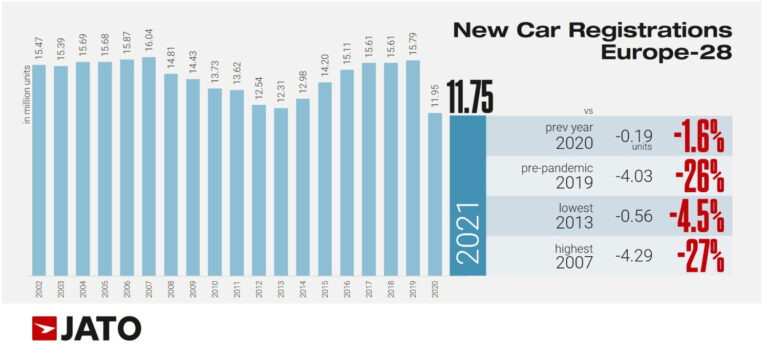

In 2021, car sales in Europe were down 1.7% to the lowest market since 1985 while the VW Golf remained the top-selling car model.

In full-year 2021, the European new car market contracted by a further 1.7% to only 11.75 million vehicles — the lowest sales total since 1985. Low emission vehicles took nearly a fifth of the market — almost equal with diesel. Hyundai-Kia, Toyota, and Tesla gained market share but the Volkswagen Group continued to dominate the European new car market in 2021 with the VW Golf again Europe’s favorite car in 2021. The Tesla Model 3 was the top-selling battery-electric car model in Europe in 2021.

Latest European Car Market Statistics 2021: January, February, March, Q1, April, May, June, HY, July, August, September, Q3, October, November, December, Full Year — 2020: Q1, HY, Q3, Full Year

European New Car Market in 2021 (Full Year)

2021 was a challenging year for the European automotive industry. Total volume was at its lowest level since 1985, with 11.75 million new cars registered in Europe in 2021. The semiconductor shortage has been even more damaging to the industry than the lockdown restrictions of 2020. Felipe Munoz, Global Analyst at JATO Dynamics, commented: “Crisis after crisis had a negative impact on demand and registrations in the market. The ongoing uncertainty of the COVID-19 pandemic, alongside the prolonged semiconductor shortage, created a perfect storm for OEMs last year.”

The second wave of the crisis began in July 2021 as volume started to fall at a double-digit rate compared with 2020. In December 2021, registrations in these countries totaled 949,252, down by 22% from the same month in 2020, and 25% less than December 2019, just before the pandemic hit the market.

While some key markets were able to maintain the levels seen in 2020, JATO’s analysis indicates that the difficulties faced by the German market have been a major driver of the poor results seen across the EU. Germany saw a significant drop in volume compared with 2020 and its worst results since 1985. It was also the worst year for new car registrations in Austria since 1984, in Belgium since 1995, and in the Netherlands since 1980.

See also: 2021 (Full Year) Europe: Car Sales per EU, UK, and EFTA Country for a more detailed breakdown of sales by country.

Increased Popularity of Electric Cars in Europe in 2021

Despite the poor overall results, the current crisis created an opportunity for low emissions vehicles. Munoz added: “For much of the year, it was easier to buy electric than petrol given the shorter lead times for these vehicles, and thanks to the generous incentives granted by governments.”

Consumers have increasingly turned their attention to pure electric and plug-in hybrid alternatives allowing these vehicles to achieve new volume and market share records. In 2021, the industry registered 2.25 million units making up 19% of the market. While diesels accounted for 21.7% of the market – it is likely that they will be outsold by EVs in 2022.

While Covid restrictions remained a problem, it was hugely overshadowed by the supply-chain issues of computer chips, semiconductors, and other components. Production was sharply down with sales a reflection of the cars manufacturers could deliver more than popular demand for models. Volkswagen alone claimed to have half a million cars on backorder in Europe, including around 100,000 electric vehicles, at the end of 2021. Other manufacturers made similar claims and that production was adjusted to favor profitability over volume. Certain models were quietly dropped from the range while low emission cars often were favored to reduce fleet CO2 emissions to avoid EU fines.

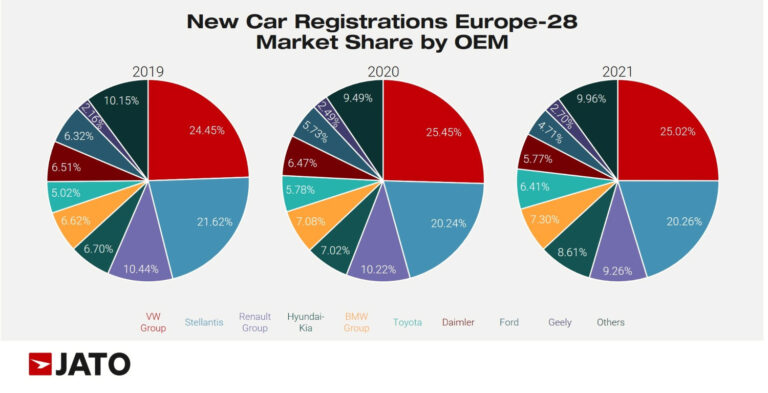

Best-Selling Car Brands in Europe in 2021

While last year brought huge challenges for many OEMs, for others it offered great opportunities. For example, Hyundai- Kia was able to increase its presence in Europe due to its breadth of competitive SUV and EV models. These brands saw their market share increase by almost two points, from 6.7% in 2019 to 8.6% in 2021.

It was also a strong year for Toyota, up by 1.4 points of share, thanks largely to the latest generation of the Toyota Yaris which hit the top 10 in 14 countries. Despite these advances, Tesla, BMW Group, and Volkswagen Group were still able to gain traction over the last two years.

Tesla’s market share doubled between 2019 and 2021. In 2021, the American manufacturer registered more new vehicles than other brands such as Land Rover or Jeep – both leaders in the SUV market. Between 2020 and 2021, it was able to outsell Mazda, Mitsubishi, and came close to overtaking Mini.

See 2021 (Full Year) Europe: Best-Selling Car Manufacturers and Brands for detailed statistics.

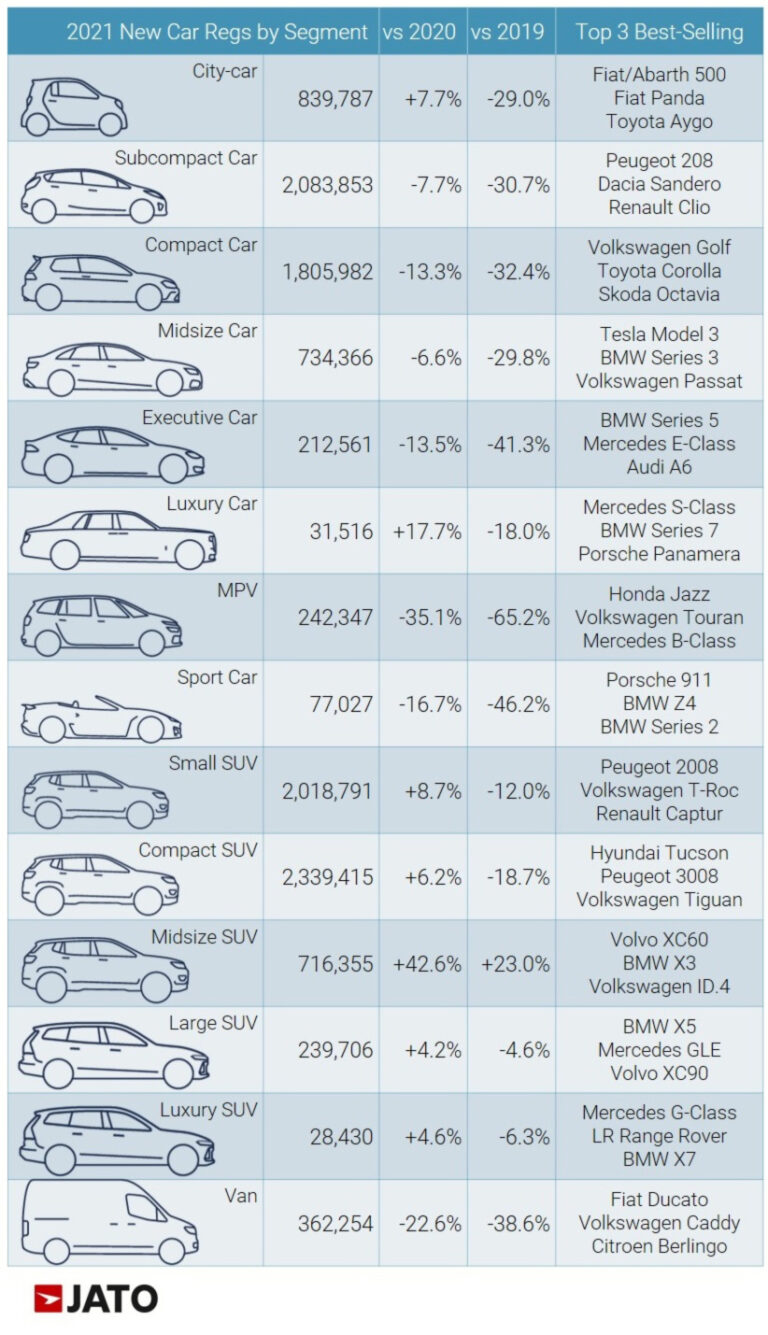

Best-Selling Car Models by Market Segment in Europe in 2021

The top three best-selling car models by market segment in Europe in full-year 2021 were as follows:

SUVs Increasingly Popular in Europe in 2021

Despite ongoing availability issues at dealerships, European consumers continued to shift from traditional vehicles such as hatchbacks, sedans, and MPVs, to SUVs. These vehicles have continued to perform well thanks to the arrival of new electrified models. In 2021, registrations of SUVs totaled 5.34 million units, up by 11% when compared to 2020, and down by 12% compared to 2019. The market share of these vehicles jumped from 38.2% in 2019, and 40.3% in 2020, to 45.5% last year. This is the highest ever market share for SUVs in Europe and closes the gap on the 52.3% recorded in the USA.

In 2021, the Volkswagen Group was the leading seller of SUVs in Europe, as one in four registered vehicles was made by the German manufacturer. Compared with 2019, SUV volume only dropped marginally (-2%) whereas Volkswagen’s closest competitor Stellantis, saw its volume decrease by 24%. Volkswagen was the biggest winner of market share between 2019 and 2021, followed by Hyundai-Kia and Daimler. In contrast, Stellantis posted the highest market share drop, followed by Renault Group and Nissan Group.

The SUV ranking by model was led by the Peugeot 2008, outselling the Renault Captur which led the market in 2020. The 2008 saw the largest market share growth of any SUV between 2019 and 2021, excluding models that were not available two years ago. It was not however the only SUV to post double-digit growth since 2019: the Volkswagen T- Cross, Volvo XC40, Toyota RAV4, Kia Niro, and Nissan Juke, also climbed the rankings.

The Volkswagen Golf was again the best-selling car model in Europe — see Top 25 Best-selling Car Models in Europe in 2021 for more details.

European Car Sales Statistics for 2021 (Full Year)

- 2021 — European New Car Market Overview and Analysis

- 2021 — Car Sales per EU, UK, and EFTA Country

- 2021 — Europe: Best-Selling Car Manufacturers and Brands

- 2021 — Top 25 Best-Selling Car Models in Europe

Car Sales Statistics for Europe in 2021

→ Latest European Car Sales Statistics

- Car Sales and Market Analysis: January, February, March, April, May, June, July, August, September, October, November, December, Full Year 2021

- Top-Selling Car Models: Top 25 Models 2021, Top 15 Electric Models

- Sales per European Country: Q1, Half Year, Q3, Full Year

- Sales by Brand: Q1, Half Year, Q3, Full Year

- Electric and PHEV Sales by Country: Q1, Half Year, Q3, Full Year, Top Electric Brands and Models