In December 2021, the European new car market contracted by 22% with the Tesla Model 3 the best-selling car model and Tesla sales at record levels in Europe.

The European new car market ended the year weak with sales down by over a fifth in December 2021 to fewer than a million passenger vehicle registrations. Electrified vehicles took a record market share of 29 while less than a fifth of all new cars sold in Europe in December 2021 were diesels. Tesla had its highest monthly sales ever in Europe in December 2021 with the Tesla Model 3 the best-selling car model overall and the top-selling battery-electric vehicle.

Latest European Car Market Statistics 2021: January, February, March, Q1, April, May, June, HY, July, August, September, Q3, October, November, December, Full Year — 2020: Q1, HY, Q3, Full Year

Europe New Car Market in December 2021

New passenger vehicle registrations in Europe contracted by 22% in December 2021 compared to the final month of 2020. According to data for 28 markets analyzed by Jato Dynamics, the sales volume fell to only 949,252 cars compared to 1,212,858 vehicles in December 2020, which was already 3.8% weaker than December 2019.

Car Sales by Fuel Type in Europe in December 2021

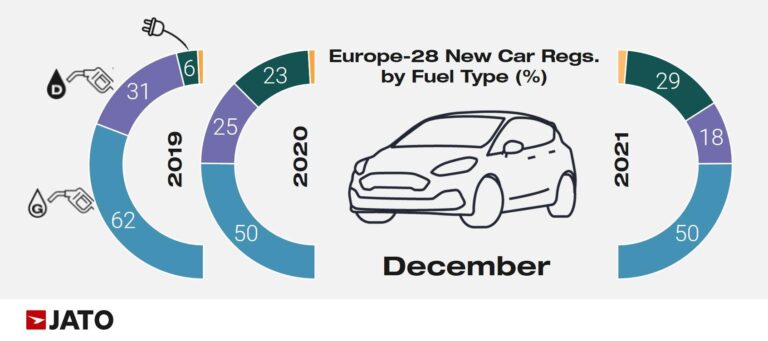

Low-emission, electrified vehicles took a record 29% share of new car sales in Europe in December 2021. Electrified vehicles (EVs) took a majority market share in several European countries, including Norway (90%), the Netherlands (64%), Sweden (61%), and Denmark (57%).

The increase in sales of both PHEVs and BEVs was due to higher availability, government incentives, as well as the desire of manufacturers to lower CO2 emissions to avoid EU fines. Computer chip shortages also affected this sector of the market but carmakers found it financially advantageous to give preference to high earning, and low emission vehicles when allocating components for production schedules.

Petrol remained by far the most popular energy source for new cars with a 50% market share similar to a year ago. However, the market share of new diesel-engined cars in Europe fell to only 18% in December 2021 compared to a quarter of the total market only a year earlier and nearly a third in December 2019.

Higher SUV Sales in Europe in December 2021

However, the popularity of SUVs in Europe also continued unabated with SUVs taking a new monthly record share of 47.5% of total new passenger vehicle registrations in Europe in December 2021. European new car buyers seem to place less emphasis on low emissions and environmental concerns by continuing the purchase of larger and heavier vehicles that are less energy efficient than standard cars.

According to Jato, the segment was led by Volkswagen Group with 23.9% market share, followed by Stellantis with 16.4%, and Hyundai-Kia with 10%. Peugeot’s 2008 led the SUV model rankings with 16,330 units, down by 9% on 2020, and up by 47% compared with 2019. The Dacia Duster, Hyundai Tucson, Toyota Yaris Cross, Opel/Vauxhall Mokka, and Tesla Model Y, also saw strong results.

Best-Selling Car Models in Europe in December 2021

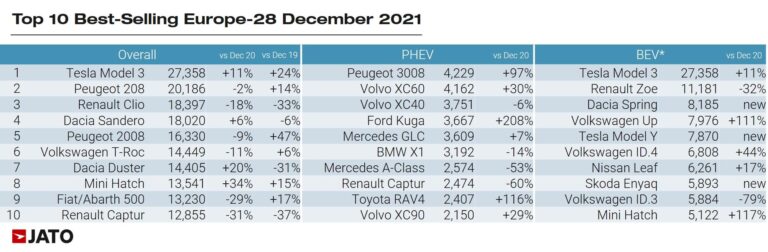

The top-selling car models, plug-in hybrid vehicles, and battery-electric cars in Europe in December 2021 were as follows according to JATO:

Although the Volkswagen Golf remained Europe’s best-selling car model for 2021, it dropped to only 12th in December 2021. The Tesla Model 3 was the top-selling car model in Europe in December 2021 and also the best-selling battery-electric vehicle. Tesla sold 35,230 cars in Europe in December 2021 — its highest total ever. In addition to the Model 3, Tesla sold 7,870 Model Y SUVs and only two further cars.

The VW T-Roc was the only model of the larger Volkswagen Group in the top ten list in December 2021 while Stellantis had three and Renault Group four.

Supply played as big a role in the car sales rankings as the general popularity of models for much of 2021 with December no exception. Volkswagen claims to have half a million cars in Europe on backorder with most manufacturers claiming a similar supply-chain bottleneck that allowed carmakers to concentrate on profitability rather than volume sales.

Car Sales Statistics for Europe in 2021

→ Latest European Car Sales Statistics

- Car Sales and Market Analysis: January, February, March, April, May, June, July, August, September, October, November, December, Full Year 2021

- Top-Selling Car Models: Top 25 Models 2021, Top 15 Electric Models

- Sales per European Country: Q1, Half Year, Q3, Full Year

- Sales by Brand: Q1, Half Year, Q3, Full Year

- Electric and PHEV Sales by Country: Q1, Half Year, Q3, Full Year, Top Electric Brands and Models