October 2021: Stellantis outsold Volkswagen as the new car market in Europe contracted by a third with the VW Golf slipping to only 20th sales position.

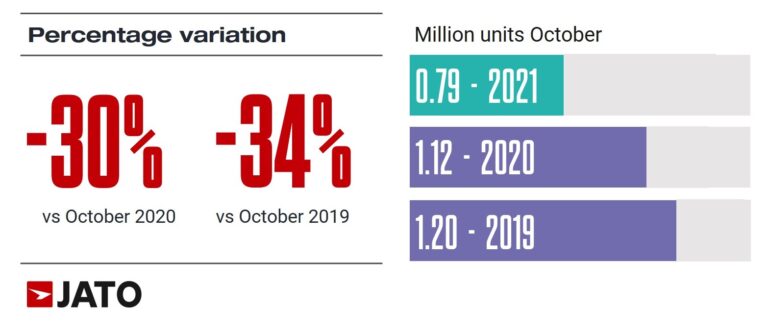

The European new car market contracted by nearly a third in October 2021 with sales down to only 790,652 vehicles. All manufacturers struggled with a shortage in electronic components with the Volkswagen Group particularly hard hit — it was outsold on a monthly basis for only the second time in more than two decades. Stellantis took the lead as the largest carmaker in Europe in October 2021. Stellantis produced five of the most popular car models in Europe in October 2021 including the top-selling Peugeot 2008. The Renault Zoe was the best-selling battery-electric car in Europe. The VW Golf remained the top-selling car in Europe in 2021 but in October slipped to only 20th place.

Latest European Car Market Statistics 2021: January, February, March, Q1, April, May, June, HY, July, August, September, Q3, October, November, December, Full Year — 2020: Q1, HY, Q3, Full Year

European New Car Market in October 2021

October 2021 was a challenging month for Europe’s automotive industry, as total registrations decreased by 30% to 790,652 units due to the continued impact of shortages of new cars at dealerships. According to Felipe Munoz, Global Analyst at JATO Dynamics, the shortage of semiconductors is proving to be as severe as the COVID lockdowns of last year. Factories shut down across the continent, and at present, the industry is struggling to find a solution to the supply chain crisis.

Year-to-date 2021, the total volume for Europe’s 26 markets continues to outperform in comparison to 2020, up by 2.6% to 9.85 million units. However, the gap has once again narrowed when compared with the 7% rise that was seen in September 2021.

Car Sales in Europe by Fuel Type in October 2021

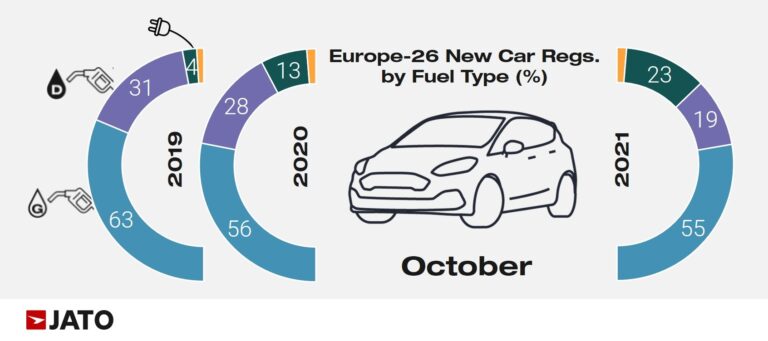

In October 2021, a new monthly record was set for the sale of electrically chargeable cars when a total of 181,300 units of BEV and PHEV were registered, accounting for 22.9% of total market share. While the EV segment continues its upward trajectory, diesel vehicles are struggling to gain traction in Europe, with market share dropping to just 19%.

Munoz added: “As we saw during the pandemic, the current crisis has proved to be more of an opportunity than a threat to the developing EV market. COP 26 marked a significant turning point for the industry as 24 countries and 11 OEMs committed to no longer producing ICE vehicles by 2040, and so the shift towards EVs will only accelerate further in the coming years.”

Due to the shortage in electronic components, manufacturers preferred to produce low emission vehicles and high-profit car models. However, the trend away from diesel is likely to be permanent with neither car buyers nor manufacturers seemingly keen on diesels in future.

Best-Selling Car Brands

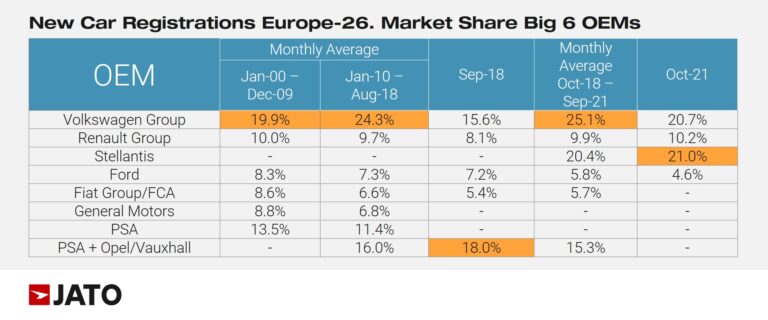

The shortages are also having a direct impact on sales leadership across the European market. According to JATO Dynamics’ data, October 2021 was only the second time, this century, that Volkswagen Group fell out of the leadership position for monthly registrations ranking by OEM. This marks the first time since its formation earlier in 2021 that Stellantis has outsold the German manufacturer.

In October 2021, Volkswagen recorded a 42% decline in volume, with double-digit drops in all countries except Ireland. Its compact and midsize cars were the most severely affected segments. Munoz continued: “Carmakers are being forced to prioritize their best-selling segments, meaning that the few available semiconductors are being used solely to produce SUV and EVs.”

The market share for SUVs jumped from 40.7% in October 2020 to a new monthly record of 46.8% last month. Unlike the traditional segments, demand for SUVs has continued to gain momentum as manufacturers roll out their new EV alternatives. The segment was led by Volkswagen Group, Stellantis, and Hyundai-Kia, but only the latter posted notably strong growth at +23%, due to its latest launches. Toyota, in 6th position, also saw its volume increase by 3%.

Top Ten Best-Selling Car Models in Europe in October 2021

As a consequence of the crisis, there was a considerable change in the rankings by model. The Peugeot 2008 secured the top spot for the first time since its introduction in 2013. Stellantis had 5 models in the top 10, followed by Renault group with 2 models, and Volkswagen Group, Ford, and Hyundai with one model each.

The VW Golf remained Europe’s favorite car in 2021 with 184,698 sales but in October 2021 slipped to 20th place with 8,649 sales — over two-thirds lower than in October 2020. Even in Germany, where the Golf has been the market leader since 1981, it slipped to second place behind the VW T-Roc. The second most popular car in Europe thus far in 2021, the Toyota Yaris with 163,826 sales, slipped to 30th place in October.

The Hyundai Tucson again performed well, up by 59% thanks to the new generation. Strong results were also posted by while the Volkswagen T-Cross +10%; BMW X3 +74%; Kia Sportage and Ceed, +23% and +26% respectively; Mitsubishi Space Star +45%; Ford Ecosport +36%; Tesla Model 3 +236%; Porsche Macan +38%; BMW 4-Series +31%; Volkswagen Arteon +103%; Porsche Taycan +41%; the Lexus UX + 28%.

Among the latest launches, the Opel/Vauxhall Mokka secured a place in the SUV top ten; the C4 became Citreon’s second best-selling vehicle; Renault’s Arkana outsold the Megane and Kadjar.

The relatively cheap Dacia Spring was the third best-selling BEV, behind the aging Renault Zoe and the Volkswagen ID.3. The Tesla Model 3, the top-selling car model in Europe in September 2021, delivered only 2,836 cars in Europe in October 2021 — only the 13th most popular electric car model and not sufficient for the top 50 of all car models.

Car Sales Statistics for Europe in 2021

→ Latest European Car Sales Statistics

- Car Sales and Market Analysis: January, February, March, April, May, June, July, August, September, October, November, December, Full Year 2021

- Top-Selling Car Models: Top 25 Models 2021, Top 15 Electric Models

- Sales per European Country: Q1, Half Year, Q3, Full Year

- Sales by Brand: Q1, Half Year, Q3, Full Year

- Electric and PHEV Sales by Country: Q1, Half Year, Q3, Full Year, Top Electric Brands and Models