September 2021: new passenger vehicle registrations in Europe contracted by 25% while the Tesla Model 3 was the top-selling car model and SUVs sales increased to take a 47% share of the total market.

Car sales in Europe in September 2021 slumped by a quarter to only 964,800 vehicles. Strong end of the third quarter deliveries by Tesla allowed the Model 3 to become the top-selling car in Europe for the month of September 2021 — the first time ever that a non-European car, or a battery-electric vehicle, was the most popular car in Europe in a calendar month. The VW Golf remained the best-selling car model in Europe despite a sharp contraction in deliveries due to component shortages. SUVs continued to gain market share while diesel sales were down to only 17%.

Latest European Car Market Statistics 2021: January, February, March, Q1, April, May, June, HY, July, August, September, Q3, October, November, December, Full Year — 2020: Q1, HY, Q3, Full Year

European New Car Market in September 2021

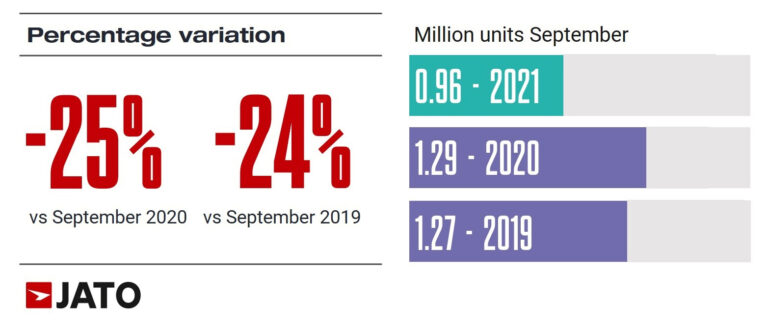

During the first three quarters of 2021, new passenger registrations in the European Union (EU), EFTA, and the UK increased by 6.9% to 9,161,918 cars compared to 8,567,920 cars in 2020. This was still a good 3 million fewer cars than the 12,117,401 registered during the corresponding months in 2019.

However, in September 2021 the market contracted sharply, as new car registrations fell by 25% to just 964,800 units. Felipe Munoz, Global Analyst at JATO Dynamics, commented: “Dealers continue to face issues with the availability of new cars due to the chip shortage. As a result, unwilling to wait more than a year for a new car, many consumers have turned to the used car market.” Or simply keep cars longer, as many European drivers drove significantly less during much of the Covid period.

Year-to-date 2021, Europe’s 26 markets continued to outperform in comparison to 2020, however, the gap has narrowed. By the end of the first half of the year, total registrations were 27% higher than in H1 2020. Results through September show that this gap has narrowed to just 7%. Munoz continued: “This year, the industry has responded well to the pandemic, but it is now facing new supply chain challenges. The growing popularity of EVs is encouraging, but sales are not yet strong enough to offset the big declines seen across other segments.”

Car Sales by Fuel Type in Europe in September 2021

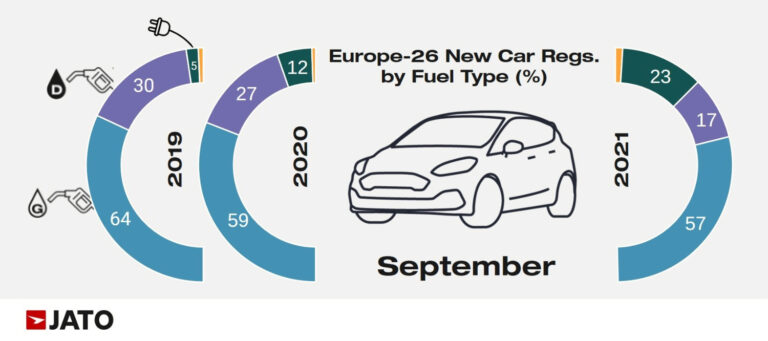

OEMs with a large offering of pure electric and plug-in hybrid cars have been less impacted by the current crisis, as European consumers continue to take advantage of the various incentives and subsidies available for these vehicles. In stark contrast, both the chip shortage and the growing severity of the climate crisis have caused diesel vehicle sales to plummet. In September 2021, low emission vehicles posted a monthly growth of 44%, to 221,500 units, while the registrations of diesels decreased by 51%, to 167,000 units.

Before the pandemic, there were 10.3 new diesel cars registered for every electric or plug-in hybrid vehicle. Today, that ratio has decreased to just 1.3. Munoz added: “Shifts of this magnitude are rare, and a number of factors have contributed to the current state of play. In addition to incentives, OEMs have enhanced their offering with more models and better deals, and many are shifting their limited supply of semiconductors to the production of EVs, instead of ICE vehicles.”

Car Sales by Segment in Europe in September 2021

Despite increasing environmental concerns and the decline in the sales of diesel cars, SUVs continued to gain popularity in Europe. In September 2021, 46.5% of the passenger cars registered in Europe were SUVs – the highest ever monthly market share for the segment. Despite the current crisis faced by OEMs, these vehicles continue to gain traction thanks to the arrival of EV and plug-in hybrid alternatives, such as Tesla’s Model Y.

Munoz commented: “If the trend continues, the roads of Europe could soon look similar to the US, where more than half of the new cars sold are SUVs.” However, SUVs in Europe are often far smaller than the vehicles in the USA. Furthermore many so-called SUVs are hardly bigger than standard compact models and often a product of marketing rather than engineering.

This segment was led by the Volkswagen Group, Stellantis, and Hyundai-Kia, and the big market share winners during the month were the Korean maker, Tesla and Volkswagen Group.

Tesla Model 3 Top-Selling Car Model in Europe in 2021 (September)

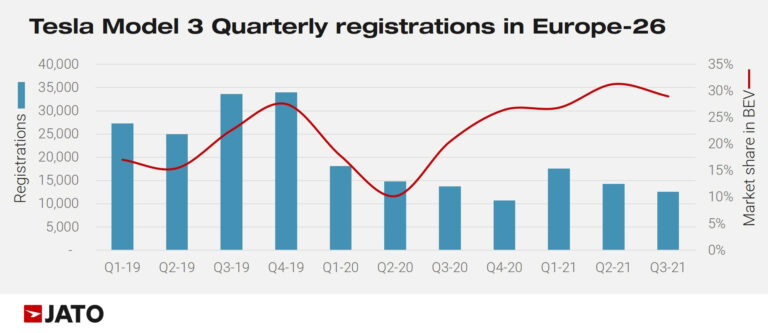

As a result of the EV boom, the Tesla Model 3 topped the European model rankings in September, with 24,600 registered units – a 2.6% market share. This is both the first time that an EV has led the market and the first time that a vehicle manufactured outside of Europe has occupied the top spot.

The strong performance of the Model 3 is in part explained by Tesla’s intensive end-of-quarter sales push. September has historically been a strong month for the US manufacturer’s registration results in Europe, on average accounting for 68% of its third-quarter deliveries since 2018. Last month, registrations accounted for 74% of third-quarter volume. Since its’ entry into the European market, the Model Y has also performed well, securing the second position in the BEV ranking.

Due to the success of these two models, Tesla leads the BEV market with a share of 24%, ahead of the Volkswagen Group with 22%, Stellantis with 13%, and Hyundai-Kia with almost 11%. Tesla also registered more new cars than established brands including Fiat, Nissan, or Seat.

→ See also: 2021 (Q3) Europe: Best-Selling Car Brands for more details.

Best-Selling Car Models in Europe in 2021 (September)

The Tesla Model 3 was the top-selling car model in Europe in September 2021. However, until Tesla deliveries became more regular, particularly once production in Germany starts, spikes in Tesla registrations are likely to continue.

The Renault Clio returned to its traditional second place after months of yoyoing sales. The Dacia Sandero, Europe’s favorite car in August and July 2021, was the third best-selling car model in September.

Although the VW Golf slipped to fourth, it is still the overall market leader for the year with 176,061 sales compared to 99,419 for the Model 3, and 157,210 for the second-placed Toyota Yaris. VW Golf sales in September 2021 were down by nearly 40%, which was in line with the overall decline in car production in Germany due to the electronic components supply issues.

Once again, the Hyundai Tucson secured a place in the top 10 with an increase in volume of 40%. The BMW 3-Series saw a 24% increase despite its direct competition with the Model 3. The new Opel/Vauxhall Mokka continued its climb up the rankings to 22nd position with 9,700 registered units. In 28th position, the Tesla Model Y outsold consumer favorites such as the Fiat Panda, Peugeot 3008, and Volkswagen ID.3.

The Kia Ceed, BMW 4-Series, DS 7 Crossback, Mazda MX-30, Volkswagen Arteon, and Porsche Taycan also posted strong monthly growth. Among the new entries, the Renault Arkana registered almost 7,000 units, becoming the third most registered Renault model while the Citroen C4 and Skoda Enyaq became the second best-selling models for their respective brands.

The Tesla Model 3 was obviously also the best-selling electric car model in Europe in September 2021. More worrying for the European competition was likely that the Model Y took second place. The Volkswagen ID3 was third and the ID4 only eighth.

The Ford Kuga was the best-selling plug-in hybrid car in Europe in September 2021 followed by the BMW 3 Series and the Peugeot 3008.

Despite government subsidies in several countries including Germany continued, buyers, and particularly private buyers, seemed unconvinced by the costs and expense of PHEV. The top 12 battery-electric cars all sold in higher numbers than the top-selling PHEV. The near absence of Volkswagen Group models among the top PHEV models also hints strongly that Europe’s largest carmaker does not consider this technology to have much of a future.

Car Sales Statistics for Europe in 2021

→ Latest European Car Sales Statistics

- Car Sales and Market Analysis: January, February, March, April, May, June, July, August, September, October, November, December, Full Year 2021

- Top-Selling Car Models: Top 25 Models 2021, Top 15 Electric Models

- Sales per European Country: Q1, Half Year, Q3, Full Year

- Sales by Brand: Q1, Half Year, Q3, Full Year

- Electric and PHEV Sales by Country: Q1, Half Year, Q3, Full Year, Top Electric Brands and Models