In full-year 2022, the new car market in Europe contracted for the third consecutive year with sales down 4% in European Union, EFTA, and the UK.

2022 (January to December): New passenger vehicle registrations in the European Union (EU), EFTA, and the UK were 4.1% weaker than in 2021. Volkswagen and Stellantis remained the largest carmakers in Europe but Hyundai-Kia, Toyota, and Chinese car producers made strong gains in Europe in 2022. Tesla also gained with the electric car brand outselling amongst others Seat, Suzuki, and Mini. The Peugeot 208 was the best-selling car model in Europe in 2022.

Latest European Car Market Statistics 2022: By Country, Brands, Models, Electric, January, February, March, April, May, June, July, August, September, October, November, Full Year, 2021 & 2020

New Car Market in Europe in 2022 (Full Year)

In the full calendar year 2022, the European new car market recorded the third consecutive year-on-year decline. According to JATO Dynamics data for 30 country markets in Europe (EU-26 + UK, Norway, Switzerland, and Iceland), volume totaled 11,309,310 units, down by 4.1% when compared to 2021, and the lowest level since 1985.

In 2022, new passenger vehicle registrations in Europe were 674,000 cars fewer than recorded in 2020 – when the Covid-19 pandemic hit Europe’s economies – marking a decline of 5.6%. Compared with 2019, total volume was down by 29% with 4.5 million fewer new vehicle registrations. Felipe Munoz, Global Analyst at JATO Dynamics, commented: “Shortages of new vehicles at dealerships, inflation, and the energy crisis, all proved to be major challenges for the already troubled market last year. The fallout of the pandemic, followed by the semi-conductor shortage throughout 2021 and 2022, was only compounded by Russia’s invasion of Ukraine and subsequent energy price increases, impacting consumer confidence and spending.”

Top Car Manufacturers in Europe in 2022

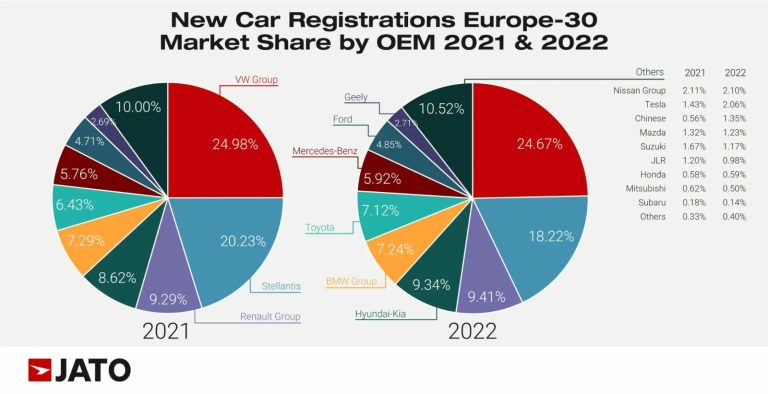

The Volkswagen Group and Stellantis remained the largest carmakers by far in Europe in 2022 but both lost some market share. The most significant drop was by Stellantis – down from 20.23% in 2021 to 18.22% in 2022. Registrations fell by 14% to 2.06 million units – the largest decline among Europe’s ten largest OEMs by volume. All four major brands under the Stellantis umbrella (Peugeot, Opel, Fiat, and Citroen) recorded double-digit drops due to supply issues arising and the availability of key vehicles such as the Peugeot 2008 and 3008 – alongside aging vehicles such as the Jeep Renegade, and Fiat 500X.

See also: 2022 (Full Year) Europe: Best-Selling Car Manufacturers and Brands for detailed data by carmaker and marque.

Hyundai-Kia and Toyota also performed well in 2022. The former saw an increase in volume of 3.8% to 1.05 million units – closing the gap on Renault Group which took third position in the OEM rankings. Kia was the main contributor to these results, outselling its sister brand, Hyundai. The latest generations of the Kia Sportage and Hyundai Tucson proved popular with consumers, outselling the SUV offering of other leading manufacturers such as the Volkswagen Tiguan, Peugeot 3008, and Nissan Qashqai.

Toyota’s results were owed largely to the successful first full year of the Yaris Cross – Europe’s fourth best-selling B-SUV. The Japanese carmaker secured a record second position in the ranking by brand, outsold only by Volkswagen.

Chinese Car Brands Gained Market Share in Europe in 2022

While they continue to play a minor role in terms of market share in Europe, Chinese brands – excluding Volvo, Polestar, Lynk & Co, (part of Geely Group) but including MG – made significant progress in 2022. Among all car groups, these brands gained the most market share, with registrations jumping from 66,100 units in 2021 to 152,400 units last year.

Combined, Chinese brands outsold established manufacturers including Mazda, Suzuki, and Jaguar Land Rover. A large proportion of sales corresponded to vehicles designed, and manufactured by the Chinese-owned brand MG, which saw a volume increase of 116% to almost 114,000 units, outselling the likes of Jeep and Honda.

DR Automobiles, an Italian company that sells rebadged vehicles manufactured by Chinese brand Chery in Spain and Italy, outsold Smart and Subaru with an increase in registrations of 197% to almost 25,000 units. MG and DR vehicles accounted for 91% of the volume registered by all Chinese brands. BYD, Hongqi, Maxus, NIO, DFSK, and Aiways, all registered over 1,000 units.

Munoz, continued: “A competitive product offering and reasonable sales targets are allowing Chinese brands to make inroads into the European car market. The next step is to build awareness and encourage the shift away from the negative sentiment that has historically dissuaded some consumers from buying Chinese products.”