In January 2022, the European new car market was 2.4% weaker — half of all car sales in Europe (EU, UK, EFTA) were SUVs.

New passenger vehicle registrations in Europe contracted by another 2.4% in January 2022 to record low sales of only 811,332 cars. New car sales were lower in all European countries during the first month of 2022 with the exception of Sweden. SUVs took a record 49.7% market share while 18% of all new cars sold in Europe in January 2022 were electrified (BEV and PHEV). The Volkswagen Group remained by far the largest carmaker in Europe with VW the largest brand. The best-selling car models in Europe in January 2022 were the Dacia Sandero followed by the Peugeot 208 and 2008. The top-selling electric car models were the Kia Niro, Renault Zoe, and Fiat 500.

Latest European Car Market Statistics 2022: By Country, Brands, Models, Electric, January, February, March, April, May, June, July, August, September, October, November, Full Year, 2021 & 2020

European New Car Market in January 2022

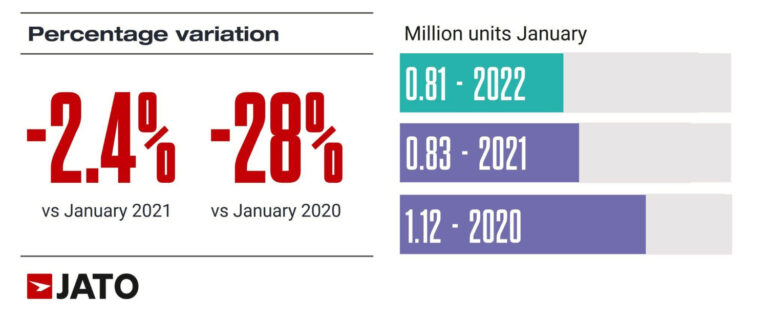

Data gathered by JATO Dynamics across 26 European markets reveals that in January 2022 the European automotive market had its worst results in January since 1991 with a total of 811,332 new cars registered compared to 839,525 in January 2021 and 1,138,057 cars in January 2020. (By some definitions this was the weakest January car market in Europe since 1982.)

New vehicle registrations fell by 2.4% compared with the same month in 2021 – when the market was still struggling with the effect of government-imposed lockdowns – and by 28% compared to January 2020. Sweden was the only market to see an increase in registrations compared with January 2020.

Felipe Munoz, Global Analyst at JATO Dynamics, commented: “Last month, consumer confidence remained low due to the economic fallout of the pandemic, and production continued to be hit by the ongoing semiconductor shortage.”

Car Sales in Europe by Market Segment in January 2022

Despite these difficult conditions, SUVs and EVs again emerged as the only drivers of growth for the market. Munoz continued: “These segments have been a lifeline for Europe’s OEMs, and the only option for consumers looking for a fast delivery.”

As during much of 2021, supply often determined the car models sold rather than demand, as buyers of popular models have to wait several months, and even years, for specific models. Mercedes-Benz for example announced that the G-Class and sedan versions of the E-Class were sold out until the new models will be introduced in 2024.

In January 2022, a total of 402,900 SUVs were registered, representing 49.7% of the market – the highest ever monthly market share for these vehicles. In contrast to the majority of traditional segments, volume increased by 11% compared with January 2021 but decreased by 10% compared with January 2020. Compact SUVs proved most popular with consumers, however, small SUVs (+19%), and midsize SUVs (+50%) also performed well. SUVs had a market share of 29% in January 2017 and increased market share progressively ever since.

The segment was led by Volkswagen Group which secured a 24% market share and an increase in volume of 7%. Growth was driven by the Cupra Formentor, the Volkswagen ID.4, Audi Q3, Skoda Enyaq, the new Volkswagen Taigo, Volkswagen Tiguan Allspace, and the Audi Q4. The German manufacturer was followed by Stellantis in the SUV rankings, which saw its market share fall from 20% in January 2020 to 17% last month. Toyota and Hyundai-Kia posted the highest market share increases between January 2020 and January 2022.

Car Sales in Europe by Fuel Type in January 2022

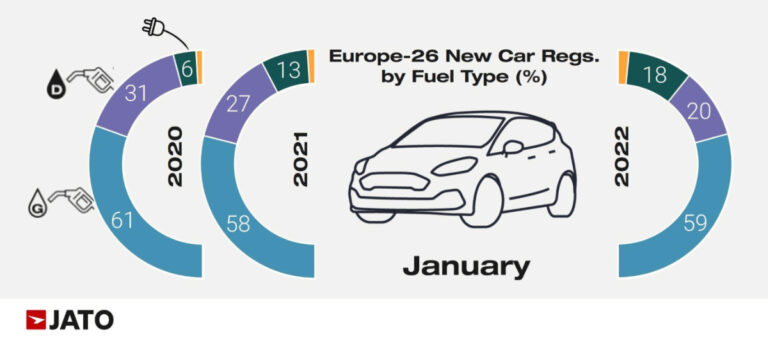

In January 2022, registrations of pure electric vehicles (BEV) and plug-in hybrids (PHEV) totaled 149,400 units during the month, up by 36% when compared with January 2021, and by 105% compared with January 2020. The rate of growth was slower than the market has seen in recent months and was not enough to offset the 27% drop in diesel registrations and the 1% drop in petrol registrations.

BEVs saw 73% growth from January 2021, accounting for 54% of the total market – outperforming the 9% growth for PHEVs over the same time period. As most PHEVs have mostly petrol engines, the share of petrol cars actually increased while diesel cars clearly are reaching the end of the road in Europe.

Top-Selling Car Makers and Brands in Europe in 2022 (January)

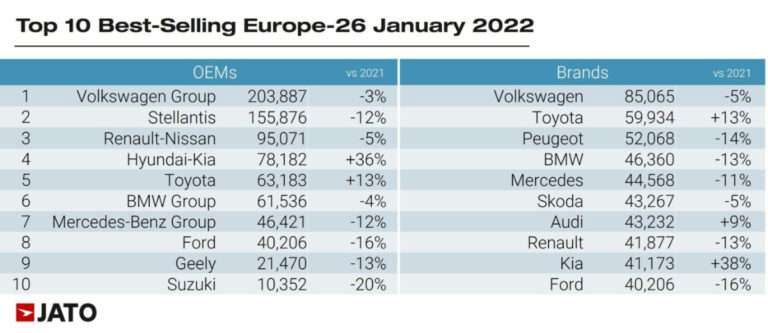

The Volkswagen Group easily remained the largest carmaker in Europe in January 2022 and only marginally underperformed the broader market. Stellantis was the second-largest car manufacturing group in Europe but bled market share while Renault-Nissan sales were only moderately weaker.

Hyundai-Kia and Toyota both outperformed and gained market share with the South Korean manufacturer increasing sales by more than a third. All other top-ten carmakers lost market share in Europe in January 2022.

Volkswagen was again the best-selling car brand in Europe in 2022 despite slightly weaker sales. Toyota gained second place from Peugeot. Skoda and Audi both moved ahead of Renault and Ford. Kia entered the top-ten list in Europe in January 2022 at the expense of Opel / Vauxhall.

Top Ten Best-Selling Car Models in Europe in January 2022

The Dacia Sandero was the most popular car model in Europe in January 2022 and the only top model to have increased volume sales compared to January 2021. The Sandero improved from third a year ago and replaced the Toyota Yaris as the top-selling car model.

The Peugeot 208 was again second followed by the Peugeot 2008, as the favorite SUV in Europe at the start of 2022. The VW Golf was again the fourth most popular car model followed by the T-Roc.

The Toyota Yaris Cross entered the top ten list as the third-most-popular SUV model, which partly helps to explain why the high market share of SUVs in Europe is fairly insignificant. The 2008, T-Roc, and Yaris Cross are hardly bigger or more robust than the passenger cars they share platforms with.

The Ford Puma and Toyota Corolla are also new entrants at the expense of the Opel Corsa and Fiat Panda.

The Kia Niro was the top-selling battery-electric vehicle (BEV) in Europe in January 2022 followed by the Renault Zoe, which had slightly weaker sales. Fiat 500 sales almost doubled from January 2021. The VW ID3 dropped out of the top ten list to eleventh while the Tesla Model 3 failed to make the top 20 of BEV sales in Europe with only 575 registrations in January 2021.

Europe Car Sales Statistics for 2022

→ Latest European Car Sales Statistics

- Full-Year 2022: Car Sales by Country, Brands, Models, Electric

- Car Sales and Market Analysis: January, February, March, April, May, June, July, August, September, October, November, Full Year

- Electric Car Sales: Q1, Full Year by Country

Car Sales Statistics for Europe in 2021

→ Latest European Car Sales Statistics

- Car Sales and Market Analysis: January, February, March, April, May, June, July, August, September, October, November, December, Full Year 2021

- Top-Selling Car Models: Top 25 Models 2021, Top 15 Electric Models

- Sales per European Country: Q1, Half Year, Q3, Full Year

- Sales by Brand: Q1, Half Year, Q3, Full Year

- Electric and PHEV Sales by Country: Q1, Half Year, Q3, Full Year, Top Electric Brands and Models