2021 (Full Year): Germany was the largest battery-electric car market in Europe and leading in plug-in hybrid vehicle sales. The UK was the second-largest electric car market followed by France.

In full calendar year 2021, the registration of battery-electric passenger vehicles in the European Union (EU), UK, and EFTA countries increased by nearly two-thirds to 1.2 million electric cars. Plug-in hybrid vehicle sales increased even stronger to just more than a million registrations. Germany was the largest market for both battery-electric cars and plug-in hybrid vehicles. Battery-electric cars took a record 10% market share of the new car sales in Europe during 2021. The Tesla Model 3 and Renault Zoe were the top-selling electric car models in Europe in 2021.

Latest European Car Market Statistics 2021: January, February, March, Q1, April, May, June, HY, July, August, September, Q3, October, November, December, Full Year — 2020: Q1, HY, Q3, Full Year

European New Electric Car Market in 2021 (Full Year)

In 2021, the market for battery electrically chargeable vehicles (BEV) in the European Union expanded by 63% to 878,432 cars. If EFTA (+51%) and the UK (+76%) were added, the expansion was 63% to 1,218,360 battery-electric-only cars — the first time ever more than a million BEVs were sold in Europe in a calendar year. Total new passenger vehicle registrations in the European Union (EU), United Kingdom, and EFTA countries contracted by 1.5% to 11,774,885 cars during 2021 — around 4 million cars less than in pre-pandemic years.

Huge incentives for buying electric cars in especially Germany, as well as manufacturers requiring electric car sales to offset higher emission (and often more profitable) larger engine cars, encouraged electric car sales. The range of electric cars on the market also expanded vastly. Furthermore, delivery of electric cars improved although long waiting lists remained for many popular models. Like the rest of the market, electric car production also suffered from a shortage in semiconductors with the issue intensifying during the second half of the year and expected to extend well into 2022. Covid restrictions continued to dampen the market to varying degrees in individual countries but were overshadowed by the production issues.

European New Car Market by Fuel Types in 2021 (Full Year)

The new car market in the EU, EFTA, and the UK during 2021 was divided into the following main fuel types according to the ACEA:

| Fuel | 2021 | 2020 | % Change | % Share |

| Petrol | 4,756,897 | 5,760,122 | -17.4 | 40.4 |

| Diesel | 2,078,022 | 3,104,226 | -33.1 | 17.6 |

| HEV | 2,409,495 | 1,520,086 | 58.5 | 20.5 |

| BEV | 1,218,360 | 745,644 | 63.4 | 10.3 |

| PHEV | 1,045,022 | 620,248 | 68.5 | 8.9 |

| TOTAL | 11,774,885 | 11,961,182 | -1.5 |

Note: Total also includes further alternatives, eg LPG and natural gas.

Petrol remained by far the most popular fuel type for new cars sold in Europe in 2021. Although market share slipped to 40%, hybrid electric cars (and to a large extent plug-in hybrids too) are primarily driven on petrol. The decline in the popularity of diesel continued and it is likely to continue as fewer diesel cars are offered and development halted. Despite the sharp increase in registration of battery-electric cars, such fully electric vehicles still made only a tenth of the European new car market in 2021.

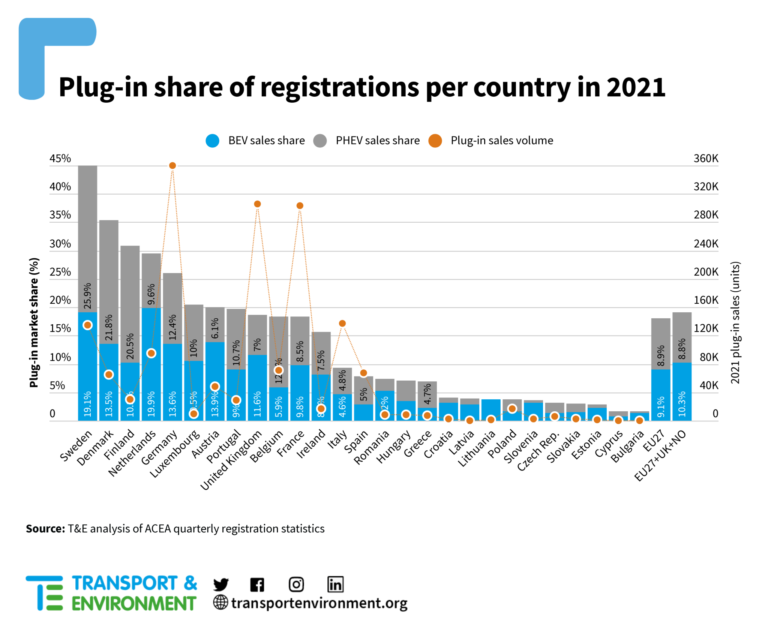

According to the green group Transport & Environment (T&E), the increase in the market share of BEV in the European Union from 1.9% in 2019 to 9.1% in 2020 was due to the EU CO2 standards that forced carmakers to reduce average CO2 emissions. T&E feared that without ambitious EU standards in 2025 and an interim target in 2027, EV sales would lose momentum in Europe for the rest of the decade as carmakers prioritize the recovery of combustion engine market share.

Battery Electric Vehicle Sales in Europe in 2021 (Full Year)

Registrations of battery electric vehicles (BEV) in various European Union and EFTA member countries during the full calendar year 2021 were as follows according to ACEA statistics:

| Country | 2021 | 2020 | % 21/20 |

| Austria | 33,380 | 15,986 | +108.8 |

| Belgium | 22,677 | 14,994 | +51.2 |

| Bulgaria | 321 | 139 | +130.9 |

| Croatia | 1,475 | 533 | +176.7 |

| Cyprus | 82 | 42 | +95.2 |

| Czech Republic | 2,701 | 3,284 | -17.8 |

| Denmark | 25,000 | 14,275 | +75.1 |

| Estonia | 484 | 342 | +41.5 |

| Finland | 10,152 | 4,244 | +139.2 |

| France | 162,167 | 111,127 | +45.9 |

| Germany | 356,425 | 194,471 | +83.3 |

| Greece | 2,176 | 679 | +220.5 |

| Hungary | 4,312 | 3,046 | +41.6 |

| Ireland | 8,646 | 4,013 | +115.4 |

| Italy | 67,283 | 32,502 | +107.0 |

| Latvia | 425 | 307 | +38.4 |

| Lithuania | 1,155 | 453 | +155.0 |

| Luxembourg | 4,650 | 2,473 | +88.0 |

| Netherlands | 64,149 | 73,005 | -12.1 |

| Poland | 7,164 | 3,679 | +94.7 |

| Portugal | 13,260 | 7,830 | +69.3 |

| Romania | 6,342 | 2,845 | +122.9 |

| Slovakia | 1,105 | 918 | +20.4 |

| Slovenia | 1,722 | 1,647 | +4.6 |

| Spain | 23,690 | 17,927 | +32.1 |

| Sweden | 57,489 | 27,973 | +105.5 |

| EUROPEAN UNION | 878,432 | 538,734 | +63.1 |

| Iceland | 3,561 | 2,356 | +51.1 |

| Norway | 113,751 | 76,804 | +48.1 |

| Switzerland | 31,889 | 19,545 | +63.2 |

| EFTA | 149,201 | 98,705 | +51.2 |

| United Kingdom | 190,727 | 108,205 | +76.3 |

| EU + EFTA + UK | 1,218,360 | 745,644 | +63.4 |

| Source: ACEA |

Plug-In Hybrid Electric Vehicle Sales in Europe in 2021

Registrations of plug-in hybrid electric vehicles (PHEV) in various European Union and EFTA member countries in 2021 were as follows according to ACEA statistics:

| Country | 2021 | 2020 | % 21/20 |

| Austria | 14,626 | 7,641 | +91.4 |

| Belgium | 47,761 | 31,694 | +50.7 |

| Bulgaria | 97 | 41 | +136.6 |

| Croatia | 399 | 143 | +179.0 |

| Cyprus | 97 | 83 | +16.9 |

| Czech Republic | 3,907 | 1,981 | +97.2 |

| Denmark | 40,478 | 18,243 | +121.9 |

| Estonia | 167 | 75 | +122.7 |

| Finland | 20,139 | 13,231 | +52.2 |

| France | 141,001 | 74,592 | +89.0 |

| Germany | 325,449 | 200,469 | +62.3 |

| Greece | 4,785 | 1,456 | +228.6 |

| Hungary | 4,236 | 2,996 | +41.4 |

| Ireland | 7,891 | 2,492 | +216.7 |

| Italy | 70,472 | 27,407 | +157.1 |

| Latvia | 144 | 73 | +97.3 |

| Lithuania | 0 | 0 | |

| Luxembourg | 4,443 | 2,685 | +65.5 |

| Netherlands | 31,016 | 14,891 | +108.3 |

| Poland | 9,269 | 4,505 | +105.7 |

| Portugal | 15,660 | 11,867 | +32.0 |

| Romania | 2,630 | 1,036 | +153.9 |

| Slovakia | 1,166 | 863 | +35.1 |

| Slovenia | 191 | 39 | +389.7 |

| Spain | 43,226 | 23,309 | +85.4 |

| Sweden | 77,842 | 66,105 | +17.8 |

| EUROPEAN UNION | 867,092 | 507,917 | +70.7 |

| Iceland | 3,420 | 1,859 | +84.0 |

| Norway | 38,166 | 28,909 | +32.0 |

| Switzerland | 21,790 | 14,429 | +51.0 |

| EFTA | 63,376 | 45,197 | +40.2 |

| United Kingdom | 114,554 | 67,134 | +70.6 |

| EU + EFTA + UK | 1,045,022 | 620,248 | +68.5 |

| Source: ACEA |

Electric Car Sales in Europe in 2021 (Full Year)

Battery-electric car sales in Europe increased by nearly two-thirds in 2021 while the total new passenger vehicle market was slightly weaker. As a result, batter-electric cars took a record 10% market share — up from 6.2% in 2020. Plug-in hybrid sales in Europe increased by two-thirds but were lagging in volume terms well behind battery-electric cars.

In 2021, Germany was the largest single-country market in Europe for both battery-electric cars as well as plug-in hybrid vehicles. Both battery and plug-in hybrids received huge government incentives in Germany despite continued doubts over the actual emission efficiency of plug-in hybrid cars. German carmakers played a major role in promoting plug-in hybrids as bridging technology, although Volkswagen’s push into battery-electric cars probably played an equally major role in forcing other brands to bring electric cars to market a bit earlier than originally intended.

Battery-electric car sales increased in Germany at a faster pace than the next three largest markets in Europe. The UK moved ahead of France with combined sales almost equal to the German BEV market. Norway, with the highest market share for battery-electric cars, remained the fourth largest market for BEVs despite the relatively small total market.

Battery-electric vehicle sales in Italy more than doubled with similar increases in Sweden and Austria. The Netherlands, where BEVs already achieved strong market share in 2020 due to government incentives, was the only top European market with lower electric car sales in 2021.

Germany remained by far the largest market for plug-in hybrid cars — a format subsidized by the German government and strongly pushed by the German automobile industry — with total PHEV sales almost equal to the next three largest markets combined. PHEV sales in Italy, Denmark, and the Netherlands more than doubled in 2021.

→ The Tesla Model 3 and Renault Zoe were the top-selling electric car models in Europe in 2021.

Car Sales Statistics for Europe in 2021

→ Latest European Car Sales Statistics

- Car Sales and Market Analysis: January, February, March, April, May, June, July, August, September, October, November, December, Full Year 2021

- Top-Selling Car Models: Top 25 Models 2021, Top 15 Electric Models

- Sales per European Country: Q1, Half Year, Q3, Full Year

- Sales by Brand: Q1, Half Year, Q3, Full Year

- Electric and PHEV Sales by Country: Q1, Half Year, Q3, Full Year, Top Electric Brands and Models