracted by a tenth with battery electric vehicle registrations taking a 10% share of the European market.

New passenger vehicle registrations in Europe were down by another ten percentage points in July 2022 but the decline in sales was slower than earlier in the year. Battery-electric vehicle (BEV) sales increased by a fifth to take just over ten percent of the European new car market. Plug-in hybrid-electric vehicle (PHEV) sales continued to plummet as tax incentives are withdrawn from many markets. The Volkswagen T-Roc was for the first time the top-selling car model in Europe while the Fiat 500 was again the best-selling electric car.

Latest European Car Market Statistics 2022: By Country, Brands, Models, Electric, January, February, March, April, May, June, July, August, September, October, November, Full Year, 2021 & 2020

European New Car Market in July 2022

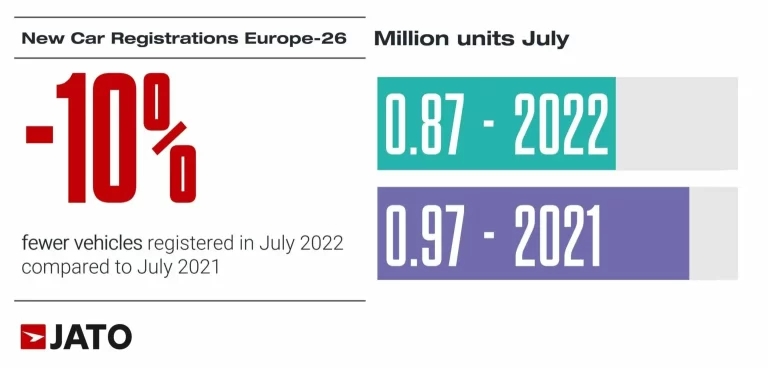

In July 2022, the European new car market contracted by another 10% but the slowdown in sales was less severe than during the first half of 2022. However, car sales volumes in Europe are traditionally low in summer (both July and August) with only 866,038 units registered across the European Union, EFTA, and the UK. This was 10% down compared with the 966,453 units registered in July 2021. Year-to-date 2022, the European new car market decreased by 13% relative to the same period last year, with a total of 6,398,609 units.

Car registrations in July 2022 were at a similar level to those seen between January and July 2020, when hit pandemic hit the market. Felipe Munoz, Global Analyst at JATO Dynamics, commented: “The impact of the chip shortage and current lack of consumer confidence is proving to be just as damaging to the market as the arrival of Covid-19.”

New Car Sales by Fuel Type in Europe in July 2022

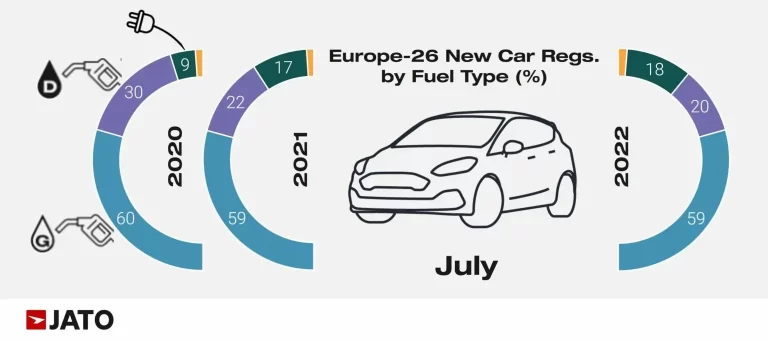

Although electrified models continue to gain traction, sales growth in Europe has slowed when compared with previous months. In July 2022, these vehicles totaled 157,614 units – down by 2% due to falling demand for plug-in hybrid electric vehicles (PHEV). According to JATO Dynamics data, PHEVs posted a 22% decline during July 2022, in response to recent announcements that these vehicles will no longer qualify for incentives in several European markets. Munoz continued: “PHEVs are losing regulatory favour and this is already impacting their position within the market. While governments are trying to steer the industry towards pure electric vehicles (BEV), hybrids still have an important role to play if we are to see widespread uptake of low emissions vehicles across Europe.”

Electric Car Sales Market Share in Europe in July 2022

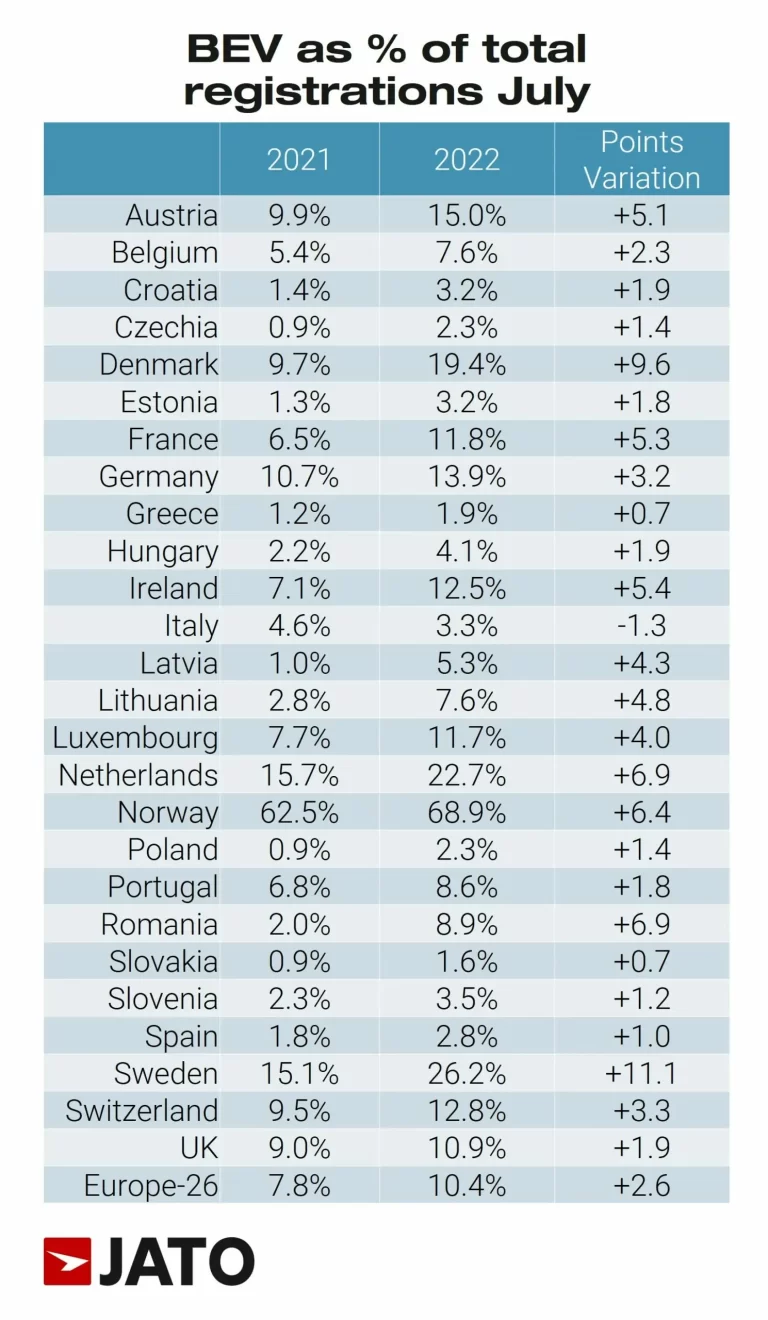

In contrast, the sales volume of BEVs increased by 20% to 90,139 units in July 2022, due to the growing deals and models available. In Germany – the largest market for BEVs – demand increased by 13%, and by 69% in France, the second largest market. These cars accounted for 14% of total registrations in Germany, 12% in France, 11% in the UK, and 3% in both Spain and Italy.

Electric cars continued to have the largest market share in Scandinavian countries and the German motoring press continued to speculate that many of the electric cars sold in Germany ended up in especially the Netherlands and Denmark as part of an incentive loophole. For electric cars to have a significant impact, market penetration in the largest countries should increase with scope for growth in all five largest countries but Spain and Italy particularly lagging.

Best-Selling Electric Car Brands in Europe in July 2022

In July 2022, the electric car segment in Europe was led by the Volkswagen Group, which accounted for almost 29% of total registrations with a volume increase of 17%. However, the growth in sales was notably lower than the gains posted by the segment’s second-largest player, Stellantis (+41%), and Renault Group – up 66% in third position. Munoz commented: “The German manufacturer is struggling to deliver its electric cars. While the ID.4 seems to be holding ground, the ID.3 is failing to deliver the same results.”

China’s OEMs (including MG, excluding Geely Group) posted a 72% increase, with 3,501 electric cars registered during the month. MG led with almost 3,000 units, up by 56%, followed by BYD with 238 units. Munoz added: “China’s manufacturers are slowly climbing the rankings, becoming a credible alternative for those looking for an affordable and appealing electric car”. Almost half of the Chinese electric cars sold in July were registered in Sweden and Norway.

Tesla was nowhere to be seen — sales in Europe in July 2022 were only 1,694 for the Model Y and 244 for the Model 3. A large release of Tesla cars is likely in August or September with supply likely to stabilize towards the end of 2022 as production at the German plant increases.

Best-Selling Models in Europe in July 2021

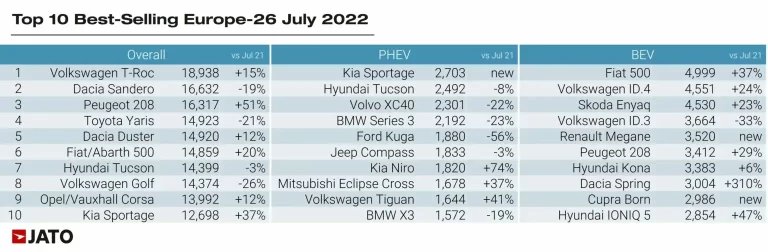

In the overall ranking by model, Volkswagen’s small SUV, the T-Roc was the top-selling car model in Europe for the first time – the second time since October 2021 that an SUV has led the market. Volkswagen increased registrations of the T-Roc by 15% due to strong demand in Italy (+73%) and the UK (+87%), its second and third largest markets.

Among the top 10, the Peugeot 208 performed well – up by 51%, following a 96% increase in Italy, its second-largest market. Fiat saw good results from the electrified version of the Fiat 500 with registrations up by 37% to 5,000 units, making it the best-selling pure electric car during the month. Kia entered the top 10 thanks to the latest version of the Sportage, seeing increased demand in Germany (+108%) and France (+122%).

Other strong performers in July included the Toyota Yaris Cross in 11th position with 12,185 units and the 5th best-selling SUV. The success of the Yaris Cross continued to damage sales of the Yaris hatchback, which was down by 21% in July. Peugeot registered 8,585 units of the 308, up by 129% as the fourth best-selling compact. Its rival, the Renault Megane, boosted by the electric version, recorded an increase of 54% to almost 7,300 units. Good results were also registered by the Cupra Formentor (+60%), Renault Arkana (+59%), BMW Series 4 (+50%), MG ZS (+100%), Mercedes V-Class (+98%), and the Land Rover RR Evoque (+100%).