In May 2021, new car sales in Europe increased by 73% from May 2020 but the market was still a quarter smaller than in May 2019. Volkswagen dominated as largest producer and brand.

New passenger vehicle registrations in Europe increased by almost three-quarters in May 2021 but the market was still far from pre-pandemic levels with sales down by 25% compared to May 2019. Low emissions vehicles took a 16% market share with battery-electric car sales up 261% and plug-in hybrid vehicle sales in Europe up 300%. Volkswagen increased its dominance of the European new car market with record market share for the manufacturing group and Volkswagen the leading brand. The VW Golf regained the claim as Europe’s favorite car model with the highest sales in both May and the first five months of 2021.

Latest European Car Market Statistics 2021: January, February, March, Q1, April, May, June, HY, July, August, September, Q3, October, November, December, Full Year — 2020: Q1, HY, Q3, Full Year

New Car Market in Europe in May 2021

In May 2021, the European new car market increased 73% compared with May 2020. According to data from JATO Dynamics for 26 European markets, volume totaled 1,073,987 units, taking the year-to-date total to 5,150,831 units. Despite this increase, European car sales volume was 25% lower than in May 2019, as the market continued to feel the effects of the pandemic.

In the European Union (EU), new passenger vehicle registrations in May 2021 increased by 53.4% to 891,665 cars with year-to-date sales increasing by 29.5% to 4.3 million vehicles, according to the ACEA.

Felipe Munoz, global analyst at JATO Dynamics commented: “The data is encouraging but the market is recovering slower than many had hoped. Economic uncertainty and a lack of consumer confidence are limiting growth at a time when the industry is also shifting away from traditional powertrains and adapting to strict CO2 emissions regulations.”

Volkswagen Dominated Car Sales in Europe in May 2021

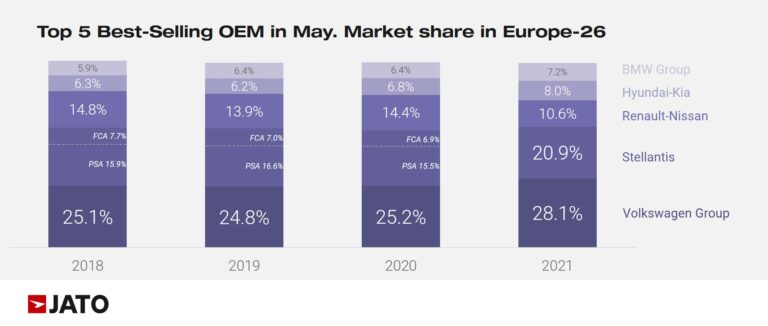

The performance of Volkswagen Group in securing the second highest monthly market share since 2001 is impressive when considering the challenges currently faced by the industry. The German manufacturer’s share totaled 28.14% during May, second only to April 2020 when it secured 29.23% as rival’s sales were harder hit by the onset of the pandemic in Europe.

The positive results in May were due to strong performance from brands such as Audi, Skoda, Seat, and Cupra. Total sales were boosted by increasing consumer demand for EVs and SUVs – with Volkswagen Group now leading in Europe across both segments.

Europe Car Market by Segment in May 2021

VW’s performance last month demonstrates the value of identifying key drivers of growth and adapting sales strategy at the right moment, in order to meet emerging consumer demand. Although Europe is a mature market, EVs and SUVs are key segments that still show considerable growth potential. “As with the diesel scandal in 2015, Volkswagen Group is again able to overcome the crisis and emerge stronger”, Munoz said.

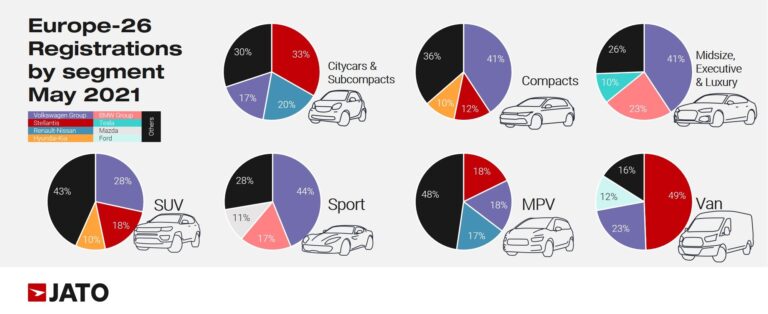

EVs posted a record share of registrations in May – with 16% – while SUVs made up almost 45% of the total volume. Munoz added: “It has become clear that having the right offering across both of these segments will be crucial to the success of OEMs over the coming years.” The market share for SUVs jumped from 40.2% in May 2020 to 44.6% last month. In May 2018, SUVs accounted for 34% of the market.

Top Ten Best-Selling Car Models in Europe in May 2021

According to JATO the following were the ten best-selling car models, battery-electric cars, and plug-in hybrid cars respectively in Europe in May 2021:

Best-Selling Battery-Electric and Plug-in Hybrid Cars in Europe in May 2021

Registrations of pure electric cars and plug-in hybrids totaled 171,415 units*, up by 279% compared with May 2020. Battery-electric vehicle BEV volume totaled 83,700 (+261%), and PHEVs totaled 87,700 (+299%).

The Tesla Model 3 was the best-selling electric car in Europe in May 2021 followed by the Volkswagen ID3 and the Renault Zoe. Volkswagen was the only brand with three car models in the top ten and a fourth (Skoda Enyaq) for the larger Volkswagen Group.

The plug-in hybrid market was more competitive with the Ford Kuga leading followed by the Peugeot 3008 and Volvo XC40. The Volkswagen Group had three cars in the top ten with the Leon narrowly outselling the Golf and Audi A3.

Top-Ten List of Best-Selling Car Models in Europe in May 2021

The Volkswagen Golf led the model ranking, while the Volkswagen T-Roc was the most registered SUV. Other strong performers include the Fiat 500, which came third in the general rankings, the Peugeot 2008 which saw an increase in sales of 2% compared with May 2019, and the Ford Puma which took twelfth position. The Renault Clio regained second place after several months away from its traditional position.

The following models posted double-digit growth compared with May 2019: Hyundai Tucson, Volkswagen T-Cross, Volvo XC40, Mini Hatch, Hyundai Kona, Tesla Model 3, Kia Niro, Fiat Ducato, Renault Zoe, BMW 4-Series, Skoda Scala, BMW 2- Series, Honda Jazz, Volkswagen Arteon, Nissan Leaf, Citroen Jumper, Audi e-tron, MG ZS, Kia Sorento, Kia Proceed, Volkswagen California, Mercedes Sprinter, Hyundai Santa Fe, BMW X6, Jeep Wrangler, among others.

The top seven best-selling car models during the first five months of 2021 in Europe were:

| Model | 1-5/2021 | |

| 1 | VW Golf | 98,546 |

| 2 | Peugeot 208 | 95,392 |

| 3 | Toyota Yaris | 91,332 |

| 4 | Peugeot 2008 | 87,693 |

| 5 | Renault Clio | 87,466 |

| 6 | Opel / Vauxhall Corsa | 86,694 |

| 7 | VW T-Roc | 84,825 |

The VW Golf regained first place in Europe from the Peugeot 208 that had relatively weak sales in May 2021.

Car Sales Statistics for Europe in 2021

→ Latest European Car Sales Statistics

- Car Sales and Market Analysis: January, February, March, April, May, June, July, August, September, October, November, December, Full Year 2021

- Top-Selling Car Models: Top 25 Models 2021, Top 15 Electric Models

- Sales per European Country: Q1, Half Year, Q3, Full Year

- Sales by Brand: Q1, Half Year, Q3, Full Year

- Electric and PHEV Sales by Country: Q1, Half Year, Q3, Full Year, Top Electric Brands and Models