In June 2021, new car sales in Europe increased by 13% from June 2020 but the market was still over 200,000 cars smaller than in June 2019. Volkswagen was the top-selling brand with the VW Golf the best-selling car model ahead of the Tesla Model 3.

New passenger vehicle registrations in Europe increased by 13% in June 2021 but were still significantly lower than in pre-pandemic years. Low emissions vehicles took an 18% market share — just behind the 21% share for diesels. SUVs took a 44% share of new car sales in Europe in June 2021, although many were small, crossover-type vehicles. The Volkswagen Golf was again Europe’s favorite car model in June 2021 but the Tesla Model 3 took a surprise second place with very strong deliveries. The Model 3 was comfortably ahead in battery-electric car sales in Europe in June 2021.

Latest European Car Market Statistics 2021: January, February, March, Q1, April, May, June, HY, July, August, September, Q3, October, November, December, Full Year — 2020: Q1, HY, Q3, Full Year

New Car Market in Europe in June 2021

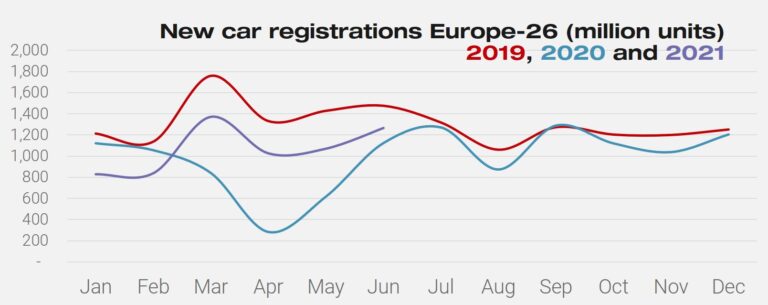

According to data from JATO Dynamics for 26 European markets (EU, EFTA, and UK), 1,268,683 new passenger cars were registered in June 2021 – an increase of 13% when compared with June 2020. Despite this increase, the market’s rate of recovery has slowed substantially relative to the growth recorded between March and May of this year. Since the beginning of 2021, the European new car market has rebounded well, however, the ongoing impact of the pandemic continues to impinge on sales momentum. Manufacturers also struggled with deliveries due to a shortage in components requiring computer chips, as well as continued pressure on raw materials for batteries.

The almost 1.27 million units registered in June, still lags behind the 1.47 million units registered in 2019, and the 1.6 million units registered in 2018.

Felipe Munoz, Global Analyst at JATO Dynamics commented: “The conditions are not yet ideal and far from a total recovery. In the mid-term, It is not clear whether the market will reach pre-Covid levels or not”.

The volume for the first half of 2021 totaled 6.41 million units, up by 27% year-on-year from 2020, but 23% lower than in H1 2019.

For more on the European new car market over the first half-year of 2021, see also: 2021 (Jan-June) Car Sales per European Country, and 2021 (Half Year) Europe: Best-Selling Car Brands, and 2021 (First Semester): Electric Car Sales by European Country.

Europe Car Sales by Fuel Type in June 2021

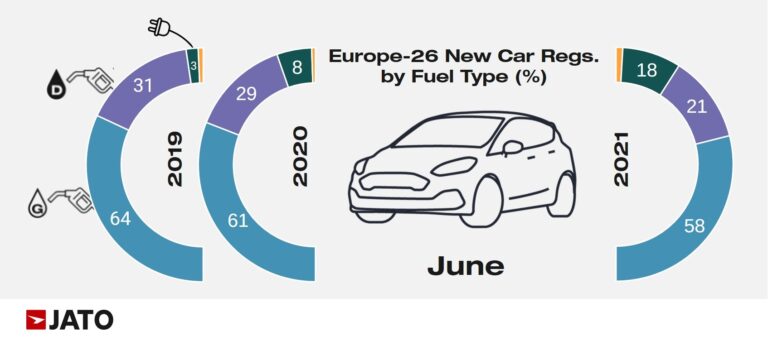

Low emissions cars (BEV and PHEV) continued to perform well, recording a new record total market share of 18.5% – up from 8.2% in June 2020. Registrations of BEVs totaled 126,000 units during the month, ahead of the 104,000 registered PHEV units. Fiat, Tesla, Skoda, Volkswagen, and Ford gained the largest market share in the BEV market while Cupra, Jeep, Volkswagen, Renault, and Seat posted the highest market share gains in the PHEV market.

Demand has been growing steadily across Europe, but significant increases in market share were posted in Norway (+24 points), Sweden (+24 points), Denmark (+21 points), Ireland (+17 points), and Germany (+15 points). In contrast, the market share of these vehicles increased by only 0.7 points in Slovakia, 1.4 points in Romania, and 1.6 points in Poland.

The increasing popularity of these vehicles is also having an impact on the sales mix for certain brands. For instance, Jeep’s new plug-in models accounted for 30% of its total volume in June, compared with 0.5% in June 2020. Cupra’s sales of low emissions vehicles jumped from 0% in June 2020 to 58% last month, while BEV and PHEV models made up 72% of MG’s total volume.

Europe Car Market by Segment in June 2021

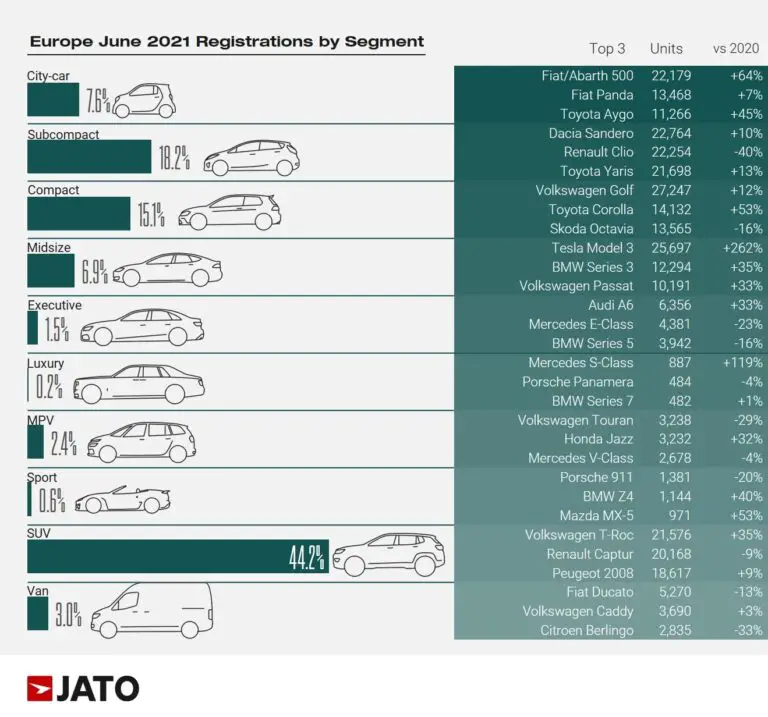

The top-selling three models per market segment in Europe during June 2021 were as follows according to JATO:

SUVs were again the largest segment of the European new car market in June 2021 with a 44.2% share of all passenger vehicle registrations. However, the three best-selling models were all smaller, crossover-type vehicles that are hardly bigger than the average compact hatchback car.

The Volkswagen Golf remained the top-selling car in Europe in June 2021 and was also the most popular model during the first half of 2021. The Peugeot 208, which was the leading model earlier in the year, fell out of the top ten completely in June 2021. More sensationally, the Tesla Model 3 moved into second place with sales more than double that of the BMW 3 Series.

Other models that posted notable growth compared to June 2019 were the Fiat 500, Toyota Yaris, Volkswagen T-Roc, Peugeot 2008, Volkswagen T-Cross, Hyundai Tucson, Audi A3, Toyota C-HR, Hyundai Kona, BMW 3-Series, and Volvo XC40.

Among the latest launches, Opel registered 7,741 units of the Mokka; 7,353 units of the Citroen C4; Volkswagen registered 7,040 units of the ID.3 and 6,347 units of the ID.4; the Skoda Enyaq found 6,011 new clients, while Cupra registered 5,967 units of the Formentor. The Renault Arkana registered 4,766 units, and the Ford Mach-E registered 3,002 units.

Top Ten Best-Selling Car Models in Europe in June 2021

According to JATO the following were the ten best-selling car models, battery-electric cars, and plug-in hybrid cars respectively in Europe in June 2021:

Top-Ten List of Best-Selling Car Models in Europe in June 2021

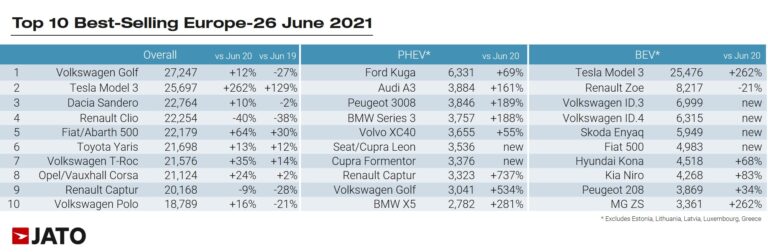

In the model rankings, the Volkswagen Golf was the most popular new car amongst consumers with 27,247 units, equating to a 2.15% market share. Despite the increase of 12% from June 2020, volume fell by 27% when compared with June 2019 – when its market share was at 2.52%. Golf numbers are in part hurt by the absence of an electric Golf with ID3 sales of course not included with Volkswagen’s top-selling model.

The Golf was followed by the Tesla Model 3, which registered 25,697 units taking the year-to-date total to 66,350 units, making it the most popular electric vehicle in Europe, and the 25th best-selling model in the general rankings through to June. The Model 3 was the top-seller in Austria, Norway, Switzerland, and the UK, and hit the top 10 in Denmark, France, Germany, Ireland, Luxembourg, and Sweden.

The Dacia Sandero narrowly outsold its more expensive Renault Clio sibling. The Clio struggled at the start of 2021 — previously it was for years reliably the second best-selling car in Europe.

The Fiat 500 was the best-selling city car and the Toyota Yaris was the top-selling Japanese model. The VW T-Roc was the most popular SUV in Europe followed by the Renault Captur. The Opel Corsa again outsold the VW Polo that is due a model facelift by the end of 2021.

Best-Selling Battery-Electric and Plug-in Hybrid Cars in Europe in June 2021

The Tesla Model 3 was by far the best-selling battery-electric car in Europe in June 2021 — registrations were over three times higher than in May 2021. Model 3 sales were similarly over three times more than the Renault Zoe and more than double the combined Volkswagen ID3 and ID4 sales. A new entry on the top ten is the MG ZS that was able to compete strongly on price.

The Ford Kuga was the leading plug-in hybrid vehicle in Europe in June 2021. PHEV continued to benefit of generous government subsidies in several countries including Germany but many manufacturers struggled to satisfy overall demand.

Car Sales Statistics for Europe in 2021

→ Latest European Car Sales Statistics

- Car Sales and Market Analysis: January, February, March, April, May, June, July, August, September, October, November, December, Full Year 2021

- Top-Selling Car Models: Top 25 Models 2021, Top 15 Electric Models

- Sales per European Country: Q1, Half Year, Q3, Full Year

- Sales by Brand: Q1, Half Year, Q3, Full Year

- Electric and PHEV Sales by Country: Q1, Half Year, Q3, Full Year, Top Electric Brands and Models