In full-year 2022, the Peugeot 208, Dacia Sandero, and Volkswagen T-Roc were the top-selling car models in Europe.

In the full-calendar-year 2022, no car in the list of the top ten best-selling models in Europe was in the same position as in 2021. The Volkswagen Golf was dethroned after 15 years with Europe’s favorite car model in 2022 being the Peugeot 208. It was followed by the Dacia Sandero and the VW T-Roc, which was not only the best-selling Volkswagen model in Europe in 2022 but also the top-selling SUV. The Fiat 500 was fourth followed by the VW Golf.

Latest European Car Market Statistics 2022: By Country, Brands, Models, Electric, January, February, March, April, May, June, July, August, September, October, November, Full Year, 2021 & 2020

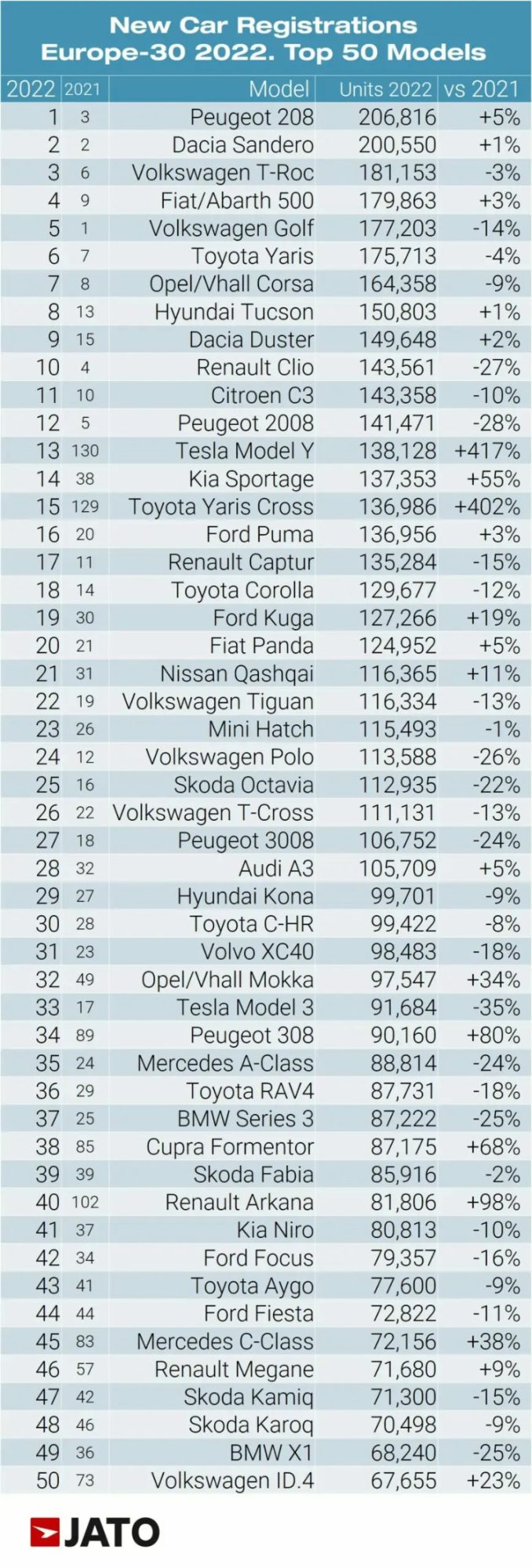

Top 50 Best-Selling Car Models in Europe in 2022 (Full Year)

The top 50 best-selling car models in Europe in 2022 according to JATO Dynamics were:

Europe’s Top 10 Favorite Car Models in 2022

The Peugeot 208 was the favorite car model of Europeans in 2022. It was the first time since 2007 that the top-selling car model in Europe was produced by Peugeot which led in 2007 with the Peugeot 207. The Peugeot 208 was helped by being affordable and offering a full battery-electric version of the model in most European markets.

2022 thus marked the end of the Volkswagen Golf’s reign as Europe’s best-selling car after 15 years at the top. The hatchback has been the most popular vehicle in Europe since 2007. According to Felipe Munoz, Global Analyst at JATO Dynamics: “The success of the Golf is owed to the fact that it was able to meet the needs of a wide range of consumers without leading in any given parameter. But times change, and today consumer priorities are quite different from some years ago.”

In addition to challenges with software, Volkswagen faced a new wave of internal competition with an increasing appetite for SUVs, and the growing popularity of its siblings, the T-Roc, Tiguan, Karoq, Ateca, and more recently the Formentor. While not direct rivals, these vehicles sit near the Golf in terms of pricing. The Peugeot 208 emerged as the beneficiary of these challenges. Volkswagen also failed to produce an electric version of the Golf, a decision that might be reversed in the near future, and the Golf suffered further from a general feeling of neglect by Volkswagen management in recent years.

The Golf fell from 1st to 5th place in the general ranking by model between 2021 and 2022. The Dacia Sandero was Europe’s second most registered vehicle, holding its position achieved in 2021 thanks to continued strong demand in France. The Volkswagen T-Roc, Europe’s best-selling SUV, secured 3rd place and was followed by the Fiat 500 which again performed well thanks to its electric version.

The Toyota Yaris was the best-selling Japanese car model in Europe in 2022. The Yaris and the strong performance of the separately listed Yaris Cross contributed to Toyota improving to the second-largest car brand in Europe in 2022.

The Opel / Vauxhall Corsa improved one rank position, as the third Stellantis small car in the top ten. Like the Peugeot 208 and Fiat 500, the Corsa also has an electric version.

The Hyundai Tucson entered the top 10 with over 150,000 units as the best-selling C-SUV while the Dacia Duster improved from 15th to ninth. The top ten was rounded out by the Renault Clio which slipped from fourth. The Clio was outsold by the cheaper Dacia-branded cars for most of the year.

Other Strong Performers

Other notable performances included the Kia Sportage; the Opel/Vauxhall Mokka saw a volume increase (+34%) becoming Stellantis’ third best-selling SUV; with the new generation, Peugeot increased registrations of the 308 (+80%); the Cupra Formentor (+68%) outsold any Seat; Renault registered close to 82,000 units of the Arkana; Volkswagen registered 67,400 units of the Taigo during its first full year on the European market.

Dacia registered 55,300 units of the Jogger while its sibling, the Spring, registered 48,800 units (+77%); the MG ZS saw its volume increase from 27,700 in 2021 to 46,100 units in 2022; BMW registered 41,100 units of the 4-Series (+36%); Hyundai registered 37,600 units of the IONIQ 5, ahead of the Cupra Born with 32,400 units, and the Polestar 2 with 32,300 units (+68%).

Tesla’s market share soared from 1.43% in 2021 to 2.06% in 2022, outselling Seat, Mini, and Suzuki, while trailing Nissan by 4,300 units. This growth was driven by the Model Y, Europe’s best-selling electric vehicle with just over 138,000 registered units. The fully-electric SUV was Europe’s 13th best-selling car in 2022, and as expected, the increasing popularity of the Model Y came at the expense of the Model 3 – Europe’s 17th most registered vehicle in 2021.