First Semester 2021: new car sales in the European Union, UK, and EFTA countries increased by 27% with Germany and France the largest markets in Europe.

January to June 2021: New passenger vehicle registrations in the European Union (EU), United Kingdom, and EFTA countries increased by 27.1% but were still around 2 million cars less than in preceding years. Car sales in every county in Europe, except in Romania, expanded during the first half of 2021. Germany remained by far the largest single-country car market in Europe. More cars were again sold in France during the first half of 2020 than in Britain but the UK market expanded faster.

Latest European Car Market Statistics 2021: January, February, March, Q1, April, May, June, HY, July, August, September, Q3, October, November, December, Full Year — 2020: Q1, HY, Q3, Full Year

European New Car Market in 2021 (First Half)

New passenger vehicle registrations during the first half of 2021 in Europe (including the EU, EFTA, and the UK) increased by 27.1% to 6,486,351 cars compared to only 5,1010,669 cars during the first six months of 2020. Despite the strong recovery, the European new car market was still around 2 million vehicles smaller than during the same period in 2019 and 2018.

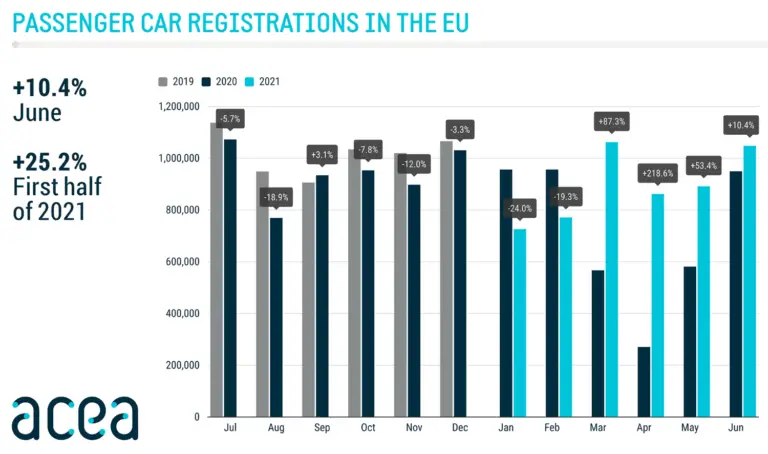

New passenger vehicle registrations in the first semester of 2021 increased by 25.2% in the EU, by 27.1% in the UK while the small but wealthy EFTA markets grew by 28.8%.

New Car Sales per European Country in 2021 (Half Year)

New passenger vehicle registrations in the European Union, EFTA, and the UK according to the ACEA were as follows during the period January to June 2021:

| Jan-Jun 2021 | Jan-Jun 2020 | % Change 21/20 | |

| Austria | 134,396 | 112,787 | +19.2 |

| Belgium | 232,391 | 216,605 | +7.3 |

| Bulgaria | 12,926 | 10,161 | +27.2 |

| Croatia | 25,975 | 17,423 | +49.1 |

| Cyprus | 5,794 | 4,913 | +17.9 |

| Czech Republic | 112,805 | 95,029 | +18.7 |

| Denmark | 96,506 | 88,395 | +9.2 |

| Estonia | 12,940 | 9,133 | +41.7 |

| Finland | 56,730 | 47,392 | +19.7 |

| France | 922,765 | 715,798 | +28.9 |

| Germany | 1,390,889 | 1,210,622 | +14.9 |

| Greece | 58,362 | 36,570 | +59.6 |

| Hungary | 64,794 | 55,674 | +16.4 |

| Ireland | 63,861 | 52,885 | +20.8 |

| Italy | 884,750 | 584,237 | +51.4 |

| Latvia | 7,684 | 6,569 | +17.0 |

| Lithuania | 18,648 | 16,821 | +10.9 |

| Luxembourg | 25,287 | 20,793 | +21.6 |

| Netherlands | 163,173 | 157,971 | +3.3 |

| Poland | 243,113 | 179,821 | +35.2 |

| Portugal | 81,445 | 64,848 | +25.6 |

| Romania | 47,169 | 49,615 | -4.9 |

| Slovakia | 38,449 | 34,015 | +13.0 |

| Slovenia | 31,009 | 28,001 | +10.7 |

| Spain | 456,833 | 339,855 | +34.4 |

| Sweden | 173,163 | 125,685 | +37.8 |

| EUROPEAN UNION | 5,361,857 | 4,281,618 | +25.2 |

| Iceland | 6,044 | 4,193 | +44.1 |

| Norway | 83,930 | 59,224 | +41.7 |

| Switzerland | 124,547 | 103,201 | +20.7 |

| EFTA | 214,521 | 166,618 | +28.8 |

| United Kingdom | 909,973 | 653,502 | +39.2 |

| EU + EFTA + UK | 6,486,351 | 5,101,738 | +27.1 |

| Source: ACEA |

Note: Data for Malta not included.

Largest New Car Markets in Europe in 2021 (Firsth Half)

New car sales in all European countries with the exception of Romania increased during the first six months of 2021 compared to the first half of 2020 when markets were totally unprepared for the impact of lockdowns and social distancing restrictions. Markets were still heavily impacted during the first half of 2021 with performances depending to a large extent on the ability to adapt to online selling and registrations. Manufacturers also struggled with production with not only direct coronavirus factors but also a lack of computer chips influencing the delivery of vehicles that customers want. A lack of battery-electric vehicle (BEV) availability continued to dampen the market.

Germany remained by far the largest new car market in Europe during the first half of 2021. Car sales in Germany increased by a modest 15% but Germany was also one of the stronger markets during the first half of 2020.

France moved ahead of the UK as the second largest new car market in Europe in the first half of 2020 and maintained the position during the first semester of 2021. Car sales in France increased by 29% while the British market expanded by a strong 39%. Italy was the most improved major European new car market with sales up by 51% while the Spanish new car market grew by just over a third.

The fastest-growing new car markets in Europe during the first half of 2021 were Greece, Italy, Coration, and Iceland while the worst performing markets were Romania, Netherlands, Belgium, and Denmark.

See also: 2021 (Half Year) Europe: Best-Selling Car Brands and Manufacturers — the VW Group a gained market share as did Stellantis and Peugeot.

Car Sales Statistics for Europe in 2021

→ Latest European Car Sales Statistics

- Car Sales and Market Analysis: January, February, March, April, May, June, July, August, September, October, November, December, Full Year 2021

- Top-Selling Car Models: Top 25 Models 2021, Top 15 Electric Models

- Sales per European Country: Q1, Half Year, Q3, Full Year

- Sales by Brand: Q1, Half Year, Q3, Full Year

- Electric and PHEV Sales by Country: Q1, Half Year, Q3, Full Year, Top Electric Brands and Models