In 2021, new passenger vehicle registrations in the European Union, UK, and EFTA were down 1.5% with car sales weak in Germany, the largest single-country market in Europe.

In full calendar year 2021, new passenger vehicle registrations in the European Union, UK, and EFTA countries contracted by 1.5%. Germany remained by far the largest new car market in Europe despite being the only large country market with weaker sales in 2021. For the second consecutive year, France was the second-largest single-country market in Europe ahead of the UK, Italy, and Spain. Car sales were higher in most European countries in 2021. Volkswagen remained the best-selling car brand in Europe in 2021.

Latest European Car Market Statistics 2021: January, February, March, Q1, April, May, June, HY, July, August, September, Q3, October, November, December, Full Year — 2020: Q1, HY, Q3, Full Year

European New Car Market in 2021 (Full Year)

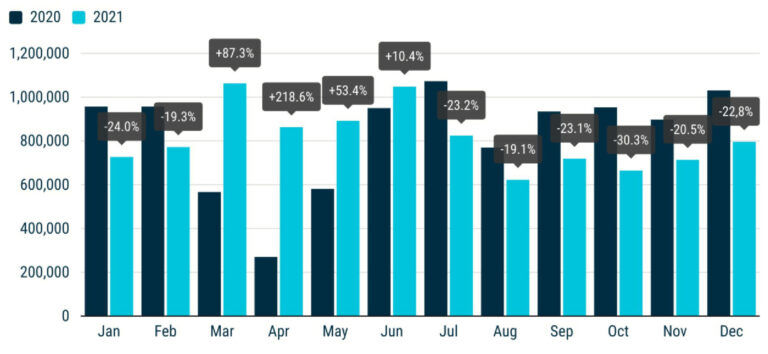

In 2021, new passenger vehicle registrations in the European Union (EU) decreased by 2.4% to 9,700,192 cars compared to 9,942,509 cars in 2020 — 3 million cars fewer than in 2019 (UK excluded). In EFTA, new car sales were up 10.3% to 427,512 cars. In the UK, new car sales increased by a percentage point to 1,647,181 cars.

In the EU, UK, and EFTA countries combined, new passenger vehicle registrations decreased by 1.5% to 11,774,885 cars compared to 11,961,182 cars in 2020 — the lowest total since 1985.

In 2019, the market of 15,805,752 cars was at its largest since 2007, and 3.5 million cars bigger than the low reached in 2013. The last time the European new car market was smaller than 12 million units were in 1993 when only 11.82 million cars were sold in Europe.

Following the quarter drop in sales in 2020, a recovery of the European new car market was expected in 2021 but a shortage in computer chips and other supply chain bottlenecks delayed production for all manufacturers. A focus on profitability and electric cars led to lower supply volumes despite high demand. Car sales during the first half of the year were generally strong but from July onwards, supply issues far overshadowed the effects of Covid measures on the market.

The outlook for the European new car market in 2022 remains largely positive, as there is clearly demand in the market — VW alone claimed to have over half a million backorders for cars in Europe and the situation is generally similar for all carmakers. However, production issues are likely to continue at least until mid-2022 with some industry watchers predicting that shortages for battery production may be a factor until the end of the decade as demand for electric cars increases.

New Car Sales in Europe by Year (2007-2021)

In recent years, annual new passenger vehicle registrations in the European Union, UK, and EFTA countries were as follows according to sales data released by the ACEA:

| Year | Car Sales | % Change |

| 2021 | 11,774,885 | -1.5 |

| 2020 | 11,961,182 | -24.3 |

| 2019 | 15,805,752 | 1.2 |

| 2018 | 15,624,486 | 0.0 |

| 2017 | 15,631,687 | 3.3 |

| 2016 | 15,131,719 | 6.5 |

| 2015 | 14,202,024 | 9.2 |

| 2014 | 13,006,451 | 5.4 |

| 2013 | 12,308,215 | -1.8 |

| 2012 | 12,527,912 | -7.8 |

| 2011 | 13,573,550 | -1.4 |

| 2010 | 13,785,698 | -4.9 |

| 2009 | 14,481,545 | -1.6 |

| 2008 | 14,712,158 | -7.8 |

| 2007 | 15,958,871 | 1.1 |

Note: All figures in this article exclude Malta.

New Car Sales by European Union, UK, and EFTA Country in 2021 (Full Year)

New passenger vehicle registrations per country in the European Union, UK, and EFTA were as follows in 2021:

| Country | 2021 | 2020 | % 21/20 |

| Austria | 239,803 | 248,740 | -3.6 |

| Belgium | 383,123 | 431,491 | -11.2 |

| Bulgaria | 24,537 | 22,368 | +9.7 |

| Croatia | 44,915 | 36,005 | +24.7 |

| Cyprus | 10,624 | 9,993 | +6.3 |

| Czech Republic | 206,876 | 202,971 | +1.9 |

| Denmark | 185,324 | 198,102 | -6.5 |

| Estonia | 22,336 | 18,750 | +19.1 |

| Finland | 98,481 | 96,418 | +2.1 |

| France | 1,659,003 | 1,650,118 | +0.5 |

| Germany | 2,622,132 | 2,917,678 | -10.1 |

| Greece | 100,916 | 80,977 | +24.6 |

| Hungary | 121,920 | 128,021 | -4.8 |

| Ireland | 104,669 | 88,325 | +18.5 |

| Italy | 1,457,952 | 1,381,756 | +5.5 |

| Latvia | 14,344 | 13,522 | +6.1 |

| Lithuania | 31,371 | 40,232 | -22.0 |

| Luxembourg | 44,372 | 45,189 | -1.8 |

| Netherlands | 322,831 | 355,431 | -9.2 |

| Poland | 446,647 | 428,347 | +4.3 |

| Portugal | 146,637 | 145,417 | +0.8 |

| Romania | 121,208 | 126,351 | -4.1 |

| Slovakia | 75,700 | 76,305 | -0.8 |

| Slovenia | 53,988 | 53,677 | +0.6 |

| Spain | 859,477 | 851,210 | +1.0 |

| Sweden | 301,006 | 292,024 | +3.1 |

| EUROPEAN UNION | 9,700,192 | 9,939,418 | -2.4 |

| Iceland | 12,755 | 9,394 | +35.8 |

| Norway | 176,276 | 141,412 | +24.7 |

| Switzerland | 238,481 | 236,828 | +0.7 |

| EFTA | 427,512 | 387,634 | +10.3 |

| United Kingdom | 1,647,181 | 1,631,064 | +1.0 |

| EU + EFTA + UK | 11,774,885 | 11,958,116 | -1.5 |

| Source: ACEA |

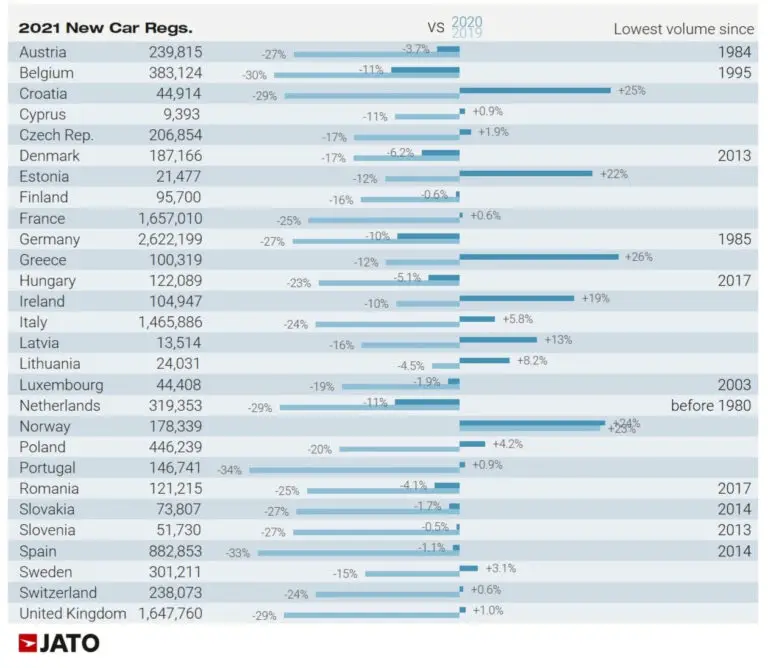

Changes in Car Sales in Europe in 2019, 2020, and 2021

According to JATO, the changes in car sales in European countries in 2019, 2020, and 2021 were as follows with the year of the previous lowest volume for some countries indicated too:

Car Sales by Country in Europe in 2021 (Full Year)

In 2020, Germany remained the largest single-country market in Europe but it was the only large market with lower sales. German new car sales were down 10% or almost 300,000 cars — more than the total contraction of the whole European market. German carmakers seemed to struggle with supply chain shortages and a clear focus on profitable and low-emission vehicles rather than volume — battery-electric cars took a 14% market share in Germany in 2021.

For the second consecutive year, France was the second-largest new car market in the European Union and in the larger Europe region. Sales in France increased by 0.5% while the increase in the UK was double that at 1%. The British new car market remained well below the long-run average.

The Italian new car market, which was particularly hard hit in 2020, improved by 5.5% while sales in Spain were up by 1%. The Polish new car market moved ahead of the Belgian market where car sales were even weaker than in Germany.

The worst-performing new car markets in Europe in 2021 were Lithuania, Belgium, and Germany.

The best-performing new car market in Europe in 2021 was Iceland where sales were up by more than a third. Car sales also increased by nearly a quarter in Norway, Greece, and Croatia.

European Car Sales Statistics for 2021 (Full Year)

- 2021 — European New Car Market Overview and Analysis

- 2021 — Car Sales per EU, UK, and EFTA Country

- 2021 — Europe: Best-Selling Car Manufacturers and Brands

- 2021 — Top 25 Best-Selling Car Models in Europe

Car Sales Statistics for Europe in 2021

→ Latest European Car Sales Statistics

- Car Sales and Market Analysis: January, February, March, April, May, June, July, August, September, October, November, December, Full Year 2021

- Top-Selling Car Models: Top 25 Models 2021, Top 15 Electric Models

- Sales per European Country: Q1, Half Year, Q3, Full Year

- Sales by Brand: Q1, Half Year, Q3, Full Year

- Electric and PHEV Sales by Country: Q1, Half Year, Q3, Full Year, Top Electric Brands and Models