Q1-Q3/2021: Germany was the largest single-country car market in Europe. Car sales in the European Union (EU), EFTA, and the UK increased by 6.9%.

January to September 2021: new passenger vehicle registrations in the European Union (EU), EFTA, and the UK increased by a modest 6.9%, after weak sales during the third quarter of 2021. Despite a small contraction, Germany remained by far the largest single-country market in Europe. The British market was again the second largest in Europe despite slightly underperforming the broader market. New car sales in France increased by 8% while the Italian new car market expanded by a fifth. Manufacturing and delivery problems due to a shortage in various parts, especially computer chips, seemed to have hampered the market more than other economic factors and the restrictions imposed by Covid. Volkswagen remained the top-selling carmaker and brand in Europe during the first three quarters of 2021.

Latest European Car Market Statistics 2021: January, February, March, Q1, April, May, June, HY, July, August, September, Q3, October, November, December, Full Year — 2020: Q1, HY, Q3, Full Year

European New Car Market in 2021 (Q1 -Q3)

During the first three quarters of 2021, new passenger registrations in the European Union (EU), EFTA, and the UK increased by 6.9% to 9,161,918 cars compared to 8,567,920 cars in 2020. This was still a good 3 million fewer cars than the 12,117,401 registered during the corresponding months in 2019.

According to the ACEA new passenger vehicle registrations during the period January to September were as follows:

| Q1-Q3/2021 | Q1-Q3/2020 | Q1-Q3/2019 | |

| TOTAL (EU + EFTA + UK) | 9,161,918 | 8,567,920 | 12,117,401 |

| EUROPEAN UNION (EU) | 7,526,613 | 7,058,090 | 9,908,370 |

| EFTA | 318,691 | 266,174 | 346,760 |

| UNITED KINGDOM | 1,316,614 | 1,243,656 | 1,862,271 |

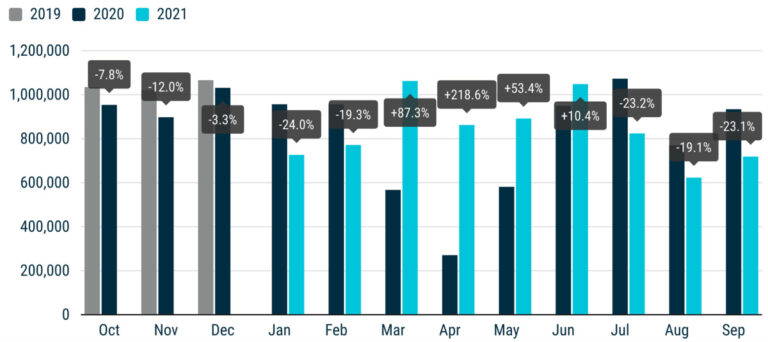

Although the European new car market expanded by 27% during the first half of 2021, car deliveries slowed down sharply during the third quarter of 2021. In September 2021, new car sales in Europe were at the lowest September month total since 1995.

Car manufacturers continued to struggle with a shortage in parts, especially microchips, which led to lower deliveries than the market demanded. For many popular models, waiting lists of several months are currently the norm. The manufacturing issues seemed to play a larger disruptive role during the third quarter than any lingering Covid restrictions or general weakness in the European economy.

European car sales by month according to the ACEA in 2019 – 2021.

Car Sales by Country in Europe in 2021 (Q1-Q3)

Car sales per European Union, EFTA, and UK country were as follows during the first nine months of 2021 according to new passenger registrations data released by the ACEA:

| European Country | Q1-Q3/2021 | Q1-Q3/2020 | % 21/20 |

| Austria | 189,881 | 180,639 | +5.1 |

| Belgium | 313,567 | 333,607 | -6.0 |

| Bulgaria | 19,040 | 17,029 | +11.8 |

| Croatia | 37,135 | 28,229 | +31.5 |

| Cyprus | 8,589 | 7,607 | +12.9 |

| Czech Republic | 161,824 | 148,319 | +9.1 |

| Denmark | 139,950 | 142,137 | -1.5 |

| Estonia | 18,533 | 14,246 | +30.1 |

| Finland | 78,662 | 73,408 | +7.2 |

| France | 1,260,373 | 1,166,698 | +8.0 |

| Germany | 2,017,561 | 2,041,831 | -1.2 |

| Greece | 81,758 | 60,046 | +36.2 |

| Hungary | 94,528 | 90,092 | +4.9 |

| Ireland | 100,620 | 84,515 | +19.1 |

| Italy | 1,165,491 | 966,335 | +20.6 |

| Latvia | 11,617 | 10,410 | +11.6 |

| Lithuania | 26,279 | 28,260 | -7.0 |

| Luxembourg | 35,011 | 34,046 | +2.8 |

| Netherlands | 235,977 | 248,206 | -4.9 |

| Poland | 347,275 | 295,101 | +17.7 |

| Portugal | 112,525 | 105,660 | +6.5 |

| Romania | 88,262 | 84,600 | +4.3 |

| Slovakia | 58,719 | 55,607 | +5.6 |

| Slovenia | 43,098 | 43,219 | -0.3 |

| Spain | 647,955 | 595,436 | +8.8 |

| Sweden | 232,383 | 202,644 | +14.7 |

| EUROPEAN UNION* | 7,526,613 | 7,057,927 | +6.6 |

| Iceland | 9,762 | 7,293 | +33.9 |

| Norway | 128,856 | 95,357 | +35.1 |

| Switzerland | 180,073 | 163,556 | +10.1 |

| EFTA | 318,691 | 266,206 | +19.7 |

| United Kingdom | 1,316,614 | 1,243,656 | +5.9 |

| EU + EFTA + UK | 9,161,918 | 8,567,789 | +6.9 |

| Source: ACEA |

*Excludes Malta statistics

Car Sales in European Countries

Car sales in most European countries increased in 2021, as could be expected after the dramatically low numbers in 2020. By mid-year, sales were up 25% but during the third quarter, the expected production problems due to part shortages led to a sharp contraction in deliveries and registrations. The shortages are predicted to continue well into 2022 with a shortage in components for electric cars predicted to last for several years.

Only six European Union countries had weaker car sales thus far this year. In Germany, new passenger vehicle registrations contracted by 1.2% but due to the size of the German new car market, the low number placed heavy pressure on the expansion of total European new car sales.

British new car sales slightly underperformed the market but the UK was again the second largest passenger vehicle market in Europe. Car sales increased stronger in the other large markets with sales up 8% in France, 21% in Italy, and 9% in Spain.

EFTA countries outperformed with car sales up by nearly a fifth thus far in 2021. In the small but prosperous markets in Norway and Iceland, car sales were up by more than a third while the Swiss market expanded by a tenth.

The fastest-growing new car markets in Europe during the first three quarters of 2021 were Greece, Norway, and Iceland. The weakest new car markets in Europe thus far this year were Lithuania, Belgium, and the Netherlands.

Car Sales Statistics for Europe in 2021

→ Latest European Car Sales Statistics

- Car Sales and Market Analysis: January, February, March, April, May, June, July, August, September, October, November, December, Full Year 2021

- Top-Selling Car Models: Top 25 Models 2021, Top 15 Electric Models

- Sales per European Country: Q1, Half Year, Q3, Full Year

- Sales by Brand: Q1, Half Year, Q3, Full Year

- Electric and PHEV Sales by Country: Q1, Half Year, Q3, Full Year, Top Electric Brands and Models