In full-year 2022, new passenger vehicle registrations in Europe, including the EU, the UK, and EFTA countries, contracted by 4.6% after the lowest European car sales in three decades.

January to December 2022: car sales in the European Union, Britain, and EFTA contracted for the third consecutive year with new passenger vehicle registrations down to only 11,286,939 cars. Sales increased in the second half of the year hinting at strong growth potential in 2023, if carmakers can resolve production issues. Germany was the only large market with positive growth in car sales in 2022. Volkswagen remained the best-selling car brand in Europe in 2022.

Latest European Car Market Statistics 2022: By Country, Brands, Models, Electric, January, February, March, April, May, June, July, August, September, October, November, Full Year, 2021 & 2020

European New Car Market in 2022 (Full Year)

In 2022, new passenger vehicle registrations in the European Union, the UK, and EFTA countries contracted by 4.1% to 11,286,939 cars. This was the third consecutive year of weaker sales with the total European new car market in 2022 more than 3.5 million vehicles smaller than in 2019.

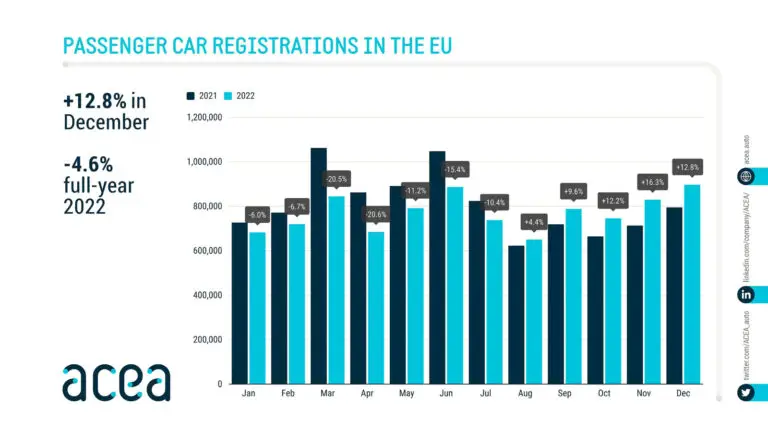

In the European Union, new passenger vehicle registrations contracted by an even stronger 4.6% to only 9,255,930 cars in 2022 — the weakest car sales in the EU since 1992 when only 9.2 million vehicles were registered.

New Passenger Vehicle Registrations in Europe by Year

New passenger vehicle registrations in the European Union, Great Britain, and the EFTA countries were as follows from 2007 to 2022:

| Year | Sales EU, UK & EFTA | % Change |

| 2022 | 11,286,939 | -4.1 |

| 2021 | 11,774,885 | -1.5 |

| 2020 | 11,961,182 | -24.3 |

| 2019 | 15,805,752 | 1.2 |

| 2018 | 15,624,486 | 0.0 |

| 2017 | 15,631,687 | 3.3 |

| 2016 | 15,131,719 | 6.5 |

| 2015 | 14,202,024 | 9.2 |

| 2014 | 13,006,451 | 5.4 |

| 2013 | 12,308,215 | -1.8 |

| 2012 | 12,527,912 | -7.8 |

| 2011 | 13,573,550 | -1.4 |

| 2010 | 13,785,698 | -4.9 |

| 2009 | 14,481,545 | -1.6 |

| 2008 | 14,712,158 | -7.8 |

| 2007 | 15,958,871 | 1.1 |

Note: Data not necessarily taking the addition of smaller new EU members into account for historical figures.

Car Sales in Europe by Month in 2022

According to the ACEA, car sales in Europe were as follows by month in 2022:

New passenger car vehicle registrations in Europe were particularly weak during the first months of 2022 but positive growth during the final five months of the year could not make up for the deficit. The main problem in the market was delivery issues. All carmakers struggled with a lack of components, especially semiconductors since 2021, but the war in Ukraine and temporary factory closures especially in China led to shortages and bottlenecks in more parts.

Although the European economies are not necessarily in robust health, the lack of demand for cars is not currently the main factor. The Volkswagen Group alone claimed to have over a million cars (including 310,000 BEVs) on backorder in Europe at the start of 2023. Production issues are likely to continue into 2023 but are expected to be increasingly manageable, which should lead to more cars being produced worldwide.

New Passenger Vehicle Registrations by European Country in 2022

New passenger vehicle registrations per European Union, the UK, and EFTA country were as follows in full-year 2022 according to the ACEA:

| EU Country | 2022 | 2021 | % 22/21 |

| Austria | 215,050 | 239,803 | -10.3 |

| Belgium | 366,303 | 383,123 | -4.4 |

| Bulgaria | 28,684 | 24,537 | +16.9 |

| Croatia | 42,939 | 44,915 | -4.4 |

| Cyprus | 11,627 | 10,624 | +9.4 |

| Czech Republic | 192,087 | 206,876 | -7.1 |

| Denmark | 148,293 | 185,312 | -20.0 |

| Estonia | 21,571 | 22,336 | -3.4 |

| Finland | 81,698 | 98,484 | -17.0 |

| France | 1,529,035 | 1,659,003 | -7.8 |

| Germany | 2,651,357 | 2,622,132 | +1.1 |

| Greece | 105,283 | 100,911 | +4.3 |

| Hungary | 111,524 | 121,920 | -8.5 |

| Ireland | 105,253 | 104,932 | +0.3 |

| Italy | 1,316,702 | 1,458,032 | -9.7 |

| Latvia | 16,713 | 14,348 | +16.5 |

| Lithuania | 25,544 | 31,454 | -18.8 |

| Luxembourg | 42,094 | 44,372 | -5.1 |

| Netherlands | 312,129 | 322,318 | -3.2 |

| Poland | 419,749 | 446,647 | -6.0 |

| Portugal | 156,304 | 146,637 | +6.6 |

| Romania | 129,328 | 121,208 | +6.7 |

| Slovakia | 78,841 | 75,700 | +4.1 |

| Slovenia | 46,339 | 53,988 | -14.2 |

| Spain | 813,396 | 859,477 | -5.4 |

| Sweden | 288,087 | 301,006 | -4.3 |

| EUROPEAN UNION | 9,255,930 | 9,700,095 | -4.6 |

| Iceland | 16,683 | 12,789 | +30.4 |

| Norway | 174,329 | 176,276 | -1.1 |

| Switzerland | 225,934 | 238,481 | -5.3 |

| EFTA | 416,946 | 427,546 | -2.5 |

| United Kingdom | 1,614,063 | 1,647,181 | -2.0 |

| EU + EFTA + UK | 11,286,939 | 11,774,822 | -4.1 |

| Source: ACEA |

Car Sales in European Countries in 2022 (Full Year)

In the full calendar year 2022, Germany was the only country of the ten largest European markets to have recorded growth in car sales. The 1.1% increase in registrations was somewhat unexpected but largely due to German carmakers (and Tesla) rushing electrified cars to customers in November and December before a change in government subsidies. From 2023, the subsidy for battery-electric cars is reduced in Germany and no subsidies at all are paid on plug-in hybrids.

Britain regained its position as the second-largest new car market in Europe in 2022 with sales only slightly weaker while France slipped back to third with sales down 8%. The Italian new car market was nearly 10% weaker while sales in Spain and Portugal were down by around 6%.

In 2022, growth was the strongest in the small new car markets of Iceland, Bulgaria, and Latvia. The contraction was the strongest in Denmark, Lithuania, and Finland.

Volkswagen remained the best-selling car brand in Europe in 2022.