In July 2021, new car sales in Europe contracted by a quarter compared to the market in 2020 and 2019. The Dacia Sandero followed by the VW Golf were the top-selling car models.

New passenger vehicle registrations in Europe contracted by 24% in July 2021 compared to July 2020 and were 26% lower than in July 2019. Although new car sales in the European market remained positive for the year to date, the industry continued to struggle with the restrictions imposed by Covid, as well as manufacturing stoppages due to the shortage of various electronic parts. SUVs took a record 46.1% market share in Europe in July 2021. The Dacia Sandero was the top-selling car model in Europe in July 2021 but the Volkswagen Golf remained in the lead over the first seven months of the year. The VW ID3 was the best-selling battery-electric vehicle in Europe in July 2021 and the Ford Kuga Europe’s favorite plug-in hybrid car.

Latest European Car Market Statistics 2021: January, February, March, Q1, April, May, June, HY, July, August, September, Q3, October, November, December, Full Year — 2020: Q1, HY, Q3, Full Year

New Car Market in Europe in July 2021

According to data from 26 European markets (EU, EFTA, and the UK), new car registrations slowed in July 2021, recording a year-on-year decline of 24% as total volume decreased from 1.27 million units to 967,830. Similar results were recorded in July 2012, when the market registered 966,090 units.

The year-to-date 2021 results remain positive, up by 17% compared to 2020 with 7,381,735 units registered, but down by 24% when compared with January to July 2019.

Felipe Munoz, Global Analyst at JATO Dynamics, commented: “Despite the efforts of national governments to boost consumer confidence, the impact of the pandemic is still being felt by the industry.” While volume increased in Norway, Croatia, Greece, Latvia, Romania, Estonia, Ireland and Lithuania, this combined accounted for only 8% of total registrations during the month.

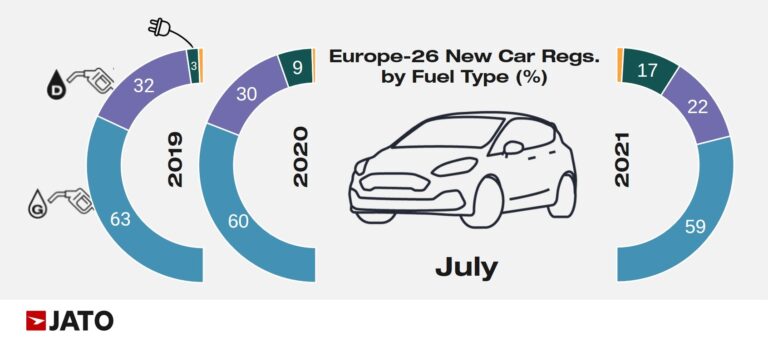

Europe Car Sales by Fuel Type in July 2021

In contrast to the overall trend, consumers in Europe continued to buy more low emissions vehicles. In July, a total of 160,646 BEV and PHEV vehicles were registered, accounting for almost 17% of total registrations. This is the second-highest monthly market share after June 2021, and the third-highest ever in Europe – BEVs accounted for 47% of that total.

Munoz added: “Consumers continue to respond positively to the deals and incentives attached to EVs which have made these vehicles far more competitive in terms of their pricing. But despite becoming increasingly popular, consumer uptake has not been enough to offset the big drops posted by diesel cars.” JATO data indicates that between July 2019 and July 2020, the market share for diesel vehicles dropped by just over 2 points, while their market share dropped by almost 8 points between July 2020 and July 2021. During the same period, the market share for EVs grew by the same amount lost for diesel vehicles.

The market share for gasoline cars has steadily declined from 63.4% in July 2019 to 59.8% in July 2020, and to 59.0% last month. Munoz continued: “We are beginning to see the impact of campaigns that favour EVs over ICE vehicles playout in the market, however the industry is not yet doing enough to enable EVs to absorb the losses sustained by traditional powertrains.” While diesel registrations decreased by 166,000 new units between July 2020 and July 2021, and almost 207,000 between July 2019 and July 2021, EVs gained only 49,000 units between July 2020 and July 2021, and 125,000 units between July 2019 and July 2021.

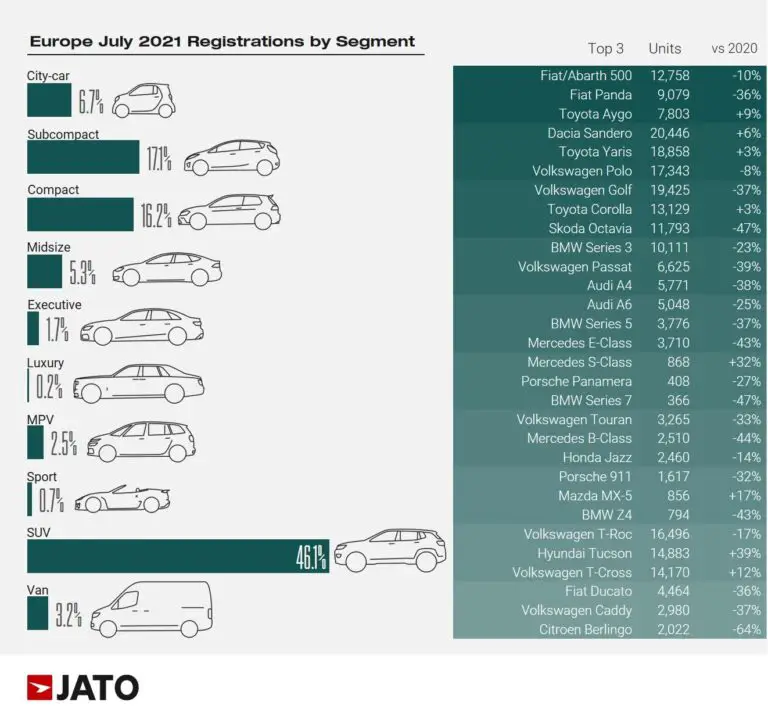

Europe Car Market by Segment in July 2021

The top-selling three models per market segment in Europe during July 2021 were as follows according to JATO:

SUVs were by far the largest car segment with nearly half of all new cars sold in Europe in July 2021 classified in this group. However, the definition of SUVs is largely down to the marketing department of manufacturers with cars in this segment ranging from cars such as the T-Cross that is not much more than a bulky subcompact to more rugged Land Rovers and Jeeps.

However, the strong performances in the SUV segment saw both the Hyundai Tucson and Ford Puma entered the top 10 to join the VW T-Roc and T-Cross. JATO data shows that SUVs recorded the highest ever monthly market share in Europe during July at 46.1%. Although the registrations volume fell by 15%, these vehicles gained market share at the expense of larger declines posted by the traditional cars (-28%), MPVs (-48%), and sports cars (-37%).

Top Ten Best-Selling Car Models in Europe in July 2021

According to JATO the following were the ten best-selling car models, battery-electric cars, and plug-in hybrid cars respectively in Europe in July 2021:

Top-Ten List of Best-Selling Car Models in Europe in July 2021

In July 2021, for the first time ever, a Dacia was the top-selling car model in Europe for a calendar month. The Dacia Sandero was originally launched in 2008 but the new generation introduced in 2020 was well received in many markets. The subcompact posted significant gains in Germany (+15%), Romania (+24%), and topped the rankings in France and Spain – alongside being the 8th best-selling car in the year-to-date rankings.

The Sandero’s volume fell by only 2% compared to July 2019, while other leaders such as the Volkswagen Golf, Volkswagen Polo, Dacia Duster, Toyota Corolla, Volkswagen Tiguan, Opel/Vauxhall Corsa, Skoda Octavia, Peugeot 208, Mercedes A-Class and Renault Clio, posted drops between 17% and 52%.

The Volkswagen Golf remained Europe’s car over the first seven months of 2021 but is suffering from production issues related to a shortage in computer chips. Furthermore, with no electric Golf on offer, VW is not able to add the ID3 sales to the Golf numbers.

Best-Selling Battery-Electric and Plug-in Hybrid Cars in Europe in July 2021

The Volkswagen ID3 was the top-selling battery-electric car in Europe in July 2021 followed by the Renault Zoe and the Kia Nero. The Tesla Model 3 had over 25,000 registrations in Europe in June 2021 but failed to make the top-ten list in July with cars clearly not arriving in Europe during the month. Three of the top ten eclectic cars in July 2021 were made by Volkswagen with the aging Up selling stronger than before the Covid crisis.

The Ford Kuga, Peugeot 3008, and Volvo XC40 were the best-selling plug-in hybrid vehicles in Europe in July 2021. Despite the marketing departments of German premium brands promoting electric cars in overdrive, Audi, Mercedes-Benz, and BMW are clearly still selling better in the PHEV segment.

Car Sales Statistics for Europe in 2021

→ Latest European Car Sales Statistics

- Car Sales and Market Analysis: January, February, March, April, May, June, July, August, September, October, November, December, Full Year 2021

- Top-Selling Car Models: Top 25 Models 2021, Top 15 Electric Models

- Sales per European Country: Q1, Half Year, Q3, Full Year

- Sales by Brand: Q1, Half Year, Q3, Full Year

- Electric and PHEV Sales by Country: Q1, Half Year, Q3, Full Year, Top Electric Brands and Models