In November 2021, car sales in Europe contracted by nearly a fifth but Volkswagen was again the top carmaker while the Renault Clio was the best-selling car model.

New passenger vehicle registrations in Europe contracted by 18% in November 2021 largely due to the continued lack of computer chips and other components. Although the Volkswagen Group recovered its position as the largest car manufacturing consortium in Europe, the VW Golf slipped out of the top ten list of best-selling car models for the second consecutive month. The Renault Clio was Europe’s favorite car model in November 2021.

Latest European Car Market Statistics 2021: January, February, March, Q1, April, May, June, HY, July, August, September, Q3, October, November, December, Full Year — 2020: Q1, HY, Q3, Full Year

European New Car Market in November 2021

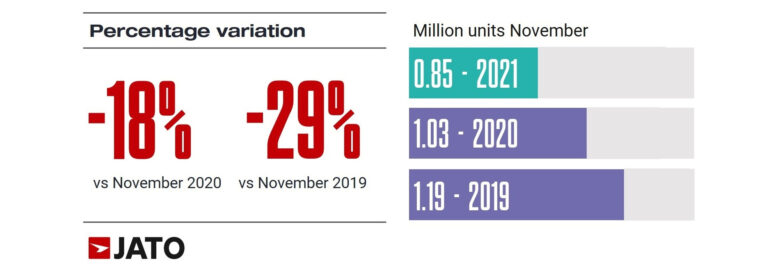

In November 2021, new passenger vehicle registration was at its lowest level for November over the last 3 decades. JATO Dynamics’ data revealed a total volume of 855,281 units, across 25 European markets.

Compared to November 2020, the total volume last month was 18% lower and 29% lower when compared to November 2019 – before the pandemic had hit the market. Felipe Munoz, Global Analyst at JATO Dynamics, commented: “Although the market has not recovered entirely from the pandemic, the current problem does not relate to a lack of demand, but rather a lack of supply.”

As a result, year-to-date 2021 growth in registrations fell to just 0.4% compared to 2020, and the year is expected to end with similarly low figures. Munoz, noted: “When you consider the chip shortage in combination with local lockdowns experienced over the course of this year, there is a clear backlog of consumers wishing to renew their cars. This delay could have two main impacts: the first being that we see a large uptick in registrations next year if the shortage is solved; the second that consumers begin to adapt their buying patterns, moving toward keeping their vehicles for longer periods.”

Europe Car Sales by Fuel Type in November 2021

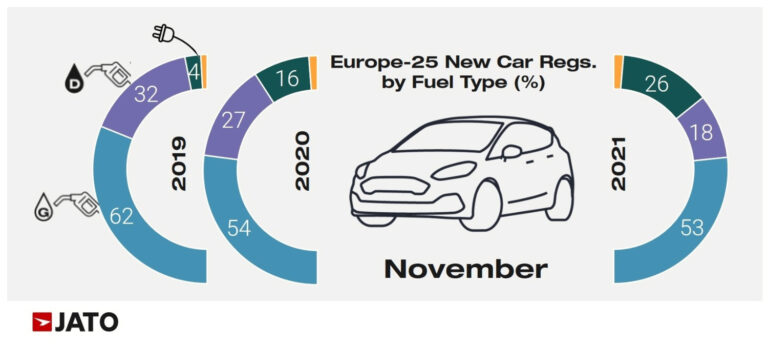

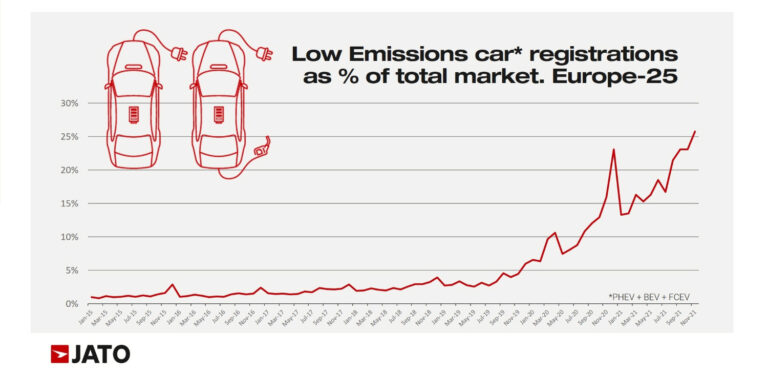

Despite the difficult environment, registrations of low emissions cars in Europe-23 totaled 217,709 units in November 2021, accounting for 26% of total registrations. Registered units of these vehicles hugely outweighed their diesel counterpart in November, with the volume for low emissions cars 41% higher than achieved for diesel. While the volume for gasoline vehicles was more than double (2.1x) the volume recorded for low emissions cars.

The strong growth for EVs is partly explained by increased interest from the public, alongside the significant shift from governments and OEMs towards lower emissions vehicles. Munoz, stated: “If you want a new car in this current environment, the chances are that EVs are going to be more accessible given the range of offers and incentives available.”

Top Selling Car Models in Europe in November 2021

The chip shortage also had a notable impact on the overall model ranking with the ability to deliver a car currently easily outperforming the actual demand for specific models. The Renault Clio reclaimed the title of Europe’s favorite car model but there were fewer than 200 sales between the top-selling Renault and the fourth-placed Peugeot 2008. Only 90 car sales prevented the Dacia Sandero — a sister car of the Clio — from becoming the first Dacia ever to be crowned best-selling car model in Europe.

The Renault Clio and its rivals – Peugeot 208 2008, and Dacia Sandero – were not as negatively affected last month as the Volkswagen Golf or Toyota Yaris, whose volume fell by 72% and 65% respectively. The Golf slipped to 35th place with only 6,755 sales in November 2021. However, the VW Golf remained the top-selling car thus far in 2021in Europe but is likely to lose that position in the final month of the year.

The Yaris fell short due to positive results from the Yaris Cross – the SUV model that went to market in September. The VW T-Roc was the top-selling Volkswagen and the only model from the group in the top ten in November 2021.

The Hyundai Tucson made it into the top 10 thanks to the new generation; Tesla more than doubled its registrations of the Model 3 as the 12th most popular car in Europe in November 2021; the new Toyota Yaris Cross came in at 24th position outselling the Yaris (35th); BMW X3 saw an increase of 55%, ahead of the new Mokka (with almost 7,900 units) and the second best-selling Opel/Vauxhall; while the Dacia Spring and Skoda Enyaq registered almost 5,900 and 5,200 units each.

The new C4 became the second best-selling Citroen; Renault registered 5,600 units of the Arkana, and Tesla registered 5,400 units of the Model Y – the fifth best-selling BEV in November, ahead of the Volkswagen ID.4 with 4,800 units.

The Tesla Model 3 led the battery-electric vehicle (BEV) ranking, followed by the Renault Zoe and Dacia Spring. Although three Volkswagens made it into the top ten, VW electric sales were well behind Tesla.

In the PHEV market, the most-registered car was the Peugeot 3008, followed by the Volvo XC40 and Ford Kuga. None of the top ten cars here even made it into the top 50 of all car models and 13 battery-electric vehicles sold in higher numbers than the 3008.

Car Sales Statistics for Europe in 2021

→ Latest European Car Sales Statistics

- Car Sales and Market Analysis: January, February, March, April, May, June, July, August, September, October, November, December, Full Year 2021

- Top-Selling Car Models: Top 25 Models 2021, Top 15 Electric Models

- Sales per European Country: Q1, Half Year, Q3, Full Year

- Sales by Brand: Q1, Half Year, Q3, Full Year

- Electric and PHEV Sales by Country: Q1, Half Year, Q3, Full Year, Top Electric Brands and Models